peepo/E+ via Getty Images

Introduction

I like baseball. And apparently, I’m not the only one in the finance industry – imagine that. The other day, I read an article titled The Economics Of The 2020 World Series, which was basically a review of the Philadelphia and Houston economies – the two cities competing for the trophy this year. In this article, I will give you my favorite (major) company located in Houston. The added value here will go a bit further than World Series “click bait” as the Sysco Corporation (NYSE:SYY) is a terrific dividend growth stock, holding the “Dividend King” title. While headwinds persist, this food service company is doing well, protecting investors against inflation and market downside.

In this article, I will discuss why the company behind the SYY ticker is such a good dividend stock with all the qualities of a World Series baseball team, and what I expect going forward.

So, bear with me!

A Top-Quality Stock

Baseball is all about consistency. Teams play 162 games a season, excluding the playoffs and pre-season Spring training. More often than not, it’s not the teams that win who have 1-2 of the best players, but teams that have good players for the right position that deliver consistent results.

On the stock market, it’s different, but similar – if that makes sense.

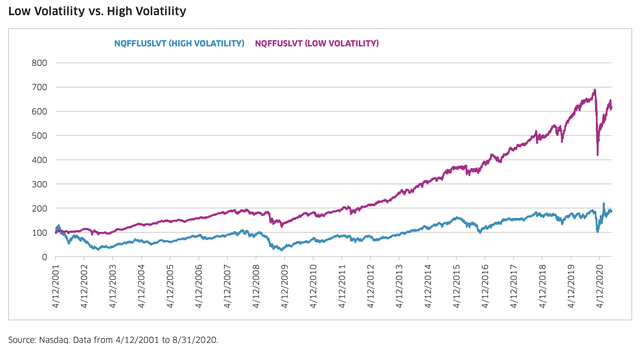

Even if a company isn’t the fastest-growing stock, if it comes with a decent business model capable of long-term growth, odds are investors are going to reward that. Even better, during bear markets, investors tend to sell riskier stocks, putting proceeds into high-quality companies. This gives investors some protection during times of turmoil, even if it doesn’t prevent most stocks from falling. Nasdaq, Inc. (NDAQ) also looked into this, finding the following:

Aside from the 1-year data, the low volatility strategy has had superior risk-adjusted returns on a 3, 5, 10-year, and since inception basis. This shows that low volatility is better at providing long-term capital appreciation compared to high volatility strategies, which makes low volatility a critical investment factor to consider.

The chart below shows that stocks with a low volatility profile have consistently outperformed stocks that come with higher volatility. While one might assume that a higher risk needs to be compensated by a higher return, we can assume that this is simply not the truth on a long-term basis.

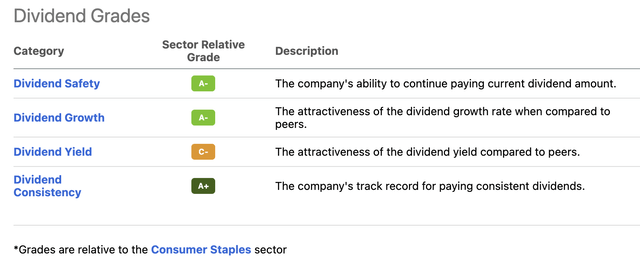

While we will discuss Sysco’s financials in greater detail, it’s fair to assume that we’re dealing with a quality stock when looking at the Seeking Alpha dividend scorecard below. While the yield doesn’t score high on a relative basis to the consumer staples sector, the company scores high on dividend safety, dividend growth, and consistency. After all, it’s a dividend king with more than 50 consecutive annual dividend hikes. That alone is a stamp of approval. Also, bear in mind that the consumer staples sector is a high-yielding sector, in general, full of matured slow-growth, high-yielding companies. Hence, I’m not too worried about the C- score as I will explain in this article.

