onurdongel

Investment Thesis: While Host Hotels & Resorts could see some upside if RevPAR levels improve, high debt and a decline in cash levels remain risk factors.

In a previous article back in April, I made the argument that Host Hotels & Resorts (NASDAQ:HST) could be set to benefit from rising real estate prices as a result of inflation. However, I also cautioned that the company would also need to ensure that it maintains sufficient cash reserves to continue funding its expansion.

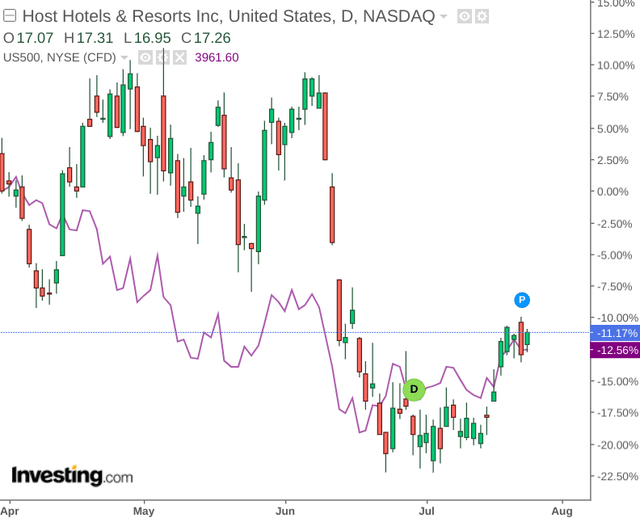

Since April, the stock has seen a significant decline – in line with that of the broader market.

The purpose of this article is to determine whether Host Hotels & Resorts can potentially see a rebound in upside going forward.

Performance

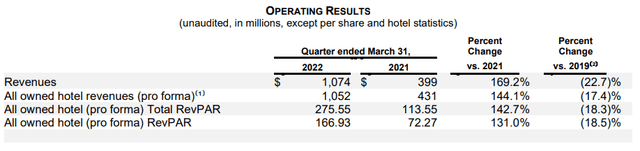

From a revenue standpoint, we can see that while Host Hotels & Resorts has yet to see a rebound to 2019 levels – revenue growth is still far above what it was in the quarter of March 2021.

Host Hotels & Resorts: First Quarter 2022 Operating Results

However, I previously cautioned that the company also needs to control its cash to total debt levels – as this will be necessary to fund the purchases of new properties before prices rise further.

From the below, we can see that the portion of cash relative to total debt has decreased significantly since the last quarter – meaning that the company has less immediate cash available to meet its liabilities.

| December 2021 | March 2022 | |

| Cash and cash equivalents | 807 | 266 |

| Total debt | 4891 | 4210 |

| Cash to total debt (%) | 16.49% | 6.32% |

Source: Figures sourced from Host Hotels & Resorts First Quarter 2022 Operating Results. Cash to total debt calculated by author.

In this regard, while the company has seen diluted earnings per share rebound to positive territory ($0.16 per share in March 2022 compared to -$0.22 in March 2021) – the fact that this growth has not also translated into higher cash levels seem to have given investors pause.

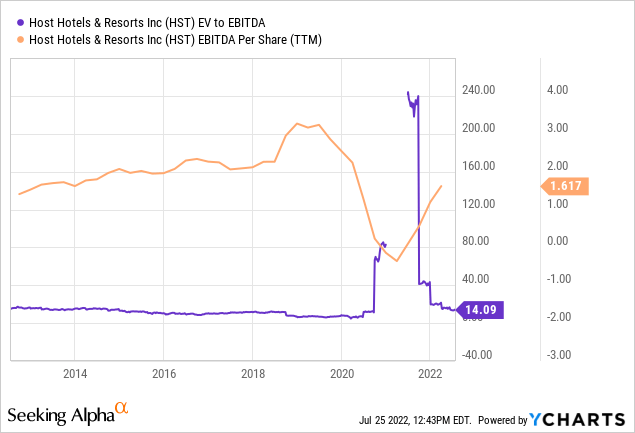

From an earnings standpoint, we can see that while the EV/EBITDA ratio is approaching pre-pandemic levels – EBITDA itself still needs to climb significantly to approach prior highs.

ycharts.com

Looking Forward

Going forward, investors are likely to want to see a rebound in cash growth before confidence is regained regarding the prospects of Host Hotels & Resorts.

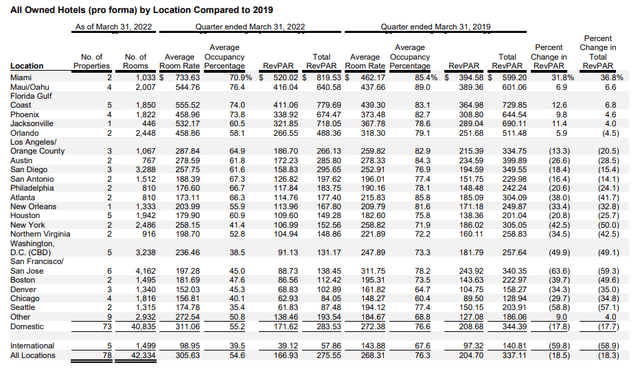

When looking at performance of all owned hotels by location – we can see that growth in RevPAR as compared to March 2019 still remains negative both internationally and in the majority of domestic locations across the United States – even though RevPAR growth across all locations is up strongly compared to March 2021.

Host Hotels & Resorts: First Quarter 2022 Results

In this regard, the upcoming quarter will be a strong indication as to whether RevPAR across owned hotels can reach 2019 levels once again as travel is increasingly expected to rebound to near pre-pandemic levels this summer. However, if inflation means that travel demand comes in lower than expected – then low growth in RevPAR could lead to further downside for the stock. A drop in travel demand after the summer months could also keep RevPAR levels below that of 2019 overall – particularly if we see a significant rebound in COVID in the winter months.

With upcoming earnings to be held on August 4, I will be paying particular attention to RevPAR levels, as well as cash to total debt levels. Should we see a significant improvement in these metrics – then there could be some case for upside. However, there is also the risk of further downside in the stock if revenue comes in lower than expected and cash levels do not increase relative to total debt.

Conclusion

To conclude, investors are likely to look for a strong rebound in RevPAR as well as an improving cash position for Host Hotels & Resorts in the upcoming earnings quarter. While the stock could see upside if growth figures come in favorably – high debt levels remain a concern. A lack of cash growth, growth in debt, or indeed a combination of these factors could also stand to lead the stock lower.

Be the first to comment