Derick Hudson/iStock Editorial via Getty Images

Meta Platforms (NASDAQ:META) is trying to build a strong hardware business that can integrate well with its social media platforms. The company is already selling large numbers of VR sets. It is becoming one of the key players in the smart speaker industry through its Portal devices. Other hardware devices like smart glasses and smartwatch should also help Meta build a wide range of devices that will improve its ecosystem.

While Meta has not revealed the unit shipments for its Oculus Quest 2 devices, Qualcomm’s (QCOM) CEO has mentioned that over 10 million sets have already been sold. Meta’s management is investing huge resources to improve its hardware business. This will pay long-term returns if the company can gain a foothold in key hardware segments. The company has recently opened its first physical store in Burlingame, California to build a stronger connection with customers in the offline space.

Meta can deliver more seamless service through its own hardware compared to products from other OEMs. It is also facing massive headwinds due to the new privacy policy of Apple (AAPL) which was one of the main reasons behind the recent correction. We should see tens of millions of unit shipments in the hardware business of Meta within the next few quarters. This will have a big impact on the top line, bottom line, and overall ecosystem of the company. A strong hardware business will also improve the moat for the company and build a much better sentiment towards the stock on Wall Street.

Moving from service to hardware

Meta is taking new initiatives to build its hardware business which will integrate with the services it currently provides. This is completely opposite to Apple which is trying to become a service-oriented company from a products-based company. Meta has already launched VR sets, smart speakers, smart glasses and is planning on launching its smartwatch. All these products have a very close integration with Facebook’s social media platform. Hence, higher sales of hardware should help the company improve the monetization of its services.

A key example is the Oculus Quest 2 which has sold over 10 million units according to Qualcomm’s CEO. Meta is already looking to monetize its metaverse by asking for a hefty commission of 47.5% for virtual assets and experiences built within its platform. Hence, more unit shipments in this division will be equal to faster monetization growth. Even if Meta is selling these devices at a loss, the company would still recoup the losses and build a very profitable business due to future monetization of the customers.

Meta’s advantages

It is tougher to increase market share within a hardware business because of production, supply chain, and sales issues. Meta can rapidly increase the user engagement within its Reels service and gain hundreds of millions of users for this service but it will take a few quarters to build strong traction for its smartglasses and smartwatch.

However, the company has a number of unique advantages. One of the biggest tailwinds for Meta in the hardware business is its strong social media business. The seamless integration of Meta’s smart glasses provides users with a better option compared to other alternatives. Similarly, Meta’s Portal smart speakers also have a distinct advantage over other players.

Another big advantage for Meta is the monetization ability within these hardware products. A customer using Meta’s smart speaker, smart watch, VR sets, or other products would inevitably be monetized through Meta’s services over the long run. This allows the company to sell these products at a loss in the short term and still make big profits for every unit shipment over the long run.

Meta has also shown the ability to absorb losses to build a new business segment. The company’s investment in metaverse has led to a drop in margins. However, the management has been willing to take these losses in order to build a business with strong growth potential. The massive free cash flow available to the company means that it can continue to invest heavily in the research of new products.

Necessity and opportunity

Meta has a big opportunity in a number of smart device segments as customer base for these products increases. But it is also a necessity for the company to have a strong hardware business. Apple and other OEMs are putting pressure on Meta and it is likely that there might be more restrictions on how Meta delivers its services. In this scenario, the company needs to have a big enough base of its own products so customers have a choice.

Facebook’s Quest 2 has already crossed 10 million mark in unit shipments. We could see tens of millions of unit shipments across all the product segments over the next few years. This will start having a bigger impact on the top line and bottom line of the company. The total revenue from selling over 10 million units of Quest 2 would already be more than $2 billion. Facebook’s Portal smart speaker was already selling over 1 million units prior to the pandemic. With the launch of new devices, this segment is likely to have seen stronger unit sales.

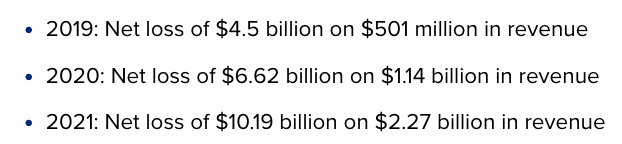

CNBC

Figure 1: Increase in revenue of Reality Labs due to higher unit sales. Source: Company Filings, CNBC

It would not be surprising if Meta can reach unit shipments of over 100 million devices across all products by 2025. Even at a low average selling price of $200, this would add another $20 billion to Meta’s revenue base. The profit from the sale of these devices might be marginal but the company could show better monetization capability over the long run. Higher unit sales will also build a strong moat for the company which would prevent new social media rivals from taking away market share.

Impact on Meta stock

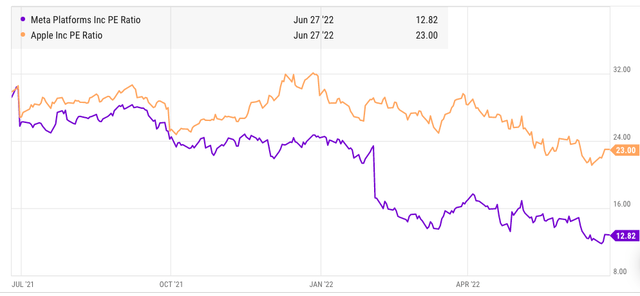

Wall Street is very bearish towards Meta stock with the PE multiple at less than 13. Compared to this, Apple is selling at over 23 times its PE multiple. Rapid growth in hardware sales should provide the company with an additional revenue stream and also help in showing a long-term growth runway. Amazon (AMZN) has built a strong Echo lineup which has helped the company promote its services and build a better moat. Facebook could show a similar strategy with its smart speakers, VR devices, smart glasses, smart watches, and other products.

We could see a short-term hit on margins as the company spends heavily on research with wafer-thin margins on most products. But Meta stock would be a better long-term bet as monetization of these products ramps up. We can already see this trend in Reality Labs. The annual revenue growth rate in the last two years was over 100% while the annual growth in losses was less than 50%. With the launch of new monetization options for creators on Horizon Worlds within metaverse, the loss margin should further decrease.

Figure 2: Meta is selling at a 45% discount in terms of PE valuation compared to Apple. Source: Ycharts

Rapid growth in hardware segment could be the key to improving sentiments towards Meta stock. The company has enough resources to drive unit shipments in products that it can integrate closely with its social media platform. Despite short-term headwinds toward margins, Meta is in a good position to deliver strong long-term growth due to improvement in its hardware business.

Investor Takeaway

Meta is ramping up its hardware business with products like new VR sets, smart speakers, smart watches, smart glasses, and more. The company can afford to sell these products at a bigger discount compared to competitors because it has the option of monetizing the customers over the long term. Most of these hardware products provide seamless integration with Meta’s social media platform which will help in improving the loyalty towards these products and services.

Meta’s moat will improve significantly if it can deliver very strong unit shipments. Wall Street’s sentiment towards the stock will also change as the hardware sales pick up and the company gets a good foothold in key smart devices segments. The strong long-term growth runway and low PE multiple of the stock make it a Buy at the current price point.

Be the first to comment