Joey Ingelhart

Pioneer Natural Resources Company (NYSE:PXD) is one of the largest independent exploration & production companies in the United States. Every company in the energy industry has certainly given investors a wild ride over the past few years as the outbreak of the COVID-19 pandemic collapsed energy prices and with them the share prices of most of these firms. As we all know though, energy prices have since rebounded and Pioneer Natural Resources has certainly not been left out as its share price is up 55.29% over the past year. The company has profited from the surge in energy prices in many other ways too as the company’s free cash flow has surged over the past eighteen months, which has allowed the company to reward its shareholders with a very large dividend. Indeed, the company yields a very attractive 13.32% at the current price. There are signs that this could be just the beginning though as the forward fundamentals for the traditional energy industry are quite strong, yet Pioneer Natural Resources’ stock price still looks to be incredibly cheap. Overall, this looks like a very attractive opportunity for any investor today.

About Pioneer Natural Resources

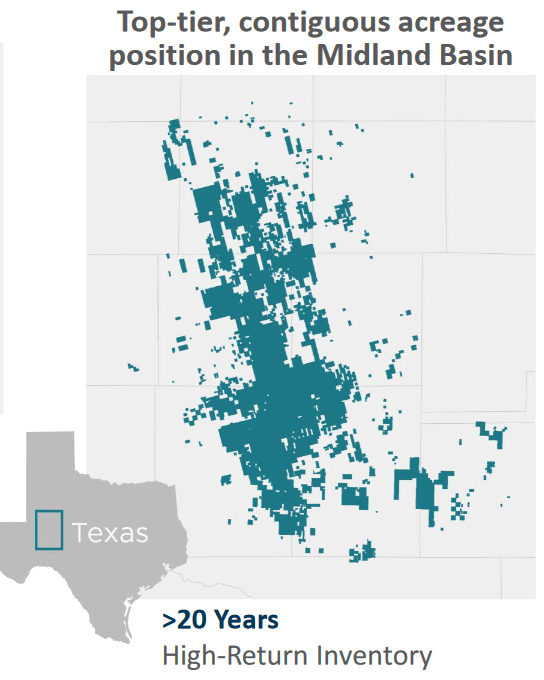

As stated in the introduction, Pioneer Natural Resources is one of the largest exploration and production companies in the United States, boasting a commanding position in the incredibly resource-rich Permian Basin. Indeed, the company only operates in that basin and it has the largest acreage of any firm:

Pioneer Natural Resources

The Permian Basin is likely to be a familiar name to anyone that has been following the energy industry for a while. After all, the basin has been at the center of the American shale oil boom that has taken place over the past decade. There is a good reason for this as the Permian Basin is the largest hydrocarbon-producing basin in the United States and one of the largest in the world. Despite the fact that the basin has been producing crude oil and natural gas since the 1920s, the United States Energy Information Administration estimates that it still contains proved reserves of five billion barrels of crude oil and nineteen trillion cubic feet of natural gas.

The incredible mineral wealth of the Permian Basin reflects itself well in Pioneer Natural Resources’ reserves. An energy company’s reserves are something that many investors overlook, but they are critically important. This is because the production of crude oil and natural gas is by its nature an extractive process. Pioneer Natural Resources literally obtains the products that it sells by pulling them out of reservoirs in the ground. As these reservoirs only contain a finite quantity of resources, the company must continually discover or otherwise obtain new sources of oil and gas to replace the resources that it pulls out of the ground. If it fails to do this, then the company will eventually run out of products to sell. As Pioneer Natural Resources is not guaranteed to be successful at this critical function, its reserves dictate how long it can sustainably operate without success.

As of December 31, 2021, Pioneer Natural Resources had proved reserves of 2.222 billion barrels of oil equivalents. As the company expects to produce between 623,000 and 648,000 barrels of oil equivalents per day on average over the course of 2022, its reserves are sufficient to last for about ten years. This is a reasonable reserve life as it is in line with most of the major energy companies but at the same time it is quite a bit less than that of many other independent shale energy companies. I will admit that I would feel a bit more comfortable if Pioneer Natural resources could get this up to around twelve years.

