nambitomo

Shares of orphan disease spin-out Eton Pharmaceuticals (NASDAQ:ETON) have lost 25% of their value in 2022 and have lost half their value over the past 3 years.

Rebound in process the past couple months and strong Q3 report spurred me to take a deeper look at this one, coupled with current market capitalization of just $82M (enterprise value of $70M). Specifically, the company has 3+ approved drugs on the market led by Alkindi Sprinkle, on its own representing a $100M market opportunity by providing a critical low-dose treatment for children with adrenal insufficiency.

While the market capitalization is bit under our $100M minimum, I thought the story here unique enough to merit further due diligence ahead of what should be an interesting 2023 for the company.

Chart

Figure 1: ETON weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares peak at $10 in early 2021 at the height of the biotech bull market. From there, share price steadily declined and bottomed at the $2 level. Currently at $3, a rebound is clearly in process as shares have risen above 20 day moving average and are sitting on SMA 50. My initial suggestion is that readers interested in this name would do well to accumulate dips in the near term ahead of what should be a strong year of continuation.

Overview

Founded in 2017 with headquarters in California (lean operation of just employees), Eton currently sports enterprise value of ~$70M and Q2 cash position of $13M providing them operational runway of roughly 1 year. This does not include a $5M milestone payment they are set to receive for the launch of Zonisamide during the fourth quarter. There are ~24.6M shares outstanding out of 50M authorized.

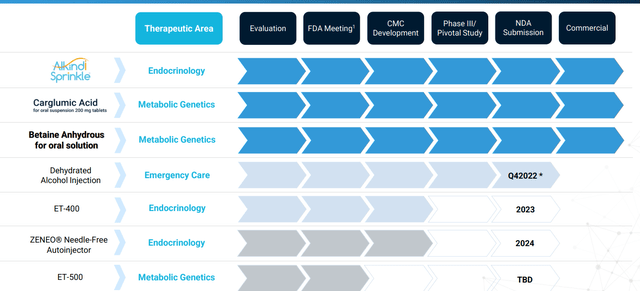

Pipeline looks quite diversified for a company of this size, with management focusing on innovative products that fulfill an unmet patient need. Since formation they’ve managed to assemble a portfolio of 11 products and product candidates (of which 6 have been approved by the FDA and commercially launched). 4 additional product candidates have been submitted to the FDA and the plan going forward is to grow the business via acquisition of additional late-stage, high-value product candidates.

Figure 2: Pipeline (Source: corporate presentation)

The orphan drug product category for treating rare disease patients is ideal for them as a small, targeted salesforce is needed to distribute product through high-touch specialty pharmacies which provide comprehensive services to patients or caregivers.

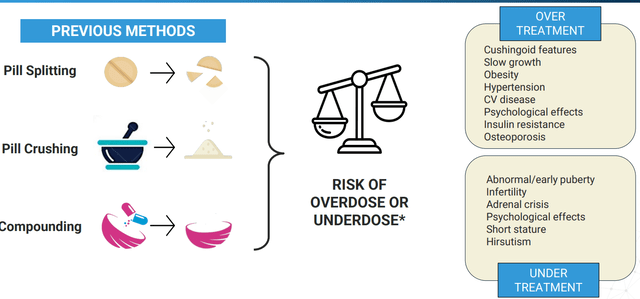

Starting with Alkindi Sprinkle (hydrocortisone granules), this product was approved by the FDA in September 2020 as a replacement therapy for Adrenocortical Insufficiency in children under 17 years of age (only approved formulation designed for use in children). This is an interesting niche product, as previous methods to obtain correct dosing had the potential to result in serious complications.

Figure 3: Dangers of improper hydrocortisone dosing (Source: corporate presentation)

Eton acquired US marketing rights in March of that year and launched in December 2020 by targeting pediatric endocrinologists. To accelerate uptake, in November 2021 they entered into a co-promotion agreement with Tolmar Pharmaceuticals to use their 60+ person salesforce to promote Alkindi Sprinkle (Tolmar receives royalty on net sales growth). There are 10,000 children suffering from AI in the US and Alkindi Sprinkle has 4 issued patents extending protection to 2034.

The second approved product is carglumic acid, the first and only FDA-approved generic version of Carbaglu which is used in treating acute and chronic hyperammonemia due to N-acetylglutamate Synthase deficiency. Importantly, Eton has 180 days of generic exclusivity and believes the total Carbaglu market is over $50M annually (goal is to capture 25% to 35%).

Recently, the company acquired FDA-approved Betaine Anhydrous for the treatment of homocystinuria (impacts less than 2,000 patients in the US). They will relaunch in early 2023 and accretive impact to earnings is expected in the same year.

