Sean Gallup/Getty Images News

Google’s (NASDAQ:GOOG)(NASDAQ:GOOGL) advertising revenue is thriving despite many other large players in the industry struggling due to changes to privacy options. In the company’s most recent report, Google Search and other services saw huge growth in revenue because of its rising popularity among small businesses. Furthermore, YouTube has unique advantages over its major competitors because of the availability of free content and ability to place multiple ads onto one video. Google Cloud is the smallest of the big three cloud providers but is making improvements to become a stronger player. Even if Google Cloud does not improve drastically, the rising size of the cloud services industry will still allow the segment to see major gains. These factors combined with the current share price and buyback program makes the stock very attractive among investors.

Google Will Likely Outperform Other Advertisers Despite Changes to Privacy

The vast majority of Google’s revenue is derived from advertising. In FY21, 92.2% of the company’s revenue was generated through its Google Services segment, which generates revenue primarily through advertisements on Google Search and other platforms. Therefore, identifying the health of Google’s future ad revenue is vital to its performance.

The issue with many advertisers is Apple’s (AAPL) changes to its privacy options for iOS users. Now iOS users can choose not to share their IDFA tag (a tag to recognize users for ad targeting) with third-party platforms. This is causing many companies that rely on this tag to speak out against it and see slowed growth. Specifically, Meta Platforms (META) has spoken out against this change because it directly hurts the company’s revenue. Now that Meta cannot target users for ads as well as it has previously, advertisers are not willing to pay as much and is directly harming the company’s top line. However, Google has the advantage of collecting its own data.

Google collects its own data on users through user accounts and other methods. This means the company does not rely on the IDFA tag while many of its competitors do. Therefore, it can still effectively target ads to users who would be best for them. This is leading to Google’s platforms becoming top choices among small businesses and other advertisers. While other platforms are seeing slower growth and even making changes to the size of their workforces to compensate, Google is still thriving. In the company’s first quarter report, revenue rose 23% Y/Y to $68.01 billion due to strong performance from Google Search. With advertisers continuing to use Google over competitors and likely continue to do so in the future for better targeting, the company’s ad revenue will likely continue to thrive.

YouTube Has Major Advantages Over Competitors

YouTube is one of Google’s best sources for advertising and accounts for about 12% of the Google Services segment. Since this platform is important to the company’s overall performance, it is important to determine how it may perform in the future. Therefore, we will compare it to competitors like Netflix (NFLX) and TikTok.

Firstly, YouTube has the advantage over Netflix that it does not have to pay for content. In FY21, Netflix paid over $17 billion for content on its platform. This is the only real significant cost for Netflix and causes the company to have a gross margin of 41.6% while Google’s is 56.9%. Furthermore, there have been cases where YouTube gets more views than content on Netflix. Namely, a large YouTuber named MrBeast made his own version of Squid Game that attained more household views than Netflix’s version. Squid Game is Netflix’s most popular series ever and reached over 147 million households. However, the version made by MrBeast now has over 263 million views and has far surpassed its competitor. Along with YouTube attaining more views than Netflix, YouTube did not have to pay for the rights or production of the video while also taking 45% of the generated ad revenue. This is just one example where content on YouTube surpassed Netflix at a lower cost.

Despite YouTube being a strong asset for Google, its growth slowed in the first quarter of this year. A big reason for this is because of the rise of TikTok and its popularity among advertisers. A survey by Cowen stated TikTok is one of the best ways for small businesses to advertise, and even outperforms Google. In this survey, 35% of respondents claimed YouTube is their favorite platform for mobile videos while 22% claimed TikTok was their favorite. Compared to last year, YouTube’s popularity decreased while TikTok’s increased. However, it is important to note the capabilities of each platform’s ad systems. On TikTok, an ad is shown roughly every 10 videos due to the content being an average of 25 seconds long. On the other hand, YouTube can place multiple ads onto one video because its content is an average of 11.7 minutes long. YouTube can also display banners and other ads on other parts of the site. This allows Google to earn more revenue by displaying multiple ads at a time for its users compared to TikTok only showing one. Therefore, it is likely that YouTube will continue to be the top platform for mobile videos and regain its strong growth in ad revenue.

