NYCstock/iStock Editorial via Getty Images

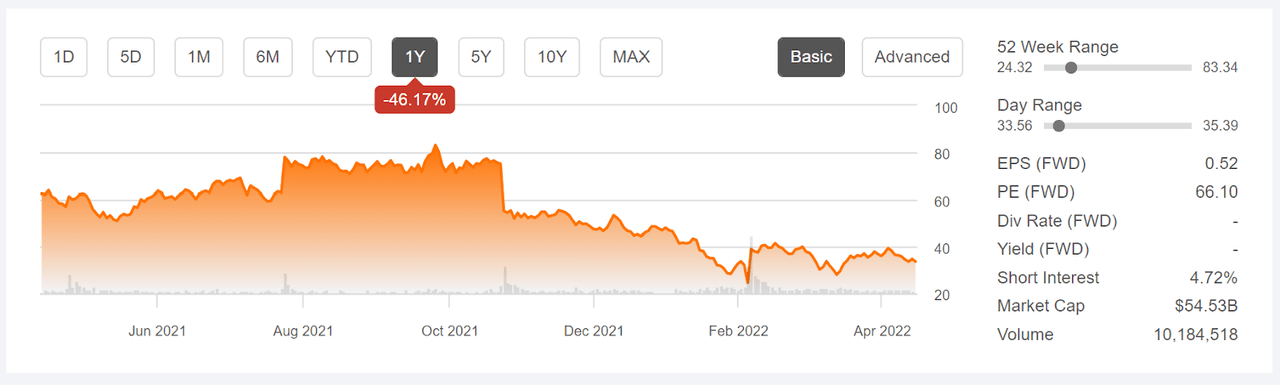

Snap Inc. (NYSE:SNAP) reports earnings on April 21st. The shares have fallen 46% over the past 12 months and almost 28% so far in 2022. The company is in a challenging position. Even though the number of active users continues to grow at a rapid pace, with 319 million daily active users in Q4 of 2021 (see slide 5), the market conditions are not favorable for this type of enterprise.

Rising rates hit growth stocks hard because of the disproportionate impact of higher discount rates on net present value. Even as SNAP has moved solidly into reporting positive earnings, the valuation continues to be very sensitive to rates. In addition, the Cathie Wood / “never bet against innovation” narrative appears to have lost its grasp on followers who drove a range of growth stocks to extreme highs (Ms. Wood’s ARKK fund held more than 2.3 million shares of SNAP in early 2021).

12-Month price history and basic statistics for SNAP (Seeking Alpha)

SNAP’s path to profitability has been consistent and impressive, with 6 consecutive quarters of EPS greater than or equal to zero. With the company expected to report near-zero earnings for Q1, it will be interesting to see whether investors are shocked by the substantial contrast between Q4 and Q1.

Historical and estimated future quarterly EPS for SNAP. Green (red) values are amounts by which quarterly EPS beats (misses) the consensus expected value (Source: E-Trade)

I have analyzed a range of stocks which have fired the public imagination and shot to incredible highs, with little or no concern as to the path to profitability. Some of these are great companies that became speculative favorites, with the share prices becoming decoupled from fundamentals. Teladoc (TDOC) is one example. These types of stocks tend to exhibit some shared characteristics. Even as they decline, the analysts tend to stand by their favorable views, such that the expected price targets imply ever-higher returns. Some analysts will break ranks, reducing their price targets, with the result that the spread among individual price targets becomes very large. A third common feature of stocks is that the options prices signal lottery-like expectations, with a high probability of loss and a small probability of huge gains. I have documented these features for a range of stocks. See, for example, my discussion of TDOC in July of 2021 and Robinhood (HOOD) in November of 2021, and there are many more examples.

For high-growth stocks like SNAP, the options market provides particularly important information via the market-implied outlook. For readers who have not encountered this concept, a brief explanation is required. The price of an option on a stock reflects the market’s consensus estimate of the probability that the share price will rise above (call option) or fall below (put option) a specific threshold (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook and represents the consensus view of traders that is reflected in the market prices of options. For readers who want a more theoretical explanation of this approach, I recommend this excellent monograph published by the CFA Institute.

