Dimitrios Kambouris

Tesla, Inc. (NASDAQ:TSLA) has built a popular image as an innovative company at the forefront of a host of advanced technologies. Bolstered by the larger-than-life public image of its charismatic CEO, Elon Musk, Tesla’s brand cachet and growth story have propelled its stock to astonishing heights. Despite representing barely 2% of the global automotive market, Tesla is the world’s most valuable automaker by market capitalization. Tesla owes this outsized market position in large part to its carefully cultivated brand and public reputation.

Since taking over as CEO of Tesla in 2008, Musk has worked tirelessly to enhance and protect Tesla’s brand. To this end, Tesla’s public image has been constructed and curated with extreme care. These efforts have resulted in a powerhouse brand name and popular reputation that are, in many ways, Tesla’s most valuable assets. Investors are well aware of this fact, which is why they tend to pay close attention to anything that could threaten Tesla’s brand.

As 2022 draws to a close, Tesla’s brand has come under threat as never before. The present threat is particularly dangerous because of its source: Elon Musk himself. Or, more specifically, Musk’s takeover of Twitter, Inc. (TWTR), which has already exposed Tesla to profound reputation risks, and may yet produce significant operational and financial risks as well.

Let’s discuss.

Reputation Risk: Tesla Brand Tarnished By Twitter

Ever since Musk took the reins in October, Twitter has been embroiled in a seemingly endless cycle of chaos and crisis. Musk’s erratic behavior and apparent lack of any coherent plans for actually leading Twitter appear to have already tarnished, at least to a degree, his reputation for far-sighted leadership and ingenious innovation with the general public. It has also spurred considerable anxiety among investors who fear that, having become inextricably linked with his various business endeavors in the public consciousness, Musk’s recent behavior could harm the companies he leads, especially Tesla.

Investors’ fears appear to be justified. There is a growing body of evidence suggesting that Musk’s activities at Twitter have already caused material collateral damage to Tesla’s brand. According to polling by Morning Consult, the proportion of people with a negative impression of Tesla reached 22% in late November, up from 15% at the start of the year. The number of positive impressions declined over the same period, from 43% to 38%.

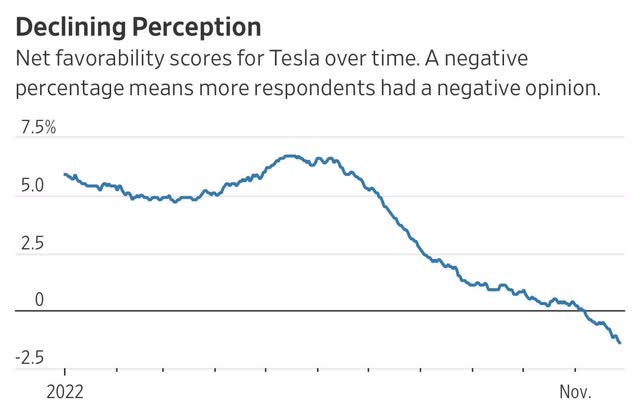

These results have been corroborated by other polls. Market research firm YouGov, for example, has also found a rapid souring of public opinion toward Tesla in recent months. As of Nov. 27th, according to YouGov, Tesla’s net favorability among U.S. respondents stood at negative 1.4%, down from positive 6.7% in May. Remarkably, November marked the first time negative opinions of Tesla outnumbered positive opinions since polling began in 2016.

Even Tesla’s most ardent boosters have acknowledged the problem. Wedbush’s Dan Ives, for example, has worried openly that Musk’s actions at the helm of Twitter represent a serious, ongoing threat to the EV maker’s brand:

“And now sitting on top of the peak of the mountain with Tesla in a massive position of strength Musk has managed to do what the bears have unsuccessfully tried for years…crush Tesla’s stock by his own doing in what we view as a purely painful dark situation…We still believe in the long term bullish thesis on Tesla, that view is unchanged. BUT this Twitter madness needs to end…brand destruction is our biggest worry with this Twitter circus show. It’s that simple and I can’t ignore it for Tesla stock.”

Mounting anxiety about brand destruction and reputational damage has spurred numerous Wall Street analysts to reassess their opinions of Tesla’s stock. Musk’s erratic, polarizing behavior has already cost Tesla its place on Wedbush’s “Best Ideas List” of top recommendations, and other analysts have also seen fit to slash their forecasts and price targets.

Operational Risk: Losing Focus On Tesla

There are only so many hours in a day, and Musk’s time is a finite commodity. Every hour spent putting out (or starting) fires at Twitter is an hour Musk cannot devote to Tesla. Yet, it is clear that the chaos engulfing Twitter has become a serious distraction for Musk himself.

One might argue that Musk can afford to divert his attention from Tesla, because Tesla is running smoothly. However, this ignores Musk’s idiosyncratic role in underpinning the market’s perception of Tesla. It is hard to overstate just how important Musk is to Tesla, both as an operating company, and as a growth stock. Musk is widely acknowledged as Tesla’s key leader, and his importance has only grown in recent years as virtually every other significant personality within the company has retired or left to pursue other opportunities.