Google Cloud is Below Competitors But is Improving

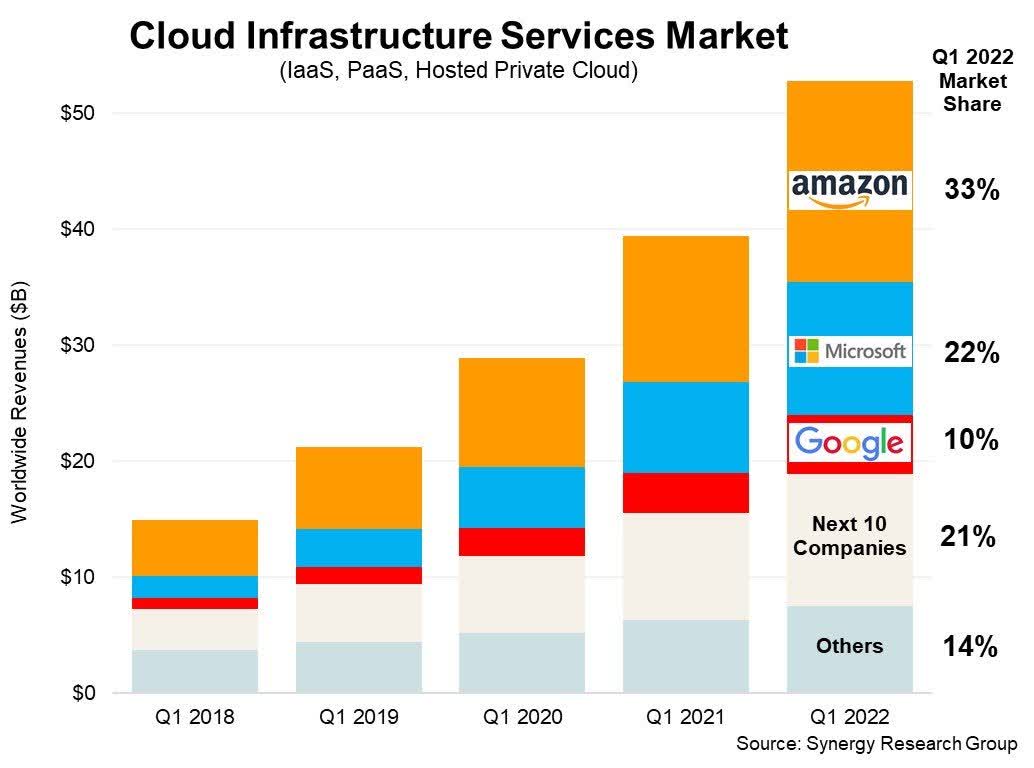

The big three names in the rising cloud services industry are AWS (AMZN), Microsoft Azure (MSFT), and Google Cloud. These three companies account for roughly 65% of the cloud industry but are far apart in market share. AWS is currently the largest provider at a 33% market share. Azure is next with 22% and Google Cloud is last at 10%. Since 2017, AWS has maintained its market share of about 33%. Meanwhile, Azure has grown its share by 9% and Google Cloud has grown by about 3%.

Cloud Services Market Share Breakdown (Synergy Research Group)

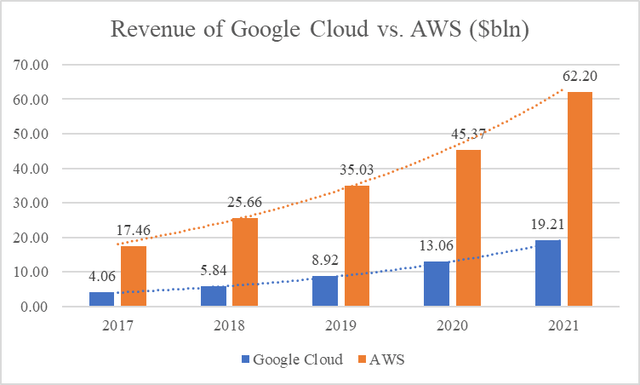

In this same time period, Google Cloud’s revenue grew rapidly. From 2017-2021, the segment’s revenue increased from $4.06 billion to $19.21 billion. This calculates to a CAGR of 47.5%. Compared to AWS, Google Cloud outperforms. From 2017-2021, AWS grew its revenue from $17.46 billion to $62.20 billion, which calculates to a CAGR of 37.4%. Although Google Cloud is growing faster than AWS, AWS is compounding its growth on way higher numbers. Therefore, it will be incredibly difficult for Google Cloud to truly compete with AWS for quite some time.

Revenue Growth of Google Cloud vs. AWS

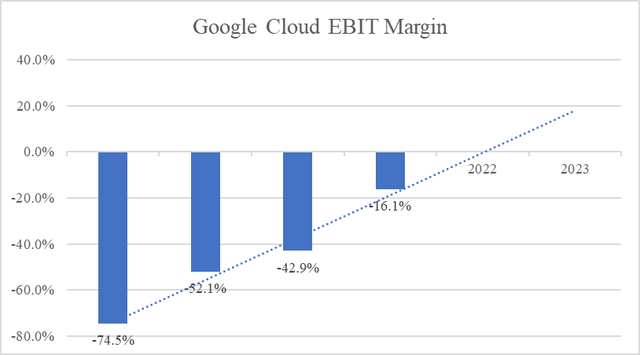

Google Cloud’s EBIT margin is where many investors become worried. The segment has yet to be profitable and is spending lots of cash to grow. On the bright side, the service’s EBIT margin is trending in the right direction and is approaching profitability quickly. Since 2018, its EBIT margin has increased from -74.5% to -16.1%. This is mainly due to the service’s revenue growing at an incredibly rapid rate. If this trend continues at its current pace, Google Cloud could achieve an operating profit in the next few years.