I would like to invest in SNAP because the company is both innovative and highly effective in marketing its products. I am analyzing SNAP for the first time, now that the shares have fallen substantially. I have calculated the market-implied outlook for SNAP through the end of 2022 and compared this with the current Wall Street consensus outlook.

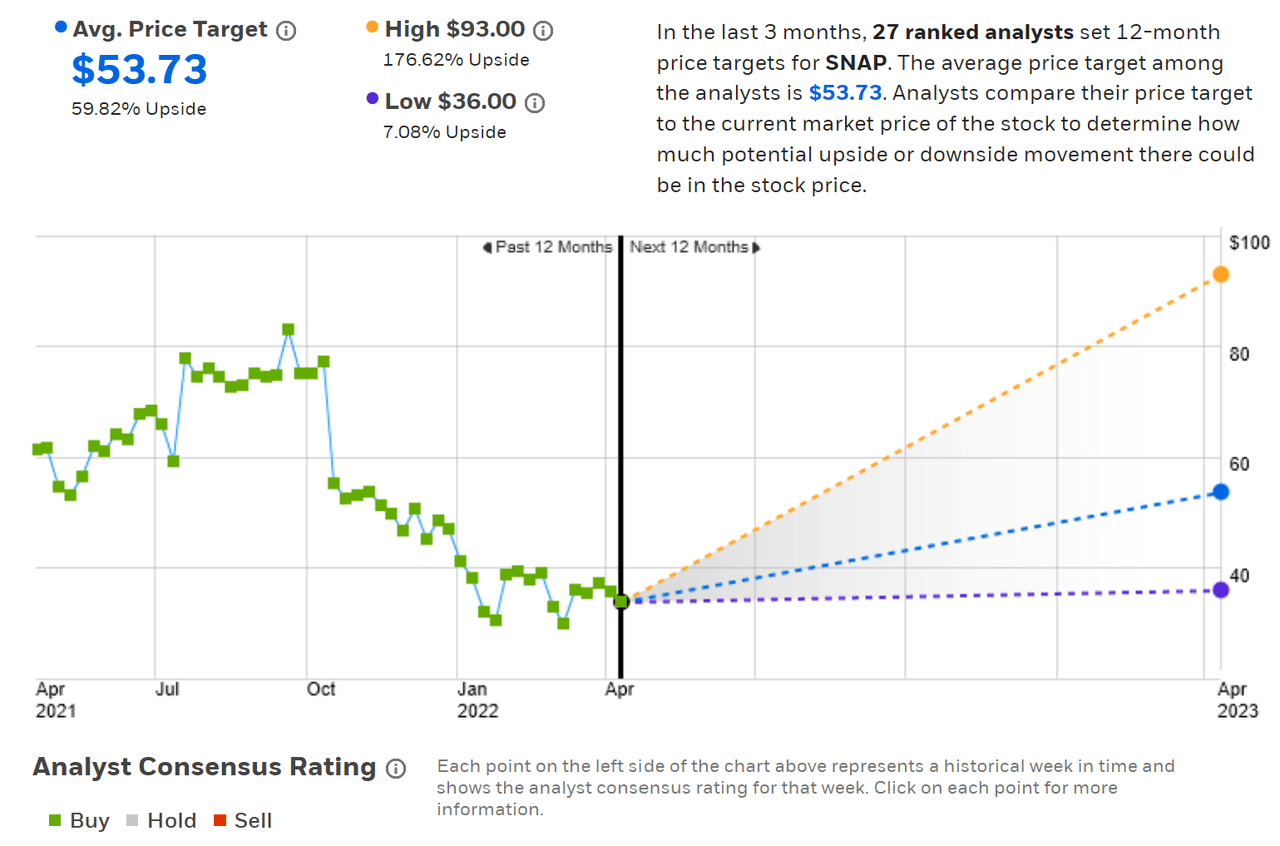

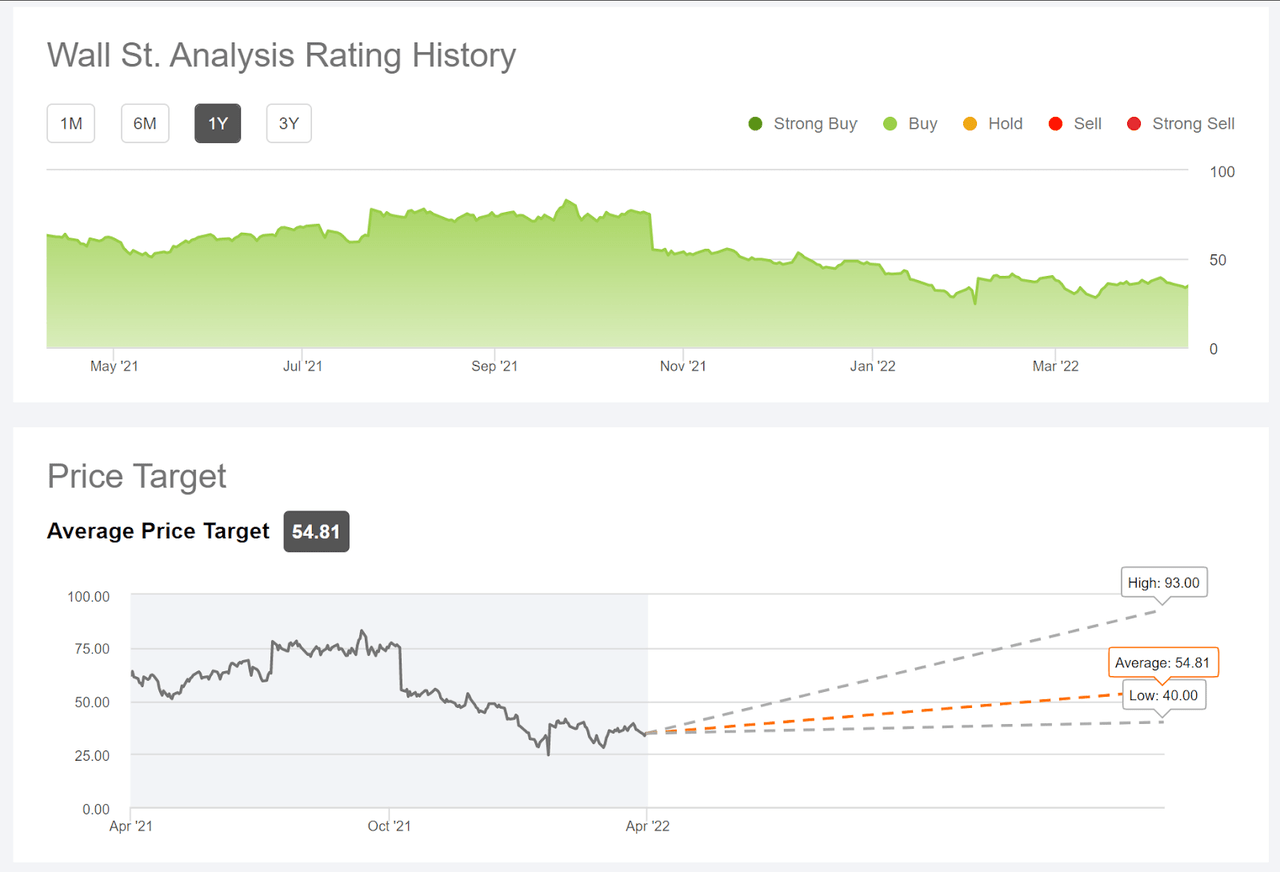

Wall Street Consensus Outlook for SNAP

E-Trade calculates the Wall Street consensus outlook by aggregating the views of 27 ranked analysts who have published ratings and price targets for SNAP over the past 3 months. The consensus rating is bullish, as it has been for all of the past year. The consensus 12-month price target is 59.8% above the current share price. A big red flag here is that there is very high dispersion in the individual analyst outlooks. The highest price target is 2.6 times the lowest. A research paper from 2019 found that the consensus price target had meaningful predictive value when the dispersion was low, but that there was actually a negative correlation between returns implied by consensus price targets and subsequent performance when dispersion was high. In this case, a consensus price target that is high above the current price combined with high dispersion among the individual prices targets, is a bearish signal.

Wall Street consensus rating and 12-month price target for SNAP (Source: E-Trade)

Seeking Alpha calculates the Wall Street consensus outlook by aggregating the views of 40 analysts who have published opinions over the past 90 days. The consensus rating is bullish and the consensus 12-month price target is 63% above the current share price. The dispersion among the individual price targets is high, with the highest price target that is 2.3 times the lowest.

