Self-driving Chevrolet Bolt by Cruise Automation undergoing testing in San Francisco. The vehicle is equipped with numerous Velodyne LiDAR sensors Michael Vi

The research and development of autonomous driving undertaken by General Motors Co. (NYSE:NYSE:GM) has been overshadowed of late, at least in public perception and the mass media, by activities involving the migration from internal combustion engines – ICE – to BEVs.

From an investment perspective, GM’s autonomous activities until now have been largely a story about massive development cost and overcoming technical hurdles – and little or nothing about payoff in terms of revenue or profit. A change is coming as GM has succeeded in San Francisco to launch a commercial robotaxi service, albeit on an extremely small scale.

Modest beginnings

A San Francisco-based startup founded in 2013, Cruise was purchased by GM in 2016, reportedly (though never confirmed) for about $500 million. The company, which employed about 40 at the time of its acquisition, now employs about 3,000 and has been given responsibility for GM’s autonomous tech development as well as its commercialization. GM has taken on additional investors, including the Honda Motor Co. (HMC), and now owns 80% of the venture, which was last valued at about $30 billion.

While other ventures including Waymo, owned by Alphabet (GOOG) (GOOGL), have been operating autonomous robotaxis on a pilot and commercial basis, mostly in less dense locales, Cruise claims to be the first to do so commercially in a major U.S. city., following issuance in June of California’s first permit to offer autonomous rides in return for payment.

According to Vogt, who presented at a conference sponsored by Goldman Sachs last week, customers seem to be generally pleased with the service:

“We’ve peaked at over 70 concurrent AVs operating – driverless AVs operating concurrently. We’re probably going to double or triple that by the end of the year. And it’s being used all the time. Through the first half of the year, I’m proud of this stat like our 28-day retention, so people coming back after a month is almost at 50%. And to put that into perspective, that’s almost as good as a mature ride-hailing company today, and we’re only just a few months into this service.”

CEO, co-founder and CTO of Cruise (Cruise)

The rollout in San Francisco hasn’t been without incident. On June 3, a Cruise vehicle collided with another vehicle at an intersection while making a left turn, resulting in minor injuries. Cruise said the other vehicle was speeding and afterward updated programming that controlled left turns unprotected by a traffic signal. Also, that month, a number of Cruise AVs blocked traffic for two hours at an intersection.

Rough spots

According to Vogt, the company is in the process of smoothing out technological “rough spots.” For the first time in eight years, he said, technology isn’t the bottleneck in the way of commercialization. The new bottleneck, he implies, is Cruise’s unproven ability to scale operations in other cities and to expand the number of vehicles it dedicates to ride-hailing – with the goal of profitability.

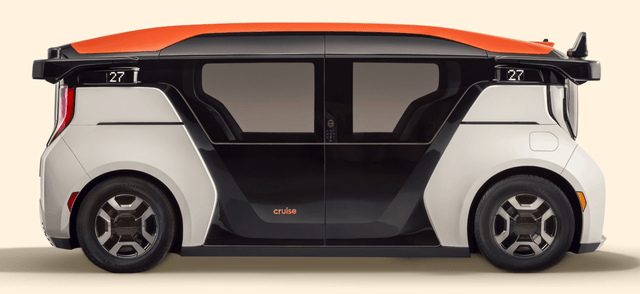

For the time being, Cruise is using Chevrolet Bolt EVs for autonomous operations. Cruise intends to transition away from a traditional passenger vehicle such as the Bolt to GM’s purpose-built people mover, the Origin – an odd-looking conveyance that lacks steering wheel and other traditional control devices.

Cruise Origin prototype (Cruise)

“The Origin is a real vehicle now,” Vogt told the Goldman Sachs conference, “and we’re currently testing it on closed courses. It’s actually driving autonomously here. It was an enormous amount of effort to bring up this new vehicle. It’s got an all-new sensing and compute platform, which you’ve been hard at work on. It has obviously new doors and screens. It has a low-cost architecture, and it was validated using a stimulation first approach, not millions of miles of testing.” GM has said the battery-powered Origin will be manufactured at its Detroit-Hamtramck assembly plant.

According to Vogt, Origin is designed for low cost and should last for 1 million miles, compared to a vehicle like the Bolt, which needs replacement after 200,000 or so miles. Cruise is working on low-cost sensors and custom semiconductor chips, he said. Eventually, Origin could be sold to individual consumers.

“The Origin is a real vehicle now, and we’re currently testing it on closed courses,” he said. “It’s actually driving autonomously here. It was an enormous amount of effort to bring up this new vehicle. It’s got an all-new sensing and compute platform, which (we’ve) been hard at work on. It has obviously new doors and screens. It has a low-cost architecture, and it was validated using a stimulation first approach, not millions of miles of testing.”

Scaling up

As for migration beyond San Francisco, Vogt claims the software developed for the Bay Area is highly adaptable to other cities. Permitting, which took 33 months in California, takes a matter of weeks in Cruise’s next markets, Phoenix and Austin – which are scheduled to begin operations before the end of the year.

“What I’m really excited about is we’re going from zero footprint, no maps, no infrastructure on the ground – to our first revenue-generating driverless rides in about 90 days. This is something people thought may take years. It doesn’t,” he said. In Phoenix, Cruise will be working with Walmart (WMT) – an investor in the amount of $2.75 billion – on package delivery.

The rollout of BEV technology to the mainstream market faces an uncertain timetable, dependent on a much better-charging infrastructure and questions about consumer acceptance of vehicles that may initially be more costly to own than standard ICE models. GM has said it will be selling 1 million BEVs (including China) by 2025 and that it aspires to an all-BEV fleet by 2035. In the U.S., much may depend on government incentives and development of reliable supply network of batteries and the minerals they require for manufacture. How profitable BEVs will be for GM and other automakers remains another mystery that only time will resolve.

Now that Cruise’s San Francisco pilot is migrating to real-time, with two more markets set to begin, autonomous technology’s financial potential can soon be evaluated. The enthusiasm of GM’s top executives shouldn’t sway investors too much – the numbers will be available shortly. But if Cruise’s Phoenix and Austin prove to be fruitful, there’s little doubt that GM will accelerate its plans and expenditures.

I have been cautious about GM until now and remain so, rating it a hold. But I’ll be watching closely for signs that autonomous tech continues to fulfill the promise of a decade ago, when the industry realized the billions – and maybe trillions – that stand to be realized once our cars are taught to drive themselves safely.

Be the first to comment