12MN

Arch Resources, Inc. (NYSE:ARCH) looks quite undervalued to me at current prices. Coal companies are extremely out of favor. In part, this is understandable as governments are increasingly (present circumstances an exception to the larger trend) disincentivizing its use. Investors are increasingly focused on ESG, and coal isn’t exactly welcome in that club. Meanwhile, unusually Asian thermal coal prices hit a record high earlier this month. The thermal coal market is extremely tight as Europe has banned imports from Russia.

The FT quoted Alex Tackrah, head of coal pricing at Argus Media, as saying:

There is very high demand at the moment for coal within Europe, with various governments in Europe looking to bring coal back online

We have seen prices trending steadily higher for the last 12-18 months

The above applies to thermal coal. Coking coal has come off its high, and that’s Arch its current primary strength. I’d still say coking or metallurgical coal is at high levels, given where it has historically been over a longer time frame.

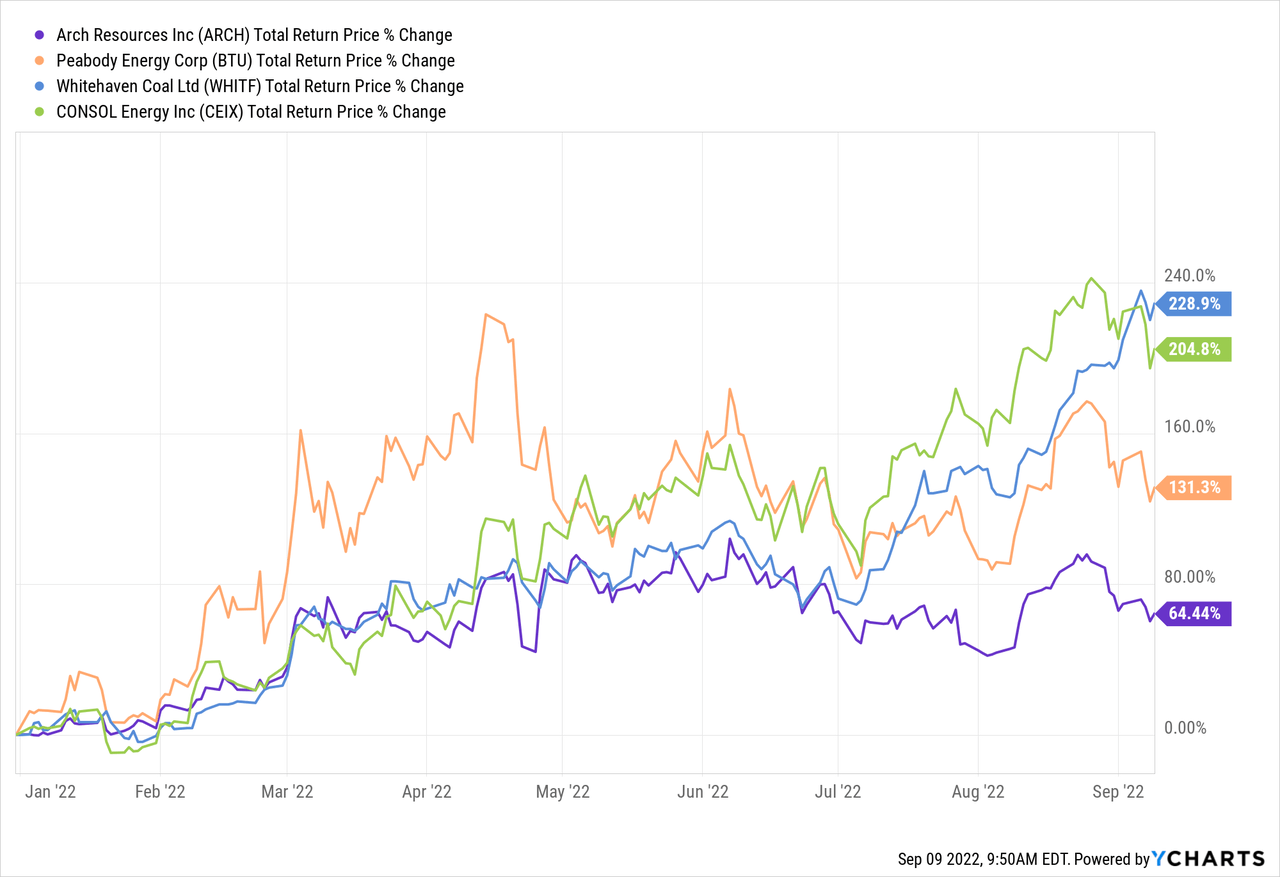

Meanwhile, Arch Resources has been somewhat of a laggard year-to-date, and I suspect that’s because the company has quite a bit of its production and is viewed as a metallurgical name.

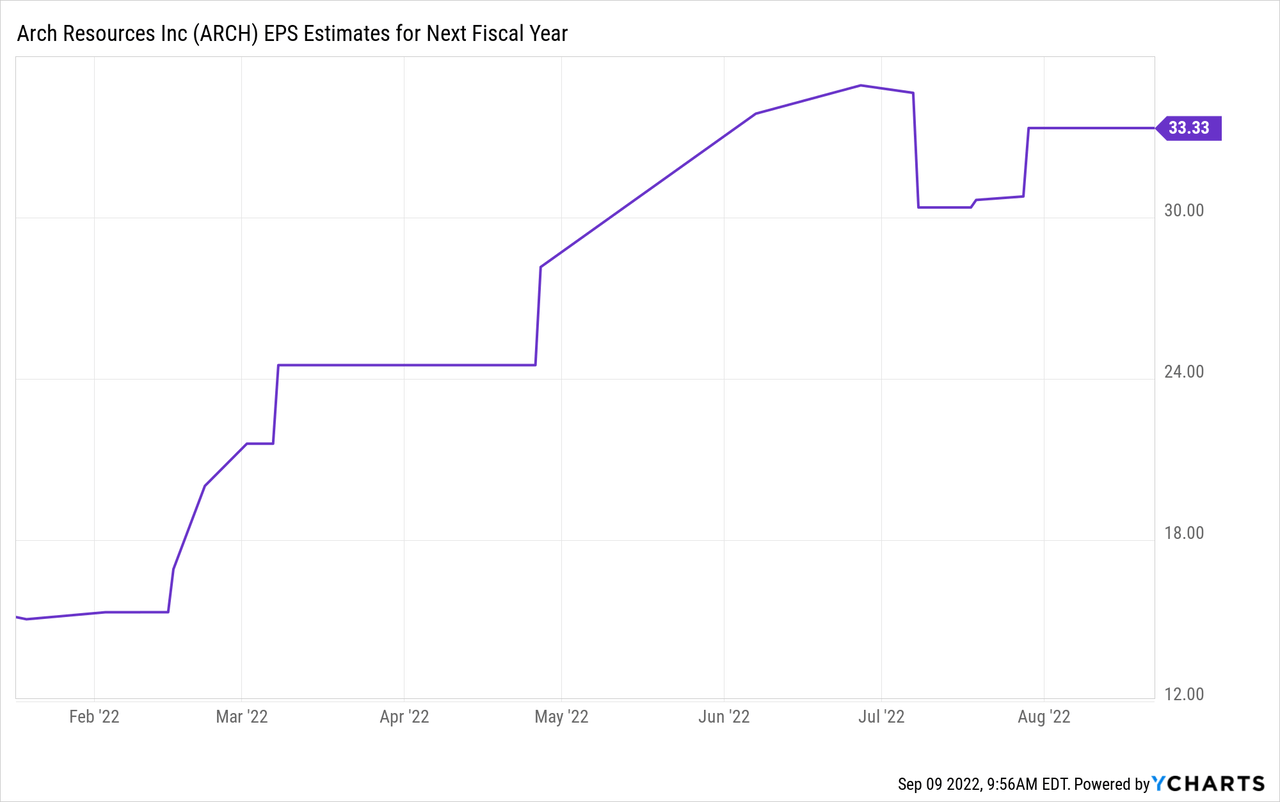

Still, Arch locked in some rates when coal prices were fairly high. Analysts have it pegged at an EPS of $33 per share for next year. At the current stock price, that’s about a 4x multiple on forward earnings. Sure, a lot of cyclicals trade at multiples like that. The market is baking in a recession. However, if you hedged a lot of production right through the year where that recession is supposed to take place… should you still be valued at 4x?

