Justin Sullivan

Introduction

Last week, Roku (NASDAQ:ROKU) announced its earnings and the stock was down about 25%. I often think that the stock market overreacts in both ways (up and down) but the problem is that I can’t even call this particular drop that much of an overreaction. One of my subscribers sent me a direct message with 3 words: “Is Roku doomed?” I hope that this article can answer that question.

The Earnings Results

To start with, there was a big miss on GAAP EPS. While the consensus was -$0.71, the actual number was -$0.82, so a miss by $0.11. That’s almost 15%. Now, because Roku has been swallowing the costs of the supply chain issues and inflation for its hardware to gain market share, the miss was not a big surprise, but it was bigger than I had expected, especially because the expectations had already been lowered.

Revenue came in at $764.4M, up 18.5% YoY, a miss by $40.24M or about 5%. Not great to see, sure, but not a huge disaster that warrants a 25% drop, especially not if we look a bit more under the hood.

Roku is all about the Platform Revenue, not the hardware revenue, although a majority of individual investors still don’t seem to understand that. They still think of sticks when they hear the name Roku.

We know that supply chain and inflation make it tough for hardware makers to maintain their margins. But Roku consciously chooses not to guard the margins at all. It swallows the extra costs for the hardware (primarily sticks) to increase its market share, as the vast majority of its revenue comes from Platform, not hardware.

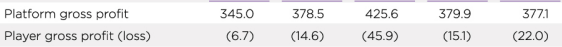

Hardware revenue was again a headwind to the overall revenue numbers, as it was down 19% YoY. As you can see, the gross profits are negative for the hardware and they have consistently been negative:

Roku’s Q2 2022 shareholder letter

(From the Q2 2022 shareholder letter)

It’s simple: the stick is a loss leader, a way to get a foot in the door. Nothing more, nothing less. Even though gross profits were down so much for the player, when you look at the sold units, it’s still higher than before the pandemic, which is great to see.

But luckily, Platform accounts for a vast majority of the revenue. The most important way is through being the operating system on brands like TLC, Sharp, Philips, RCA, Element, Hisense and many other brands. Platform accounts for 88% of the total revenue.

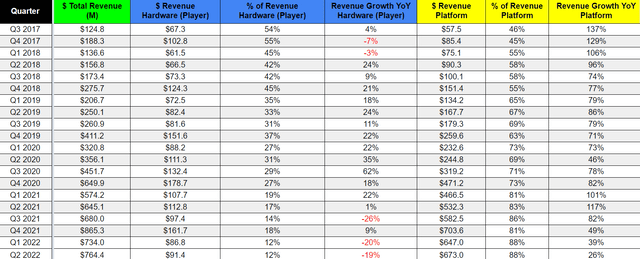

Made by the author from the company’s filings

Overall gross profit was still up 5% YoY to $355M but that was a miss by $41M versus the consensus or almost 10%. Not good.

The adjusted EBITDA margin came in negative, -1.6%, while the consensus stood at 0.5%. Another miss, in other words.

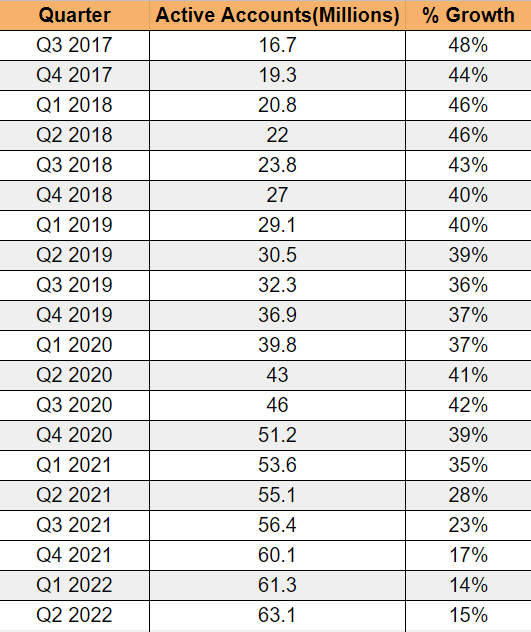

The only two lights in the dark were the number of active accounts and the streaming hours. Active accounts reached 63.1M, up 15% YoY.

