PeopleImages/iStock via Getty Images

Introduction

The Vanguard Short-Term Corporate Bond Index ETF (NASDAQ:VCSH) is an exchange traded fund that offers investors simplified access to short duration, investment grade corporate bonds. The fund is a staple among fixed income ETFs, boasting a world-class asset manager and a rock bottom expense ratio. Additionally, the fund is large with over $40 billion in assets under management and remarkable daily liquidity. VCSH is simple and effective in its value to shareholders. Investors can access a portfolio of over 2,000 individual investment grade bonds in a single ETF, offering some of the widest possible diversification.

We initially covered VCSH in December. The article provides an in-depth analysis of the portfolio and historical performance of the fund. Additionally, we covered the fund‘s monthly distribution emphasizing the importance of the dividend to the fund‘s total performance. Finally, we provided an outlook for 2022, predicting difficult times for the fund as a variety of risk factors began to emerge. If you are unfamiliar with the fund, we would recommend reading for a more complete understanding of the fund.

Today, we want to take an opportunity to reassess our thesis and understand how the past quarter has impacted the performance of the fund.

Portfolio & Performance

Debt investments have earned a core position in income portfolios for generations. Bonds have traditionally offered investors a buoy for equity holdings with performance that is typically inversely correlated. Oftentimes, when investors flee to safety, the traditional thought process was lowering equity exposure and increasing credit. These two asset classes typically made up the bulk of portfolios, such as the classic 60/40 allocation. This should come as no surprise, being that bond performance has been remarkably steady for generations. Corporate defaults have historically remained low, averaging just 1.47% over the past 30 years. This includes the entire sphere including non-investment grade rated debt. Investment grade debt has been even safer with an average default rate of just 10 bps annually. VCSH adopted an even more conservative approach by focusing solely on bonds with an investment grade credit rating and maturity inside of five years. This strategy limits risk and volatility, but generally produces tepid performance.

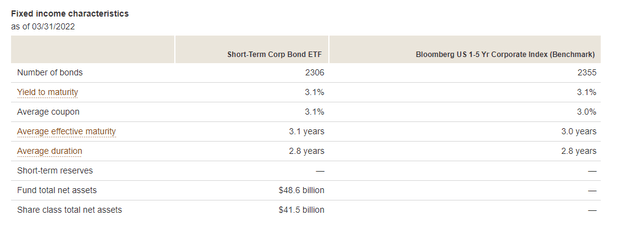

VCSH is one of the most diversified funds on the market and has been able to spread risk accordingly. With over 2,000 positions, VCSH sticks closely to its underlying index, the Bloomberg US 1-5 Yr Corporate Index. Based on the portfolio as of the end of the first quarter, VCSH has an average maturity of 3.1 years and an average duration of 2.8 years.

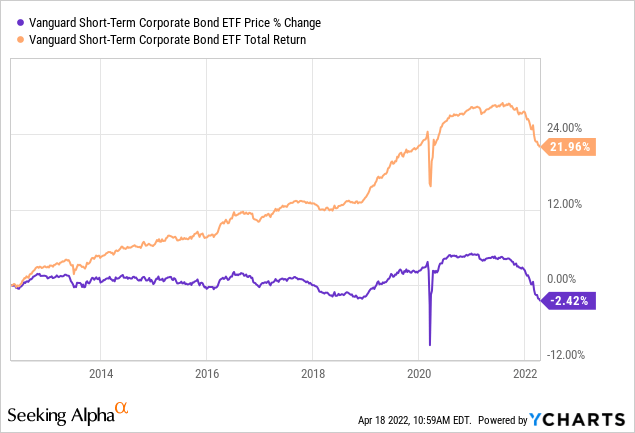

Diversification and the quality focus means VCSH has been a steady performer since its inception over a decade ago. However, with an annual return of just over 2.50% since inception, VCSH is certainly not scoring any home runs. Investors looking to take minimal risk to generate a conservative return may find VCSH attractive for the reasons stated above.

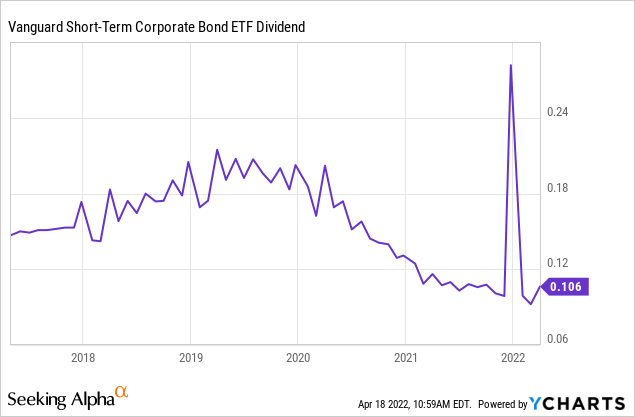

VCSH‘s return has been driven primarily by the fund‘s dividend distribution. VCSH distributes monthly dividends to shareholders. The dividends are generated by the underlying interest income from the portfolio and comes net of all management fees charged by Vanguard. VCSH‘s distribution track is based on current income in the portfolio. Accordingly, as interest rates have remained low, the fund‘s income has fallen as well. In recent years, VCSH‘s distribution has diminished greatly, resulting in a current yield of less than 2.00%. However, falling rates have aided price performance for bond funds, even those with limited duration such as VCSH.

