Vertigo3d

I feel fortunate to have refinanced a 30-year fixed rate mortgage into a 15-year mortgage back in early in 2020 at a rate far better than what I started with, and far better than what I could get today. Millions of other homeowners took advantage of similar opportunities, driving a massive boom in refinancing over the last couple of years. This refinancing peak contributed to some good results for those sitting on the mortgage-related side of the housing market, whether mortgage lenders, title insurance, or private mortgage insurance. Enact Holdings (NASDAQ:ACT) is one of a handful of providers of PMI in the United States, along with Radian Group (RDN), MGIC Investment Corp (MTG) and Essent Group (ESNT). Enact Holdings is a relatively recent addition to the public market, as it was spun out from Genworth Financial (GNW) and has only been trading independently since September 2021. I last wrote about the company in June, but as the trends in housing and mortgage originations are becoming more pronounced, I believe it is a good time for a fresh look.

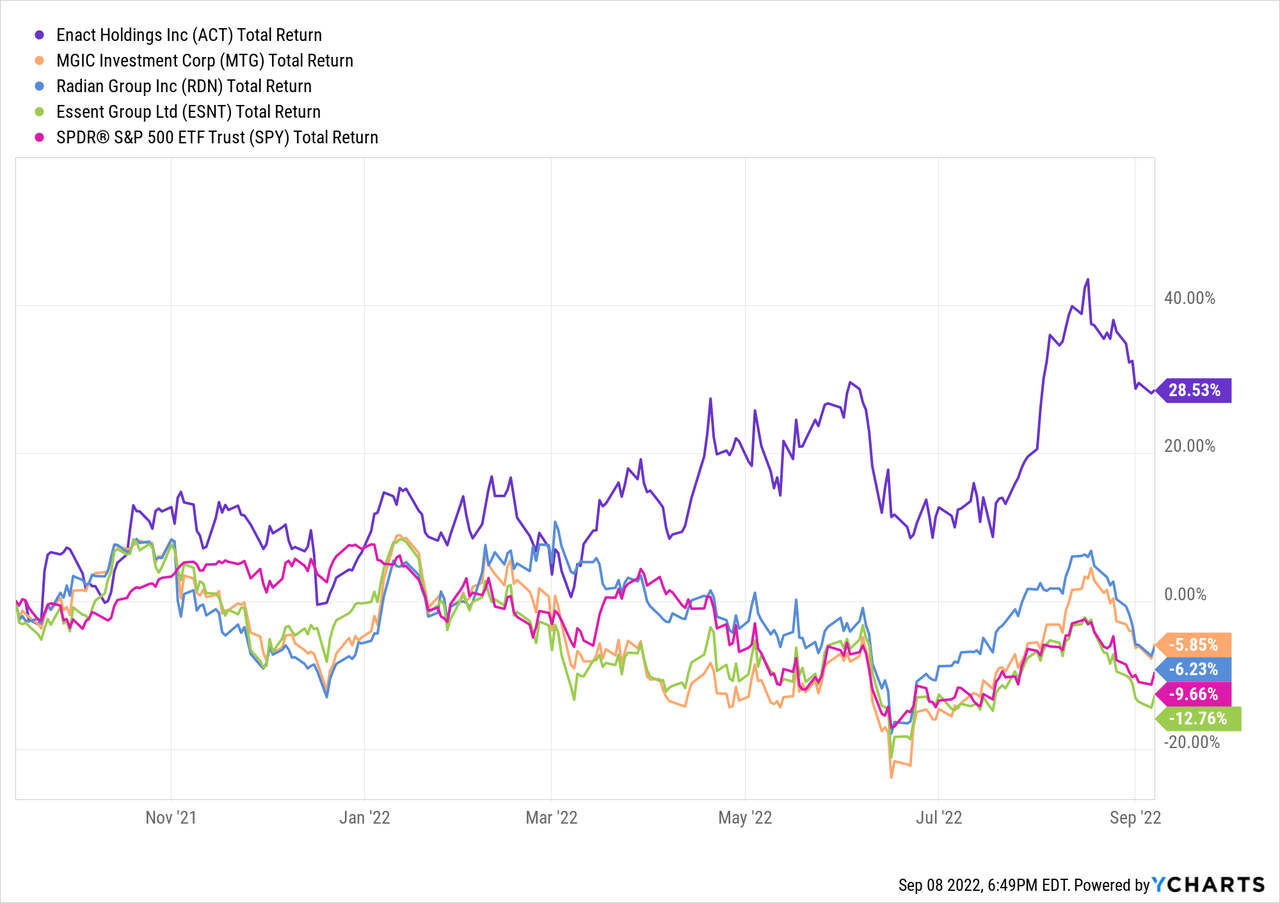

Private mortgage insurance is a product providing some protection to mortgage lenders, but the premium is paid by those home buyers in scenarios when the buyer generally has less than a 20% down payment. However, challenges are brewing in the housing market, and the potential impacts on private mortgage insurers is starting to be seen in valuations, with the sharp pullback over the summer, followed by a bit of recovery into late August, only to once again track along with the broader market indices and fall back over the last couple of weeks.

Noticeably, while Enact followed much of the same directional patterns as the other names along with the S&P index from June 2022 through the present, the shares remain positive overall on the year so far, in spite of its recent drop while the others are negative, more closely tracking to the broader market.

Housing Data Context

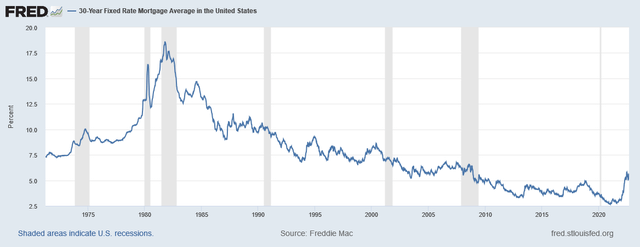

