bjdlzx

Company Overview

Ceragon Networks Ltd. (NASDAQ:CRNT) is the global innovator and leading solutions provider of 5G wireless transport. Through its innovative wireless backhaul and fronthaul solutions, Ceragon helps operators and other service providers worldwide transition their networks towards 5G high-capacity connectivity, increasing operational efficiency and enhancing the end customers’ quality of experience. The company’s customers include wireless service providers, public safety organizations, government agencies, and utility companies that use Ceragon’s solutions to deliver multimedia services and other applications. Ceragon’s solutions are deployed by more than 460+ service providers and hundreds of private network owners in more than 140+ countries.

Investment Case

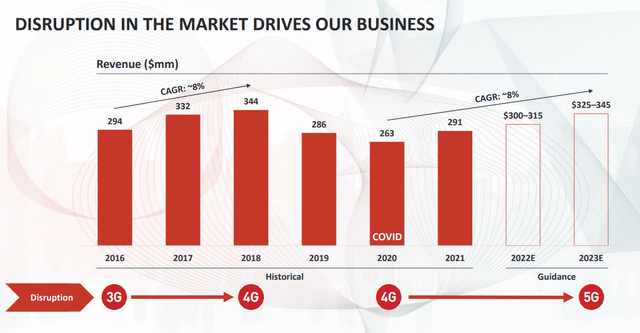

CRNT has more than halved from its last year’s high of $6.90 to $2.59, from a valuation of $500 million in February 2021, the company is now trading at a valuation of approximately $220 million. The company is poised to return to profitability and has a strong portfolio of new products in the pipeline, including 100G wireless and substantial new software capabilities.

Demand for the company’s products is expected to accelerate as we see new products rollout and 5G demand start to take hold. Based on the company’s strong product portfolio, order book, and competitive advantage. I think CRNT’s revenue growth will accelerate, and profitability will improve, reflecting multiple expansions.

CRNT has received strong bookings during 1H22 and has a backlog of over $170 million (approximately 50% of full-year revenue). I believe that the large order backlog will be sufficient to protect the company in case of any potential deterioration in the macro-environment and fuel growth going into CY23.

Ceragon pushes back on Aviat’s offer for $3.08 per share (a premium of 20% from the last close)

Aviat Networks, Inc. (AVNW), a leading company in wireless transport, has submitted an indication of interest in acquiring all of Ceragon’s outstanding shares for $3.08 per share ($2.80 per share in cash and $0.28 in equity consideration of Aviat stock). Aviat holds more than 5% of Ceragon’s outstanding shares as of June 24, 2022, making it Ceragon’s third largest shareholder. Aviat Wants to Replace three Board Members and increase the board by 2 and is looking to force a shareholder vote.

Ceragon’s management has criticized Aviat’s hostile Indication of Interest (“IoI”), calling it a non-offer with no funding secured, a “low-ball offer,” and an offer that significantly undervalues Ceragon. Aviat has forced a shareholder vote to replace three Board Members but, according to Ceragon, is not allowed under the by-laws to increase the board by two. While insiders control less than 10% of CRNT’s shares, which reduces the company’s ability to fight back, management has secured the support of the company’s largest shareholder, JDS Capital, which owns almost 10% of the shares outstanding.

New Products further boost Competitive advantage

Ceragon recently introduced the IP-50 platform. The new platform supports the movement from 4G to 5G by allowing hardware and software dis-aggregation that better suits the increased complexity and flexibility required of 5G mobile networks. IP-50 continues to leverage Ceragon’s multicore technology while adding additional features and routing capabilities and facilitates simpler and faster deployments that ultimately result in lower TCO for Service Providers.

The company shared plans to enhance the suite of IP-50 products using a new in-house developed radio chip. The new products are expected to be launched in 2023, and the products will reduce the costs of the bill of materials by 40%. This will be a significant cost advantage and will drive higher margins for the company going forward. Moreover, the company’s system-on-a-chip or SoC, the 5th generation chipset, is three years ahead of competing technologies in the market. The SoC will generate significant cost savings and deliver enhanced performance.

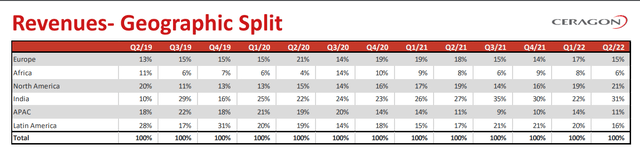

Rising Share in North America beneficial for margin expansion

North America now represents 26% of Total Bookings, up 38% YoY, and quicker 5G rollout has created a favorable sales environment. North America is a strategically important region as margins are generally higher as compared with other regions. Ceragon has become a key supplier to U.S. Tier 1 operators in North America and is rapidly hiring new sales employees in the region.

Superior technology and Indo/Chinese tensions to benefit Ceragon in India

India has been a critically important region for the company, and the revenue share has increased significantly from the region, increasing 18% YoY, to 31% of total revenue during Q2-2022 ($21.9 Million). The management noted that the increase in revenue in India mostly reflects deployments with existing customers. Ceragon had begun gaining share from Huawei in the India Telco market based on its superior technology even before the escalation in India-China tensions. As the Indian government takes a more aggressive approach against Huawei and tightens restrictions on the Chinese company and in its telco networks, Ceragon should continue to gain share from Huawei in India as Service Provider spending in India just begins to rebound.

Ceragon believes it has a whopping 50% share of the high-capacity wireless market in India. This is becoming a critical differential in 4G LTE, with 5G looming. Management estimates 5G rollouts will take off significantly in 2H22 in India when a low-cost handset is available. Moreover, the management in the Q2-2022 earnings call noted India’s highly dynamic regulatory, technological, and competitive environment. The market is gearing up for the countrywide rollout of 5G services.

DISH-Ceragon agreement for 5G Transport to be a catalyst for growth

Earlier in May, Ceragon and DISH Wireless (DISH) announced an agreement whereby Ceragon would provide ultra-high-capacity IP-50C microwave and IP-50E millimeter wave transport solutions. DISH, deploying America’s first cloud-native 5G Smart Network, has contracted Ceragon to provide ultra-high-capacity IP-50C microwave and IP-50E millimeter wave transport solutions.

Ceragon stated the contract should start to ship to orders in hand soon and is likely to see CY22 orders in the “$10s of millions”. Ceragon also noted it expects to be the majority supplier of systems as well as provide the Operating Software and Managed Services. The Gross Margins for Software and Systems tend to be higher in North America, where customers buy the most advanced features.

Conclusion

Our liking for Ceragon is based on the company’s superior technology and strong product catalog. The company’s new IP-50 products will drive margin expansion, cutting material costs by approximately 40%. Ceragon’s design activity with service providers in 5G networks has accelerated in recent years. The rollout of 5G in India and North America will drive significant revenue growth for the company.

The company’s strong orders backlog ($170 million) will serve as a cushion against the deteriorating macro-environment. Moreover, new chip designs and a more pervasive need for front haul connectivity play well to deeper, denser use of microwaves, particularly as the bandwidth of Ceragon’s products increases.

Be the first to comment