Editor’s note: Seeking Alpha is proud to welcome Marco Wang as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

JHVEPhoto

Thesis

Despite showing potential for growth in the international market and digital segment, I don’t recommend buying Wingstop (NASDAQ:WING) stock as it appears to be overvalued currently. However, there are some good growth plans that investors should take note of, and I think the stock can be a better buy once the valuation comes down a bit. In this article, I discuss Wingstop’s strong digital sales and growth in new stores, as well as an analysis of its financials, which lead me to give WING a Hold rating.

Company Overview

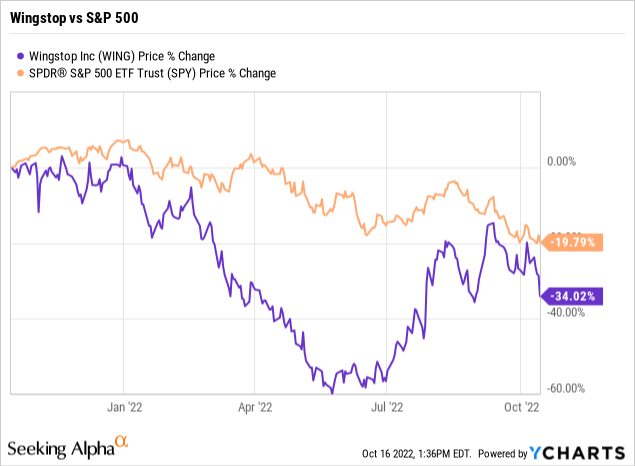

Wingstop is an American food chain specializing in the selling of chicken wings. Founded in 1994 by Antonio Swad in Garland, Texas, Wingstop has 1,731 locations worldwide, most of which are in the United States. Although not as well known internationally, Wingstop has become a staple fast food franchise in the country. The stock price is $128.32 as of October 8, 2022. It currently has a 52-week return of -34.02% compared to the S&P 500’s return of -19.79%. However, the stock’s return increased to 11.22% in the last six months, compared to the S&P 500’s return of -18.31%.

While operating in the fast food chain segment, Wingstop has several sizable competitors, such as Popeyes, Chick-Fil-A, and McDonald’s (MCD). While it currently does not feature as many items on its menu as some of the other fast food chains, Wingstop has been steadily adding to its menu, even recently adding its version of the chicken sandwich, as well as several new flavors for its wings. Such product innovation is good to see, as it shows management’s efforts to experiment and create new offerings in the market.

Growth From New Stores

Wingstop’s 3-year revenue CAGR is 19.30%, which has shown to be an indicator of solid growth in the last three years. However, the company’s growth potential is much greater than that of other restaurants. I believe that the stock can become much more valuable as sales grow along with an expansion of stores internationally. For example, Wingstop’s 3-year revenue CAGR of 19.30% is nearly five times as high as the 3-year revenue CAGR for McDonald’s, which is 4.01%.

