Klaus Vedfelt/DigitalVision via Getty Images

Thesis

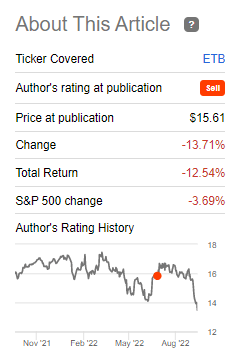

During the summer bear market rally we re-visited one of our favorite buy-write funds from the Eaton Vance family, namely Eaton Vance Tax-Managed Buy-Write Income Fund (NYSE:ETB). In our article we expressed our admiration for the long term performance that this CEF has recorded but pointed out that the fund was overextended with a historically large premium to NAV:

What is the most concerning aspect for ETB is its historic high premium to NAV that currently stands at 15.06%. When looking at the Morningstar data, the historic high prior to this month was realized in 2017 when the fund had a 10% premium to NAV. We are much higher now, and the reason for that is the realization of market participants around the benefits of a “buy-write” option strategy in a decreasing market with high implied volatility. That does not justify to us the enormous premium now embedded in the fund. We expect the premium to normalize to something closer to 5%-7%. We also expect the stock market to resume its downtrend after this bear market rally.

We correctly identified at the time the prevailing market propensity to navigate towards buy-write funds with the view that the stock market was not going to make any new highs, therefore a written call strategy was the optimal path to pursue. Furthermore we were spot on with our Sell rating for this name, with the fund subsequently collapsing in price:

Author Sell Rating (Seeking Alpha)

What happened to the premium to NAV?

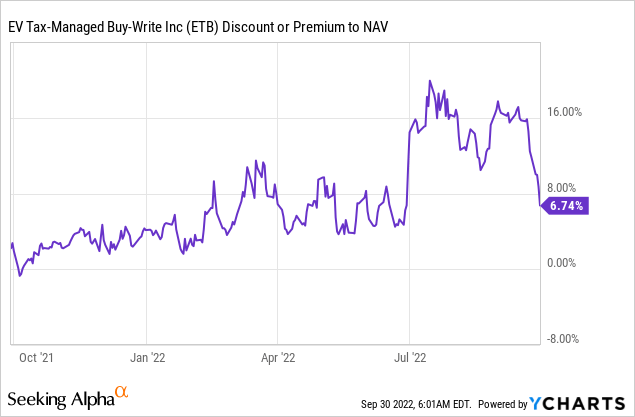

One of the main reasons behind our sell rating was the historic high premium to NAV for ETB:

The fund now sports a decade-long high premium to NAV of 15%. […] We can see from the Morningstar data that the prior high in premium to NAV was realized in 2017 when the fund had a 10% premium to its net asset value. We believe the current state of affairs resides with the realization of many market participants around the benefits of writing call options in a down market. We do not think that a 15% premium justifies the benefits. An investor can just actively replicate this strategy in their own portfolio.

Let us have a look at what the premium has done since our article:

As expected the premium has mean-reverted, closing in on its historic average. Miracles do not last for a long time and all financial instruments tend to mean-revert to a true long term trend. We are currently seeing this develop right in front of our eyes in respect to once high-flying tech names. Tech was all the rage in 2021 with money and liquidity being thrown at the space with little regard to valuation and forwards. It is all receding now, with Nasdaq taking a pounding and once high-flying darling down more than -70% for the year. All financial instruments eventually revert to long term trend growth levels, and ETB’s premium to NAV is no exception.

Holdings

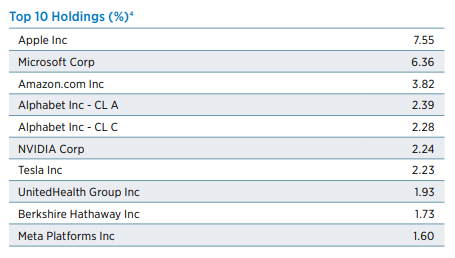

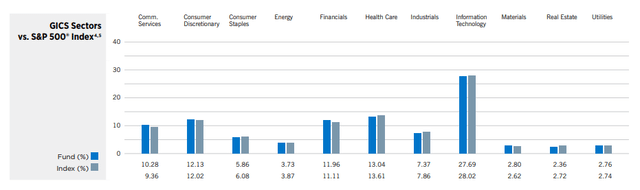

The fund holds a portfolio that closely resembles the S&P 500 index:

We can see from the above table that the sectoral allocations are very similar to the index composition with +/- 1% divergences in discrete sectors.

The fund’s top holdings are as follows:

Top Holdings (Fund Fact Sheet)

What is next for ETB?

ETB is our favorite buy-write fund from Eaton Vance, but even when you like a security long term you cannot part ways when it is overpriced. That is how good trading looks like, even for a buy-and-hold investor. It is similar to an overextended elastic – you know that eventually it will snap back to its original form. And ETB has most certainly snapped back. Down almost -13% since our rating (on a total return basis) the fund’s performance has been driven by both a premium compression as well as the market-wide sell-off.

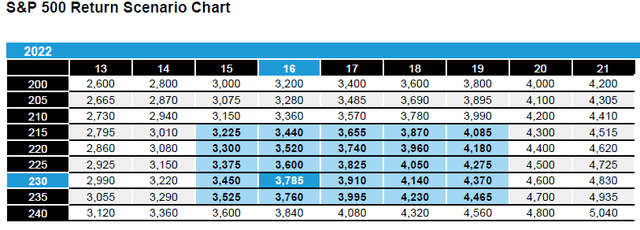

With the premium reversion to fair value, the CEF is back doing what it is supposed to do – convert equity market returns into dividends. The market is currently in a down cycle (in our opinion) and not necessarily done with the selling pressure, although the worst is behind us. Where the bottom lies in the Index is as much dependent on the Earnings component as it is on the P/E de-rating:

S&P 500 P/E Ratio (Alliance Bernstein)

We are of the opinion that we are moving towards the long-term average of 15x P/E ratio, with a -5% to -10% revision down in earnings. That should move the Index to the low 3000s levels.

Conclusion

ETB is a premier buy-write fund from Eaton Vance. The vehicle has been able to generate consistent long term results, but even solid buy-and-hold vehicles need trimming in a market like 2022. Our prior article on the name written in the summer contained a Sell rating given the historic high premium to NAV for the CEF. We were quite clear in our article that the premium is unsustainable and it will come down during the next leg of this bear market. Our view was fully confirmed with an almost -10% retracement in the premium. The CEF is now back towards fair value but not out of the woods yet. We believe that the overall equity market might still have a downdraft left and ETB will closely move in correlation with the overall index if that is the case. There are ample discussions around a double bottom having been realized as well, with some analysts of the opinion the next leg is up. Our view is therefore now in the neutral range for the name so we are moving to Hold.

Be the first to comment