During my adult years, I cannot think of a time comparable to the last 12 months in terms of the steep rate of change in mortgage interest rates – a 279 basis points increase, to an average of 5.66% on a 30-year mortgage as of September 1, compared to 2.87% at the end of August 2021. I expect it will continue to rise generally through the end of the year based on Federal Reserve chairman Jerome Powell’s recent comments at Jackson Hole. In the twelve months from March 1985 to February 1986, rates moved at a similar pace but in the opposite direction (measured as the absolute basis points change over time), decreasing by 314 basis points. Admittedly, that was normal compared to a couple of year earlier, when rates jumped by around 600 basis points from August 1980 to October 1981, and then came back down by June of 1983, and have more or less remained on a downward trajectory ever since until now.

Historical mortgage rates, May 1971 to Present, ( https://fred.stlouisfed.org/series/MORTGAGE30US)

This quick rise is starting to put a dent in home sales relative to 2021, which are definitely trending down under the combined impact of higher mortgage rates and higher prices. Sales for July 2022 were down by 20% compared to July 2021, and down 5.9% just since June. Nevertheless, July’s figures pointed to a seasonally adjusted rate of 4.81 million existing home sales for the year. The absolute figures are good to know, keeping in mind that the low-rate environment really pushed the combined totals of new mortgage originations and refinances to historically high levels. For 2021, that combined total in dollar terms was around $4.4 trillion, broken down as $1.7 trillion in purchase financing (an all-time record), and $2.7 trillion in refinance, so all year over year comparisons showing declining activity are being measured against a record high year. These factors are certainly important to private mortgage insurance volumes in booking new business, and may partially explain some of the change in valuation, but are not necessarily pointing to an unhealthy housing market.

