anusorn nakdee/iStock via Getty Images

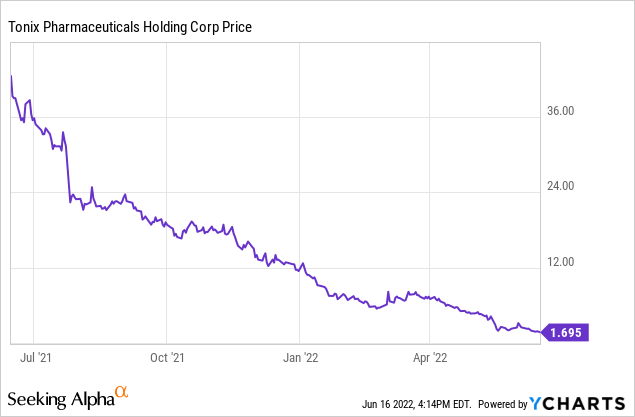

Tonix Pharmaceuticals (NASDAQ:TNXP) is a small biotech company focused on developing drugs for several different diseases. The company has been unsuccessful on both a short and long-term basis. Over the past year alone, TNXP’s stock is down a headache-inducing 96%:

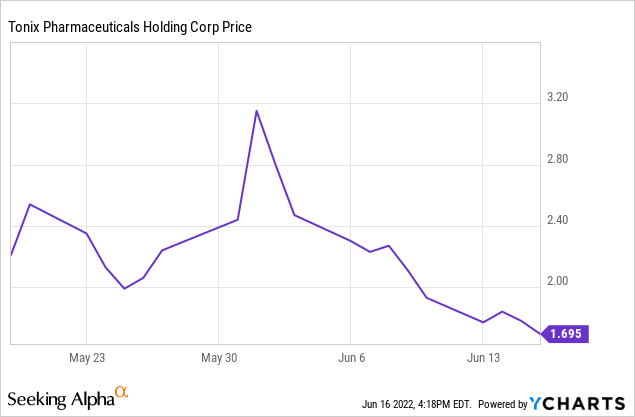

However, TNXP stock isn’t quite out of the ballgame yet. In fact, the stock has leapt back onto traders’ radars over the past month thanks to a recently announced share buyback. Zooming in on the above chart, we can see that Tonix jumped from $2 to $3 for a brief moment at the end of May. That came on the news of the share buyback being announced, though those gains are now long gone:

Indeed, the market has judged the Tonix Pharmaceuticals share buyback to be a non-event. And that’s the right conclusion, as I’ll demonstrate in a minute. But first, let’s dig into the details and possible rationale for the move.

When Was Tonix Pharmaceuticals Stock Buyback Announced?

Tonix announced its share buyback program on May 31. In it, the company announced plans to repurchase up to $12.5 million of its own stock either in the open market or through privately-negotiated transactions.

As the above chart demonstrates, this was associated with a significant rally in TNXP stock. Shares jumped from $2.40 to as high as $4.00 during the day and closed above the $3 mark. Within days, however, shares were back below $2.40.

Why Is Tonix Pharmaceuticals Doing A Stock Buyback?

Generally, companies repurchase their own stock when they believe it is substantially undervalued. Often, that’s associated with some tangible sign of cheapness, such as the stock selling at a low price compared to earnings, free cash flow, book value, or other such metrics.

In the case of Tonix, however, it’s harder to quantify shareholder value here. That’s because Tonix has demonstrated no capacity to develop drugs which ultimately garner FDA approval or generate commercial revenues.

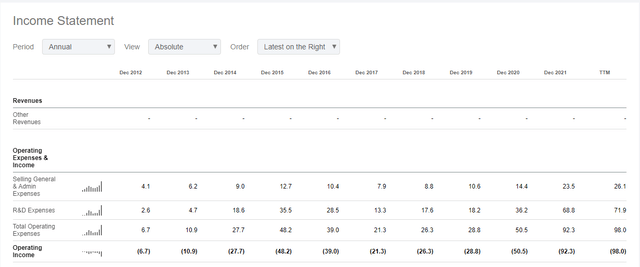

To that point, Tonix has generated no revenues over the past decade:

Tonix income statement (Seeking Alpha)

Meanwhile, its operating losses have soared, rising from the low $10s of millions per year in the early 2010s up to nearly a $100 million loss last year.