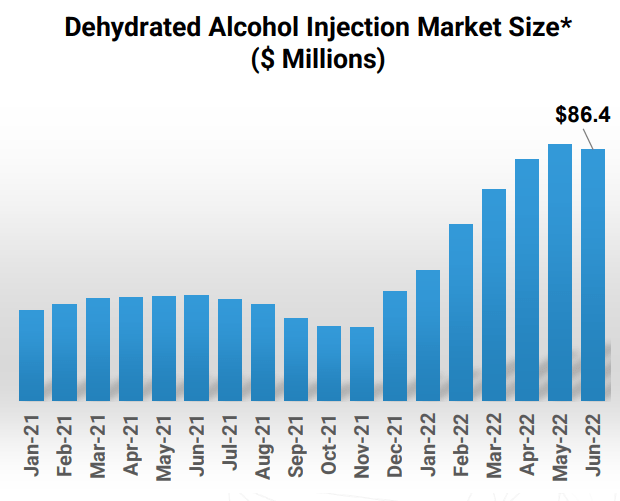

Moving on to the company’s dehydrated alcohol injection product candidate for the treatment of methanol poisoning, they had a setback in May 2021 upon receipt of Complete Response Letter from the FDA. All items raised have been addressed and resubmission to FDA is expected near term ($80M+ market opportunity). The only currently approved product has a price tag of $995 versus historic price of $80, so Eton’s entry would be welcome.

Corporate Presentation

Figure 4: $80M+ market opportunity for treating Methanol Poisoning (Source: corporate presentation)

Next up, the company’s Zeneo hydrocortisone autoinjector product candidate is a proprietary needle-free autoinjector under development for the treatment of adrenal crisis. Eton acquired it from Crossject in June 2021 and current market for Solu-Cortef (lyophilized injection kit that must be reconstituted prior to delivery) exceeds $75M annually based on IQVIA data. Eton plans to submit NDA in 2023 which could lead to approval in 2024.

As for the category of hospital products, Biorphen is the first and only FDA-approved formulation of ready-to-use phenylephrine injection. Eton owns the Biorphen NDA, but the product is currently promoted by Xellia Pharmaceuticals under co-promotion agreement. Eton is working on converting the product from ampule container to vial and plans is in the process of launching the latter, which should drastically increase adoption (competes with FDA-approved formulations of concentrated phenylephrine injection which must be diluted prior to administration as well as unapproved formulations sold by 503B compounding pharmacies). Rezipres also is a ready-to-use formulation of a molecule indicated for the treatment of clinically important hypotension occurring in the setting of anesthesia (similar competitive dynamics). Eton’s cysteine injection candidate is a generic form of Elcys from EXELA Pharma Sciences (Eton has first-to-file status and would be entitled to 180 days of generic exclusivity IF they are successful with their patent challenge).

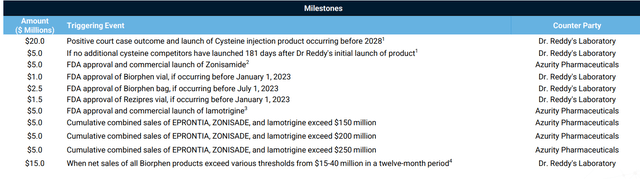

The above does not take into account royalty products that Eton does not commercialize. Essentially, Eton initiated development or licensed at an early stage, advanced each drug candidate to FDA submission before selling rights to a third party in return for milestones and royalties on sales (thus NO further investment is required. Eton currently has 4 royalty products, starting with Always Preservative Free marketed by Bausch Health. The other 3 are neurology liquid products Eprontia, Zonisamide oral suspension and Lamotrigine oral suspension (all owned and marketed by Azurity Pharmaceuticals). Focusing on the latter, Azurity has paid Eton $17M so far and will pay up to $25M in additional milestone payments plus single digit royalty on net sales.

Figure 5: Timing of up to $70M in potential milestone payments (Source: corporate presentation)

Other Information

For the third quarter of 2022, the company reported cash and equivalents of $13.4M (not including expected $5M milestone payment for the launch of Zonisamide in Q4). Net loss fell by 50% to $3M, while G&A expense rose to $4.2M. R&D expenses fell by 75% to $0.7M. Gross profit rose to $2M, while net sales came in at $3.2M (big increase from $0.8M in the prior year period). Revenue was comprised of product sales and royalties, with growth driven by Alkindi Sprinkle and launch of Carglumic Acid in late 2021.

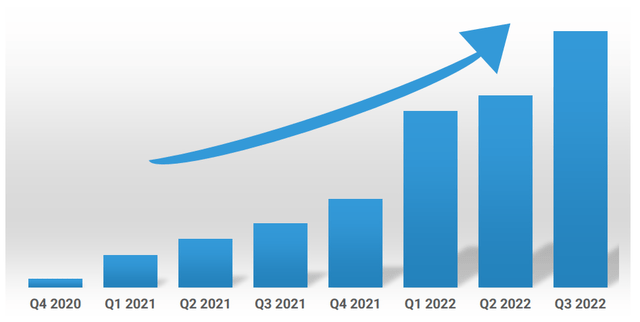

Figure 6: 7 straight quarters of growth as company focused on niche endocrinology and metabolic genetics products (Source: corporate presentation)

As for the conference call, management notes that revenue increased sequentially with 37% jump from Q2 and parent & physician feedback for Alkindi Sprinkle continues to be overwhelmingly positive (addresses significant unmet need for low-dose option of hydrocortisone treatment). Opportunity here again totals $100M with multi-year growth runway expected. Carglumic acid also drove growth with revenue increasing by 40% over prior quarter driven by it being a lower cost alternative to Carbaglu (cost of which can exceed $1M annually for some patients). Additionally, Eton’s tablets do not require refrigeration thus providing a convenience benefit to patients. Capturing just 25% market share would equate to $12M in revenue (and doing up to $20M seems feasible on the high end). In Q3 management continued to execute by adding a third rare disease asset to the portfolio by acquiring Betaine Anhydrous oral solution for treatment of homocystinuria (immediately accretive to earnings in 2023).