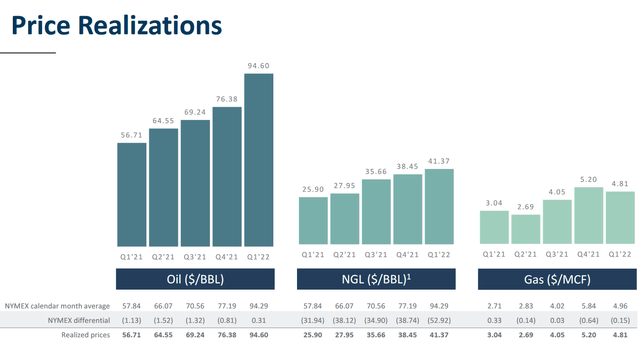

It is unlikely to be a surprise to anyone reading this that the price of both crude oil and natural gas has increased substantially since the middle of 2020. As of the time of writing, West Texas Intermediate crude oil has increased by 34.18% and the price of natural gas at Henry Hub is up 115.02% over the past year. Pioneer Natural Resources has certainly benefited from this. As we can see here, the prices that the company has been receiving for all of the products that it produces have been climbing, with the price that it realized for crude oil averaging $94.60 per barrel in the first quarter:

This has allowed the company to be incredibly profitable as it only costs the company $11.14 per barrel to produce crude oil. This situation has allowed Pioneer Natural Resources to achieve incredibly high margins and by extension free cash flow. In the trailing twelve-month period ended March 31, 2022, Pioneer Natural Resources reported a levered free cash flow of $2.4041 billion, which while not an all-time high, was one of the highest levels that the company ever had in a twelve-month period. This is something that is very nice to see because free cash flow is the money left over from the firm’s ordinary operations after it pays all of its bills and makes all capital expenditures. This is therefore the money that is available to create value for the shareholders by either paying down debt, buying back stock, or paying a dividend.

Pioneer Natural Resources has opted to do exactly these things. The company has decided to pay out at least 80% of its free cash flow every quarter as a dividend to the shareholders. To this end, it has elected to pay a fixed plus variable dividend. The way that this works is that the company will pay out a set amount (currently $0.78 per share quarterly) regardless of its free cash flow. After that, the company will pay out an additional amount of whatever is necessary to hit its 80% goal. In the second quarter, that additional amount was $6.50 per share, resulting in a total dividend of $7.38 per share. This works out to $29.52 annualized, which gives Pioneer Natural Resources an incredibly impressive 13.32% annualized yield. Not only is this substantially higher than the 1.52% yield of the S&P 500 index (SPY) but it is higher than even most midstream companies! While this yield will undoubtedly attract nearly any investor that is looking for income, it is important to keep in mind that it is dependent on the company being able to maintain its current free cash flow and that requires crude oil and natural gas prices to remain near their current levels or higher. As we will see shortly though, that is actually a likely scenario.

Contrary to popular belief, there are some ways for an energy company to generate growth independently of increases in energy prices. One of the primary ways is to increase its production, which makes sense since that would give it more products to sell and thus should result in more money coming through the door, all else being equal. When we consider how high energy prices are right now, we would think that the industry would be increasing production as fast as possible to bring in large profits. However, Pioneer Natural Resources is not planning on doing this. As stated earlier, the company has guided to produce an average of 623,000 to 648,000 barrels of oil equivalents per day over the course of 2022. In the first quarter of 2022, Pioneer Natural Resources produced an average of 638,000 barrels of oil equivalents per day, which is right in this range. Thus, the company does not appear to be planning any production growth this year.

