Nisian Hughes/DigitalVision via Getty Images

Intel (INTC) in mid February 2022 announced it was signing a definitive agreement to acquire Israel-based Tower Semiconductor (NASDAQ:TSEM) for $5.4 billion or $53 per share in an all-cash deal. Intel has set its sights on sub-7nm chips, and noted that the acquisition is in line with the company’s IDM 2.0 strategy to expand its manufacturing capacity, global footprint, and technology portfolio.

In the nine months since the acquisition announcement, regulatory approval has not been finalized. Important to Tower investors, the acquisition agreement gave the companies a full year in which to complete the deal – February 2023. Even more important, because of Tower’s global reach, it requires approval from regulators in the US, China, Germany, Israel, Japan, the UK, and Italy.

All Eyes on China and the Regulatory Agency

Even under normal times, China has been the sticking point on most mergers. In February 2022, China approved the merger between Advanced Micro Devices (AMD) and Xilinx, but turned down the acquisition of ARM Ltd by Nvidia (NVDA).

But these decisions took place prior to an Oct. 7, 2022, escalation of sanctions imposed on China by the U.S. government. I’ve written extensively on Seeking Alpha about China sanctions, and the latest was on Nov. 5, 2022, with an article entitled “U.S. Chip Equipment Suppliers Biggest Losers From China Sanctions But KLA Fares Best.”

These U.S. sanctions have an impact on China as a country. While Chinese President Xi Jinping is seemingly concerned about climate change and has agreed to resume climate change talks with Biden during their meeting in Bali, others in the China government are focused on U.S. sanctions. On Oct. 8, 2022, following the latest round of sanctions, China’s foreign ministry spokesperson Mao Ning said “The United States will only hurt and isolate itself when its actions backfire.”

But the U.S. sanctions have directly impact China’s Semiconductor Manufacturing International Corporation (SMIC), a partially state-owned publicly-listed Chinese pure-play semiconductor foundry company. It’s the largest contract chip maker in mainland China.

SMIC’s expects fourth quarter revenue will fall 13% to 15%, and expects the gross profit margin to shrink to 30% to 32% QoQ on weak demand in the mobile phone and consumer market. But SMIC has been struggling because of U.S. sanctions. Capacity utilization was 92.1%, down five percentage points from the previous quarter.

China’s Hua Hong is also a competitor of Tower Semiconductor. Most of its revenue is from China (65% of 2020 revenue), followed by North America (13%). Its major products include power discrete products, micro-controller units (MCUs) and smartcards.

These three companies – Tower, SMIC, and Hua Hong – will be analyzed in this article as it pertains to (1) Tower’s prowess as a competing semiconductor foundry with and without being acquired by Intel and (2) Whether the Chinese regulatory will approve the acquisition based on its competition against SMIC and Hua Hong.

Tower Semiconductor Competition With Chinese Foundries

Importantly, SMIC competes with Tower Semiconductor, particularly in the production of semiconductors on 200mm wafers, and this direct competition, will impact the decision of Chinese regulators.

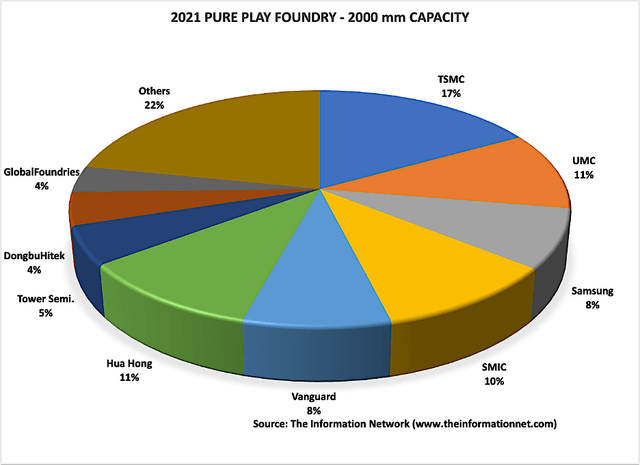

Chart 1 shows 200mm wafer capacity by pure-play foundries (semiconductor companies that make chips for others with no internal chip usage). In 2021, SMIC had an 11% share of the overall 200mm capacity of 3.1 million wafers per month. China’s Hua Hong held a 11% share of 200mm capacity, while Tower Semiconductor held a 5% share.