Roku Streaming hours and active accounts overview (Made by the author from the company’s filings)

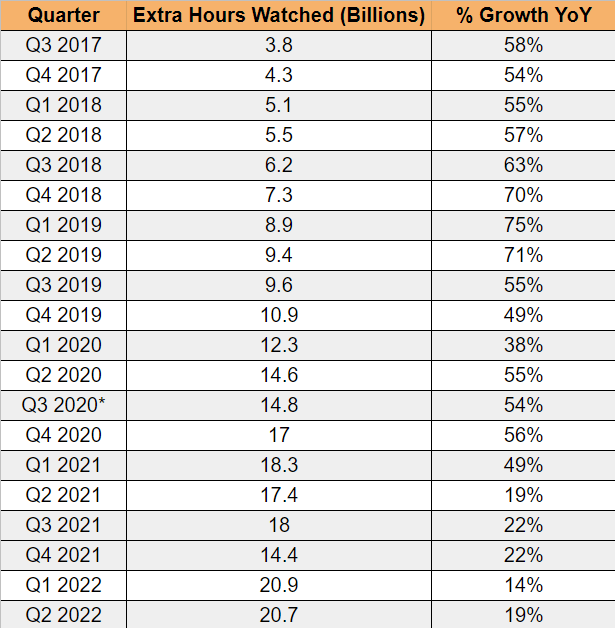

When it comes to streaming hours, the company saw them decrease by 0.2 billion hours QoQ but they still grew at a healthy clip of 19% YoY.

Roku Streaming hours overview (Made by the author from the company’s filings)

The second quarter was seasonally weaker last year, and that’s why a YoY comparison is better here.

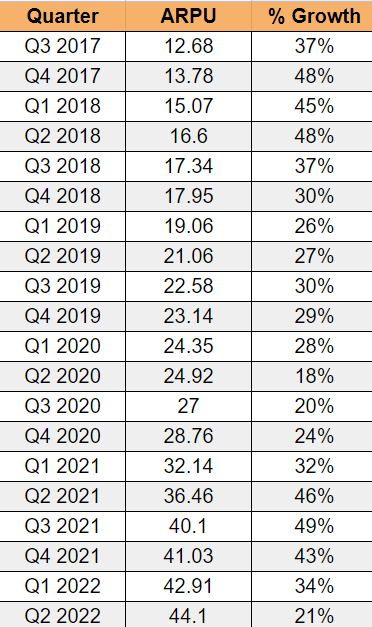

The ARPU (average revenue per user) was up to $44.10 (on a ttm basis). That’s a miss of 2% versus the consensus, but still up 21% YoY.

Roku’s ARPU evolution (Made by the author from the company’s filings)

As you can see, if you look back, ARPU has doubled over the last 3 years and tripled over the last 5. That’s pretty impressive.

To summarize, I’m using this overview by Consensus Gurus. As you can see, there are a lot of misses there.

But despite the misses, there is nothing truly dramatic and if this would be the reason for the 25% drop, I would say it’s an overreaction. As I said from the start, that’s not the case. The drop was not exaggerated. The reason is guidance. Let’s look at that.

Guidance Is Horrible

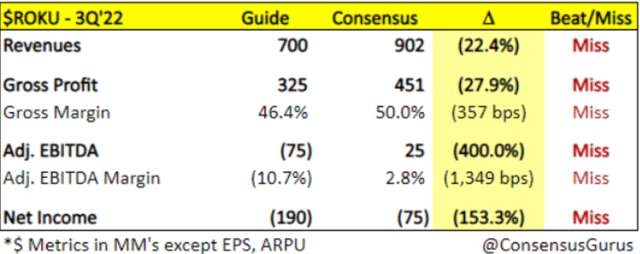

I don’t often use strong negative words, but I think the term horrible is warranted in this case. The company slashed its guidance. Revenue was expected to be $902M for Q3, but now Roku guides for just $700M, 22.5% lower. Ouch. That’s 3% growth YoY versus the expected 33%. Do you see now why I understand the big price drop?

Gross profit is even worse. The consensus stood at $451M, management now guides for $325M, a miss by almost 28%. Adjusted EBITDA was expected to be $25M, now guidance sees them at a negative $75M. Net income was guided to be -$190M versus the consensus of -$75M. Again, ConsensusGurus summarized it well:

What’s Going On?

