Joey Ingelhart

Investment Thesis

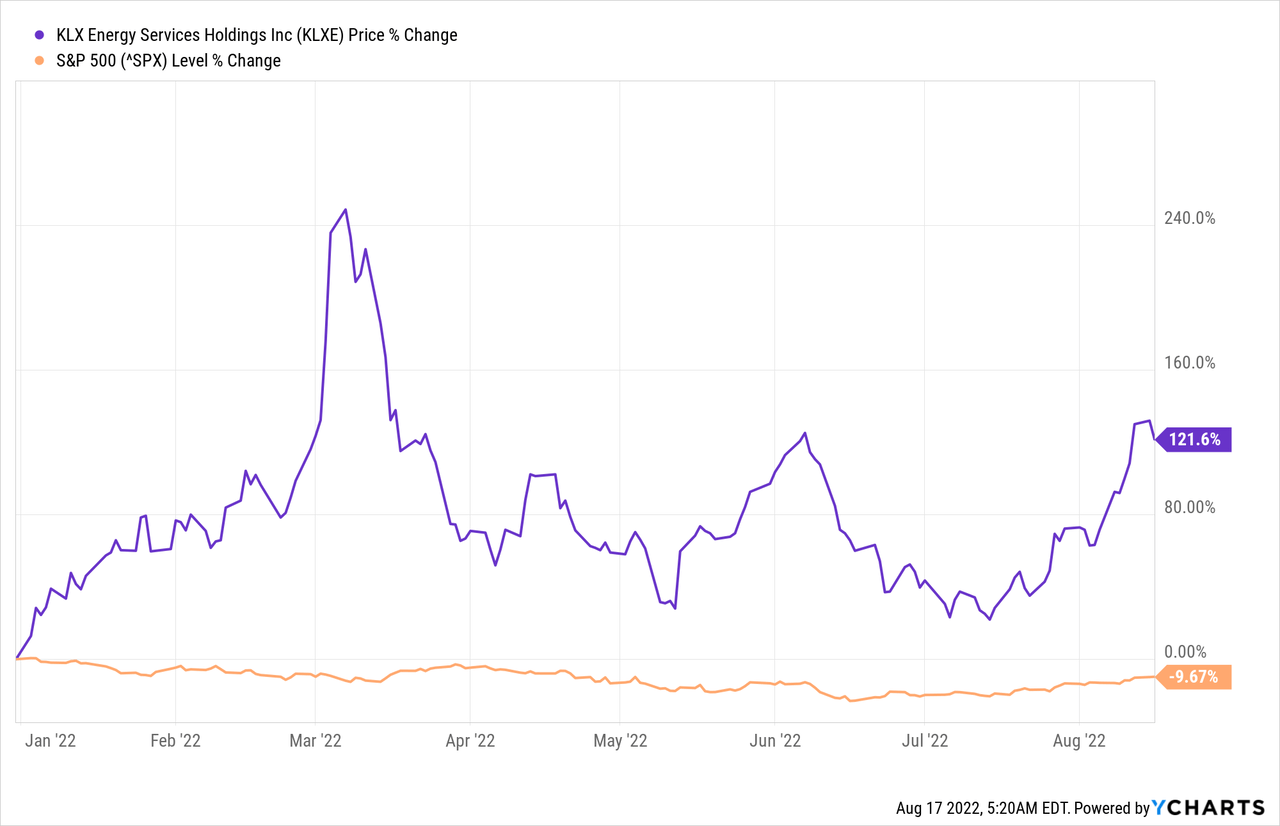

KLX Energy Services Holdings, Inc. (NASDAQ:KLXE) is a cyclical stock that has lost about 95% of its value in the last 5 years. However, the stock is gradually catching investors’ attention, as its share price gained over 30% in the past 52 weeks and more than doubled YTD.

With oil prices reaching their highest point in over a decade, the overall market has rebounded strongly post-pandemic. Additionally, the Russia-Ukraine conflict has directly contributed to the crude oil price surge, creating more demand for drilling and production activities.

This has initiated a debate in the U.S. to increase its production to strengthen the US energy independence or switch toward renewable sources for efficiency augmentation and green initiatives. The industry is recovering surprisingly better than expected. Still, vulnerability is more likely to occur in the market in the coming years as the US promotes clean energy and renewable sources.