The Information Network

Chart 1

Tower Semiconductor Fabs

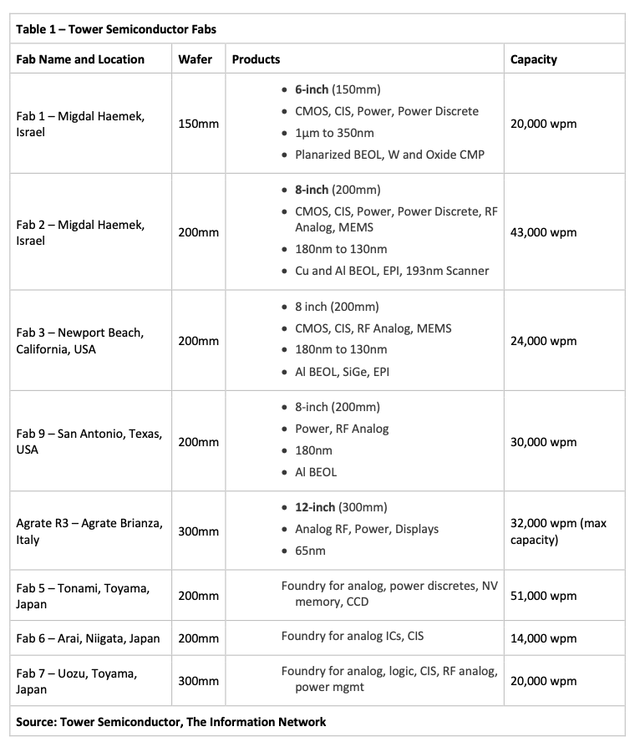

The TSEM acquisition gives Intel two 300mm wafer fabs with a combined capacity of 52,000 wafers per month, five 200mm wafer fabs with a combined capacity of 162,000 wafers per month, one 150mm fab with a capacity of 20,000 wafers per month, and 1/3 of the capacity at the ST JV fab, as shown in Table 1.

Tower Semiconductor

Fabs 5, 6, and 7 are TPSCo fabs (owned 51% by Tower, 49% by Nuvoton). The fabs support geometrics ranging down to 45nm. The Agrate R3 fab is a joint venture with ST Microelectronics (STM). I discussed the strong potential for Intel in my June 1, 2022, Seeking Alpha article entitled “Tower Semiconductor Acquisition: A SiC Source For Intel For Future U.S. EV Production.”

The SiC inverter market for EVs for 2021 and 2030. The market will grow from $3.4 billion in 2021 to $186.6 billion. This represents a CAGR (compound annual growth rate) of 56% between 2021 and 2030. according to our report entitled “Power Semiconductors: Markets, Materials and Technologies.”

SMIC Fabs

SMIC has three 200mm fabs and five 300mm fabs. SMIC added 19% capacity in 2021 and expects 2022 capacity additions to be faster than 2021.

Hua Hong

Hua Hong Semiconductor (Hua Hong) is the second-largest foundry (by capacity) in China dedicated to IC manufacturing at both 8-inch and 12-inch wafer fabs. Its first 12-inch fab began mass production in Q419. Hua Hong operates three 200mm and one 300mm fab.

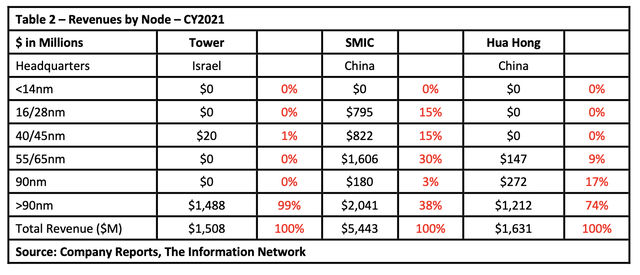

Revenue by Node

In Table 2, I show revenues for the three foundries for 2021. Data for TSEM are nebulous because of the way the company provides financial metrics. Announced revenue for 2021 was $1,058 million, as compared to $1,266 million in 2020, reflecting 19% revenue growth. But it partners with Nuvoton, which had revenues of $40.8 million in 2021, and which I estimate its chips were manufactured at the 45 nm. Revenues to TSEM were $20 million.

The Information Network

Table 2 shows that there’s little overlap among the foundries at the current time, with most of Tower’s revenues from nodes greater than 90nm. But one benefit from being acquired by Intel is that when the company converts to smaller nodes, fully depreciated equipment can be transferred to Tower facilities rather than sold on the used equipment market. With Intel’s emphasis on moving its foundry business to <7nm, and with Tower’s revenues of just $1.5 billion, transitions to more profitable nodes are feasible.

From a historic basis, this is one of the routes that China used to expand into the semiconductor business. Japanese semiconductor manufacturers expanded their 200mm fabs to 300mm in Japan in the 1980, and built 200mm fabs in China, outfitting them with their used equipment.

Investor Takeaway

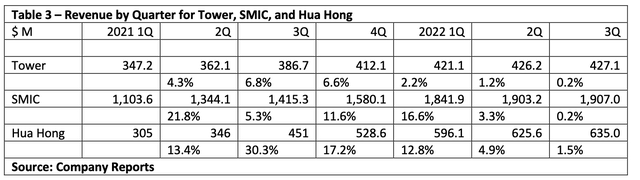

Table 3 shows revenues for the three companies as well as QoQ change. It illustrates that Tower’s revenue growth has dropped significantly to practically no growth in 3Q. Since we have no guidance from the company, I’m assuming revenue has been impacted by slow sales of consumer electronic products following a 40-year high in inflation, high fuel and food prices, and lowered discretionary money from consumers.

The dramatic slowdown in SMIC and Hua Hong are attributed to Covid lockdowns in China and to U.S. sanctions in addition to weak sales of consumer products.

The Information Network

The transition for China to become self-sufficient in Chip manufacturing, part of its Made in China 2025 program, coupled with the torpedoing of its chip industry by the U.S. is a strong rationale for the acquisition to be rejected.

China has no allegiance to Intel, which sold its NAND business and Dalian China fab to SK hynix in late 2021. Technology firms that receive government funding will be banned from building “advanced technology facilities” in China for a decade. The requirements come under the US government’s near-$53bn Chips Act intended to scale up manufacturing of semiconductor chips.

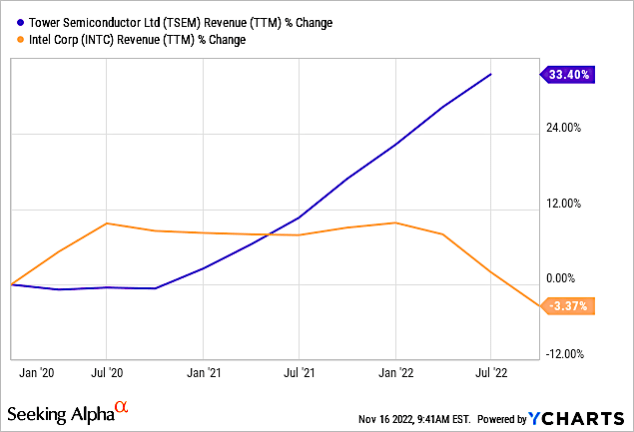

TSEM has had strong financial metrics for the past year, and on its own is worth considering as an investment. But the acquisition is even more important for Intel. Shown in Chart 2 are Revenue % change for Tower compared with Intel.

YCharts

Chart 2

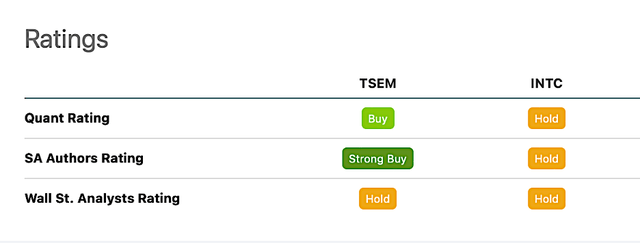

Chart 3 shows Seeking Alpha Quant Factor Grades for TSEM and INTC. The acquisition of TSEM would benefit Intel, but TSEM has strong growth potential on its own.

Seeking Alpha

Chart 3

Intel needs TSEM more than TSEM needs Intel. In my opinion, it’s Tower’s partnership with STM in SiC that is the primary catalyst of the acquisition. Without Intel, assuming the deal is rejected by China regulators, TSEM is nevertheless a Buy.

Be the first to comment