Brandon Bell/Getty Images News

Kroger (NYSE:KR) has been a strong performer this year, as the grocery store company has shown strong fundamental resilience even amidst inflation and tough comparables. I have been quite bullish on the stock with the impression that some patience was needed to wait for the multiple to re-rate. While the stock still trades at 11x earnings, the stock’s resilience amidst choppy markets suggests that, at the very least, the market is rewarding the stock as a potential inflation winner. KR has since announced intentions to acquire Albertsons (ACI), which would represent a monumental if not messy transaction. I discuss the details of that transaction as well as why I continue to view the stock as a buy.

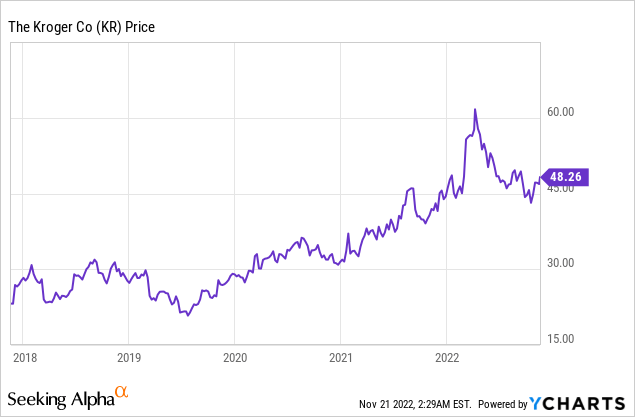

KR Stock Price

It is reasonable to observe that value stocks have held up much better in this market than growth, and KR provides no exception.

I last covered KR in September, where I rated the stock a buy ahead of the second quarter earnings report. That recommendation looked golden at first, but the stock has since dipped back to trade at around the same levels. With the ACI acquisition now announced, the stock still looks compelling here.

KR Stock Key Metrics

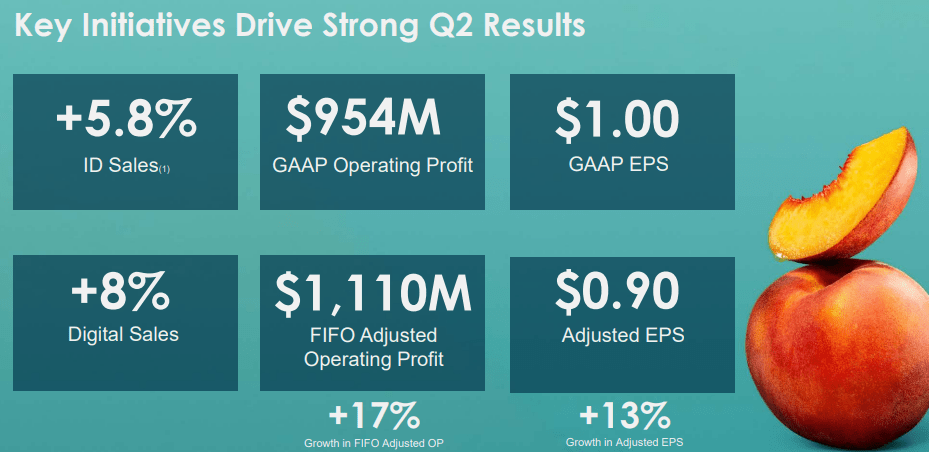

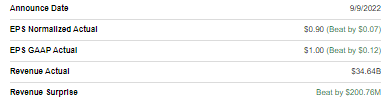

The second quarter saw KR deliver a robust 13% growth in adjusted earnings to $0.90 per share.

