t_kimura/iStock via Getty Images

Understanding AFRM business model: The poor loan quality and the securitization process

Affirm Holdings (NASDAQ:AFRM) business model is based on the principle of “buy-now-pay-later” (BNPL), which allows consumers to purchase an item and then spread the payment for such item over the following weeks or months. They offer a wide range of funding solutions that are divided between interest-bearing and non-interest-bearing. The first ones are offered basically at 0% APR for the consumers, and the second ones often result in high-double-digits APR (as shown below).

As one can imagine, the company is lending to one of the riskiest and most poor credit quality groups of people. These people need credit to buy cheap products, from $1 to $1000 mainly, as loans of this amount compose more than 70% of the total, and are willing to pay an average interest rate of 22%(!).

But how do they manage loan origination? And does AFRM retain the risk on its Balance sheet? These are key questions because Affirm’s business model is based on one process: they issue the loans, package the loans, and sell them to a group of investors (i.e., securitization). This allows them to (1) not to hold the risk on their balance sheet, and (2) increase the volume of loans issued as they re-use the liquidity derived from the sale to issue more loans, and repeat. The majority of the risk is thus transferred to the buyers of these deals, but AFRM still retains an “equity tranche”. So, any excess yield earned by the trusts (if any), is given to Affirm.

Basically, securitization is a form of financing for the company, which also means that the higher the interest they have to pay on the securitization tranches, the lower their net interest margin and thus the higher pressure on their overall profitability. And this scenario is exactly what’s happening, and how higher interest rates are disrupting AFRM and the entire BNPL sector.

To better understand the dynamics behind these deals, we can look and the rating and pre-sale reports issued by the rating agencies assigned to these transactions.

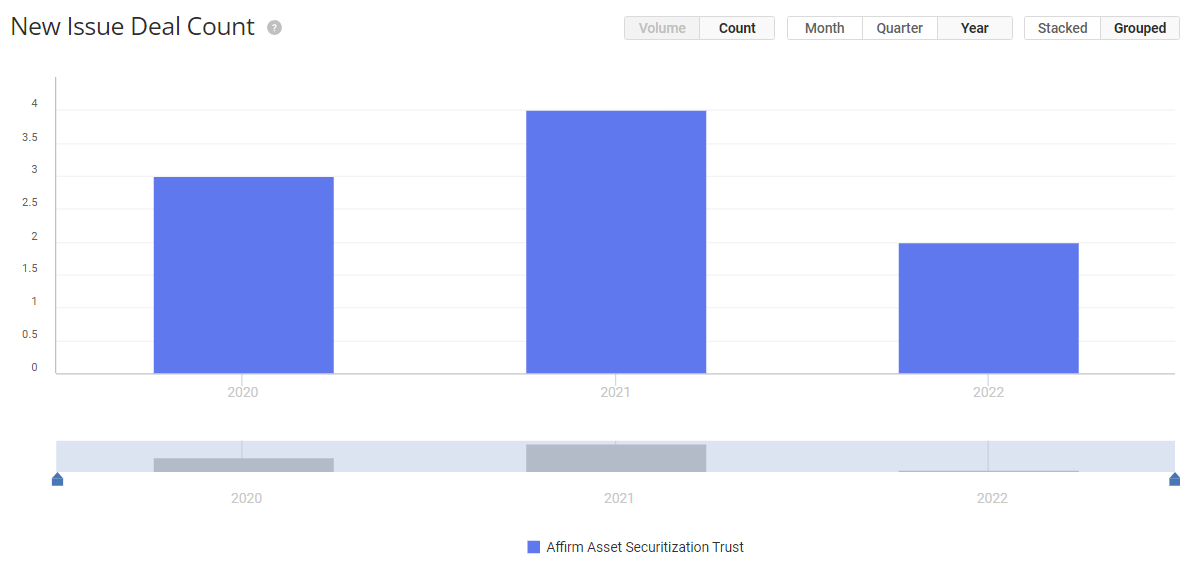

AFRM Deals (Finsight.com – Affirm Holdings Deals)

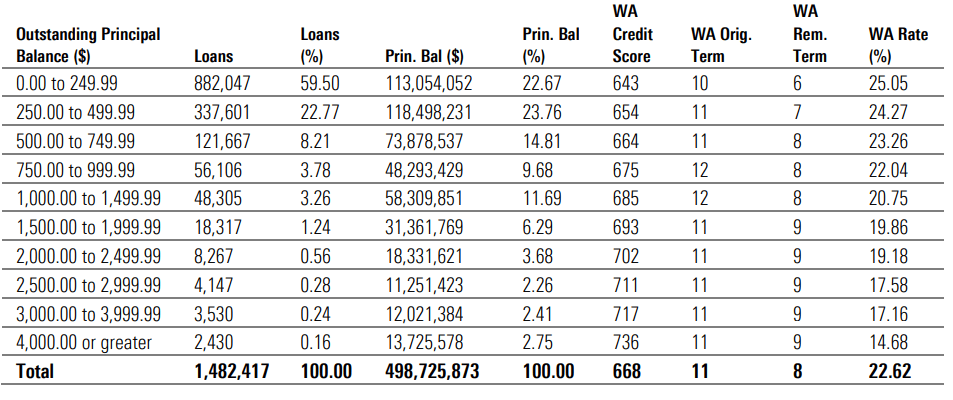

This is the number of issuances per year, and we can immediately note the substantial increase in 2021, especially in terms of volume ($800 million in 2020 v. $1.3 billion in 2021). But as the number of loans, fees, and interest increased, the quality of such deals steadily declined. In a securitization rating report back in mid-2020, they had loans with avg interest of 18%, avg FICO of 690. In 2021, the avg interest passed to 20% and FICO slightly below 686. But now in 2022 deterioration accelerated: the avg interest rate in the latest securitization is 22% and avg FICO is 668(!). You can find this info in the table provided in their latest securitization deal rating report, issued by Morningstar DBRS (below).

