shaunl

Description

Looking at its potential and nature, E2open Parent Holdings, Inc. (NYSE:ETWO) is a supply chain management software company that has provided its SCM solutions to some of the major brands, including Microsoft. It has garnered a blue-chip customer base with long-term relationships. Being mission-critical software, ETWO has high retention rates and pricing power. Further, its continued M&A strategy could further boost growth.

I love ETWO business, but the current valuation does not provide enough margin of safety to invest.

Company overview

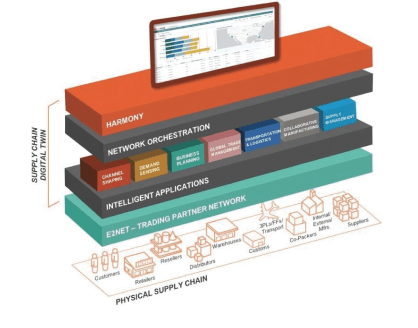

ETWO is the industry leader when it comes to providing end-to-end supply chain management software that is entirely cloud-based. The software that E2open designs brings together networks, data, and applications on a single platform so that customers can manage their supply chains more efficiently.

S-1

ETWO is in a great position to steal market share from competitors

The fact is that the supply chain is very complex, which means there are many problems to solve. Brand owners have evolved from manufacturers to orchestrators, responsible for coordinating the day-to-day activities of a broad network of outsourced trading partners involved in everything from channel management to supply chain management [SCM] to international trade and logistics. With globalization and complexity getting worse, SCM software is more important than ever for managing huge supply chains.

I believe this high level of complexity demands merging previously isolated data sets to guide strategy. The manufacturing industry is becoming more focused on integrating previously siloed data sources to make better, more informed decisions. Until recently, data that may aid manufacturers in bringing their products to market was isolated within the manufacturers’ own departments and throughout their wider ecosystems of partners. Not only is it beneficial for each department inside manufacturing to have access to timely and comprehensive data, but it is also essential for partners of the manufacturer to have such access for them to successfully run efficient operations on the manufacturer’s behalf. More and more often, brand owners are using retail demand sensing to predict required manufacturing output and other data from across the supply chain to inform their manufacturing decisions. Because of this, brand owners are paying more attention to what carriers, shippers, and third-party logistics providers have to offer.

Aside from the above, if one were to take a step back and look at the world, one would notice that the supply chain is getting more and more globalized. The tax, tariff, and regulatory compliance frameworks that manufacturers must operate within have become increasingly nuanced and intricate. I believe SCM software solutions will continue to be important because they automate these processes and make it easier for businesses to comply with rules.

While there are many benefits to utilizing an SCM, one major roadblock is that many organizations still use inefficient, time-consuming manual processes because they are stuck using inflexible, paper-based systems like old on-premise applications or home-grown, spreadsheet-based solutions developed over time. And these SCM solutions oftentimes rely on hidden and one-off point-to-point links with third parties to get information. Due to the lower value and higher error rates of these alternatives, I strongly believe that the modern SCM software market is a good place for new companies to start, as there is no need to compete with and replace existing solutions.

Supply chain management is anticipated to be a $16 billion industry by 2020, per Statista. I agree that ETWO’s core total addressable market (“TAM”) is a smaller subset of the total $16 billion, but that the company could increase its share of the pie by entering adjacent verticals. Generally speaking, I think the TAM is huge, and ETWO is in a great position to steal market share from them.

E2open’s mission-critical software has cutting-edge capabilities and performance

Many companies now rely on software to handle the rising complexity introduced by their shift from product lifecycle owner to orchestrator of discrete production, distribution, and sales activities. Manufacturers generally use several-point solutions with siloed data and procedures that limit visibility, leading to sub-optimal decision-making based on obsolete or incorrect information. Unfortunately, most SCM software has not been intended to handle these difficulties fully.

ETWO’s approach, on the other hand, offers the most cutting-edge capabilities and performance due to its cloud-based SaaS platform with end-to-end visibility and real-time, network-powered data. ETWO provides a strong value proposition to customers by essentially running a software platform that connects network ecosystems and applications through a unified user interface. As a result, ETWO is critical to the operation of the business and would be extremely difficult to replace.

As we have seen time and again, mission-critical solutions carry significant bargaining power. Microsoft Corporation (MSFT) is the best example I can think of because it continues to raise prices while its customers continue to pay. Using the same logic, I believe ETWO will keep its pricing power in the long run.