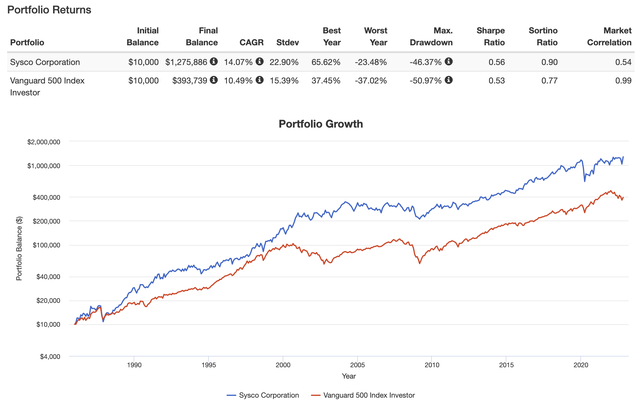

Based on this context, it’s interesting that Sysco is also trading like a high-quality stock. Since 1986, the stock has returned 14.1% per year, beating the S&P 500 by roughly 350 basis points – per year. Even better, the standard deviation in this period was just 22.9%. That’s very low for a single stock. The S&P 500 is at 15.4%, but that’s a well-diversified index of 500 stocks. Hence, SYY shares have beaten the S&P 500 on a volatility-adjusted basis as well (Sharpe/Sortino ratios) with a rather low correlation of just 0.54.

Even better, Sysco outperformed the S&P 500 during every major sell-off, except for the pandemic in 2020 when the stock was slow to recover. That has everything to do with mandatory shutdowns of restaurants.

Now, let’s dive a bit deeper and discuss why Sysco has so much earnings power.

What Makes Sysco So Powerful

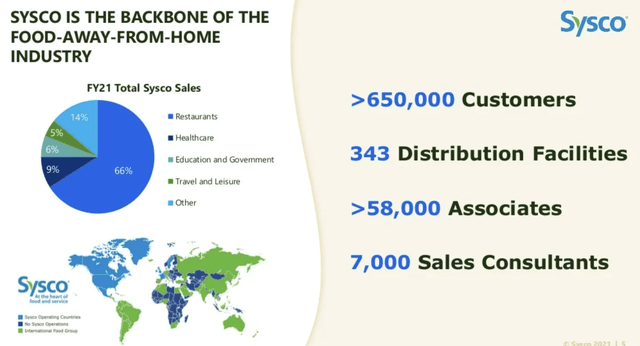

With a market cap of $42.6 billion, Sysco is one of the largest consumer defensive stocks in the world. In this case, the company operates in the food distribution industry.

Founded in 1969, this Houston-based company is the largest global distributor of food and related products, primarily to the food service or food-away-from-home industry.

Sysco distributes food and related products to restaurants, healthcare, and educational facilities, lodging establishments, and other food service customers.

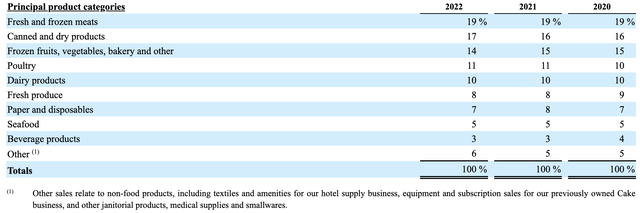

More than 70% of total sales are generated in the US food service operations segment, which includes a full line of food products, including custom-cut meat, seafood, produce, specialty Italian, imports, and non-food products for customers in the US.

Most of its customers are restaurants (63%), which explains why the pandemic was such a big issue – almost all of its customers were closed during mandatory lockdowns.

The company runs distribution centers, which it calls operating sites. There, products of suppliers and private labels are distributed to regional customers. The company has a wide network of suppliers. None of which account for more than 10% of procurement volumes.

The industry is highly competitive. Sysco has a 17% market cap of what is estimated to be a $300 billion foodservice market. In this case, I believe that an industry with low entry barriers is a blessing as it allows companies with an edge – like Sysco – to take market share of smaller, less efficient companies.