Wall Street consensus rating and 12-month price target for SNAP (Source: Seeking Alpha)

Having the consensus rating maintained at buy / bullish and the consensus price target far above the current share price is a positive sign. The very high dispersion among the views of the individual analysts is a bearish signal. As a rule of thumb, I discount the consensus outlook when the highest price target is more than twice the lowest.

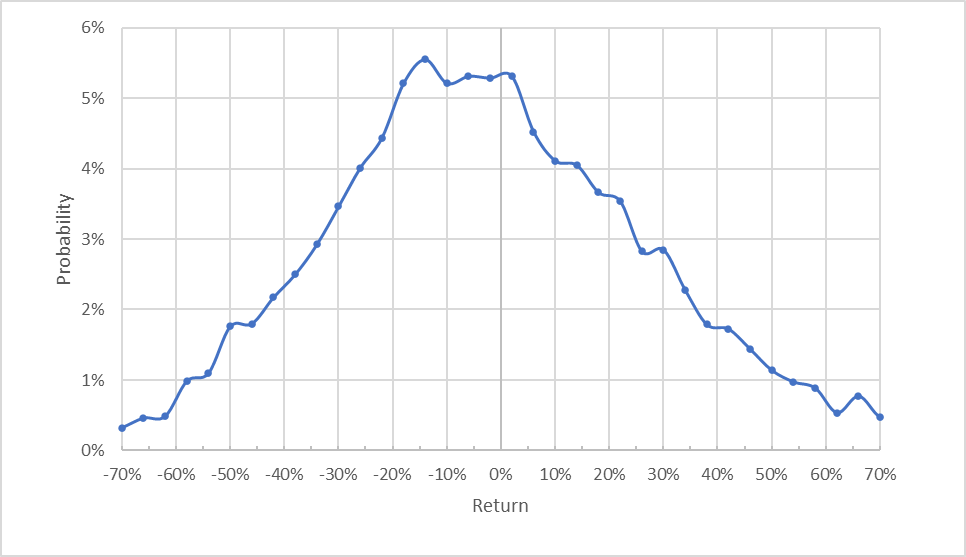

Market-Implied Outlook for SNAP

I have calculated the market-implied outlook for SNAP for the 2.1-month period between now and June 17, 2022 and the 9.2-month period from now until January 20, 2023, using the prices of options that expire on these dates. I selected these two expiration dates to provide a view to the middle of 2022 and through the end of the year. The January expiration date is the closest to the end of 2022.

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Market-implied price return probabilities for SNAP for the 2.1-month period from now until June 17, 2022 (Source: Author’s calculations using options quotes from E-Trade)

The market-implied outlook to the middle of June is tilted to favor negative returns, with the maximum probability corresponding to a price return of -14%. The expected volatility calculated from this outlook is 82% (annualized). For comparison, E-Trade calculates 75% implied volatility for the options expiring on June 17th.

To make it easier to directly compare the probabilities of positive and negative returns of the same magnitude, I rotate the negative return side of the distribution about the vertical axis (see chart below).

