ArtistGNDphotography/E+ via Getty Images

Elanco Animal Health (NYSE:ELAN) manufactures and distributes an extensive portfolio of veterinary products for domesticated pets and farm livestock covering everything from prescription and over-the-counter parasiticides to vaccines, and therapeutics. The company’s 2020 acquisition of ‘Bayer Animal Health’ from Bayer AG (OTCPK:BAYZF) has helped it consolidate its position as one of the global leaders in the segment.

Coming off a record 2021 highlighted by strong earnings and the post-pandemic recovery, one of the challenges early this year is an Avian Flu outbreak that has added near-term uncertainties related to Elanco’s exposure to the poultry market. That said, we are bullish on ELAN viewing the recent selloff as overdone considering the company’s poultry exposure is relatively limited while broader fundamentals remain solid. We see value in the stock at the current level into several long-term growth tailwinds.

ELAN Financials Recap

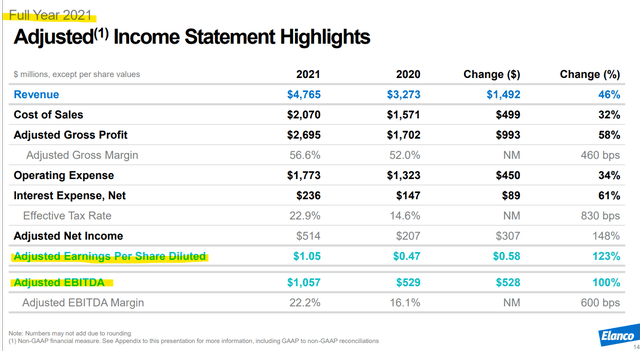

Ahead of Elanco’s upcoming Q1 earnings set for May 9th, it’s worth revisiting current financials. The company last reported its Q4 results back in February with full-year revenue of $4.8 billion, up 46% year-over-year. The Bayer Animal Health deal contributed approximately $1.3 billion to the top line meaning organic or pro-forma growth was closer to 7%.

The company’s expanded scale into the pet segment now representing 50% of total sales was accretive to margins last year. Indeed, the gross margin climbed 460 basis points to 56.6% while adjusted EBITDA at 22.2% was sharply higher from 16.1% in 2020. Full-year EPS at $1.05 more than doubled from $0.58 in the year before.

source: company IR

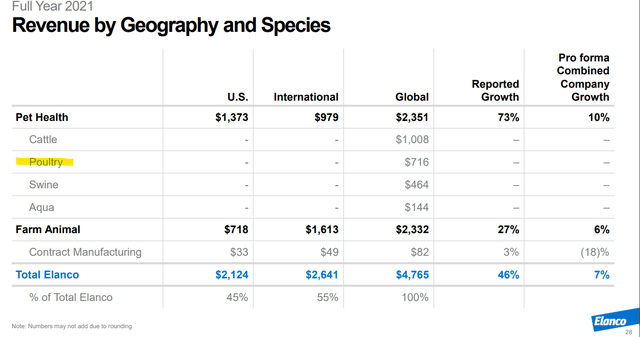

Management noted growth in all regions and four out of five core animal species. Poultry revenue at $716 million representing around 15% of the total was a strong point with 14% y/y growth. On the other hand, swine-related products with sales at $464 million declined by 9%, pressured by weakness in the Chinese market from a swine flu outbreak last year. We bring this up because it helps to place in context the current headlines regarding the wave of an Avian Flu or “Bird Flu” sweeping across commercial flocks.

source: company IR

The latest reports are that a highly pathogenic avian influenza “HPAI” detected in 30 states has thus far resulted in more than 27 million chickens, turkeys, and other birds culled or scheduled for depopulation which is done to contain the spread.

As it relates to Elanco, the thinking is that the situation will pressure demand for regular poultry flock medications and maintenance consumables by farmers over the coming quarters. Still, considering the size of the segment, we believe the impact on the overall business will be modest. The upcoming Q1 earnings will provide a chance for management to update the market.

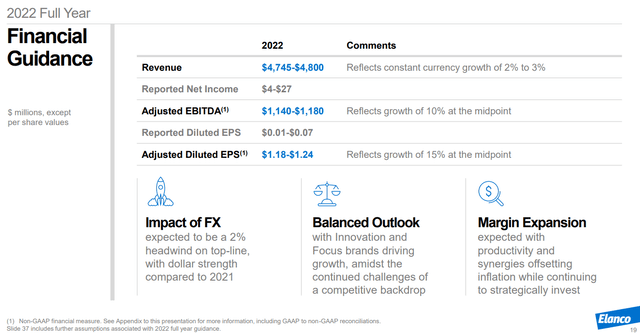

In terms of guidance, the company was previously targeting 2022 revenue near $4.8 billion representing a 2% to 3% growth from 2021 in constant currency. This single-digit revenue growth range is near the company’s “long-term growth algorithm” targeting 3% to 4% growth recognizing that this year is up against more difficult comparables from a record 2021. More favorable is the trend of margin expansion which is expected to generate 10% adjusted EBTIDA growth and an EPS target between $1.18 to $1.24, representing a 15% y/y increase at the midpoint.

source: company IR

ELAN Stock Price Forecast

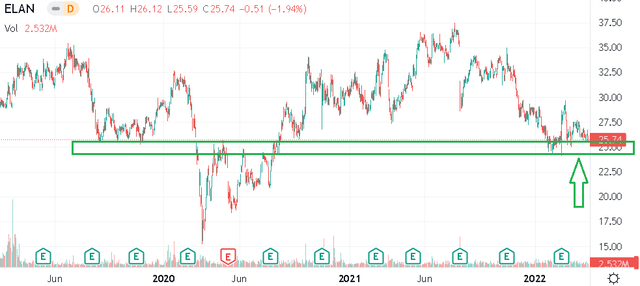

Shares of ELAN are down about 32% from its 2021 peak when it traded as high as $37.50. While some of the recent weakness is likely related to the Bird Flu headlines, a few other factors might explain the selloff in the stock amid the broader market volatility.