Moreover, as I wrote earlier this year:

The company has outstanding online capabilities that make it easy for customers to order. Adding to that, the company is building an omnichannel inventory system and distribution order management system to broaden its supply chain. Especially in current times, a great relationship with sellers is a pro.

This includes the company’s sales force, which is focused on consultative selling instead of administrative task management, which makes selling very efficient.

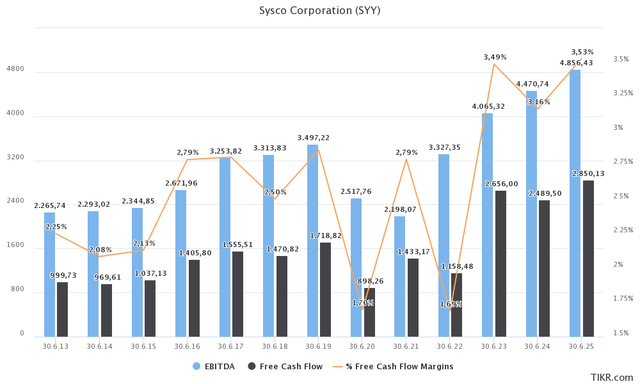

Looking at the company’s financials, we clearly see the impact of the pandemic. In the current fiscal year, the company is expected to grow above pre-pandemic levels again, boosting free cash flow to $2.7 billion with free cash flow margins close to 3.5%, roughly 70 basis points above pre-pandemic levels.

This is good news because a $2.7 billion free cash flow result would imply a 6.3% free cash flow yield, using the company’s $42.6 billion market cap.

As the company’s net debt is expected to fall to 2.4x EBITDA again, there is no need to prioritize balance sheet health. Moreover, the company has an investment-grade (BBB) credit rating. The company’s target debt ratio is 2.50-2.75x, meaning next year could see more aggressive shareholder distributions. Also, 95% of SYY’s debt is fixed-rate debt, which helps the company to deal with the current environment of elevated interest rates.

Now, before we discuss the dividend in detail, let me comment a bit more on its financials.

In its just-released 1Q23 quarter, the company generated revenue worth $19.1 billion, that’s 15.9% higher compared to the prior-year quarter, and $430 million higher than expected. The company was upbeat about its business while remaining appropriately cautious about the macro environment.

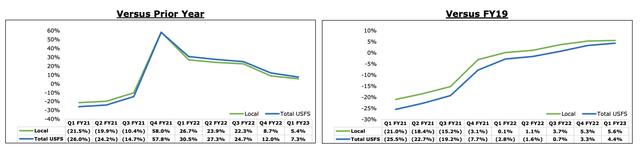

What matters is that the company’s sales grew 1.4x as fast as the industry, indicating further market share gains. It’s also the third quarter reporting growth versus pre-pandemic levels. The company expects to outgrow the industry by 35% in FY23.

When it comes to the business outlook, management commented:

Restaurants continued to be resilient and our travel hospitality, plus our business and industry segments of our business posted year-on-year improvements. We see continued strength coming as tailwinds in the non-commercial sector should continue. We are closely monitoring macroeconomic conditions for signs of a business slowdown.

The first quarter was one of the company’s strongest quarters ever in terms of new business wins. Its sales force has now brought in more than $2 billion worth of new sales over the past 8 quarters.

It also needs to be said that the company managed input price growth quite effectively. Food inflation was 9.7%, which the company offset using pricing – without failing to report outperforming growth. It pushed gross margins up 20 basis points to 18.2%.

Now, so far, the company has a few things going in its favor:

- Industry fundamentals are improving beyond pre-COVID levels despite macro headwinds.

- Pricing power is offsetting inflation.

- Sysco is outperforming its industry, which is expected to last.

- Its debt levels will reach the company’s target in the 2023 fiscal year.