Where Does This Leave Enact Holdings

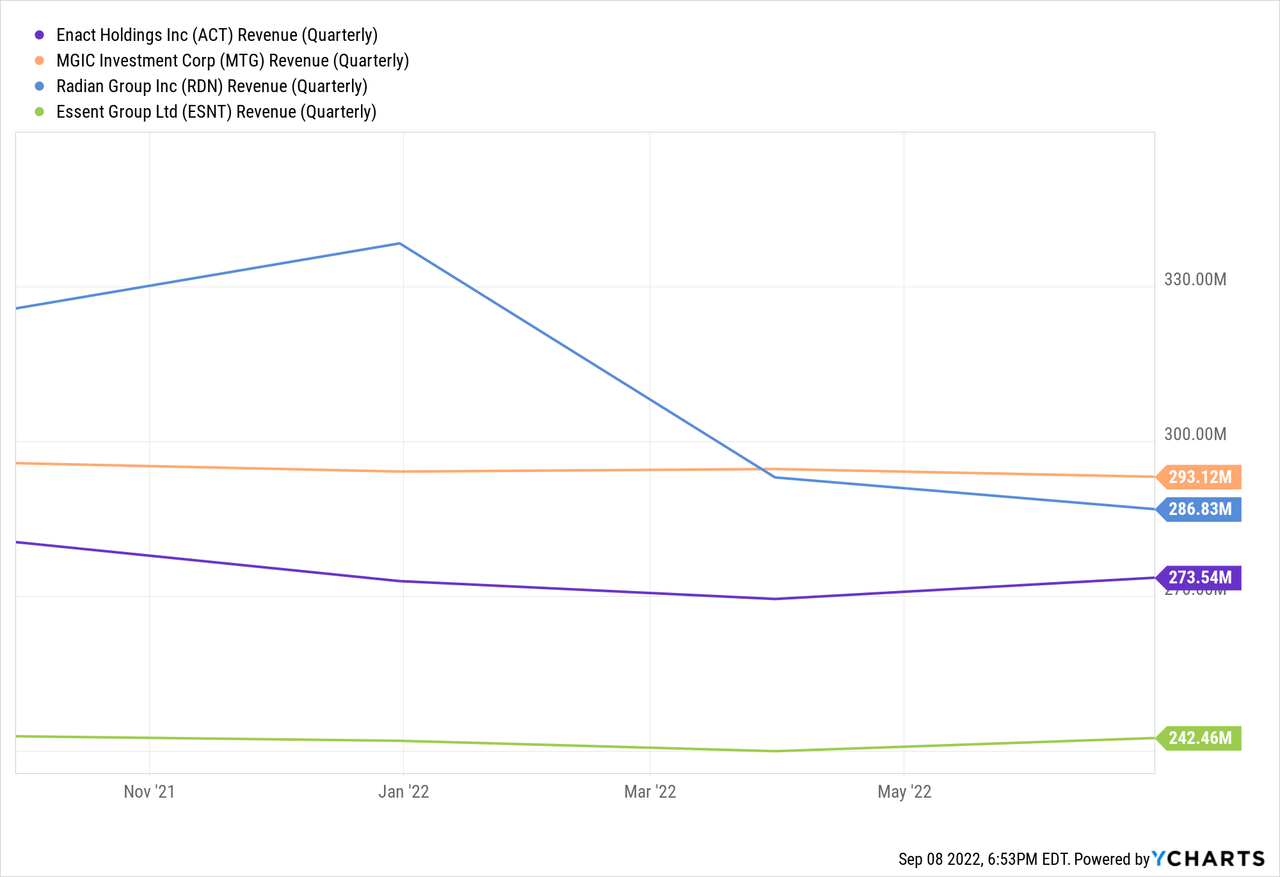

The impact of the slowdown in housing is starting to show up in the PMI carriers top-line results, but the changes are far from equally distributed among these firms.

Essent Group, MGIC Investments and Enact Holdings kept revenue relatively steady since the start of 2020. Radian Group, on the other hand, has seen its topline come down much more severely. For Enact, the Q2 results started with premium revenue of $237 million and investment income of $36 million, for a total of $273 million. While those premiums mostly flow in as mortgage payments get made each month, from time to time a claim will need to be paid out when a borrower defaults. However, that has been such a rarity that Enact was able to book a net benefit here for the quarter on the order of $61 million, essentially offsetting its operating costs of $58 million. The net benefit came from better than expected outcomes on mortgage delinquencies than were planned for during the heights of the pandemic, allowing for a $96 million reserve release during the quarter. This left its expenses for the quarter a mere $12 million, (basically amounting to the interest expense for the period), and delivering an after-tax net income of $204 million, or $1.25 per diluted share.

Behind those results is Enact’s overall persistency – how well it retained its customers. Private mortgage insurance is “sticky” product – once a customer has a policy in force, he does not typically shop around for another carrier, as the premium is collected by the lender right along with the monthly mortgage payment. The typical home buyer has minimal interaction directly with the PMI carrier, even though the home buyer is the one paying the premium. While refinance volume was the overall driver of mortgage volume in 2021, Enact’s business relies more on purchase originations. The company reported overall persistency for the quarter of 80%, which isn’t bad. Even better, though, was this snippet from CEO Rohit Gupta on the earnings call (boldtype for emphasis):

We also benefit from increased persistency, which has been positively affected by the same rise in rates. Importantly, 98% of our portfolio has mortgage rates at least 50 basis points below current market rates and we expect this to have a positive impact on persistency moving forward.

When a typical buyer locked in a new mortgage last year at a low rate and started paying that premium, for most buyers the interest rate today would be higher, reducing the likelihood of refinancing with a different lender going forward. In other words, for Enact, the policies in force are very likely to stay in force until their conditions are met to release them, greatly reducing the risk that the buyer will have the chance to switch to another PMI provider.