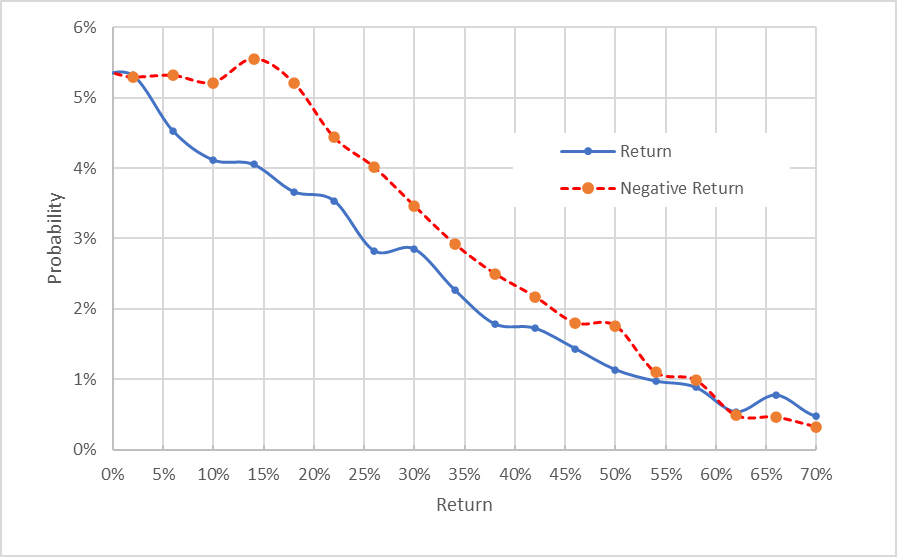

Market-implied price return probabilities for SNAP for the 2.1-month period from now until June 17, 2022. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from E-Trade)

This view highlights that the probabilities of negative returns are substantially and consistently higher than the probabilities of positive returns of the same magnitude (the dashed red line is well above the solid blue line across a wide range of the most-probable outcomes). This is a bearish outlook for SNAP.

Theory suggests that the market-implied outlook is expected to have a negative bias because risk-averse investors tend to pay more than fair value for downside protection. There is no way to measure whether this bias is present, however. The substantial tilt in this market-implied outlook, as compared to the range of other companies that I have analyzed, is sufficiently large that I am confident in interpreting this market-implied outlook as bearish.

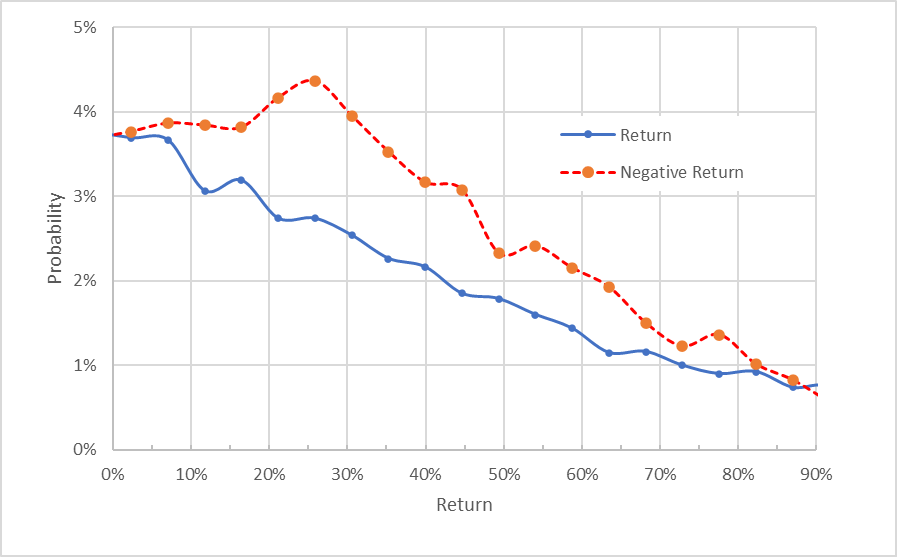

The market-implied outlook to early 2023 is qualitatively similar to the shorter-term outlook, although the bearish tilt is even more pronounced. The peak probability corresponds to a return of -26% over this 9.2-month period and the spread in probabilities between negative and positive returns is large. This is a bearish outlook to early 2023. The expected volatility calculated from this distribution is 63% (annualized). While this is still a high level of volatility, the market-implied outlooks are indicating that SNAP’s risk level is expected to decline.

Market-implied price return probabilities for SNAP for the 9.2-month period from now until January 20, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from E-Trade)

The market-implied outlooks for SNAP are similar to results from a range of other high-growth stocks. The most-probable outcomes are for negative returns, both in the near term and to early 2023. There is some potential for large positive returns, of course. The outlook is consistently bearish, with high volatility.

Summary

As I noted earlier, I would like to invest in SNAP and I was hoping that the shares would look reasonable after the large declines over the past 12 months. The Wall Street consensus outlook is bullish, with expected 12-month gains of around 60%. Even with the high expected volatility, this level of expected return would be attractive. The high level of disagreement between the analysts, reflected in large dispersion in price targets, leads me to discount the consensus outlook, however. The market-implied outlooks are bearish to the middle of 2022 and to early 2023. I am assigning a sell rating to SNAP, although I would be afraid to take a short position because of the very high volatility.

Be the first to comment