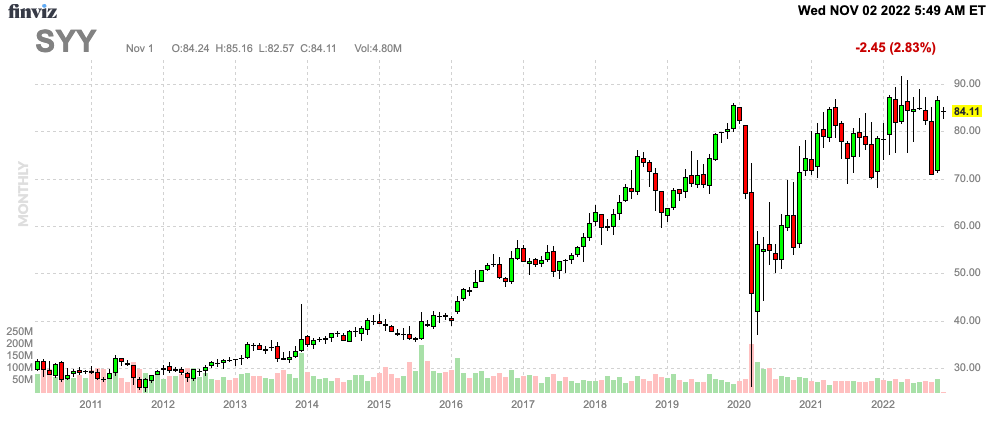

This explains why SYY shares are UP 7% this year, versus a market decline of 19%.

FINVIZ

It also explains why shareholders continue to be in a very good place.

A Closer Look At The Dividend (And Buybacks)

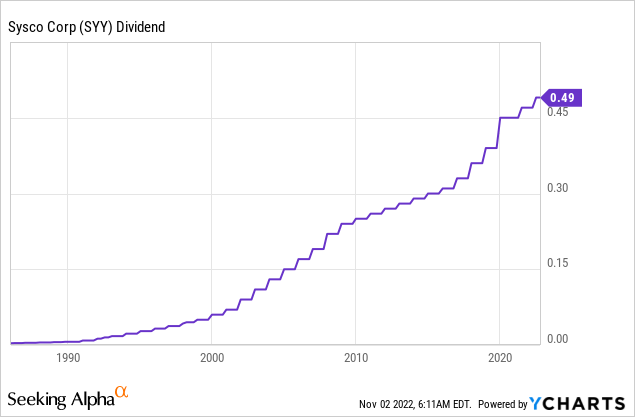

We already briefly discussed that SYY is scoring high on everything, except for its yield – on a relative basis. Sysco shares currently pay a $0.49 dividend per quarter. That translates to $1.96 per year or 2.3% of its stock price.

That’s a decent yield, in my book, yet nothing to get overly excited about. However, long-term dividend growth is decent. Over the past 10 years, the average annual dividend growth is 5.9%.

These are the most “recent” hikes:

- April 2022: 4.3%

- May 2021: 4.4%

- Pandemic: no hike (also no cut!)

- November 2019: 15.4%

- November 2018: 8.3%

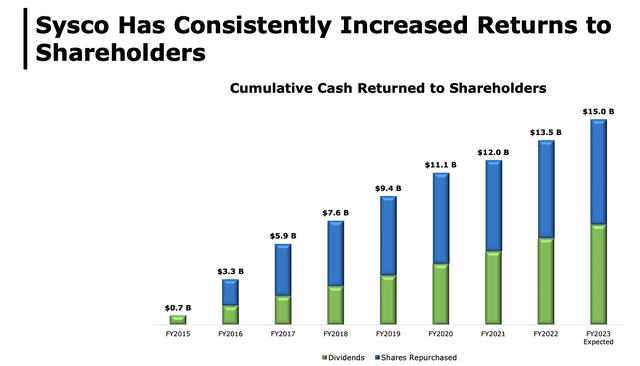

Bear in mind that dividend growth can easily pick up in the years ahead. The implied free cash flow yield of 6.3% covers the dividend, allows SYY to reduce debt, and it paves the road for consistent buybacks (indirect cash distributions).

Using the company’s LTM and NTM EPS numbers, the payout ratio is 74% and 41%, respectively.