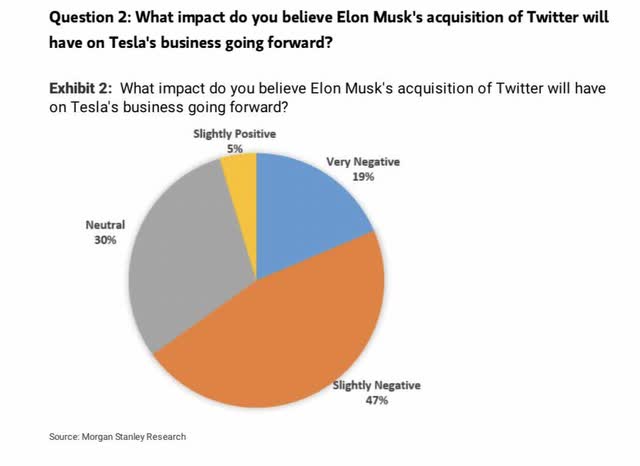

The Twitter saga has served to throw Tesla’s extreme dependence on Musk himself into starker relief than ever before, leading some investors to question whether Musk has the bandwidth to run Tesla properly while also worrying about Twitter. In a survey conducted last month, Morgan Stanley Research found that a majority of investors believe Musk’s acquisition of Twitter will negatively impact Tesla.

It is also worth noting that these have reared their head at a particularly inconvenient time for Musk and Tesla. Last month, a long-awaited shareholder lawsuit concerning Musk’s pay package came to trial in Delaware. When Tesla’s board asked shareholders to approve the package in 2018, their chief justification for the astonishing generosity of the compensation deal was the supreme importance of Musk personally to Tesla’s future. That has made the timing of Musk’s recent shift of focus to Twitter somewhat awkward, a fact that did not go unnoticed during the trial proceedings.

Financial Risk: Twitter’s Precarious Financials

The final risk facing Tesla as a result of Musk’s Twitter takeover is financial in nature. Specifically, Twitter’s inability to maintain sustainable operations without further external investment creates knock-on effects that could negatively impact Tesla.

When Musk took control of Twitter at the end of October, he seemed to have little in the way of a concrete strategy for running the social media company. This is hardly surprising, when one considers that he had spent the preceding months trying to wriggle out of the deal altogether. Musk only opted to stop fighting and to honor the original buyout terms once it had become clear that a courtroom victory was out of reach. As a result, Musk’s management of Twitter has been almost entirely improvisational.

Musk’s leadership has not worked out terribly well for Twitter thus far. His more laissez-faire approach to content moderation, for example, has caused many top advertisers to pause or cancel ad buys. Musk has responded poorly to advertiser withdrawals, characterizing them as deliberate attacks on freedom of speech – and even on democracy itself. However, this line of attack has failed to gain much traction, even among Musk’s most dedicated backers.

Other factors contribute to Twitter’s economic precariousness. The $44 billion Twitter acquisition was funded from a mix of sources, including $13 billion in loans from Wall Street banks. As is standard practice in a leveraged buyout, this debt was technically taken on by Twitter, not Musk. Thus, it is Twitter that is on the hook for the approximately $1 billion in annual interest payments related to the debt. That presents a problem for a company that has historically struggled to find pathways to profitability, and which posted a net loss of $221 million in 2021.

Of course, debt was not the only source of funding for the Twitter buyout. A number of private investors joined in on the equity piece, however, Musk ended up footing the lion’s share of the equity component. In order to raise the necessary cash to do so, Musk had to sell a sizable chunk of his Tesla holdings. All told, Musk sold more than $19 billion worth of Tesla stock between April and November 2022. These sales put considerable pressure on Tesla’s stock at the time, much to the chagrin of Tesla investors. Now that the deal is done, this particular overhang may seem to have been lifted. However, dismissing it now would be premature.

Twitter’s persistent lack of profitability was already a problem before Musk showed up. Falling advertising revenue and an additional $1 billion in annual debt payments have only exacerbated the issue. Indeed, the situation has gotten so bad, according to a recent analysis by Seeking Alpha’s Motorhead, that Twitter may actually be structurally bankrupt. In other words, Musk is likely going to have to inject more cash into the company to keep it afloat. He could try to raise more debt; however, given the fact that Twitter’s lenders are currently doing everything they can to offload the $13 billion in LBO loans on their books, that seems like a non-starter. That leaves equity as the only viable option available. While Musk might be able to convince some additional external investors to stump up more cash, he would likely have to contribute as well. To do so, he would likely have to sell more Tesla stock.

Investor’s Perspective

The market behaves as if Tesla is “more than a car company” because investors believe Elon Musk when he tells them it is. It is only because investors believe in Musk’s bold vision and vivid promises of monumental future growth and profitability that Tesla boasts a $610 billion market capitalization.

If the market were to lose faith in Musk’s future, Tesla’s present valuation could not long survive. That is why Musk’s actions since taking Twitter private are so dangerous for Tesla, as tech columnist Jason Aten recently observed:

“Once the myth is gone, it’s gone. You can’t will it back into existence. No amount of showmanship can make people believe your narrative once it’s been shown to be a lie. That’s a problem for Musk at Twitter, but it’s an even bigger problem at his other companies. All of those big promises start to look empty once the myth is revealed. Promises of self-driving cars and AI-powered robots just look like hype, which is a problem when you depend on the confidence of your investors.”

Tesla’s stock has suffered already as a result of rising investor uncertainty and mounting public disgust. Unfortunately, there is little Tesla the company can actually do from an operational standpoint to address the root cause of these headwinds. Its fate and fortunes are, as they have ever been, inextricably tied to those of Elon Musk.

With no clear end to the Twitter overhang in sight, Tesla’s investors would be wise either to get off the road now or buckle up for a bumpy ride.

Be the first to comment