In some ways, the pet segment is exposed to trends in consumer spending as a discretionary category which is up against elevated inflation as a global theme pressuring global growth. There is some concern that higher inflationary costs can chip away at ELAN margins and open the door for softer earnings. We can also bring up Elanco’s elevated debt level near $5.7 billion following the Bayer deal. While the company is profitable and generates positive cash flows, the high net-debt to EBITDA leverage ratio above 5.5x has also weighed on the stock this year.

Seeking Alpha

Nevertheless, it’s important to recognize the long-term opportunity for the company. On the pet health side, Elanco benefits from a structural driver of growing demand with consumers taking take care of their canine and feline companions that are increasingly seen as part of the family. More people worldwide are owning pets. Estimates are that spending on pet care overall is expected to grow at a compound annual rate of 8.8% globally through 2027.

With farm animals, the understanding is that improved welfare is critical for the food supply and sustainable farming. On this point, the current market environment is particularly bullish toward agriculture and food items. Beyond the U.S. poultry farmers, protein producers globally are benefiting from strong market pricing amid supply chain disruptions. We believe Elanco Animal Health livestock products are well-positioned to capture a boost in sales this year as part of the bullish case for the stock.

Going back to the stock chart above, the $25.00 price level appears to be an important level of technical support since before the pandemic in 2019. There is a case to be made that Elanco’s long-term outlook is as strong as ever considering the recent financial trends and its larger scale. By this measure, we think the next move is higher as the stock regains momentum.

Is ELAN Overvalued?

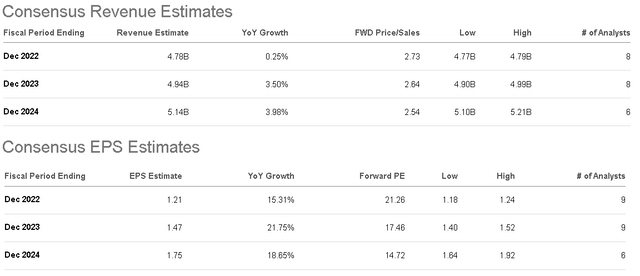

According to consensus, the market is forecasting Elanco 2022 revenue of $4.8 billion and EPS of $1.21 which is in line with current management guidance. Looking ahead, steady top-line growth in the 4% range is expected in 2023 and 2024 whole earnings accelerate near 20% with the company fully realizing the synergies from the Bayer deal adding to margins.

Seeking Alpha

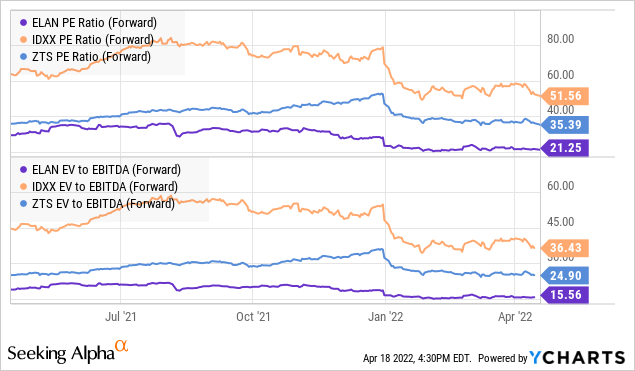

So putting it all together, while Elanco doesn’t stand out as an exceptional growth stock this year, we like the value in the stock at the current level. We highlight that ELAN trading at a forward P/E of 21x represents a discount compared to competitors Zoetis Inc. (ZTS) at 35x and Idexx Laboratories, Inc. (IDXX) at 52x. Similarly, ELAN trading at an EV to forward EBITDA ratio of 16x is also below the average for this group. While each company has a differing business model focusing on varying segments, the valuation spread in ELAN is attractive and we consider the stock undervalued to the sector.

Is ELAN a Buy, Sell, or Hold?

We rate ELAN as a buy with a price target for the year ahead at $32.50 representing an 18.5x EV multiple on management’s 2022 EBITDA guidance or a 27x multiple on the current 2022 consensus EPS. We believe this level helps Elanco’s valuation premium converge closer to peers. Ultimately, we see upside to the earnings estimates with a thinking that the sentiment towards the stock is too poor, and the recent selloff has more than priced in near-term headwinds.

Heading into the Q1 report in early May, the main risk is the possibility that management revises guidance lower amid the Bird Flu outbreak. On the other hand, we believe a more positive environment for agriculture and livestock in general within tight food supply conditions can help balance the near-term impacts on poultry.

Be the first to comment