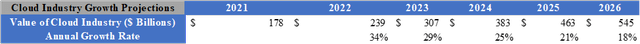

Although Google Cloud needs some work to catch up with its larger competitors, it will still provide lots of value to the company due to the rapid growth of the cloud services industry as a whole. Over the past 3 years, the cloud services industry has grown by an average of 34% per year. Currently, the industry is worth a total of $178 billion. By using its current value combined with a 34% growth rate that slows by 15% per year, we can calculate the industry’s future value. By using these assumptions, the cloud services industry could be worth $545 billion in 2026. If Google Cloud retains its 10% market share, the service would be valued at about $54.5 billion.

Possible Growth of the Cloud Services Industry

Valuation

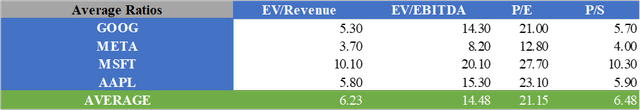

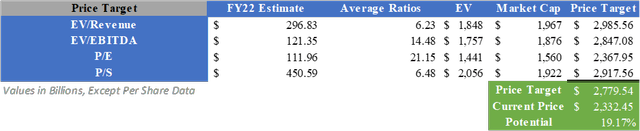

When valuing the company’s stock, I used a relative valuation and DCF to find a fair value. For the relative valuation, I found the average valuation multiples for EV/Revenue, EV/EBITDA, P/E, and P/S of Google and its competitors and combined them with the consensus analyst estimates for FY22. After adjusting for the company’s cash and debt, a fair value of $2779.54 can be calculated. This gives an implied upside of about 19.17%.

Relative Valuation of Alphabet Stock

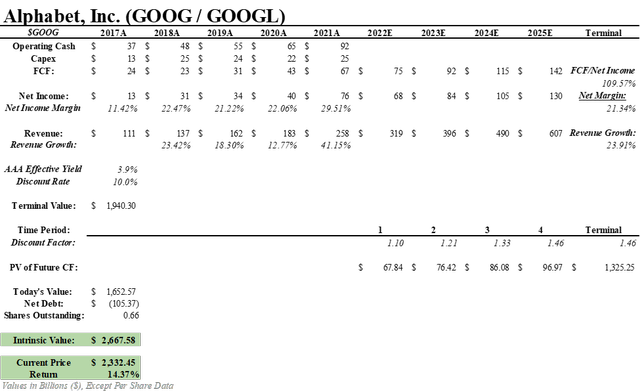

For the DCF, I first projected the company’s future revenue by utilizing its average annual growth in revenue of 23.91%. After finding the projected revenue, I calculated the projected net income in the upcoming fiscal years by using the company’s average net income margin of 21.34%. I then multiplied the projected net income by Google’s average FCF/Net Income ratio of 109.57% to find the future free cash flows. For the discount rate, I used 10% to ensure a large premium over AAA corporate bonds. Finally, I found the sum of the future free cash flows, adjusted for the net debt, and divided by the shares outstanding to arrive at a fair value of $2667.58 per share. This implies an upside of about 14.37% for the stock.

DCF of Alphabet Stock with a 10% Discount Rate

A few key notes to mention about Google’s stock price is its upcoming stock split and share buyback program. On July 15, shares of Google are undergoing a 20-for-1 stock split. This means the current share price and price targets would be divided by 20 to arrive at the new prices. Furthermore, the company announced a $70 billion share buyback. At the time of this announcement, this represented about 4.5% of the total market cap. These developments will likely give increased value to shareholders and bring new investors into the stock.

What Does This Mean for Investors?

Despite other tech companies facing difficulties from changes to advertising, Google will likely continue to thrive due to collecting its own data for more personalized ads. This can already be seen in the company’s most recent quarterly report where Google Search became more popular among small businesses and grew dramatically. Although YouTube experienced slower growth recently, it has major advantages over its competitors including free content and the capability to display multiple ads. As for Google Cloud, it is growing quickly but needs to see some improvements. It will be difficult for the service to gain ground on AWS and Azure, however, it does not necessarily need to as the growing cloud industry will allow for huge growth anyway. Due to all of this and the current price the shares are trading at, I will apply a Buy rating at this time.

Be the first to comment