The company is well capitalized, with net cash and marketable securities of $4.5 billion, a loss reserve of $559 million, and it opened a $200 million revolving credit line during the quarter. After the close of the quarter, Moody’s upgraded Enact Holdings from Baa2 to Baa1, noting a stable outlook. Specifically, Moody’s called out:

The upgrade of Enact’s ratings also reflect improvements to the company’s overall credit profile, including its market position, profitability, capital adequacy and financial flexibility. During Q1 2022, Enact’s market share of the private mortgage insurance market was approximately 18%, up from 16.6% during 2021. Enact reported net income of $546.7 million and a combined ratio of 38% in 2021, and Moody’s expects Enact’s profitability to remain strong during the second half of 2022 and into 2023 as increasing persistency rates and higher interest rates boost revenues even as mortgage loan origination volumes are expected to trend lower.

My take away from a review of Q2 is that in spite of some of turbulence in the housing market, Enact Holdings is well situated.

Capital Allocation and Valuation

In addition to the stability in Enact’s operations and financial performance, the company is positioned to be quite shareholder friendly with its capital allocation. Targeted returns to shareholders have been clearly stated, and have just begun being implemented with a dividend of $0.14 per quarter. That dividend comes to 2.25% yield at the moment; not bad, but substantially trailing Radian Group’s yield of 3.90% yield. However, that is far from the whole story. The dividend costs Enact about $22.8 million per quarter, or just over $91 million per year. Yet CFO Dean Mitchell reiterated a larger goal for shareholder returns, stating:

we’re committed to returning $250 million of capital to shareholders this year. That includes both quarterly dividends as well as a return of excess capital, obviously subject to requisite approvals, economic conditions and business performance. If we think about excess capital in the forms that, that might take, I think that – we continue to believe that special dividends and share buybacks are available to us as a future means to return capital to shareholders. I think we have to acknowledge that we do have a limited float constraint. So any share buyback program would need to be, what I call, tailored kind of to our facts and circumstances, but we certainly believe that’s a possibility that a tool in our toolbox.

While no announcement has yet been made on either a special dividend or share repurchase plan, clearly management has high confidence that even in this current environment they can return an additional $159 million to shareholders over and above the normal dividend, or an extra $0.97 per share in some form. In December 2021, shortly after the spinoff from Genworth, Enact paid its shareholder a special dividend of $1.23, so there is a bit of established history there. I would not be surprised to see a more modest special dividend schedule for December 2022 payment, along with a share repurchase plan to kick in for 2023. With the company generating well over $3.00 in free cash flow per share on a TTM basis for the last seven quarters and nothing massive on the short-term horizon to put that in jeopardy, I have confidence that the generous shareholder return for this year is responsible capital allocation without jeopardizing other priorities.

Although this is all plainly out in the open, I am not convinced it is factored into how the market it valuing Enact.

