thekopmylife

A Quick Take On EMulate Therapeutics

EMulate Therapeutics (EMTX) has filed to raise $15.6 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is developing medical device technology to treat a range of serious health conditions.

When we learn more IPO details from management, I’ll provide an update.

EMulate Overview

Bellevue, Washington-based EMulate was founded to develop its ulRFE low-to-ultra-low radio frequency energy device to regulate ‘signaling and metabolic pathways on the molecular and genetic levels – without chemicals, radiation or drugs.’

Management is headed by Chairman, CEO and president Chris E. Rivera, who has been with the firm since 2014 and was previously founder, CEO and president of Hyperion Therapeutics and head of Commercial Operations at Genzyme Therapeutics, ‘where he built and ran Genzyme’s US renal Commercial Operations.’

The firm says its electro-magnetic field technology has ‘produced substantially similar molecular effects as the paclitaxel drug at the cellular level’.

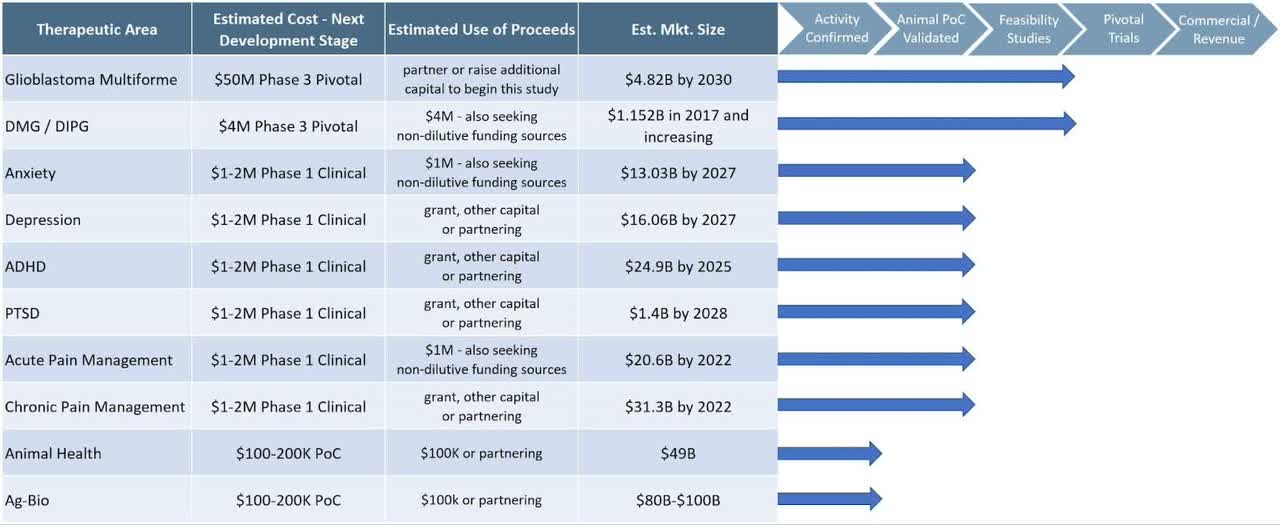

Below is a chart from the firm detailing the status of its device studies:

Company Development Status (SEC Edgar)

Management says it is ‘pivotal trial ready’ for various treatment indications but is not currently conducting trials and it is unclear to what extent Phase 1 or Phase 2 trials have been conducted and accepted by the U.S. FDA.

The company operates through a number of subsidiary entities depending on the specific health focus.

EMulate has booked fair market value investment of $19.2 million as of June 30, 2022 from investors including The Butters Family Revocable Trust and individuals.

EMulate’ Market & Competition

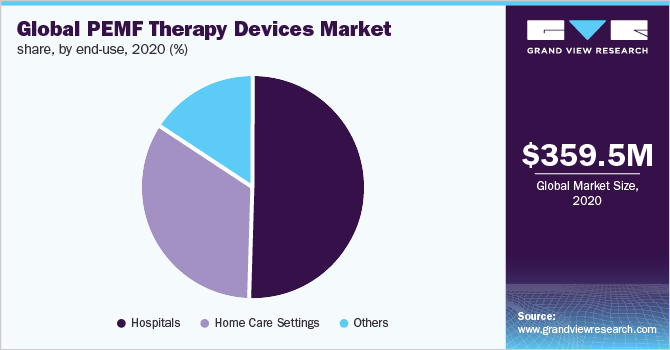

According to a 2021 market research report by Grand View Research, the global market for pulse electromagnetic field therapy [PEMF] devices was an estimated $360 million in 2020 and is forecast to reach $656 million by 2028.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 7.8% from 2021 to 2028.

Key elements driving this expected growth are improvements in PEMF device technologies, miniaturization and increasing bone fractures and diseases associated with aging populations.