Hence, since 2015, SYY has distributed (including FY23 outlook) $15.0 billion to shareholders. Slightly more than half of it went to share buybacks. However, since 2018, the share count has been reduced by just 2.3%, which means a lot of these buybacks were offset by stock-based compensations and others. Personally, I would prefer it if the company would focus more on its dividend. Let me know in the comments if you disagree or agree with that – especially if you’re an SYY investor.

With that said, here’s what to make of the valuation.

Valuation

The beautiful thing about bear markets is that we get to buy stocks at great prices. That’s one of the many reasons why I sleep very well, even if my portfolio suffers every now and then.

Unfortunately, it’s not that great that SYY is trading at an all-time high. It’s well-deserved given what we just discussed, but it’s still not great. After all, with the market down 19%, we want discounts. Right?

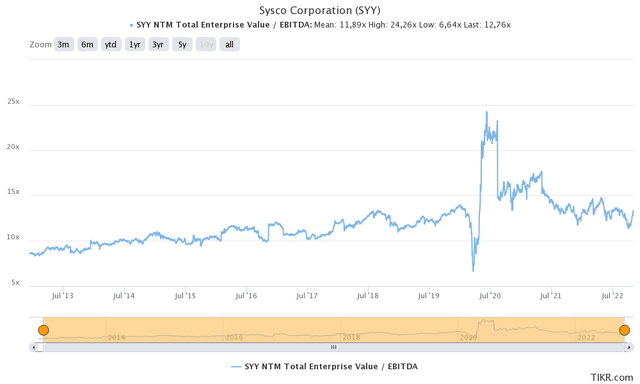

That said, SYY shares are not trading at elevated prices. Using the company’s $42.6 billion market cap, $9.2 billion in expected FY24 net debt, and $400 million in pension liabilities, we get an enterprise value of $52.2 billion. That’s 11.6x FY24E EBITDA of $4.5 billion.

That’s the lowest forward multiple since 2018.

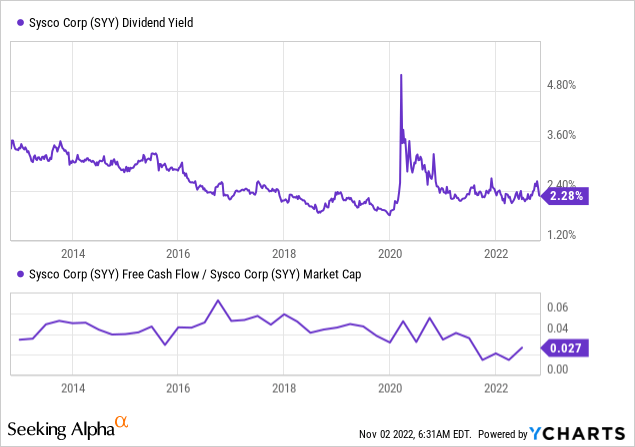

Moreover, while the dividend yield is close to the longer-term median, the implied free cash flow yield of 6.3% is close to the higher bound of the 10-year range, which is a good thing considering how well SYY is recovering – and what it means for shareholder distributions.

Takeaway

In this article, we discussed a very conservative, yet impressive long-term dividend growth stock. If Sysco were a baseball team, I have no doubt it would make it to the playoffs every year. The company is consistent, it has a stable and defensive business model that still allows it to generate outperforming growth.

Free cash flow generation is high, allowing the company to quickly recover from the pandemic, and boosting shareholder distributions along the way.

The company will reach its debt targets next year, which should allow this dividend king to increase dividend growth. It helps that the implied free cash flow yield is higher than 6% while 95% of SYY debt is fixed, protecting the company against the current interest rate environment.

Moreover, while the company operates in a cyclical business (as most customers are restaurants), it continues to see growth despite macro challenges, while higher prices offset inflationary pressures.

In other words, it’s justified that SYY is trading at an all-time high.

However, SYY isn’t overvalued. If investors are looking for high-quality and defensive dividend growth, look no further.

(Dis)agree? Let me know in the comments!

Be the first to comment