Kwangmoozaa/iStock via Getty Images

Introduction

Just when we thought the COVID crisis was over and REITs would benefit from ‘the new normal,” the European political landscape changed completely when Russia invaded Ukraine. And although commercial REITs in Western Europe are not directly impacted (other than higher heating costs in the malls), the consumer confidence levels and spiking inflation may reduce the footfall and that’s why most REIT share prices have evolved sideways lately. Klepierre (OTCPK:KLPEF) owns in excess of 20B EUR of commercial real estate in Western Europe (with France (40%), Italy (20%) and Scandinavia (13%) as main contributors to the net rental income) has seen its share price decrease by almost 20% since my previous article was published. And while it’s OK to be conservative, I think Klepierre is now too cheap to ignore.

Klepierre has its primary listing on Euronext Paris where it’s trading with LI as its ticker symbol. The average daily volume remained pretty stable at approximately 1 million shares per day, so the Paris listing clearly offers superior liquidity compared to the secondary listings. I will use the EUR as the base currency throughout this article.

All relevant data and publications can be found here.

A strong set of results in the first half of the year bodes well for the second semester

It’s always interesting to see the half-year results of Western European REITs as the quarterly updates are generally just trading updates. And Klepierre most definitely did not disappoint in the first semester of the current financial year.

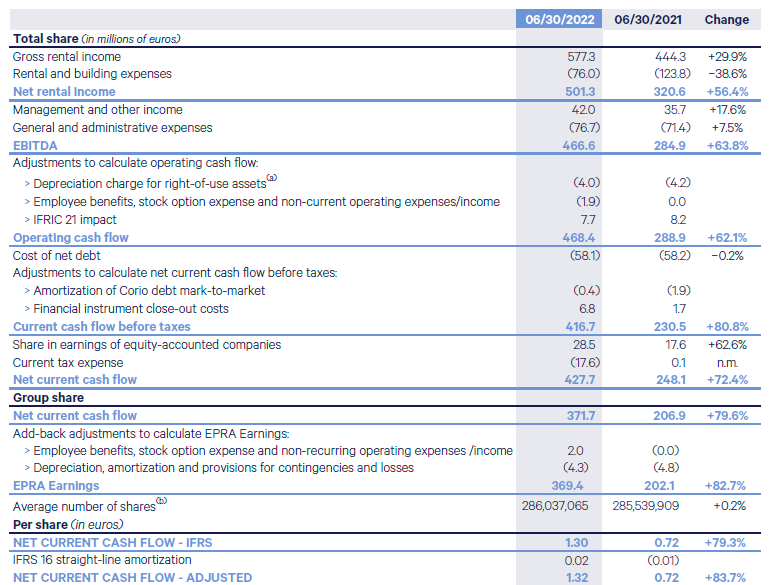

In the first half of the year, Klepierre’s gross rental income increased by almost 30% while the rental expenses decreased by 39%. This is obviously entirely related to the tenants going back to paying the rent in full rather than Klepierre providing rent support (which both weighed on the revenue as well as on the expenses depending on whether a tenant was provided with definitive relief or reduced/suspended payments). The EBITDA of the REIT exploded by almost 64% to 467M EUR.

Klepierre Investor Relations

What really matters here are the “current cash flows,” sometimes also called the “direct result per share.” This could be compared with the FFO used in North America. The net current cash flow in the first half of the year came in at 372M EUR (428M EUR on a consolidated basis, but there are minority interests that need to be taken into account as well). The EPRA earnings were pretty close to this result as those came in at 369.4M EUR or 1.30 EUR per share. A 2 cent per share straight-line amortization benefit further boosted this to 1.32 EUR per share on an adjusted basis. That’s almost double the result from in the first half of last year.

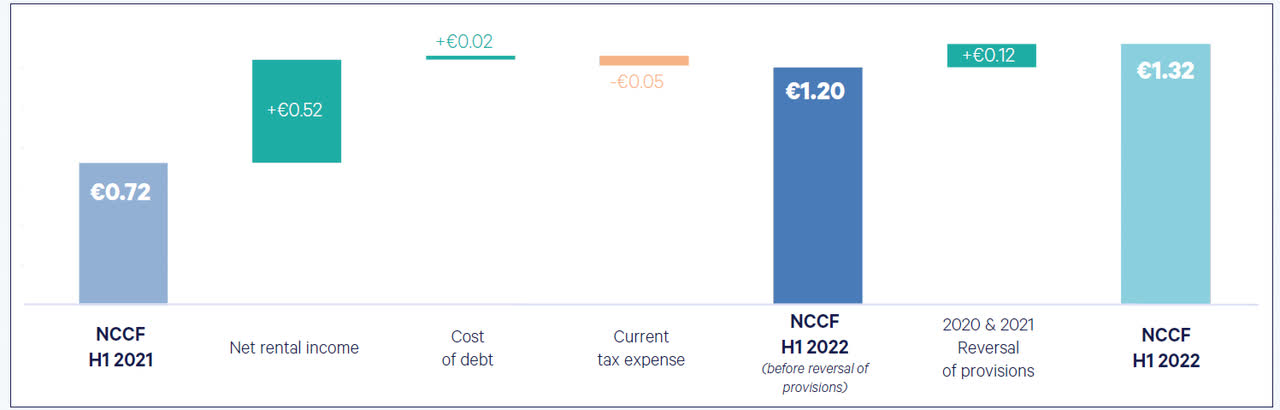

Keep in mind, there are a few non-recurring items that provided a nice boost to this per-share result. Included in the 1.32 EUR per share is a non-recurring benefit of 0.12 EUR per share caused by the reversal of provisions for COVID-related losses. So on an underlying basis, the direct result per share was approximately 1.20 EUR.