It is simple to look at the past performance and reliability of a fund like VCSH and hop on board. With minimal risk, conservative investors have flocked to VCSH looking for protection from volatility in the equity markets while still earning a productive return.

In our past article, we laid out a thesis that this party has essentially ended for the foreseeable future. Let‘s take an opportunity to reassess our thesis and look at how the first quarter has impacted VCSH.

First Quarter Overview

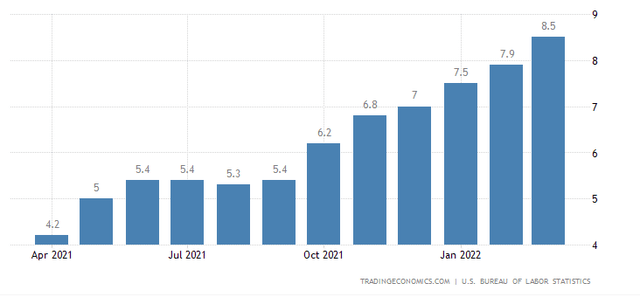

The first quarter proved a tumultuous time for the markets. As the global economy faces continued problems stemming from the COVID-19 pandemic which is entering its third year, other risk factors have begun to emerge. Inflation, while certainly related to the pandemic, has become a primary risk factor as rates remain the highest in generations. As of now, there appears to be no slowing down as inflation has accelerated into the new year, now reaching 8.5%.

Additionally, geopolitical risk factors have begun to emerge as the Russian invasion of Ukraine creates a ripple effect across the global economy, primarily the energy market. However, the effects are never isolated and the impact has reached across markets and asset classes.

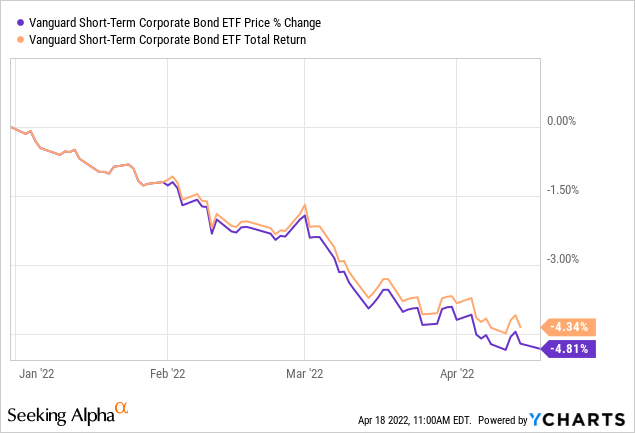

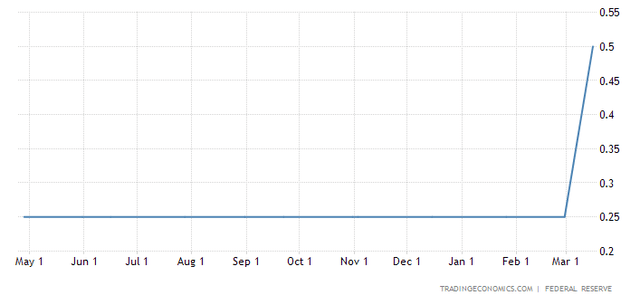

For VCSH, both of those risk factors are overshadowed by increases in interest rates. This year, the Federal Reserve announced the first interest rate increase in years. Although investors certainly saw this coming, the impact of rising rates has still been dramatic for credit markets. Additionally, the impact could accelerate with the federal reserve hinting that there could be multiple 50bps rate increases on the horizon. Bear in mind, the federal reserve generally moves interest rates in 25 bps increments.

Having passed the first interest rate increase, let‘s assess how VCSH has weathered the storm.

The start to the year has been difficult for VCSH with losses mounting as investors flee the fund. Despite the short term maturities, the ETF has been unable to navigate the increases in rates. Let‘s take a look and understand why.

Duration Analysis

As an index fund, VCSH‘s performance reflects the performance and health of the broader credit markets. Luckily for investors, debt investments have simple risk factors. The two primary risk factors facing credit investors are credit risk and duration risk. As we‘ve established, the former risk is well mitigated with a portfolio of investment grade bonds. However, duration risk is not mitigated by underlying corporate fundamentals. So, what exactly is duration risk?