It is not alone in this as numerous other companies operating in the Permian Basin are merely planning to hold their production steady instead of growing it. Even among those firms that are boosting production, the increase in output is not as large as might be expected. This is ostensibly to allow the company to maximize its free cash flow by holding down capital spending as well as preventing an oversupply of resources that may begin to drag down energy prices. With that said though, Pioneer has stated that it may consider growing its crude oil production at a maximum of a 5% rate going forward, which will likely depend on the pricing environment. If it does decide to do this, then it would likely have a very positive effect on the company’s free cash flow and dividend yield since presumably Pioneer Natural Resources will only do this in a high-price environment. Either way, the company should be able to provide substantial rewards to its shareholders.

Fundamentals Of Crude Oil And Natural Gas

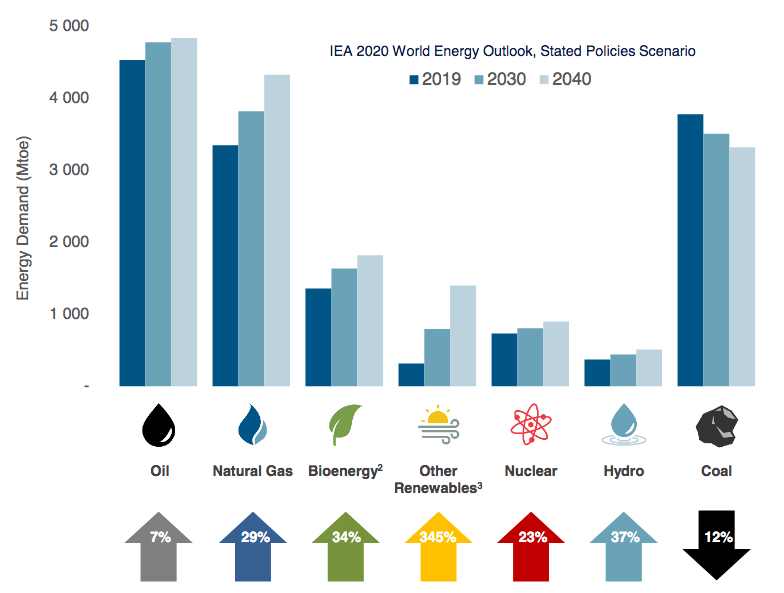

Pioneer Natural Resources is primarily a producer of crude oil, although the company also produces a substantial amount of natural gas. As such, it would be a good idea to take a look at the fundamentals of both of these products as part of our analysis of the company. Fortunately, the fundamentals are quite positive, which may be surprising considering the general demonization of fossil fuels that we frequently encounter in Western nations. However, the International Energy Agency predicts that the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

The demand growth for natural gas is primarily driven by concerns about climate change. As many readers of this article are no doubt aware, these concerns have incentivized governments all around the world to craft a variety of policies that are intended to reduce the carbon emissions of their respective nations. The most significant of these policies is to encourage utilities to retire their old coal-fired power plants, which are replaced with renewable plants. Unfortunately, renewables are not reliable enough to support a modern electric grid on their own. After all, solar plants do not generate electricity when the sun is not shining and wind power does not work when the air is still (or ironically when it is blowing too quickly). The usual solution to this problem is to supplement renewables with natural gas turbines. This is because natural gas does produce electricity reliably enough to support the needs of modern society and it burns cleaner than any other fossil fuel. This is why natural gas is often called a “transitional fuel” since it can support the needs of modern society and still reduce carbon emissions until renewable technology advances sufficiently to allow them to do it alone.

The case for crude oil demand growth is admittedly somewhat more difficult to understand. After all, many politicians, activists, and others in the developed nations are pushing for a reduction in crude oil consumption. However, it is a very different story when we look at the various emerging markets around the world. These nations are expected to experience tremendous economic growth over the projection period. This economic growth will have the effect of lifting the citizens of these nations out of poverty and putting them securely into the middle class. These newly middle-class people will naturally want to live a life that is much closer to their counterparts in the developed nations than what they have now. This will require the growing consumption of energy, including energy derived from crude oil. As the population of these nations is substantially larger than that of the developed nations, the rising demand for crude oil from the world’s emerging markets will more than offset the stagnant-to-declining demand in the developed nations.