2022 Q2 Presentation

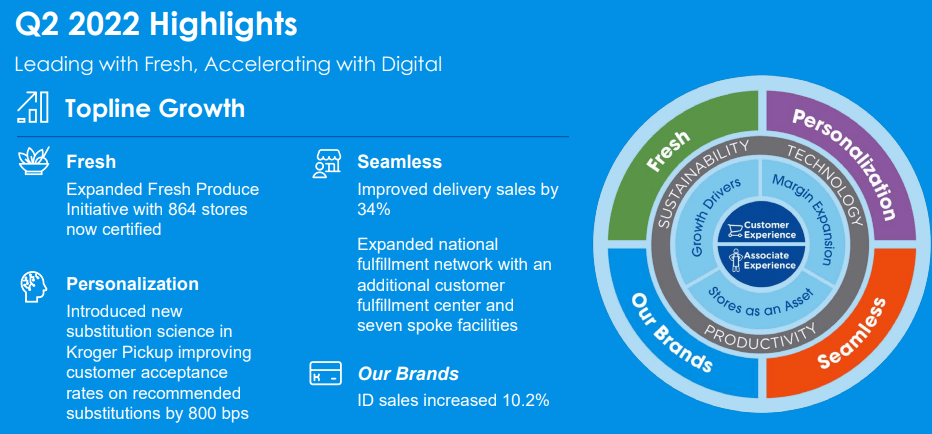

KR grew identical sales by 5.8%, including 10.2% for owned brands. KR touts the strength as being due to the increased rollout of their Fresh Produce initiative as well as continued execution on delivery. Considering that many pandemic winners like those in e-commerce are seeing muted growth, it is very impressive to see KR continue to grow – I, for one, would have expected tough comps to lead to negative growth as social distancing is a thing of the past.

2022 Q2 Presentation

On the conference call, management cited the difficult economic environment as being a potential tailwind for their business.

We continue to see more customers cooking from scratch and eating out less often. Our broad assortment of products is meeting the need for customers to buy what they want on their terms. For example, some customers are continuing to buy more of their favorite fresh products like apples, tomatoes and grapes. While other customers are choosing products like frozen fruit and vegetables, allowing products to last longer in their homes.

Overall, customers are looking to save money and make healthier choices by cooking more meals at home rather than eating out.

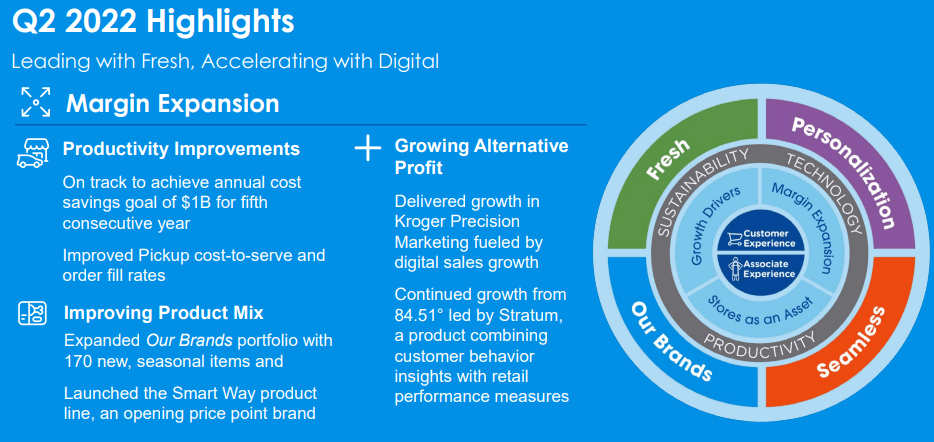

KR also delivered margin expansion – the company has a strong track record on delivering cost savings, with 2022 shaping up to be the fifth consecutive year of $1 billion annual cost savings. KR has also boosted margins through increasing their owned brands portfolio.

2022 Q2 Presentation

KR ended the quarter with low leverage – debt to EBITDA stood at 1.63x, down from 1.78x and far lower than their targeted range of 2.3x to 2.5x. I note that leverage is set to rise drastically pending their acquisition of ACI, which I will discuss later.

How Was Kroger’s Previous Earnings?

Those results were enough to handily beat Wall Street expectations on both the top and bottom lines.

Seeking Alpha

Is Kroger Expected To Beat Earnings?

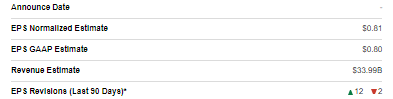

Looking ahead, analysts have been increasing their third quarter estimates.

