Allkindza/E+ via Getty Images

Tanger Factory Outlet Centers, Inc. (NYSE:SKT) benefits from a fundamental recovery in the retail market in the United States. The real estate investment trust recently increased its dividend by a significant percentage, giving investors confidence that the retail market in the United States is strong enough to support dividend growth in the future.

Furthermore, the trust’s business operations are well-capitalized, and Tanger Factory has a very low payout ratio, which will allow for many more dividend increases in the future.

Let’s Start Off With The Good Stuff

Tanger Factory recently increased its dividend by 9.6% amid a strong market recovery in the retail real estate sector, bringing the total annual dividend payout to $0.80 per share, up from $0.73 per share previously. Tanger Outlet’s current stock price is $17.43, implying a 4.6% stock yield.

To receive the next dividend payment of $0.20 per share, you must purchase Tanger Outlet stock before April 28, 2022, the trust’s ex-dividend date for the upcoming dividend payment.

Tanger Factory’s Business Is In A Robust Upswing

If you haven’t heard of Tanger Factory, you have been missing out.

Tanger Factory owns and operates a network of upscale open-air outlet malls across the United States. The trust’s operating properties include 36 outlet centers totaling 13.6 million square feet spread across 20 states and Canada. Tanger Factory leases its properties to well-known retail brands such as Michael Kors, The Gap (GPS), adidas (OTCQX:ADDYY) (OTCQX:ADDDF), NIKE (NKE), Lululemon (LULU), and others.

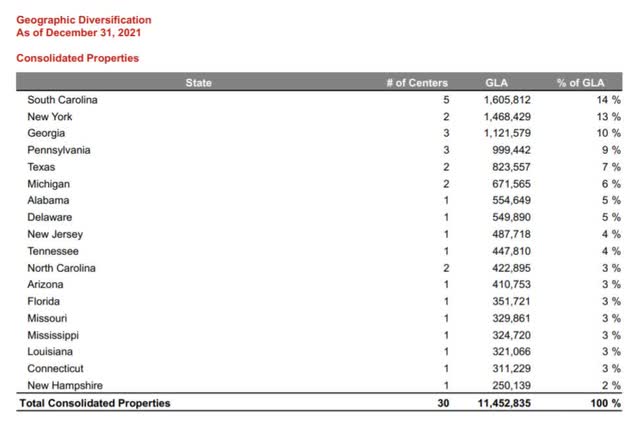

Diverse Geographic Footprint (Tanger Factory Outlet Centers)

Tanger Factory Outlet Centers are primarily located on the East Coast, but states such as Texas, South Carolina, and North Carolina are also represented in the trust’s geographical footprint. South Carolina, in fact, has the most shopping centers in Tanger Factory’s portfolio, while the majority of states only have one or two outlet centers within their borders. In addition to the 30 consolidated outlet properties listed below, the trust has non-consolidated investments in 6 other outlet centers.

Geographic Diversification (Tanger Factory Outlet Centers)

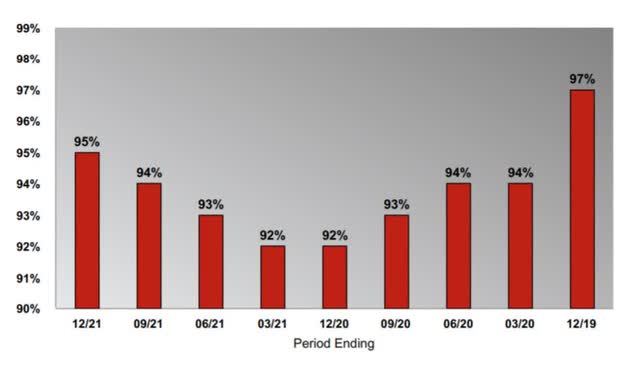

Tanger Factory’s strong rebound in occupancy rate after Covid-19 provides compelling justification for an investment. Despite the fact that Tanger Factory’s Outlet Centers business was crushed by Covid-19 restrictions in 2020 and, to a lesser extent, in 2021, the trust has seen a strong recovery in the real estate markets where it operates. Tanger Factory’s occupancy rate fell from 97% before Covid-19 to 92% in 4Q-20 and 1Q-21, but it has steadily recovered in 2021.

The trust’s occupancy rate at the end of 2021 was 95%, which isn’t quite where it was before the pandemic, but Tanger Factory could return to a pre-Covid-19 occupancy rate by the end of this year. Growth in occupancy rates implies growth in net operating income and funds from operations, two key figures for REIT investors.

Occupancy Rates (Tanger Factory Outlet Centers)

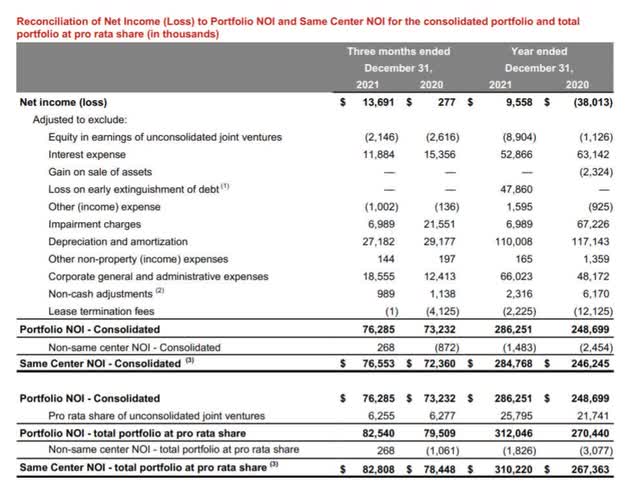

Net Operating Income Recovery

If retail market fundamentals remain strong in 2022 and a recession does not derail Tanger Factory’s investment case, the trust could see a significant increase in net operating income and funds from operations this year.

