cagkansayin/iStock via Getty Images

Chinese education services giant TAL Education (NYSE:TAL) is showing early signs of recovery after China’s Double Reduction policy decimated the company’s bread-and-butter K-12 private tutoring business last year. Longer term the company has a number of strategic business initiatives in place but risks remain.

Recovery

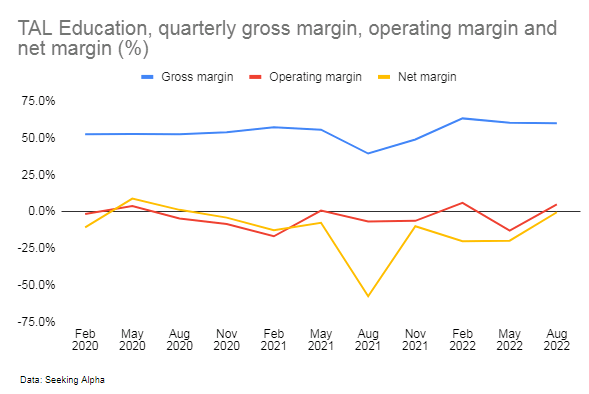

After suffering a steep loss last year as a result of the Chinese governments’ overhaul of the domestic education space last year, TAL Education is showing signs of recovery. During the August 2022 quarter, revenues sank 80% YoY to USD 294 million driven by continued cessation of its K-12 private tutoring business. The company’s losses however narrowed to just USD 800,000, a considerable improvement in profitability, helping net margins improve on a sequential basis.

Author

Learning services (TAL’s biggest segment accounting for 75% of revenues) which covers various offline and online learning programs including enrichment programs, and overseas learning services, saw “healthy” growth momentum in the August 2022 quarter according to the company, while content solutions, (TAL’s second biggest revenue generator accounting for 15% of revenues which covers learning content created both in-house, as well as content licensed or acquired), reported “encouraging” QoQ growth. Looking ahead, the company expects profitability to be lower in the coming quarter due to seasonality. Longer term, the company is working on a number of strategic new business initiatives that could potentially support business expansion longer term.

Refocusing on enrichment learning and overseas expansion

While shedding their K-12 private tutoring business to comply with China’s new rules, TAL Education has refocused their attention on non-academic enrichment programs and overseas learning services which are currently part of TAL’s Learning Services business segment, its biggest business segment by revenues. With the company focusing on scaling these two businesses going forward, Learning Services is expected to remain as TAL’s primary revenue contributor going forward.

Enrichment education is seeing strong demand in China, as students and parents, no longer burdened with excessive K-12 tutoring programs as a result of China’s Double Reduction policy, find themselves with more time for non-academic, enrichment courses.

To capitalize on this, TAL has been launching new courses such as natural sciences, chess and rhetoric and retention rates for some of these subjects are close to that of academic tutoring subjects in the last few years. Along with seeking opportunities to expand their enrichment courses, the company is also aiming to increase retention rates for those subjects whose retention rates have room for improvement. As one of China’s leading education services providers (New Oriental is the other notable rival), TAL Education enjoys strong brand recognition and is poised to capture a decent share of China’s demand for enrichment education.

Since 2020, TAL has been dipping their toes into overseas markets through their international education brand ‘Think Academy’; the company opened a new school in the U.S. and expanded their business to other countries such as Singapore and the U.K.

The results are already bearing fruit with overseas learning services revenues growing at triple digit YoY growth rates over the past two quarters (Q1 2023 and Q2 2023).

Going forward, this segment could continue growing at a robust pace; there is growing demand for Chinese education among international students (international students studying academic degrees in China have increased 35% over the past decade), and the Chinese government as of now has an encouraging stance towards internationalizing its domestic education sector. It remains to be seen how well this segment succeeds going forward as TAL Education doesn’t enjoy a strong level of brand recognition outside of its home market China. The company has a cash balance of more than USD 3 billion as of August 2022 (against total liabilities of less than USD 900 million) leaving them with ample cash to fund overseas expansion. Profitability however may come under pressure near term as the company invests in product development and product localization, customer acquisition and brand building efforts overseas.

Aiming to increase learner interest in science through technology

STEAM learning continues to be a priority for China and TAL Education is seeking to capitalize on this opportunity by creating interesting learning experiences through technology (as part of their aptly named strategy “empower lifelong growth with love and technology”). The company recently launched an app offering metaverse-based immersive learning experiences covering science-related topics such as dinosaurs, undersea learning etc. Metaverse-based products are relatively new and TAL’s investment may not bear fruit, but the technology’s promise as a solution to bridge the divide between urban and rural education (an ongoing effort in China), as well as the younger generation’s affinity to new technology, suggests prospects are optimistic.

eCommerce venture could drive growth and margins but prospects uncertain

Like rival New Oriental Education (EDU) whose new higher margin eCommerce venture has enjoyed strong traction, TAL Education has also ventured into eCommerce. Unlike New Oriental however, which is capitalizing on government efforts to boost the rural community partly through agriculture eCommerce, TAL Education’s platform is focused on selling educational items such as stationery, a business with low barriers to entry and likely to have no shortage of rivals. How successful this effort will be remains to be seen.

Risks

Delisting risks

This year, TAL Education was added to the list of companies that could face a possible delisting from U.S. exchanges. Investing in TAL’s Hong Kong-listed shares however could eliminate this risk.

Geopolitical tensions may limit overseas expansion efforts

Although demand conditions for Chinese education could remain favorable as China’s continued rise as an economic powerhouse is likely to increase its appeal among international students, geopolitical tensions may crimp education providers’ overseas expansion efforts. The US for instance has already been closing a number of China’s Confucius Institutes (Chinese state-funded language teaching centers in universities) and the UK is now working to close them as well.

Competitive risks

Unlike China’s K-12 education sector which was insulated from foreign rivals, most of the sector’s new growth opportunities, such as enrichment education, vocational training, internationalization of Chinese education, and education technology are generally open to foreign competitors and China’s significantly narrowed negative list for foreign investment in the country’s education sector is likely to attract foreign competitors into what is one of the world’s largest education markets.

Summary

TAL Education is showing signs of recovery after being compelled to shut down its K-12 after-school tutoring business as a result of China’s Double Reduction policy. Longer term the company has a number of strategic business initiatives in place to support expansion but it remains to be seen how successful these would be. Moreover, competitive risks and geopolitical tensions could hamper growth. Given TAL’s uncertain long-term outlook, the stock may not be appealing to risk averse investors.

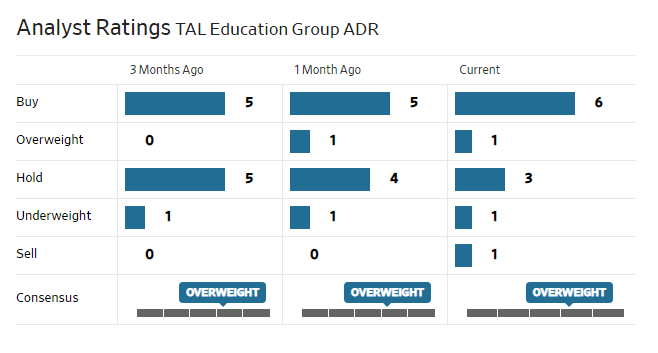

Analysts are generally bullish on the stock. UBS recently upgraded the stock to buy on improved profitability as did Bank of America which anticipates TAL to potentially notch a profit in 2024.

WSJ

Be the first to comment