Klepierre Investor Relations

The full-year guidance was hiked, the LTV ratio was reduced, and I expect a dividend hike

The strong result in the first half of the year allowed Klepierre to hike its full-year result to 2.45 EUR per share. This still includes the 0.12 EUR in non-recurring COVID-related provision reversals in the first half of the year, and I think this means Klepierre is still underpromising and will likely overdeliver. Excluding these reversals, the H1 direct result was approximately 1.20 EUR per share. So on an annualized basis this would already represent a full-year result of 2.40 EUR and adding that 0.12 EUR per share would result in a direct result per share of 2.52 EUR per share. Sure, the REIT sold some assets after the end of the first semester, but I am also anticipating some inflation-related rent hikes, so I think Klepierre’s new guidance is still a bit conservative.

The guidance hike comes about six months after I already thought the REIT’s official guidance was too low. In my February article, I wrote:

[…] while the FY 2022 guidance of 2.30-2.35 EUR per share is slightly lower than my expectations of 2.40-2.50 EUR per share.

With the full-year guidance updated to 2.45 EUR per share, Klepierre’s official guidance is now right in the middle of the range I was anticipating a while ago. This also means I’m now more confident in indeed seeing a dividend hike. While Klepierre hasn’t provided an update on the expectations for the full-year dividend, I expect an increase from the 1.70 EUR per share that was paid out based on the FY 2021 result. The 1.70 EUR represented a payout ratio of 78% of the 2.18 EUR in direct result per share and applying an 80% payout ratio on the 2.45 EUR DRPS would result in a dividend of 1.96 EUR per share. Perhaps Klepierre will want to deduct the 0.12 EUR in non-recurring income from the starting point in which case the full-year dividend would come in at 1.86 EUR per share. Pretty close to my estimate of 1.85 EUR per share I posted in February, so for now I’m sticking with a dividend anticipation of 1.85 EUR per share.

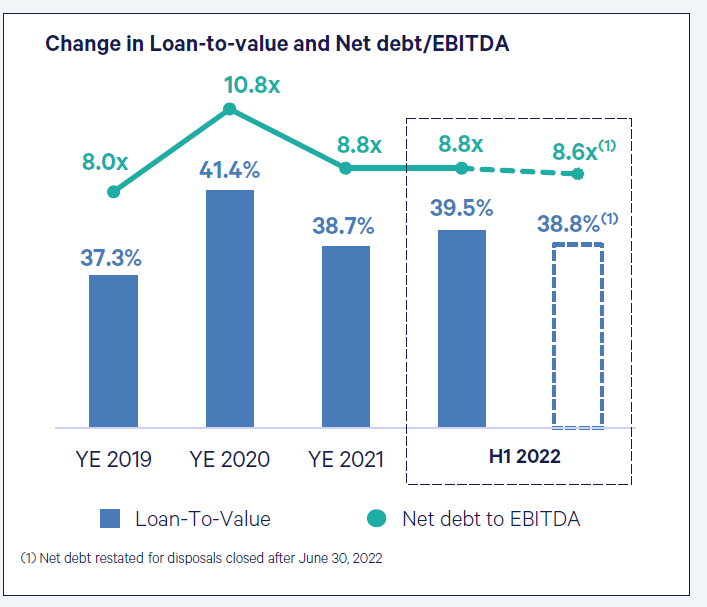

Subsequent to the end of the first semester, Klepierre sold a few more assets, and this reduced the pro forma LTV ratio to just 38.8%. That’s the lowest it has been since year-end 2021, but keep in mind the REIT paid a 1.70 EUR cash dividend in the first half of this year which had a negative impact of about 220bp on the LTV ratio. Excluding this dividend, the LTV ratio would have come in at 36.6% and comfortably below the year-end 2021 ratio. As Klepierre pays an annual dividend, the in excess of 300M EUR in direct result expected to be generated in the current semester will likely push the LTV ratio to just above 37% (excluding changes in the valuation of the assets).

Klepierre Investor Relations

Investment thesis

This means Klepierre is now attractive again on pretty much every metric. The stock is trading at just 8.5 times the annualized H2 direct result per share while the dividend yield increases to 8.7% if my assumption of a dividend of 1.85 EUR per share turns out to be correct. Keeping the occupancy at a high level will now be Klepierre’s main focus as that’s what will ultimately drive the per-share results.

As of the end of June, Klepierre’s NTA came in at 30.60 EUR per share while the Net Disposal Value (including the deduction of capital gains taxes) was 29.2 EUR per share. The combination of a low earnings multiple, healthy dividend and decent discount to the tangible value and disposable value makes Klepierre very interesting at the current levels.

Be the first to comment