For real estate investment trusts and investors, net operating income is a critical figure. The net operating income (NOI) of a landlord is the amount of money earned from tenants after deducting property expenses. Tanger Factory generated $284.8 million in same-center net operating income in 2021, an increase of 16% over the previous year.

The same-center NOI is used to assess a trust’s financial performance on a like-for-like basis, which means that net operating income growth from acquired properties is not included in the calculation. Tanger Factory’s net operating income has increased due to improved asset performance (higher occupancy rates) in a recovering real estate market.

Net Operating Income (Tanger Factory Outlet Centers)

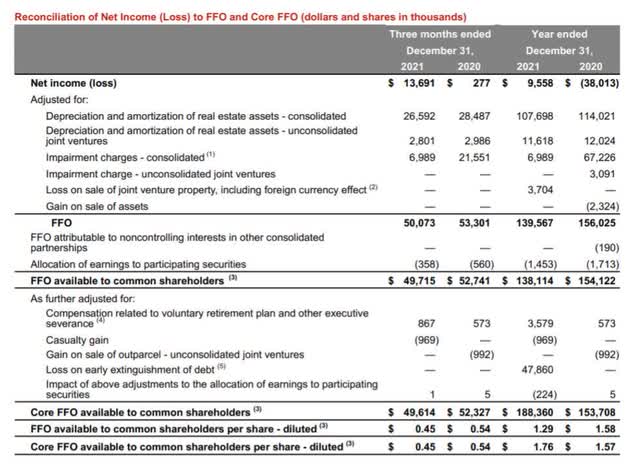

Net operating income growth can be expected to translate into increased funds from operations. Tanger Factory’s Outlet Center assets generated $138.1 million in funds from operations in 2021, a 10% decrease YoY.

If not for a one-time loss related to debt early extinguishment in the amount of $47.9 million in 2021, the trust’s FFO would have been significantly higher and would have shown YoY growth. Adjusting Tanger Factory’s funds from operations for this one-time effect results in (core) funds from operations of $188.4 million, a 23% increase YoY.

NOI To FFO (Tanger Factory Outlet Centers)

Tanger Factory’s FFO per share fell 18% YoY to $1.29 per share. Even with the lower FFO figure, Tanger Factory had a payout ratio of only 55%, indicating that the trust has a lot of room to increase its dividend payout in the near future.

Robust Balance Sheet

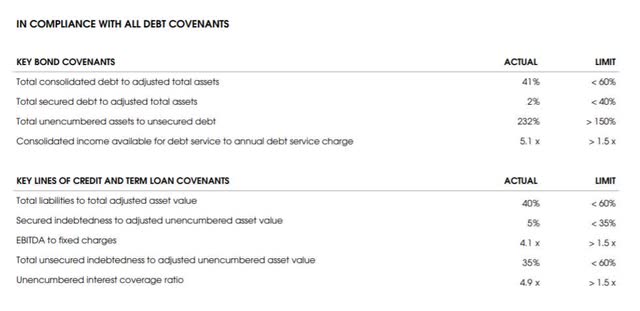

Tanger Factory’s balance sheet is adequately capitalized. Coverage ratios, such as the consolidated income available for debt service to annual debt service charge, are 5.1x, indicating that the trust has significantly more portfolio income than is required to service its debt obligations.

The credit metrics of the trust are also significantly lower than the contractually required covenant requirements. Finally, Tanger Factory had more than $160 million in cash on its balance sheet. The trust has more than enough cash to fund its operations and, in fact, make some acquisitions, thanks to $520 million in unused capacity under unsecured lines.

Balance Sheet (Tanger Factory Outlet Centers)

Outlook 2022, FFO Multiple

Tanger Factory anticipates a 1.5% to 3.5% increase in same-center net operating income in 2022. Tanger Factory could see FFO of $1.68 per share to $1.76 per share for the trust’s funds from operations. Because SKT closed last week at $17.43, the implied FFO multiple here is only 10x, making the outlet center operator a good buy for me.

SKT is so cheap in comparison to other retail trusts with a broader investment focus because outlet and mall operators are more vulnerable to a recession, which some predict will occur in 2022.

What Could Drive SKT Lower?

A recession and skyrocketing inflation.

Although inflation is beneficial to property owners and investors, high inflation raises the risk of a recession. Clearly, recession risks are increasing, and an economic downturn poses a significant risk not only to SKT, but to the entire industry.

My Conclusion

SKT has a payout ratio of only 55% and recently increased its dividend by 9.6%. Based on expected 2022 funds from operations, the stock is cheap, and occupancy rate recovery could result in higher net operating income for the trust in the future.

Given Tanger Factory’s low payout ratio (and high occupancy rate), I am confident in investing in SKT even if the real estate market experiences a downturn later this year.

Be the first to comment