Despite the recent margin expansions driven by cost-cutting and pricing advantage, the company has been an underperformer. However, as the pricing advantage dissipates, I expect the company’s improvements to be marginal in the medium term, exhibiting unimpressive growth.

In the wake of the recent stock price surge, I rate the stock as a sell for investors to cash in their profits and invest their capital in securities with a much better risk-reward dynamic.

The Company

KLXE serves onshore oil and natural gas reserves exploration and development companies in the US, providing drilling, completions, production, and well intervention services and products. It offers engineering solutions, including streamlining operations, non-productive time replacement, and developing cost-effective solutions and customized tools across the well’s lifecycle for its customers.

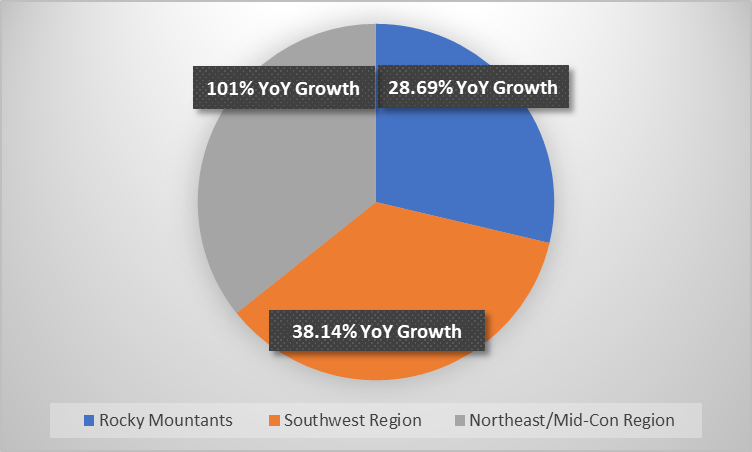

Its operational sites, which form its revenue-generating segments, include the Rocky Mountains Region, the Southwest Region, and the Northeast/Mid-Con Region. In the MRQ, each segment accounted for 28.69%, 35.61%, and 35.7% of the revenue, respectively.

The company showed an aggregate YoY revenue growth of 66.1%, composed of 64.49%, 38.14%, and 101.25% YoY growth, respectively.

Data from Q2 Reports

The Market

Crude oil prices spiraled upwards in 2022, resulting in over 33% gain during Q1 2022 and an incremental gain of about 17% YTD, fueled by the Biden administration banning Russian oil imports to the US after the Ukrainian invasion. As a result, US-based drilling and production activities started to increase.

According to the recent numbers from Baker Hughes, the rig count in the U.S has increased 28% from December 2021 to June 2022 and 52% from August 2021 to August 2022, resulting in 763 total operational rigs. The commodity prices have declined in the third quarter from the highs of the second quarter. One can expect a decline in these prices in the short term due to the increasingly gloomy economic outlook caused by the uncertainty and volatility arising from the Russia-Ukraine conflict, high inflation, and a looming recession.

However, the long-term pricing prospect is expected to be relatively high over the coming years. The current market is extremely volatile and uncertain amid macroeconomic and geopolitical instability, making any underlying assumptions for short-term estimates and scenarios highly unreliable.

The company claims to have increased demand for its services, which resulted in the recent financial performance augmentation, but the sustainability of this demand remains questionable.

Threats from the Alternate Energy Market

Despite being one of the vital players in the U.S economy, rising environmental issues such as air and water quality and chemicals management have put the oil and gas sector under scrutiny. These environmental issues have encouraged the establishment of shale gas infrastructure as an alternative energy product.

Environmental regulations for reducing greenhouse gases have greatly impacted the established gas drilling sectors, especially on coal power plants. The government is taking measures for more shale gas exploration, approving the Natural Gas Pipeline Permitting Reform Act to speed up the government survey process for applications of interstate gas pipelines.

In contrast, the Clean air act has positively impacted this industry, iterating that companies should take measures to capture the emitted gases and sell them separately instead of being released as waste material.

According to a report by Environmental Protection Agency, taking the previous 3 decades into account, the costs incurred by this act are approximately $65 billion. Still, the savings from fewer unexpected losses, lower well-being costs, and expanded efficiency will add to about $2 trillion by 2020.

The U.S. government recently signed a $369 billion bill for climate change spending. This could be the foremost important legislation in the history of the U.S regarding climate control. Presented by President Biden at the Glasgow climate summit in 2021, this law could be the first step to achieving zero carbon emission by the year 2050. It will have a trickle-down effect, negatively impacting the revenue and operational functions of conventional oil and gas drilling.