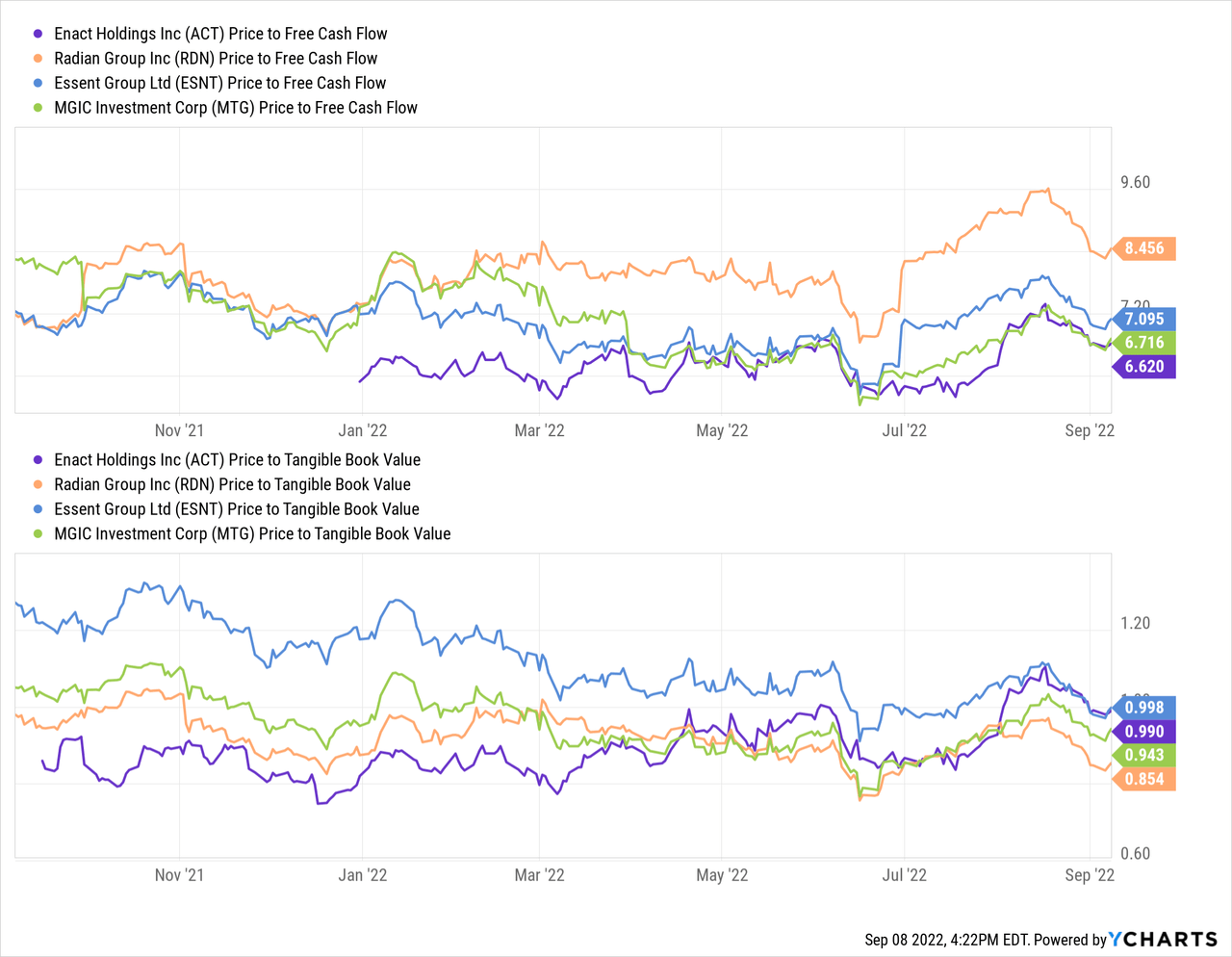

While I often use a price to tangible book value in the insurance industry to look for value opportunities, looking at price to free cash flow provides another good lens for value. Enact, MGIC Investment and Essent are valued on nearly a 1.00x basis with regards to tangible book, with Radian trailing for the moment on this measure. However, Enact is the best value on a price to free cash flow metric, with Radian being the most expensive. Ironically, in my opinion, Bank of America (BAC) recently re-evaluated this sector, upgrading Radian and MGIC Investment, kept Essent at the same “buy” rating, with Enact being the only one downgraded to neutral on the basis of stretched valuation.

I am not convinced that Enact’s valuation is stretched, given both its operational strength and plans to return capital, nor am I seeing it in the valuation comparisons. Moving up to a P/FCF of 7.0x, around the recent historic average, would only be a 5.5% gain, but factored with the normal dividend of 2.25% and a special dividend of $0.34 per share (or about one-third of the $0.97 per share of the remaining return management is guiding, which I think is a reasonable estimate) brings the total dividend yield to 3.6%, and a possible 9% gain annualized, without factoring in any benefit from allocating the other two-thirds, or about $100 million, to a share repurchase program. If the capital return were to play out along this scenario, then even if Enact had to pay an average of $30 per share (a 20% premium to the current market value), it would retire 3.33 million shares, or about 2% of the total; between all of the combined efforts, it begins to add up to some promising potential. Regardless of the details in the final plan, I believe there is strong evidence of hefty shareholder returns yet to be delivered but tentatively scheduled for the coming months.

Conclusion

Even though the headlines on housing and mortgages can look pretty choppy, I think the mortgage insurance sector is a relatively good place to be invested through the cycle. Any of the four major carriers could have things to commend them, but I find that I continue to like Enact Holdings for its strong cash flow generation and a valuation that is fair to slightly under valued. Whether or not the shares appreciate in value in the coming year, shareholders should still see a nice amount of cash back in their pockets from the regular dividend and additional capital return goals. I rate Enact Holdings as a buy.

Be the first to comment