Moving on to late-stage candidate dehydrated alcohol injection, they’ve addressed FDA requests with goal of near-term resubmission and 6-month review cycle. Thus, it could be launched in middle of 2023 into an $80M market opportunity where Eton would be one of only two players (and protected by orphan drug exclusivity so they can take significant share). The company expects to reach profitability in 2023.

As for institutional investors of note and insiders, Opaleye Management owns over 2.5M shares or 9.7% of the company. CEO Sean Brynjelsen owns over 1M shares having made his last purchase in September.

As for relevant leadership experience, CEO Brynjelsen served prior as SVP Global Business Development at Akorn. CFO James Gruber hails from recently acquired Horizon Therapeutics, as does SVP Regulatory Affairs Ingrid Hoos. Multiple other members of management team worked together prior at Akorn, specializing in ophthalmic and injectable products.

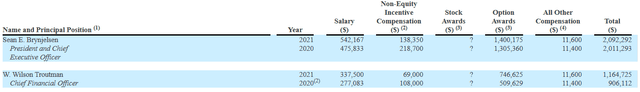

Moving on to executive compensation, cash portion of salary is definitely not excessive but still on the high side for the CEO at $542,167 considering small size of the company and its light balance sheet. On the other hand, non-equity compensation and option awards are at a more than reasonable level.

Figure 7: Executive compensation table (Source: Proxy filing)

The important thing is to avoid companies where the management team is potentially in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Final Thoughts

To conclude, with market capitalization of $82M and EV of ~$70M, I like the direction Eton Pharmaceuticals is moving in since last time I did due diligence on this name. Management is taking the right steps by selling its hospital products to Dr. Reddy’s while focusing efforts on pipeline of orphan drug products or candidates.

Cash position of $18M (including $5M milestone payment) may be on the light side, but so was Q3 net loss at just $3M with management guiding for reaching profitability in 2023. They have a knack for licensing in rights for approved products (or late stage) that are both derisked and able to contribute to revenue growth int he near term, so I expect such solid execution in the area of business development to continue. I also would not be surprised to see a financing (secondary offering) in the near term, as just $10M (~3M shares sold) would provide additional cash to go on the hunt for other assets that could accelerate revenue growth going forward.

For readers who are interested in the story and have done their due diligence, ETON is a Buy and I suggest accumulating a position below the $3.50 level. A prudent strategy could be to purchase half of one’s desired exposure, then waiting for financing before buying the rest. I also note that volume has been erratic here (average of 70,000 shares traded/day), so LIMIT ORDERS are a must.

While market capitalization is just under our typical $100M limit, I feel that upside here (as well as downside cushion via multiple approved products and growing sales), merited going forward with this article.

Taking a long-term perspective (3 to 5 years), I see multi-year revenue growth coming via sales growth across multiple approved products (especially Alkindi Sprinkle addressing $100M opportunity). Management’s savvy business development has the potential to bring in additional novel assets to further accelerate growth, but a sharp eye should be kept on such efforts as that’s where risk lies as well (overpaying for assets or choosing opportunities with poor risk/reward profile or too much development or regulatory risk involved).

As for risks, I still think a dilutive financing in the near term is a distinct possibility (perhaps 10% to 15% dilution in order to in-license new assets and bolster the balance sheet). Competition for certain products is a key risk factor, and I also note that the company sells its Alkindi Sprinkle and Carglumic Acid product to just one pharmacy distributor customer (who then in turn provides order fulfilment and inventory storage/distribution services). The company may sell products in the US to wholesale pharmaceutical distributors, but again does not have the control that comes from having an internal sales team. Eton also uses 3rd party logistics vendor to process and fulfill orders. The company bills at initial product list price which are subject to offsets for patient co-pay assistance and state Medicaid reimbursements (also subject to discounts for prompt payment and chargebacks when prices negotiated with group purchasing organizations or GPOs). The above to say that I appreciate that Eton runs a lean operation, but on the converse side there are multiple aspects of the business they have less control of as a result.

As for price targets, I leave those for the analysts but think a rebound to April highs in the mid $4s in 2023 is a logical near-term target. While the weekly chart shows a steep decline from 2021 highs, fundamentals of the business have never been better (to my eyes) and so 2023 to 2024 period is where I’d expect the chart to catch up.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment