SHansche

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) submitted its earnings sheet for the third-quarter on Wednesday. Although the company reported strong earnings, conditions in the container market are deteriorating sharply. Shipping rates kept dropping throughout November and are now at their lowest in a year. As a result, ZIM Integrated Shipping lowered its adjusted EBITDA forecast, and I expect the stock to remain under pressure for the foreseeable future. The last reason investors should buy ZIM Integrated Shipping relates to the firm’s 72% (forward) dividend yield!

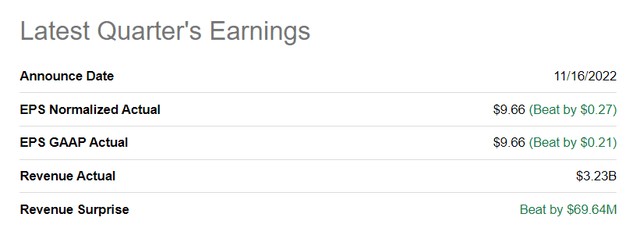

ZIM Integrated Shipping Beats On Earnings

The shipping company delivered a beat on the top line and the bottom line yesterday. Revenues for the third-quarter were $3.23B, which beat the estimate by $70M. On the bottom line, ZIM Integrated Shipping delivered EPS of $9.66 compared to an estimate of $9.39.

Seeking Alpha: ZIM Q3’22 Results

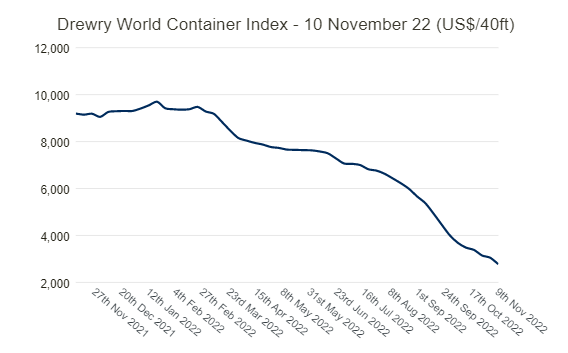

Container freight rates keep dropping

The biggest reason for the decline in ZIM Integrated Shipping’s valuation this year — shares are down 35% year to date and 70% from ZIM’s 1-year high at $91.23 — is the collapse in shipping rates. According to the Drewry World Container Index, which reflects shipping rates for a 40-foot container, cargo rates remained in free-fall in November. Transporting a 40-container cost $2,773.49 in the week ending November 10, 2022, showing a 9% decline week over week. Since last year, shipping rates have dropped a massive 70%, which is having a serious effect on the profitability of shipping companies that specialize in cargo transport. The sharp decline in shipping rates over the last year strongly indicates that the market expects a global recession and a potentially severe contraction in container volumes.

Source: Drewry

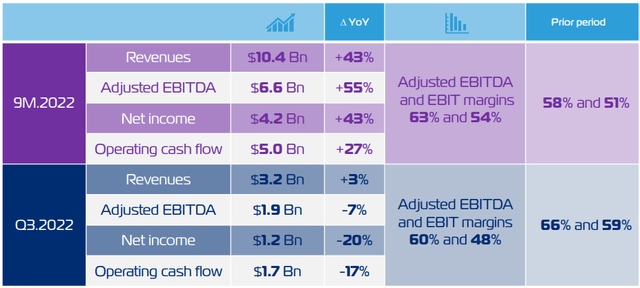

The decline in shipping rates due to slowing customer demand has led to a deceleration of revenue and adjusted EBITDA growth for ZIM Integrated Shipping as well. The firm’s revenues grew only 3% year-over-year to $3.2B in Q3’22, after growing 44% year-over-year in Q2’22. I believe, at this point, that the shipping company is strongly looking at the possibility of negative top-line growth next year if the current trends in the container market continue.

ZIM Integrated Shipping’s earnings prospects are also deteriorating, as adjusted EBITDA dropped 7% year-over-year to $1.9B and net income cratered 20% year over year to $1.2B. While still positing strong profitability, the business is clearly seeing a sharp slowdown compared against the second-quarter.

Source: ZIM Integrated Shipping

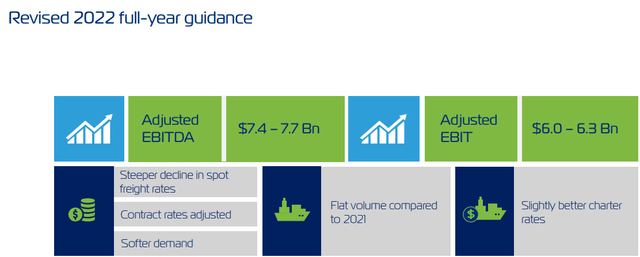

Deteriorating Market Conditions Result In Guidance Adjustment

ZIM Integrated Shipping lowered its guidance for its FY 2022 adjusted EBITDA due to falling shipping rates and a deteriorating macro outlook. ZIM Integrated Shipping now expects to see adjusted EBITDA of $7.4-7.7B compared to a previous guidance of $7.8-8.2B. On a mid-point basis, the new guidance reflects a 6% decrease in EBITDA expectations.

Source: ZIM Integrated Shipping

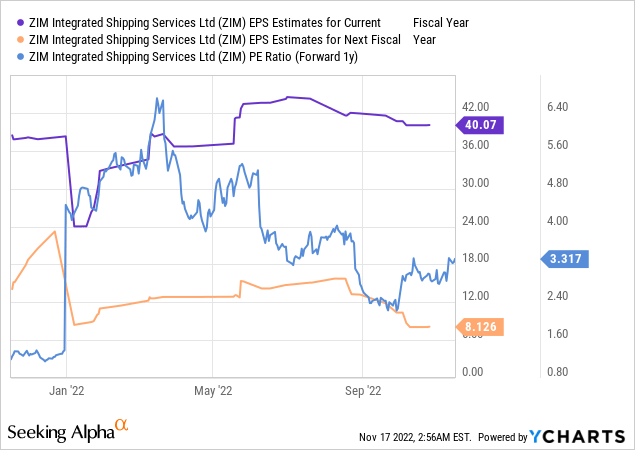

Valuation and declining EPS expectations

ZIM Integrated Shipping may be more expensive than it seems. Shares of the shipping company currently have a P/E ratio of 3.3 X, but EPS estimates have dropped sharply in recent months, indicating that the shipping industry as a whole already peaked last year due to record-setting freight rates. The estimate trend for ZIM Integrated Shipping is highly unfavorable, with EPS down-ward revisions for FY 2022 outmatching up-ward revisions by a ratio of 6:0. If the down-turn in the economy gets worse, which I expect, ZIM Integrated Shipping’s P/E ratio may be set for a sharp increase.

Don’t buy for the dividend yield

The forward dividend yield for ZIM is 72%, as shown by SeekingAlpha, but the shipping company is paying a variable (30%) dividend that depends on the company’s total net income. If net income declines, the actual dividend payment will be much lower moving forward than in the past. In reality, ZIM may have an actual forward dividend yield closer to 9-10%.

Risks with ZIM Integrated Shipping

A major global recession and a continual drop in cargo freight rates are the two biggest risks for ZIM Integrated Shipping at this point. Freight rates have dropped materially this year and there is no reason to assume that they have bottomed out just yet. Going forward, I expect pressure on shipping rates to build which could result in compressing margins, slowing top line growth, and a much higher P/E ratio for ZIM Shipping Integrated’s shares.

Final thoughts

ZIM Integrated Shipping disclosed strong profitability for the third-quarter yesterday, but it can’t be denied that the fundamentals in the industry have sharply deteriorated… and they are still rapidly deteriorating. Container freight rates dropped to a 1-year low last week which indicates potentially negative revenue growth for the shipping company in FY 2023. Additionally, ZIM Integrated Shipping lowered its adjusted EBITDA forecast as container rates kept dropping throughout Q3’22 and consumer demand remains weak. With a global recession on the horizon, ZIM Integrated Shipping Services Ltd.’s shares have a highly unattractive risk profile!

Be the first to comment