Unfortunately, it does not appear that energy production will increase sufficiently to meet this demand growth. We have already seen that Pioneer Natural Resources has no intention of increasing its crude oil production sufficiently to accommodate 7% growth and considering that natural gas is produced as a byproduct of crude oil production, it is unlikely that the company’s natural gas production will increase sufficiently either. The situation will be much the same across the entire energy industry. This is because the energy industry in aggregate has been chronically underinvesting in production capacity and midstream infrastructure since the 2015 crude oil bear market. This is one of the reasons why the offshore drilling industry never recovered from that event. According to Moody’s, the upstream producers in aggregate must increase their capital spending by $542 billion annually in aggregate in order to avoid a supply shock. It is highly unlikely that the industry will actually increase its spending to this degree. After all, it is under tremendous pressure from politicians and environmental activists to improve the sustainability of its operations. It is also under pressure from investors to increase its returns. Thus, we have a situation in which the demand growth for both crude oil and natural gas will outstrip the supply growth of these products. According to the laws of economics, this should cause prices to rise going forward. As we have already seen, Pioneer Natural Resources and its investors will greatly benefit from any increases in prices. This, therefore, strengthens our investment thesis.

Financial Considerations

It is always important to have a look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company because the company must make regular payments on its debt if it is to remain solvent. As such, an event that causes a company’s cash flow to decline could push it into insolvency if it has too much debt. This is an especially big risk in the energy industry due to the sometimes volatile nature of commodity prices.

One metric that we can use to measure a company’s ability to carry its debt is the leverage ratio, which is also known as the net debt-to-EBITDAX ratio. This ratio essentially tells us how many years it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to this task. Pioneer Natural Resources is on track to have this ratio at 0.1x by the end of the year assuming energy prices remain at today’s levels. This is one of the lowest ratios in the industry and indicates that Pioneer Natural Resources is using almost no debt to finance itself. I am generally happy if this figure is under 1.0x for an upstream company. Overall, there is nothing at all to worry about here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on it. In the case of an exploration and production company like Pioneer Natural Resources, one ratio that we can use to value it is the price-to-earnings growth ratio. This is a modified form of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is an indication that the stock may be undervalued relative to its forward earnings per share growth and vice versa. As I have pointed out in numerous past articles though, pretty much everything in the traditional energy industry is substantially undervalued right now so it may make sense to compare the valuation of Pioneer Natural Resources to its peers and see which company has the most reasonable relative valuation.

According to Zacks Investment Research, Pioneer Natural Resources will grow its earnings per share at an 8.55% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 0.78 at the current price. Here is how that compares to some of the company’s peers:

| Company | PEG Ratio |

| Pioneer Natural Resources | 0.78 |

| Range Resources (RRC) | 0.22 |

| Diamondback Energy (FANG) | 0.21 |

| Continental Resources (CLR) | 0.14 |

| APA Corporation (APA) | 0.18 |

| Occidental Petroleum (OXY) | 0.50 |

As we can see, Pioneer Natural Resources does not have the lowest valuation in the space, although the ratio still indicates that the stock is remarkably cheap given its forward earnings per share growth. However, despite Pioneer Natural Resources not being the cheapest company on the list, it may be one of the best investments because it also has by far the lowest leverage of any of these firms. Thus, it might be worth paying for quality since we would still be getting an attractive valuation.

Conclusion

In conclusion, Pioneer Natural Resources certainly has a lot to like right now. The company has a commanding acreage position in one of the most hydrocarbon-rich basins in the world, which it has been using to great effect in today’s high-price environment. The company’s combination of low costs and high realized prices allows it to generate a substantial amount of free cash flow, which it has been using to reward its shareholders in the form of a high dividend. When we combine this with the company’s incredibly low leverage and reasonably attractive valuation, it has all the makings of a terrific investment. Owning Pioneer Natural Resources could certainly help take some of the sting off the next time you have to gas up your car!

Be the first to comment