Seeking Alpha

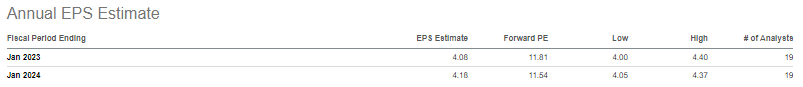

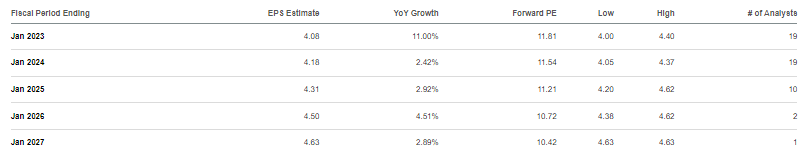

Considering that consensus estimates are calling for $4.06 in full year EPS, it is reasonable to assume that KR is expected to beat and raise when it reports earnings on December 1st.

Seeking Alpha

What Can You Expect From The Upcoming Earnings?

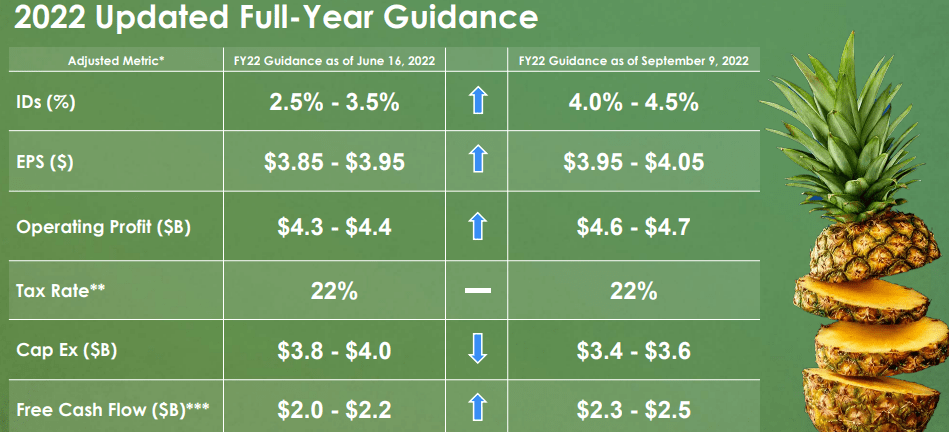

Management has guided for full year earnings of up to $4.05 per share. That is based on up to 4.5% identical sales growth.

2022 Q2 Presentation

It is highly impressive that KR is able to show solid growth even as it laps pandemic comparables – it appears that grocery stores are one sector which benefits from inflation.

What Is The Long-Term Outlook?

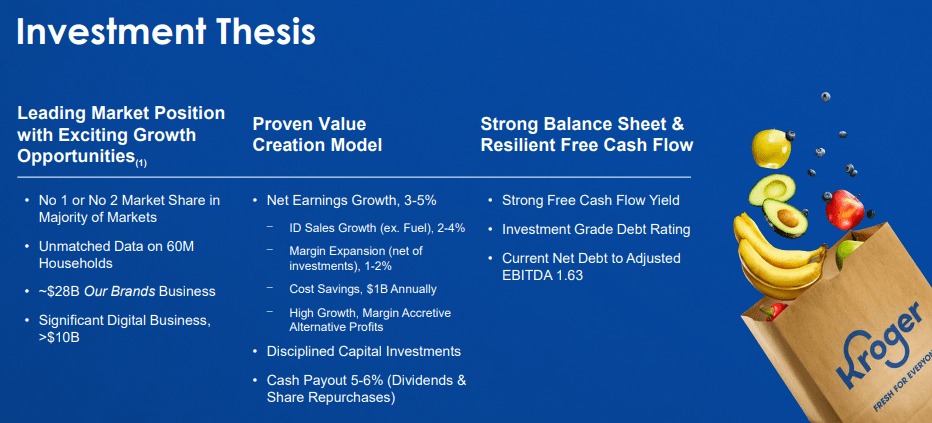

Over the long term, management has guided for 3-5% earnings growth based on 2-4% identical sales growth and 1-2% margin expansion. That plus the 5-6% shareholder yield is expected to lead 8-11% annual total returns.