You must understand that Roku gets most of its revenue from ads, both from channels on its platform and its own The Roku Channel. When things go down for businesses, the first thing they always look at is ad spending and Roku is the victim of this macroeconomic context. This is what Roku’s founder and CEO Anthony Wood wrote in the shareholder letter:

In Q2, there was a significant slowdown in TV advertising spend due to the macro-economic environment, which pressured our platform revenue growth. Consumers began to moderate discretionary spend, and advertisers significantly curtailed spend in the ad scatter market (TV ads bought during the quarter). We expect these challenges to continue in the near term as economic concerns pressure markets worldwide.

On the conference call, he was even clearer:

The current economic state is causing TV advertisers to pause and reconsider spend

In the Q&A section, he gave more color:

So, at a high level, of course we are seeing advertisers worried about a possible recession, and so we’re seeing them reduce their spend in places that are easy for them to turn off and turn back on. So for example, the scatter market* which is, an important source of ad revenue for Roku is an easy market for advertisers to turn off and turn back on, and so that’s one of the big factors we’re seeing from the macroeconomic environment and that’s impacting the growth rate in the short term.

(*scatter market: all the ad inventory that is not bought upfront, note from the author)

Roku had a fantastic upfront (where advertisers commit ad dollars for the next year) and it crossed the $1B line for the first time with the upfront. But the scatter market is very flexible and that’s where there is weakness now. And that weakness is not expected to go away in Q3, to the contrary. CFO Steven Loudon on the conference call:

As we look ahead to the third quarter, we are facing an increasingly difficult and uncertain environment. Recessionary fear, inflationary pressures, rising interest rates and ongoing supply chain issues will continue to impact both consumers and advertisers. We believe consumers are going to continue to moderate discretionary spend and the ad scanner market will remain pressure.

Less ad spending is becoming a clear trend in this earnings season. We saw that at Snap (SNAP), Meta Platforms (META) and several others. Last week, the second quarter with a decline in GDP was announced, and even though there is some debate about that (let’s not go into that discussion here) this has always been the definition of a recession.

Like many other companies, Roku has immediately taken action to adjust spending. From the shareholder letter:

In response, we took steps in Q2 to significantly slow both operating expense and headcount growth.

And on the conference call:

We are closely monitoring macro conditions and will continue to be flexible with our OpEx and content spend.

The company spent a lot more on OpEx and SG&A, probably because of the original content and its promotion. They can be very flexible with this.

Is the thesis broken?

With this poor quarter and especially that awful guidance, is the thesis broken or, ‘Is Roku Doomed’?

The bright spots are very important here: more streaming hours, more accounts and ARPU (average revenue per user) up 21%, which was just a slight miss. I don’t want to kill the already smothered enthusiasm but Roku said that the beat in accounts was the result of stores with inventories doing all kinds of promotional actions and that boosted TV sales. With discretionary spending expected to be down and no special actions, combined with high inflation, Roku expects that TV sales will be below historical levels for the rest of the year.

Nevertheless, this shows that the thesis for Roku is not broken. While Roku is impacted heavily by the macroeconomic circumstances, it uses this crisis intending to come out stronger on the other side, whenever that may be. That’s precisely what you want to see. This is a very conscious decision by management. Before listening to the conference call, I was unaware of how intentionally management is playing this long-term plan, almost like 3D chess. And just like in real chess, it’s sometimes better to sacrifice a pawn to win the game. The pawn, in this case, is the short term, the game for Roku is the long term. Consider this quote from the shareholder letter, for example:

While our revenue and gross profit growth have slowed, we continue to win advertising share and grow active accounts. We remain confident in our industry leadership in TV streaming, the size of the opportunity in front of us, and our unique assets, including the Roku TV OS, The Roku Channel, and our ad platform.

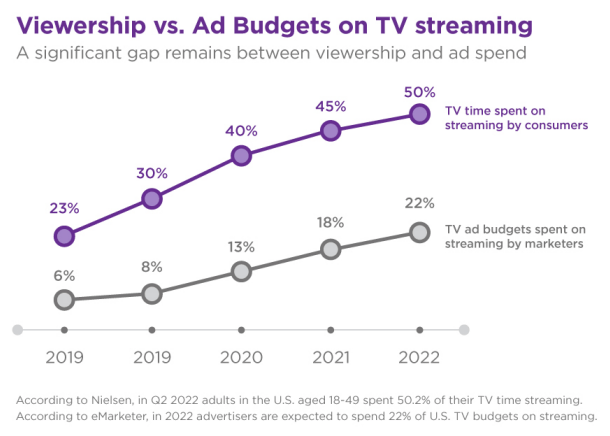

The long-term game also includes the numbers and ad spend that will shift online.