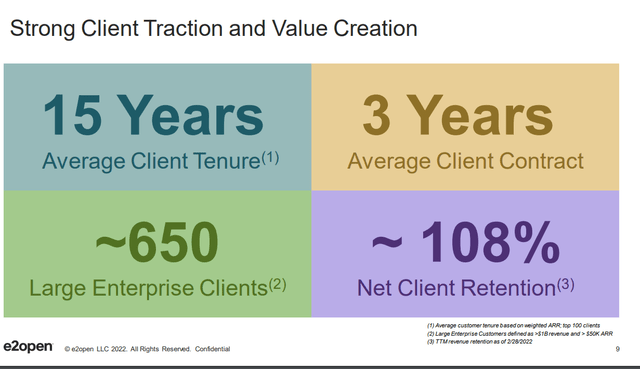

E2open’s solutions are trusted, giving it an edge over competitors

E2open’s solutions are trusted by more than 125 customers whose annual revenues exceed $10 billion, including some of the world’s largest brand owners and manufacturers. It might not seem like an advantage in the marketplace, but I think it is. By slowly implementing ETWO solutions, these large, practical organizations have shown that ETWO works and can be trusted.

Customers like these would be added to ETWO’s “portfolio” to be used as references when making sales presentations to potential new clients. Again, using Microsoft as an example, someone who has already sold their solution to Microsoft will seem more credible. This gives ETWO an edge over up-and-coming firms in the market.

M&A strategy could further boost growth

ETWO’s third growth plan lever is a commitment to making more smart acquisitions. ETWO intends to take a methodical approach to mergers and acquisitions, prioritizing deals that would advance the company both strategically and monetarily by allowing ETWO to capitalize on synergies resulting from the integration.

ETWO has shown that it can successfully increase its product line and speed up its expansion through mergers and acquisitions. Because of its acquisition of INTTRA, ETWO is now able to provide end-to-end supply chain visibility, which is a major selling point for the company. After acquiring INTTRA, which accounted for 26% of global maritime freight data, the company was able to make its software platform and business model even better by taking advantage of network effects.

ETWO also has a proven record of successfully integrating acquired technologies from a financial and operational perspective. I found that the company has consistently outperformed its integration-related cost savings targets since 2015, saving an aggregate of 20% across all of its acquisitions. These additional growth potentials are not currently accounted for in its projected financial performance, but the company plans to engage with its Board as outlined above to explore them anyhow.

Valuation

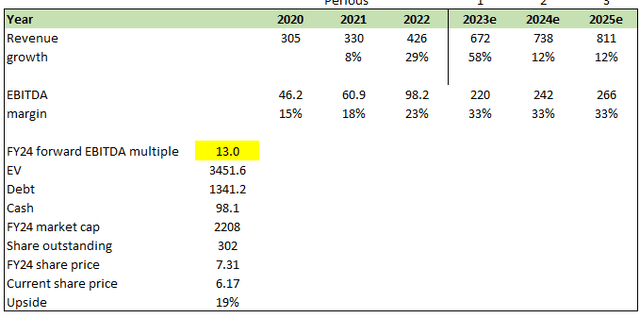

I believe ETWO is worth USD7.31/share in FY24, representing 19% upside from the date of writing.

This value is derived from my model based on the following assumptions:

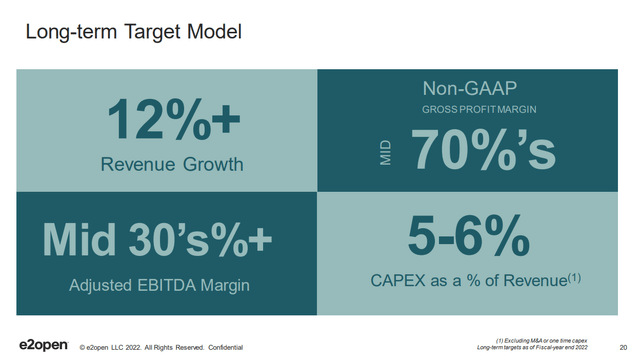

- Revenue will meet management’s guidance in FY23 and continue growing at 12%, which is in-line with management steady-state subscription revenue growth target. The fact is ETWO might grow faster than this, but I am being conservative

- I expect ETWO to meet FY23 EBITDA guidance as well and also to achieve similar margins moving forward

- ETWO currently trades at 13x forward EBITDA, and I expect no changes.

KEY RISKS

Highly levered

ETWO has a lot of debt that could cause cash flow problems if it isn’t handled properly. Worst case scenario: they have to raise capital through equity financing, which dilutes current shareholders. Also, ETWO would have less money to reinvest in expansion if it had to pay the bills.

Large customers have high bargaining power

It’s important to note that some of ETWO’s customers have considerable leverage because they can source equivalent items from competitors or create unique solutions in-house. Some of ETWO’s customers may also negotiate for more favorable pricing and other commercial and performance terms, which could demand the addition of new capabilities to the products ETWO offers for sale or increase the complexity of its customer agreements. ETW’s current pricing methodology accounts for a wide range of variables, such as the customer’s size and the extent to which it uses a certain product, in order to provide a more accurate price. As a result, the average cost per product can go down as a customer makes more purchases.

Summary

I love ETWO’s business, but the current valuation does not provide enough margin of safety to invest. There are many positives in this business that could yield an investor good long-term return; however, I would prefer to invest in E2open Parent Holdings, Inc. at a cheaper valuation.

Be the first to comment