2022 Q2 Presentation

Put more concretely, I view the grocery growth thesis as being one focused on improving efficiencies – largely by improving logistics as well as reducing headcount (has anyone else noticed an increasing number of self-checkout lanes over the past few years?).

Details On Kroger And Albertsons Merger

Yet all those numbers arguably matter less than the elephant in the room: KR and ACI have agreed to a merger. KR announced the blockbuster deal in early October, valuing ACI at $34.10 per share in cash. I note that after accounting for the $6.85 per share special dividend, the adjusted acquisition price is $27.25 per share. The initial terms called for KR to pay $19.9 billion in cash plus assumption of $4.7 billion in debt. Those terms adjust based on any dividend, so I estimate that KR will need to pay around $15 billion in cash for the company. Including the $4.7 billion in assumed debt, this $20 billion deal is huge – for reference, KR trades at a $34 billion market cap.

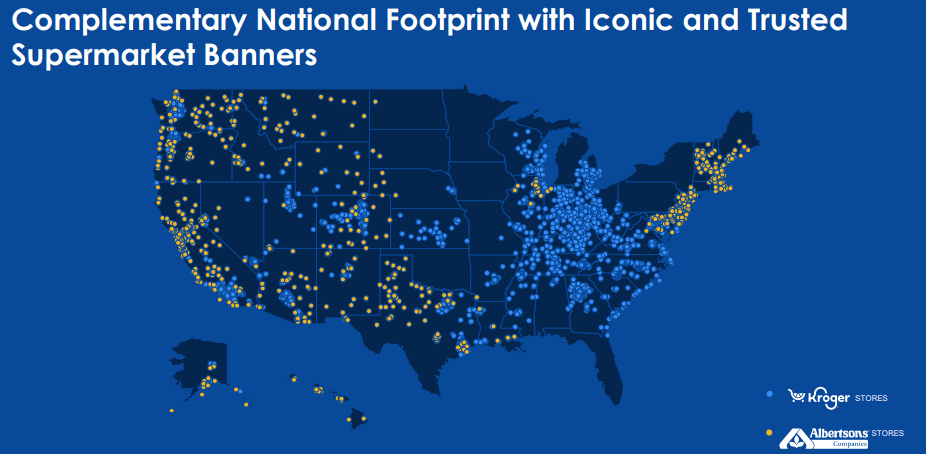

The combined company will have a wide national footprint with some crossover.

Kroger-Albertsons Presentation

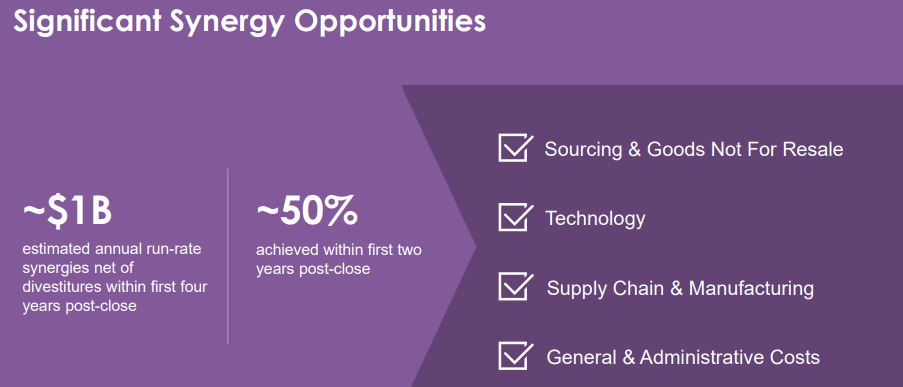

KR expects to have to sell off anywhere between 100 and 375 stores due to antitrust issues. KR expects to realize $1 billion of annual synergies based on overlapping supply chain as well as the typical savings on G&A.