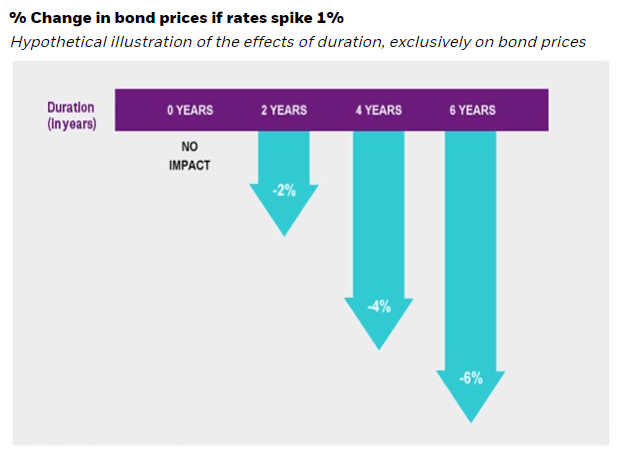

Bond duration is a method of predicting price action of bonds based on movements in interest rates. In the simplest terms, a bond‘s duration acts as a multiple for movements in the opposite direction of interest rates. The bond market is efficient and liquid, meaning bonds are generally well priced and fit relatively close to this model. If a bond has a duration of two years, a one percent increase in interest rates will decrease the bond‘s face value by two percent. If a bond has a duration of six years, a one percent increase in interest rates will cause price to fall by six percent.

BLK

The fundamental driving force behind duration is opportunity cost. When interest rates rise, previously issued bonds look less attractive as investors are able to purchase new paper at a higher coupon with the same corporate level risk factors. Given the market‘s efficiency, this means outstanding bonds adjust to reflect a similar yield to maturity as newly issued paper. As yields rise with interest rates, existing bond prices have nowhere to go but down in order to increase their yield.

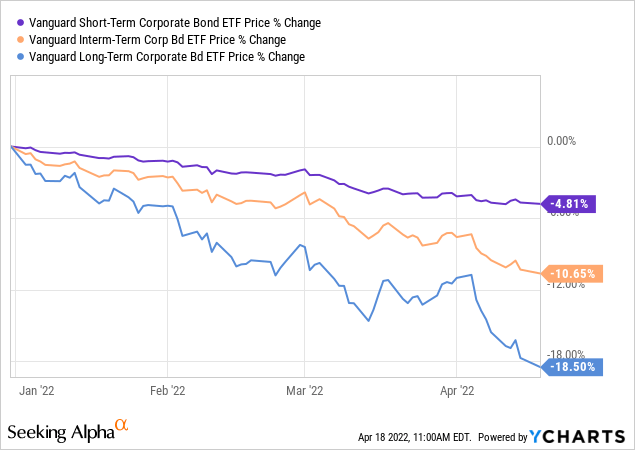

Bonds with longer maturities have longer duration and are thus exposed to greater interest rate risk. This concept has materialized with VCSH as competing funds with longer mandates maturity ranges have seen steeper year to date losses. Even still, VCSH faces a substantial problem.

As the federal reserve introduced their first interest rate increase in several years, the impact for VCSH has been material. With a distribution of under 2.00%, the year to date losses have already overshadowed the distribution income for the year. Should the federal reserve make good on their hints of multiple aggressive rate increases, more pain will inevitably lie ahead for VCSH. Despite a duration of 2.8 years and a small increase in rates, the impact has been real for VCSH as weary shareholders look at the future.

Conclusion

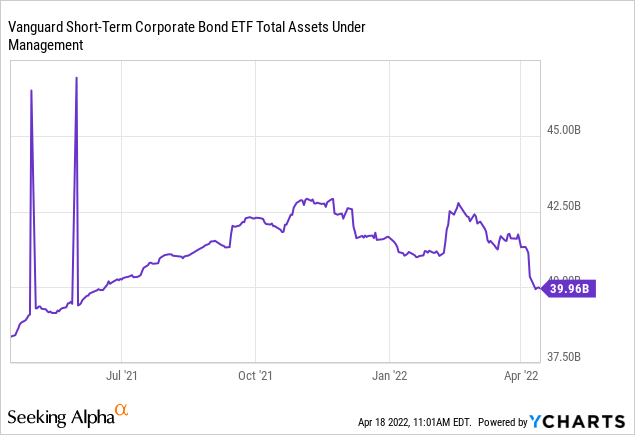

Our thesis has begun to unfortunately take hold with VCSH. Despite the economy remaining strong and credit risk staying minimal, increase in rates leaves nowhere to run. Repricing of bonds is a reality that investors are forced to face. VCSH‘s short term focus has successfully mitigated pain in comparison to its longer duration siblings. Even still, losses are mounting and could become worse if the economy maintains its course. Investors are taking note of these risk factors and the fund has experienced an unusual drawdown in assets since the beginning of the year. Considering the fund has rapidly grown as ETF popularity grows, seeing assets shrink as investors move away from credit is interesting.

In all reality, VCSH is a best in class bond fund which has delivered on its mission for over ten years. For investors who are seeking short-term bond exposure, VCSH is an excellent option. That said, considering the risk factors of the market means we must use caution investing in “classic” funds on the basis of historical performance. The outlook is very different today than even just one year ago. It is difficult to assign a bearish rating to Vanguard funds. The asset manager is one of the best and offers substantial value for rock bottom fees. However, there is a spotlight on passive bond funds given the pain that could lie ahead. At this time, there is not a compelling thesis for an investment in VCSH. Despite offering safety of principal to investors, rising rates leave almost no room for a positive return in the fund.

Be the first to comment