I’m of the mind coal companies are making so much money and trade at such modest multiples that an investor can theoretically make his money back quickly. I don’t disagree coal will likely play a significantly smaller role in future energy generation, but metallurgical (as Arch is betting on) will likely have a longer runway. A MW of wind power requires 120-180 tons of steel, according to Arcelor-Mittal (MT). Steel production requires metallurgical coal. Solar power requires less steel, but the amount still isn’t insignificant. In some ways, the energy transition is a short to medium-term tailwind to metallurgical coal. I’m not an expert on carbon capture technology, but innovation in that direction at least suggest there are some outlier scenarios where coal has a much brighter future than many expect (not to mention what’s baked into stock prices).

Arch has a market cap of $2.6 billion. It has a pinch of debt but a net cash position of $80 million. Management is committed to returning 50% of discretionary cash flow to shareholders through quarterly dividends. In addition, the allocation for the other 50% isn’t set in stone, but management has been hinting at steady and opportunistic buybacks, and there’s a $500 million share buyback authorization in place. Not too bad on a $2.6 billion market cap company.

Last quarter the company did $460 million in EBITDA. Interestingly, the thermal coal segment did $93 million in Q2 and spent only $4.6 million in CapEx. Arch seems to plan to milk the thermal segment for whatever it can get while avoiding large investments with the uncertainty of return. Basic EPS per share was $24.

In my view, these numbers are jaw-dropping, to begin with. This is the quarterly EBITDA and a quarterly EPS number. With thermal at record highs, the thermal EBITDA number could go up significantly due to operating leverage and make an even more significant contribution next quarter.

Aside from the macro backdrop discussed above, the numbers are all the more interesting: revenue has been gated because of bad railway service.

Suboptimal rail service is something I’m seeing across the board at coal producers. The critical problem seems to be that railways cannot attract sufficient capable employees in the very tight U.S. labor market. At the same time, cyclical multiples are depressed because the Fed is on a hiking path. Ergo, the Fed tightens until we are in a recession. Well, usually, a recession or even slowdown would also result in higher unemployment… In turn, suggesting Arch, its transportation issues would alleviate. Of course, demand is also likely to fall in these scenarios (but my argument is that it’s likely priced in already). The demand we’re not seeing reflected in the numbers because it can’t be serviced could function as somewhat of a cushion.

Finally, thermal coal prices above coking coal prices is an anomaly. Only a small subset of all coal has the required characteristics to be used in the steelmaking process. I understand this type of coal tends to contain more energy per ton. In reality, it is not as simple as that. The coking types of coal can still be less efficient in burning for heat due to its composition. There are also often longer-term contracts in place between coking coal producers and steelmakers. Coking coal can’t simply be regarded as thermal coal. Otherwise, this situation wouldn’t exist.

However, it seems unlikely that this situation will last long. Arch said on its latest earnings call it already succeeded in selling a (partial) coking coal shipment into the thermal market and indicated more would be coming:

In fact, we anticipate that a fair amount of global coking coal supply is already crossing over into the much larger thermal coal marketplace, which should serve to support coking coal prices over time.

As you can imagine, we are exploring every opportunity to ship some of our own uncommitted coking coal volumes into the thermal markets, and have had success this week, with a fourth quarter cargo out of Mount Laurel into Europe.

Meanwhile, U.S.-based LNG export facility Freeport should return to service in mid-November. That should support Europe’s energy needs and benefit U.S. gas and coal producers.

There seem to be many short- to medium-term potential catalysts for higher coal prices. Prices staying level is all it takes to produce copious amounts of cash. Management is committed to returning significant cash to shareholders. Arch Resources trades at roughly 4x forward earnings. It has what I’d call great short to medium-term prospects. It has admittedly awfully uncertain long-term prospects. But given the metallurgical focus, the short-term, and Arch Resources’ valuation, I view the long-term almost as a freeroll.

Be the first to comment