This frames the planned share buyback in a most unusual light. It’s hard to explain why the company would choose to use cash on a share repurchase program when it has little plausible path to commercial revenues let alone profits anytime soon.

Tonix did have $140 million of cash and cash equivalents on hand as of March 31, 2022. It can easily afford to spend $12.5 million of that on share repurchases today.

And with the company’s market cap well under $40 million today, it might seem compelling to repurchase shares of the company given its huge cash stockpile in comparison with its modest market cap. In fact, if the company was planning to wind up its operations and distribute its remaining cash to shareholders, that could be quite an interesting scenario.

However, there’s no sign that Tonix is planning to suspend its research. In fact, the company has been recently publishing numerous press releases relating to its monkeypox program.

Is TNXP’s Long-Term Outlook Good?

No, Tonix’s long-term outlook is not good at all.

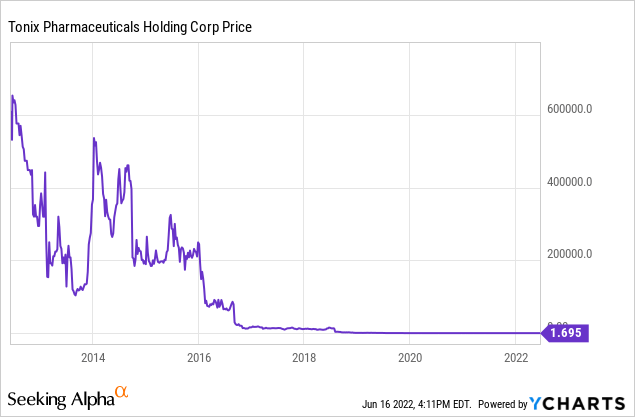

Tonix has generated a jaw-droppingly bad long-term track record, with investors losing nearly 100% of their investment if they’ve held long enough:

You read that right, on a split-adjusted basis, shares are down from $600,000 each in 2012 to just $1.70 now.

Over the years, Tonix has long attempted to get a drug approved for PTSD and fibromyalgia. More recently, it has added programs for other things along the way, such as long Covid, and now monkeypox.

Like some other biotech companies, Tonix seems to have a way about launching programs for conditions which are currently generating a lot of media and trader interest. However, it hasn’t demonstrated much capability of turning these first steps into successful FDA-approved drugs.

Given the company’s chronic inability to generate revenues, it seems Tonix will eventually have to raise more capital. The company used $31 million of cash in its operations last quarter. At an annualized rate, that’s around $120 million.

As noted above, it had $140 million left as of March. Plus, it may spend up to $12.5 million on the buyback, reducing that $140 million to an additional degree. All-in-all, it seems likely Tonix will have to raise more funding by mid-2023.

That’s what makes this share buyback so puzzling. Without earnings or some other way to replenish its capital base, this share buyback is simply going to force Tonix to issue shares again more quickly than it otherwise would have.

There’s the seed of an interesting idea here. Tonix’s cash balance is far greater than its current market cap. But if Tonix is going to burn through all that cash in the near future, then it’s hard to justify repurchasing shares today, even if they are optically cheap on a book value basis.

Is TNXP Stock A Buy, Hold, Or Sell?

Tonix Pharmaceuticals is a fascinating case study right now. The share buyback is unlikely to generate much value for TNXP shareholders, given the company’s continued inability to advance drugs to achieve FDA approval or generate revenue. Without a sustainable stream of cash flows, it’s hard to run a business let alone return cash to shareholders.

That said, there are a bunch of biotech firms out there trading at some of their lowest valuations in many years. An Oppenheimer report released in May noted nearly 150 biotech companies traded below their cash values, which is an unprecedented number for the industry. Share buybacks could drive a lot of value for investors in the biotech industry in 2022. However, it makes more sense to stick to biotech firms that already have approved drugs and which can generate cash flows to drive those share repurchases.

In the case of Tonix, unfortunately, this share buyback seems more like a gimmick. Without any reliable way of obtaining revenues, Tonix will eventually have to issue more stock to the public to fund its ongoing expenses. As such, any improvement in the share price from the buyback is likely to be fleeting.

Indeed, shares have already slumped to below the levels where they were prior to this buyback being announced. And that’s with good reason. Tonix has not demonstrated nearly enough to merit consideration as a long-term investment at this point.

Be the first to comment