Roku’s Q2 2022 shareholder letter

An Important Cost Advantage For Roku

Roku continues to have a cost advantage over its competitors in CTV, Amazon (AMZN) and Google (GOOGL) (GOOG) when it comes to the TV operating system. The company keeps repeating that it’s the only purpose-built TV operating system, but it doesn’t stress enough the consequences. It gives Roku a big advantage. Because it’s the only operating system built for CTVs, it’s much lighter than the operating system of its competitors. Google uses Android, which is built for phones, not smart TVs, and Amazon uses a variation of Android.

The fact that it’s lighter allows TV manufacturers to build their TVs with much cheaper chips than if they have to build them for an Android-powered TV. That means they can undercut the price of their competitors that don’t work with Roku, ask for the same price and have a better profit margin or a combination of both.

When the macro environment is tough, this advantage is even bigger. That’s why this tough environment could give Roku the opportunity to make its market share even bigger than it already is. Don’t forget that it’s by far the biggest streaming platform in the U.S. and is also number one in Canada and Mexico. It’s expanding rapidly in Latin America, particularly in Brazil, and fighting for market dominance with Samsung there.

Roku’s outstanding price-quality ratio will become more important when people don’t want to spend too much. That’s probably also why Roku highlighted this in its letter to shareholders.

Our streaming devices continue to be recognized for their value and the outstanding experience they provide our customers. Tom’s Guide recently named the Roku® Streaming Stick® 4K the “Best streaming device.” Forbes named the Roku Streaming Stick 4K the “Best Budget-Friendly 4K Streaming Device” and the Roku Ultra the “Best Full-Featured 4K Streaming Device Overall.” And Popular Science named the Roku Streambar the “Best Soundbar Under $100″and the Roku Streambar Pro the “Best Soundbar Under $200.”

I used a quote earlier in this article that I will repeat here.

The current economic state is causing TV advertisers to pause and reconsider spend, which is painful in the short term,

But that quote was not complete. It goes on like this:

but it also causes them to seek greater efficiency and ROI, which will benefit Roku in the mid and long term. This reminds us of when advertisers pause spend during the 2008 recession, but it became a catalyst that accelerated the shift of ad spend from print publishing to digital.

We believe a similar opportunity exists now for advertisers to accelerate their shift from legacy pay TV to TV streaming. We’re already seeing this in the upfronts where we continue to take share from broadcast networks and where we surpassed the milestone of $1 billion in commitments recently.

I think Anthony Wood may have a good point here. Yes, the market environment is very tough and yes, there may be much more pain over the short term, but Roku could come out as a winner over the long term.

Roku can increase accounts, streaming hours and especially ARPU (average revenue per user) for a very long time, even though there will be hiccups. It recently rolled out shopping on TV. You simply click OK during an ad and can buy something seamlessly, paying with Roku Pay, another opportunity Roku has to monetize much more over time.

Selling, Holding, or Adding?

Now that I have digested everything, I’m less worried than when I saw the results, especially that awful Q3 guidance. It’s a very tough macro environment for ad-fueled businesses right now. The company has a robust balance sheet, so that’s not a worry. But I want to see how Roku navigates the ship through the wild sea in the next few quarters.

Every single long-term winner has had tough periods and it’s during these periods, that the long-term winners are separated from the short-term also-rans. It’s when it’s hard that you can show your competitive strength. The fact that Roku has reportedly taken more market share during this quarter is a good sign, even though it won’t be apparent in the numbers in the next quarter or quarters. At a certain moment, it should.

I’m not selling my position, as I don’t see anything that points to the fact that the long-term thesis for Roku is broken. I won’t add much right now, though, as we don’t know when this tough environment will go away. That may take longer than some expect now. I also want to see how Roku does and if it can continue to gain market share in the next quarters. To answer that question, it all started with: I don’t think Roku is doomed at all.

Conclusion

To me, Roku looks like a clear victim of the macroeconomic environment. Let’s call a horse a horse and use the term recession. But there is definitely a good chance that Roku comes out stronger on the other side and that’s why I don’t think the long-term thesis is broken.

In the meantime, keep growing!

Be the first to comment