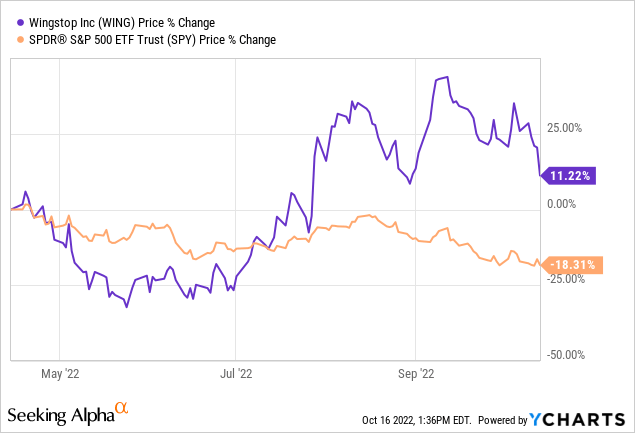

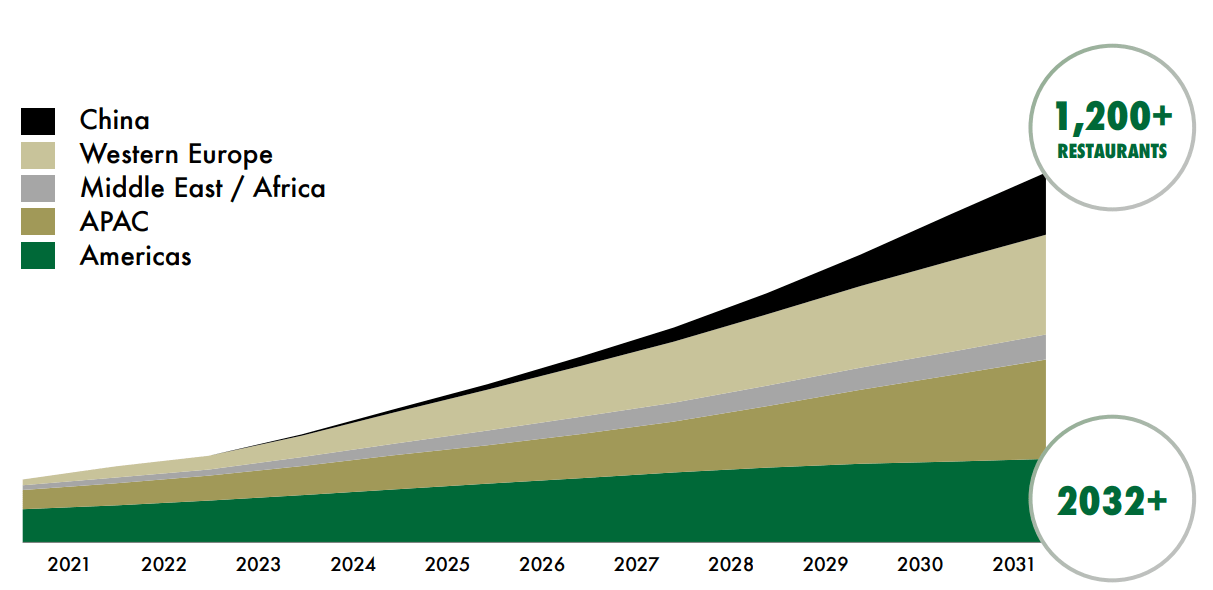

Wingstop Investor Day Presentation

I believe that Wingstop’s growth has stemmed from its steady increase in restaurants globally, demonstrating the company’s strategy of expanding outside of the United States. While in 2017, Wingstop only had 1,133 restaurants globally, as of 2021, it features 1,731 restaurants. The 5-year CAGR of the company’s global restaurant count is currently 8.85%, which partially explains its strong revenue growth in the past five years, and also shows me that the financial performance can continue to grow as Wingstop eyes international expansion. The increasing global development pipeline also demonstrates that Wingstop has a lot of development in store, as seen with the company’s recent entry into a market like Korea.

Peer Analysis

|

Companies |

Stock Price |

Revenue |

P/E |

P/S |

|

WING |

122.33 |

297,791,000 |

91.98 |

12.86 |

|

MCD |

246.48 |

23,594,800,000 |

30.35 |

7.35 |

|

WEN |

19.96 |

1,570,000,000 |

24.64 |

2.18 |

|

JACK |

79.85 |

1,340,000,000 |

15.69 |

1.19 |

I did a quick comparison of Wingstop and similar peers on key metrics. As you can see, Wingstop’s P/E ratio is exceptionally high and is significantly higher than other well-known competitors, such as McDonald’s and Wendy’s (WEN) which are restaurants that also happen to be much larger and more well-known than Wingstop. Even on a P/S basis, WING is significantly more expensive than MCD and WEN. When comparing Wingstop to these strong brands, the significant difference in valuation ratios and revenue should be concerning to potential investors.