Also, the pie chart below shows the breakdown of PEMF devices by market use:

Global PEMF Therapy Devices Market (Grand View Research)

Major competitive vendors that provide or are developing related treatments include:

-

Novocure

-

Bedfont Scientific

-

Orthofix Holdings

-

I-Tech Medical Division

-

OSKA

-

Medithera

-

NiuDeSai

-

Nuage Health

-

Oxford Medical Instruments Health

-

Bemer, LLC

EMulate Therapeutics Financial Status

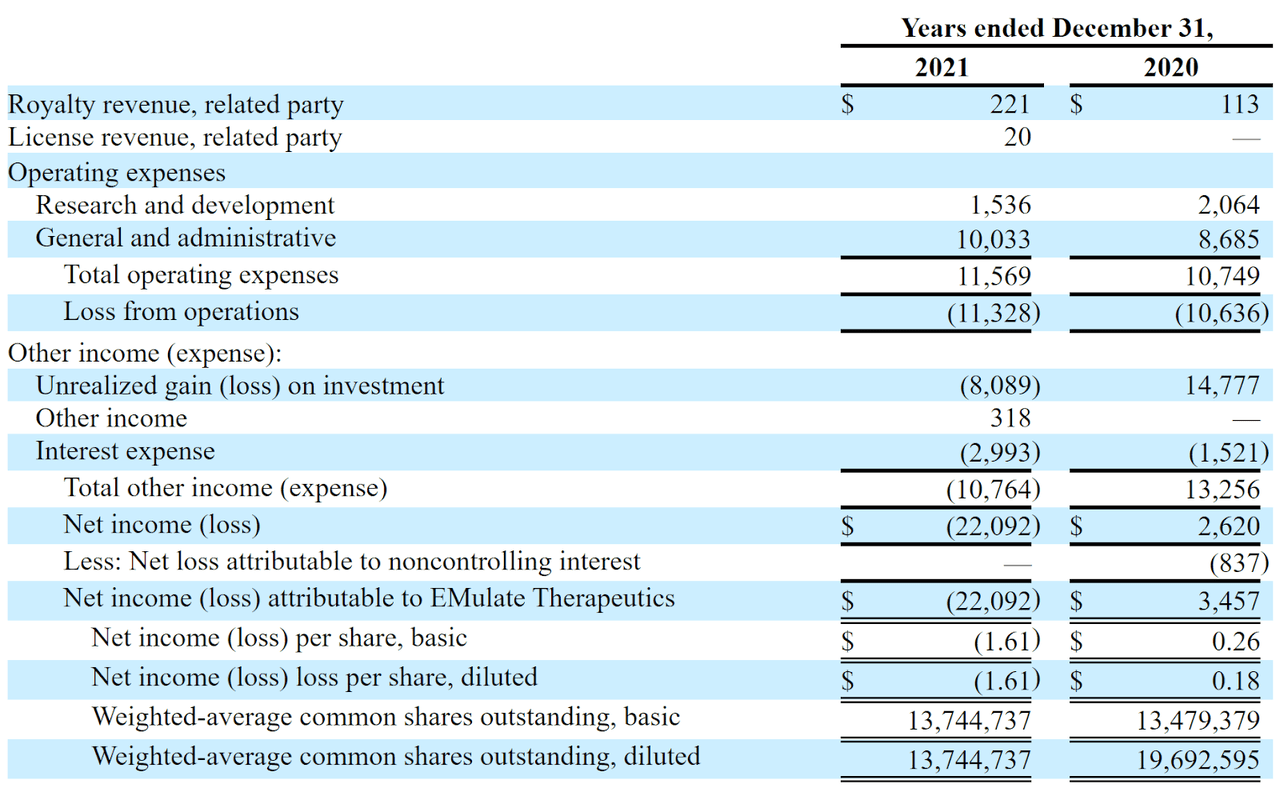

The firm’s recent financial results are typical of a development stage life science firm, with little in the way of revenue and significant R&D and G&A costs associated with its product development efforts.

Below are the company’s financial results for the past two calendar years:

Statement Of Operations (SEC Edgar)

As of June 30, 2022, the company had approximately $10,000 in cash and $19.9 million in total liabilities.

EMulate Therapeutics IPO Details

EMulate intends to raise $15.6 million in gross proceeds from an IPO of its common stock, although the final figure may vary.

No existing shareholders have indicated an interest to purchase shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

Management says it will use the net proceeds from the IPO for working capital, sales and marketing, research and development and licensing and banking activities.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, “pursuant to an arbitrated settlement in 2016 with two former employees and founders of the Company regarding the severance amounts payable under their respective employment agreements, we are obligated for the payment of a severance amount to these individuals. Payment of the full amount has to date been deferred pursuant to a series of agreements, and we remain current in our scheduled payment obligations under those deferral agreements. The unpaid aggregate severance amount as of August 15, 2022 is approximately $6.3 million. [Emphasis mine] We are in discussions with the former employees and founders. The ultimate outcome of this matter cannot be predicted at this time.” (Source – SEC)

The sole listed bookrunner of the IPO is EF Hutton.

Commentary About EMulate’s IPO

EMTX is seeking U.S. public market capital to fund its continued product development and corporate plans.

The firm’s lead candidate has ‘produced substantially similar molecular effects as the paclitaxel drug at the cellular level’, although management is not currently in trials and it is unclear what approvals the company has received from the FDA for trial purposes.

The market opportunities for PEMF treatment options for various indications is potentially large but is difficult to quantify as to their applicability to the firm’s treatment approach.

Management has not disclosed any major pharma or medical device firm collaboration relationships.

The company’s investor syndicate doesn’t include any well known, institutional life science venture capital firms or strategic medical device investors.

EF Hutton is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (39.4%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Management’s strategy is to pursue treatment approvals for a wide range of conditions, so the firm has set up subsidiaries in specific areas to better enable partnering and financing options.

I tend to favor a more focused approach, as it is difficult and time consuming enough to get one device approved and successfully commercialized, let alone ten of them.

When we learn more details about the IPO, I’ll provide a final opinion.

Be the first to comment