Financial Performance

The company generated $184.4 in the MRQ, a 21% YoY increase, composed of 28.2% from drilling accounts, 49.8% from completion, 11.9% from production, and 10.1% from intervention services, respectively.

Revenue for the Rocky Mountains segment showed a 23%, the Southwest segment showed a 16% increase, and the Northeast/Mid-Con segment showed a 25% sequential increase, driven by activity and pricing increases.

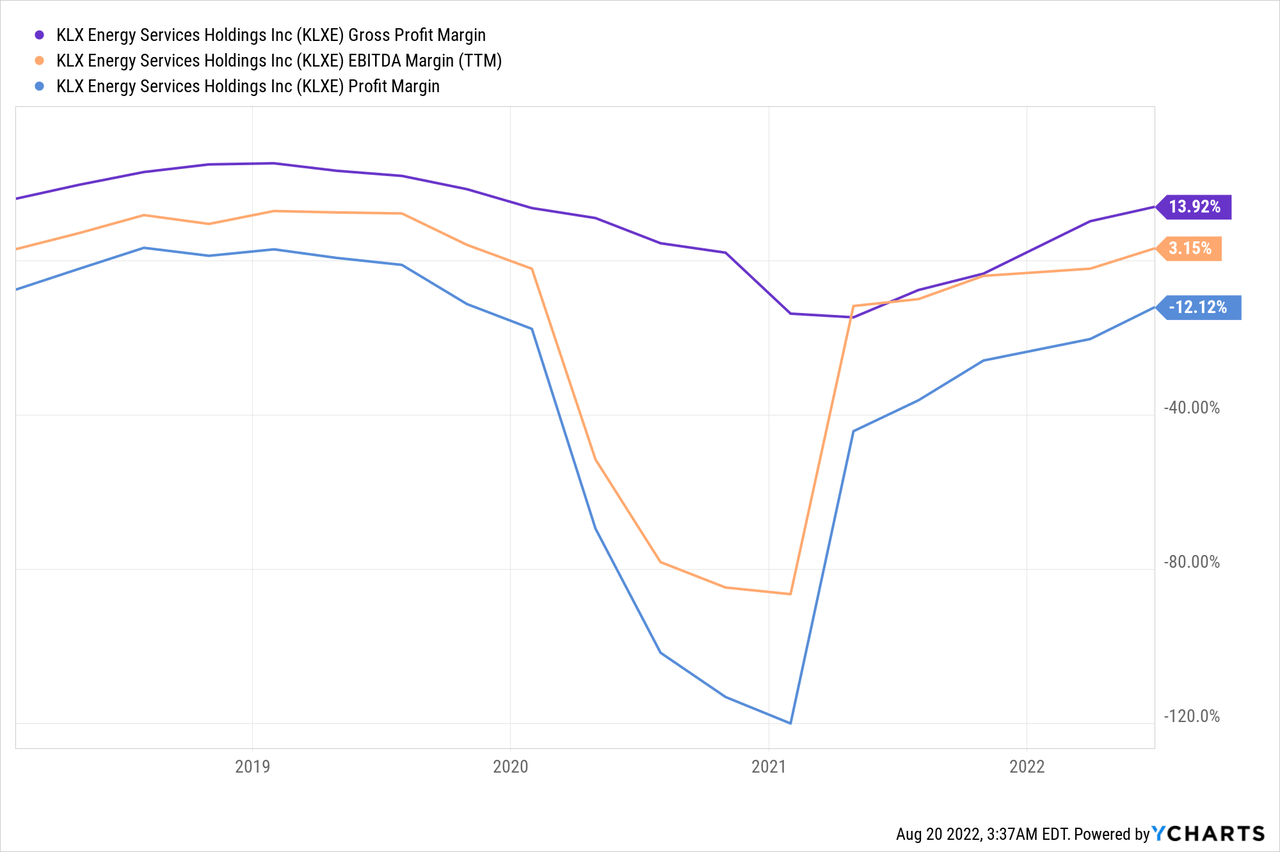

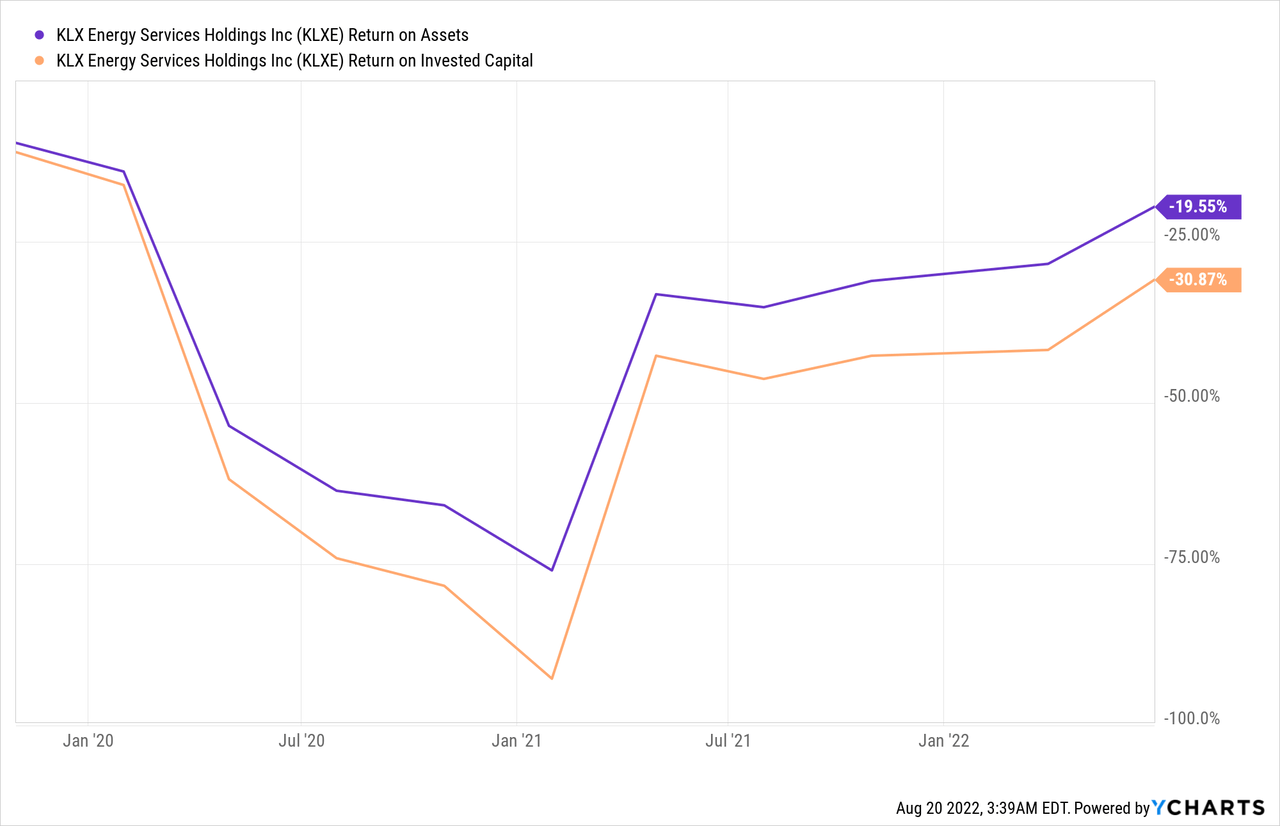

The company’s financial performance has faltered since mid-2019 but has recouped nicely since mid-2021. Since the company’s margins have been squeezed for the better part of its existence, the management is focused on improving its financial statements through cost-cutting and CAPEX control initiatives.

These initiatives have resulted in expanded margins and improved resource utilization ratios sequentially during the trailing 12 months.

Despite the improvements, the margins are still significantly lower than the industry average and KLXE has consistently missed its revenue and EPS targets since 2018, reporting lower-than-sector median profitability.

Since the overall industry faces threats and uncertainties outlined above, being a loss-maker and an underperformer does not bode well for KLX’s future price performance.

Conclusion

Despite the significant upward pricing movements in the market, the company’s revenue has not moved enough to make the stock worthwhile because of its unimpressive cash flows and profitability.

KLX has a negative book value per share of about $5, over 110% LT debt to capital ratio, a 60-month beta of 2.33x, and a negative Altman-Z score of 1, indicating a highly volatile stock with a troubled financial position.

Even though there are some improvements in its financial performance, I would recommend staying away from the stock because of its cyclical nature, which is prone to plummeting with an economic downturn. Investors would be better off investing in more stable stocks.

Be the first to comment