koyu/iStock via Getty Images

One of the more pressing questions about renewable energy is how to store it in volume pending final use. Traditional energy solutions, including now lithium, are suboptimal. Lead-acid and lithium-ion batteries ‘drain’ such that they need recharging but, even then, require replacement every few years. Still, they are widely available and portable making this technology eminently suitable for electric vehicles and so forth, notwithstanding safety concerns.

Volume Storage is Required

However, grid-level storage of electricity is another matter. In contrast to traditional batteries wherein the electrolytes mix readily with conductors in a single encased cell, in flow batteries:

the fluid is separated into two tanks and electrons flow through electrochemical cells and a membrane which separates them… The larger the tanks, the more electricity can be generated.

This gives flow batteries the distinct advantage of being able to store energy in quantity, before it is needed, as it is created, for example, by wind turbines and solar panels.

Moreover, flow batteries are more cost effective because they “don’t lose capacity or decay over time like other types of batteries, so they always discharge fully at 100 percent capacity no matter their age.” In addition, they are safer and have lower maintenance. Vanadium redox flow batteries hold the advantage. Why? Because, according to the DOE:

Unlike other RFBs, vanadium redox flow batteries (VRBs) use only one element (vanadium) in both tanks, exploiting vanadium’s ability to exist in several states. By using one element in both tanks, VRBs can overcome cross-contamination degradation, a significant issue with other RFB chemistries that use more than one element.

Investing in Flow Batteries

The challenge here is that pure-play opportunities in flow batteries are in early-stage companies will all the incumbent risks. Invinity Energy Systems (OTCPK:IVVGF) is a case in point. This Channel Island operation is winning businesses including in the UK and Canada. However, their income statement and cash flow are wobbly, and their balance sheet is not solid enough to support material growth. I’m steering clear.

On the flip side, we have Lockheed Martin (LMT), ranked #49 on the Fortune 500. Through their energy division and proprietary “GridStar” technology, this company has put down a footprint in redox flow batteries and, I’m guessing, they could come to dominate the field. However, as a major defense contractor, the question remains as to whether this business will move the needle for investors. Nevertheless, we have long held LMT for the more obvious reasons and are happy to continue doing so.

So, at least for now, the investment landscape for pure-play self-contained/turnkey flow battery systems is muddy. That said, the move to renewable energy is already well underway and will now accelerate as the West moves to reduce/eliminate its dependency on Russian oil and gas. Therefore, it is critical that we have significant solutions for storing renewable energy before it finds use on the grid. So, I decided to look further back into the supply chain for ideas on how to capitalize on this pressing trend and I turned my attention to vanadium miners, specifically one operating in the Americas.

Largo

Largo Resources Ltd. (NASDAQ:LGO) is a Canadian company with very high-grade vanadium interests in Brazil. Largo has designs on:

combining [their] world-class vanadium operations with [their] manufacturing capabilities to provide vanadium focused energy storage to serve the world’s long duration energy storage needs.

In other words, it is pursuing an integration strategy that could put it at the very heart of coupling renewable sources to the grid. They aren’t there yet, but the idea is worthy, IMO.

SA does not carry financials on Largo, but MarketWatch does, here. Looking back a few years, we see a company with a see-saw record across their income statement and cash flow. However, more recently, their P&L shows significant promise coupled with a solid balance sheet. Two years of key stats with annual growth percentages stack up like this:

|

2020 |

2021 |

Growth |

|

|

Sales/Revenue |

$160.94M |

$248.59M |

+54.46% |

|

Gross Income |

$38.28M |

$77.99M |

+103.71% |

|

Pre-Tax Income |

$10.36M |

$39.82M |

+284.38% |

|

Net Income |

$9.07M |

$28.3M |

+212.05% |

|

Operating CF |

$352.90M |

$145.83M |

-58.68% |

|

Cash & ST Inv. |

$100.83M |

$106.41M |

+5.53% |

|

Working Capital |

$118.42 |

$149.45 |

+26.20% |

|

Current Ratio |

3.06x |

3.84x |

– |

|

Quick Ratio |

2.22x |

2.59x |

– |

|

Liabs. to Equity |

0.26x |

0.23x |

– |

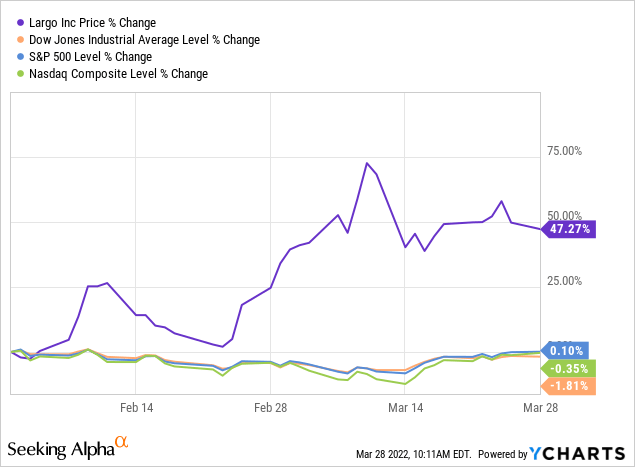

My strategic instincts notwithstanding, we lucked out when we bought LGO in early February. In just two months, we’re up 47%, no doubt contributed by the situation with Russia and what some observers, including Goldman Sachs, now describe as a “commodity super-cycle.” The price of vanadium has risen appreciably (as have other strategic metals in which we are invested).

Putting aside the runup, while only four professional analysts follow LGO, 3 have it as a “buy” with 1 as a “hold”, and an average price target of $15.51, 23% over last week’s close. SA’s quants do not cover the stock.

Still, questions remain including: a) Can Largo pull off their integration strategy in real-time notwithstanding their jumpstart in mining?, b) Would a serious setback in vanadium prices affect the company’s broader aspirations?, c) What about Lockheed should it decide to really ‘go after’ the flow battery market to the dismay of competitors?, d) Will utility companies such as Southern Company (SO) exercise their purchasing power such that “component parts” become “commoditized.”

For these reasons, were it not already “of” our portfolio, I would not chase LGO in here. However, I believe the strategic, environmental, and geopolitical arguments are so compelling that the stock warrants a place on one’s watch list. I might even buy more on a pullback.

Be the first to comment