Kroger-Albertsons Presentation

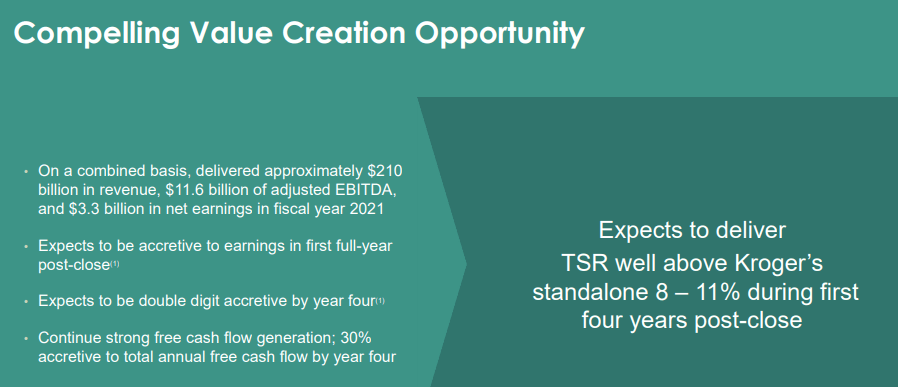

This acquisition is expected to be accretive in the first full-year, double-digit accretive by year four, and to lead to stronger returns than the aforementioned 8-11% guidance.

Kroger-Albertsons Presentation

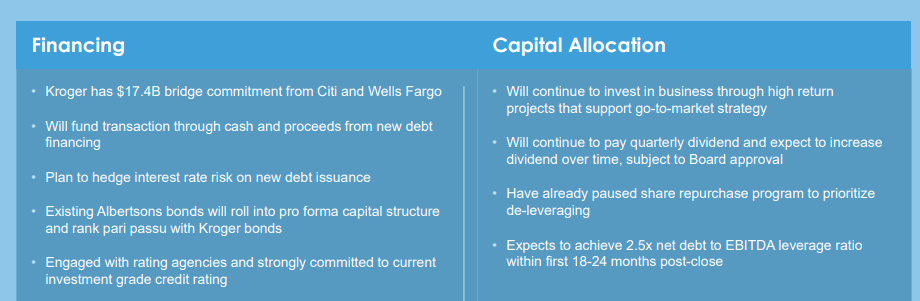

KR will need to raise debt to finance the deal, and it appears that it has already found willing lenders. Management intends to pause share repurchases until debt to EBITDA falls back to the 2.5x range.

Kroger-Albertsons Presentation

Is KR Stock A Buy, Sell, Or Hold?

Is this a good deal? That’s hard to say. At $34.10 per share, KR is buying ACI at 11.5x forward earnings. KR itself is trading at around that level.

Seeking Alpha

Clearly, management needs to execute on synergies for this deal to make sense – otherwise, why would it make sense to endanger the balance sheet? I would imagine that KR shareholders would have greatly preferred that the company accelerate its share repurchase program, even with debt. The company is taking on around $15 billion of debt to finance the deal – I’d wager that the company could have used just $3 billion annually in debt-fueled share repurchases and enjoyed significant multiple expansion. The more I think about it, this ACI deal raises eyebrows as “double-digit accretion” does not sound like a reasonable reward for the increased leverage risk. What’s more, the higher leverage ratio may reduce the possibilities for multiple expansion, which arguably would be a more efficient path to shareholder returns.

I still see the stock as being quite cheap here. I estimate that the combined company generates around $12.2 billion in adjusted EBITDA and pro forma debt to be $32.2 billion, for a 2.6x debt to EBITDA ratio. The actual ratio will be higher on account of the planned dispositions to avoid antitrust issues. If the company can quickly return to buying back stock, then I still see 15x-18x earnings as being achievable for the stock, presenting solid upside.

What are key risks? Assuming the deal goes through, execution risk looms large. There is a world of difference between 1.6x and 3x debt to EBITDA, and this is a rising interest rate environment. KR is facing stiff competition from big box retailers like Walmart (WMT) and Target (TGT) as well as from specialty grocery stores like Trader Joe’s or Whole Foods (AMZN). I personally prefer to shop either at TGT or Trader Joe’s as they seem to offer either a superior shopping experience or higher quality products. There is a real possibility that pure-play grocery stores like KR are facing tail-end secular risk from the threats laid out above. Another risk is if the company is unable to pass on inflationary pressures to consumers, or if it is unable to offset rising employee wages with cost savings. Yet at 11x earnings, I’d argue that the price is right to continue investing in this grocery giant. I rate KR a buy on account of the strong shareholder yield.

Be the first to comment