Strong Digital Sales

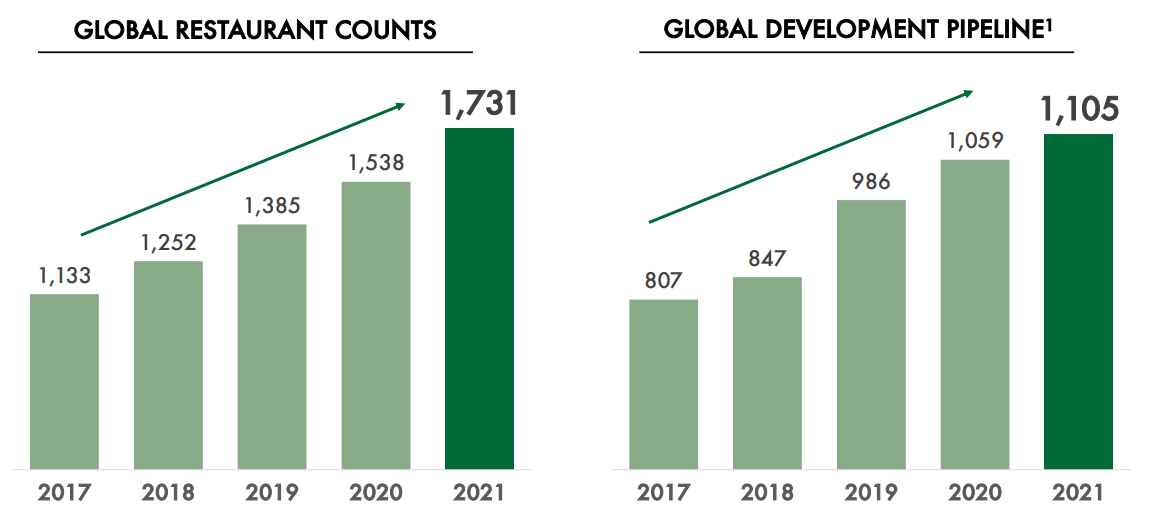

Wingstop Investor Day Presentation

I like to see strong digital sales for restaurants as it should serve as a proxy for future growth potential. With the increasing digitization of the economy, restaurants with high digital penetration are best poised to take advantage of the increase in digital food spending. Currently, over 62% of Wingstop’s domestic sales are digital, and this may prove to be very beneficial with the rise in popularity of food-delivering apps such as Uber Eats and DoorDash (DASH) as well as the accelerating consumer shift to digital sales that have occurred in the last years, allowing for much more potential growth in sales and profits. When compared to other fast food chains like Shake Shack (SHAK) and Chipotle Mexican Grill (CMG), Wingstop has a much higher percentage of digital sales, which shows the payoff of its investment in technology and the suitable and user-friendly application should serve as a competitive advantage that attracts modern consumers who prefer digital orders over in-person orders.

Wingstop – Valuation

Google Sheets

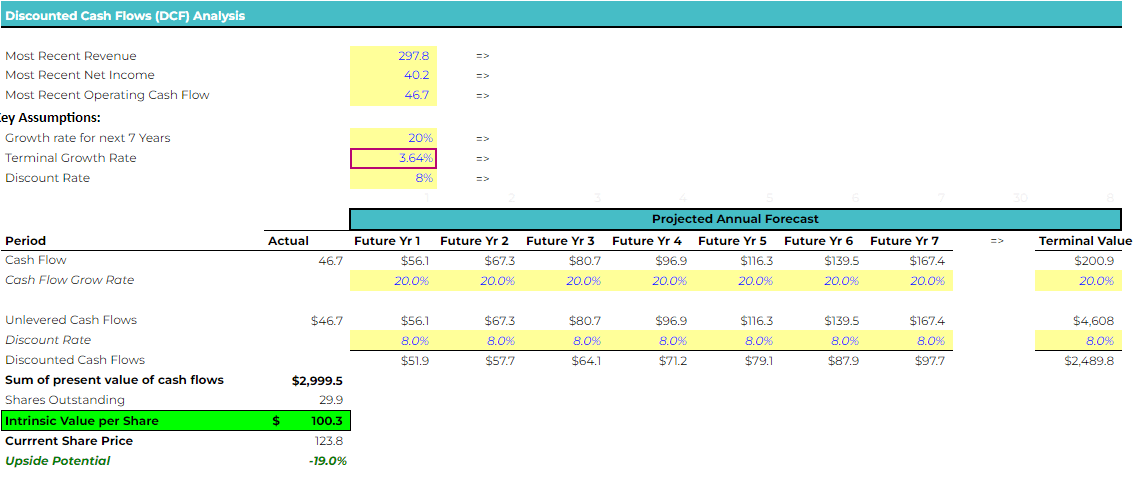

I used an intrinsic DCF valuation model to assess the stock’s value. For the DCF analysis, I used an optimistic 20% growth rate for the next seven years. This was based on my belief that Wingstop has high growth potential, and I believe the company can reasonably grow at a rate near its 3-year revenue CAGR. This is because Wingstop can expand internationally as well as achieve synergies from digital sales. For the terminal growth rate, I used the US Treasury 10-year yield of 3.64% as a proxy for the inflation rate. I also used 8% for the discount rate.

Additionally, I decided to use the operating cash flow in the model as I believe that the operating cash flow is a better measurement of Wingstop’s financial performance. As a result, my model gave me an intrinsic value of $100.3 per share, which presents a 19% downside from its current value. The model implies that the stock may be significantly overvalued by the market.

Risks/Weaknesses

One particular weakness Wingstop faces is intense competition. The company has many strong competitors in the chicken wing market and the fast food market in general. There are numerous private and public fast food chains that it competes with, ranging from Buffalo Wild Wings, McDonald’s, Popeyes, KFC, and more. Although Wingstop does attempt to offer a variety of options on its menu, it doesn’t appear to me that there is anything in particular that stands out when compared to other chicken wing franchises.

Wingstop also is lacking in terms of international reach and only has 219 international restaurants currently. This puts it very behind in contrast with other major global fast food chains. However, this could prove to be a source of potential growth for the company, and it expects to grow more internationally in the coming years. Furthermore, Wingstop’s limited international presence also allows its business model to become more focused on changing market conditions and is not susceptible to geopolitical risk.

Wingstop Investor Day Presentation

Conclusion

Overall, though Wingstop has some good things going for the company, I believe the current valuation is too high to justify a “Buy” rating. Wingstop deserves a “Hold” rating, and as valuation normalizes, I will revisit my thesis on the stock. Some things to look out for are the company’s international growth plans and trends in digital sales. If things go right, I believe Wingstop can be on par with other well-known fast food brands like Wendy’s and McDonald’s. Nevertheless, the valuation is currently too high based on peer comparisons and on an intrinsic valuation basis, and I recommend that investors should watch Wingstop from the sidelines.

Be the first to comment