AFRM Securitization Data (DBRS – Rating Report – AFRM 2022-A)

This credit quality deterioration left a much riskier balance sheet and loan pool, which is one of the many reasons their business model appears unsustainable.

The other important fact is about losses sustainability and excess spread. From 2020 to 2022, the rating reports highlighted very different levels of sustainable losses per tranche. In the 2020 deal we read the following:

The Affirm 2020-A transaction is able to withstand cumulative defaults of approximately 19.63% for A.

Then, in 2021 it changed this way (for the same rating):

The Affirm 2021-A transaction is able to withstand cumulative defaults of approximately 17.10% for A.

And in 2022:

The Affirm 2022-A transaction is able to withstand cumulative defaults of approximately 14.06% for A.

What does this mean? Basically that the trusts are getting risker and riskier, and they are capable of limiting lower losses than in the past (i.e., concentrated credit events lead to a higher probability of default). If the trusts default (even on the lowest tranche!), the interest that AFRM retains in these deals becomes automatically worthless. But what about its peers? For comparison, we will look at Upstart Holdings (UPST), which has a very similar business model. Here is what we can read in their latest securitization (2022-1), published on April 4, 2022:

The UPST 2022-1 transaction is able to withstand cumulative defaults of approximately 43.75% for A.

So for the same rating (we are referring in each comparison to A-rated tranches), the max cumulative defaults that the transactions can tolerate are 14% for AFRM and 43% for UPST. They are really playing with fire at Affirm Holdings relative to the comparable companies.

The other big thing is the trend of the interest rates charged on these transactions. The investors buying these piles of low-quality consumer loans are demanding significantly higher rates, which will eventually increase Affirm’s funding costs.

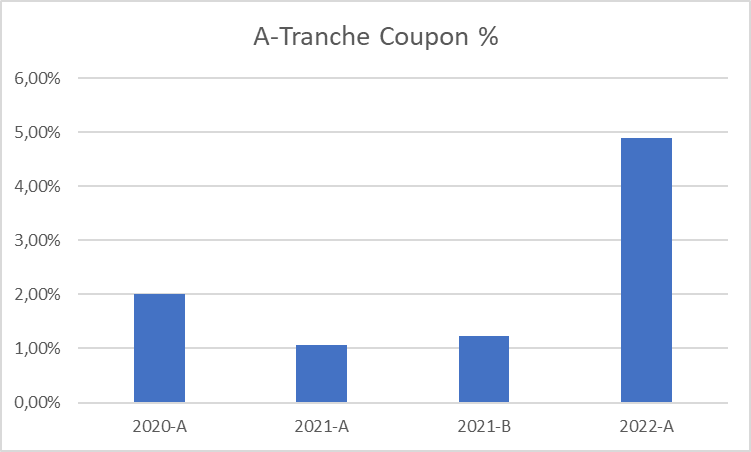

Coupons on A-tranches (Author’s own made chart)

This chart shows the A-rated tranche coupon paid to investors. This is the most commonly rated tranche and it’s present on every single deal made by the company, and thus allows us to visualize even quarterly changes. The 2021-A deal was made in February 2021, while the 2022-A deal in May 2022. The skyrocketing coupon means that no cheap funding is borrowable anymore. For Affirm, more expensive funding means that (1) they will have a hard time lending with 0% APR or low APR, which may cause a drop in customer growth, and (2) they will report lower and lower gains from the sale of the loans.

So, we get that these deals are getting worse, that the quality of the loans is deteriorating, and that the interest rates paid to investors are skyrocketing, but how will AFRM be damaged by this? There will be two main issues: no more gains on sales of the loans and lower interest income from the equity tranches → Lower revenues from Affirm.

Indeed, they reported around $140 million in gains from the sale of loans in 2021, which accounted for around 20% of their total revenues. They gained an average of $15 million per deal, while the coupon rates were below 1%. With rates now above 4% (for AAA tranches), we should expect much, much lower gains on sales reported as revenues. This is what AFRM reports in their 10-Q:

We recognize a gain or loss on sale of such loans as the difference between the proceeds received, adjusted for initial recognition of servicing assets and liabilities obtained at the date of sale, and the carrying value of the loan.

As the liabilities increase (higher rates to pay means higher obligations), this difference will become lower and lower until turned negative (loss on sale), which eventually means that their financing sources have become more expensive. We already saw a negative impact on Q1 2022, and revenues from the sale of loans declined by some $3 million, but the worse is yet to come as rates continue to rise.

Then there is the interest income from the equity tranches. Since AFRM retains the equity participation in these deals, they expect to earn (and were earning during 2021), the excess yield earned by the trusts after paying back the holders of the debt tranches. While it is not clear how much they are earning from loans held from investment and these equity tranches, we can assume that the $390 million interest income will take a hit, thus increasing pressure on their already-unprofitable business model.

A closer look at their profitability issues – Assessing a fair price for AFRM

The fortune of Affirm Holdings lies in the fact that they were able to raise billions in the zero-interest rates environment that led to its development. As of March 2022, they had more than $2.2 billion in cash on their balance sheet. This high liquidity balance is the only reason why the company is still trading at a $5 billion market cap, despite losing hundreds of millions per year.

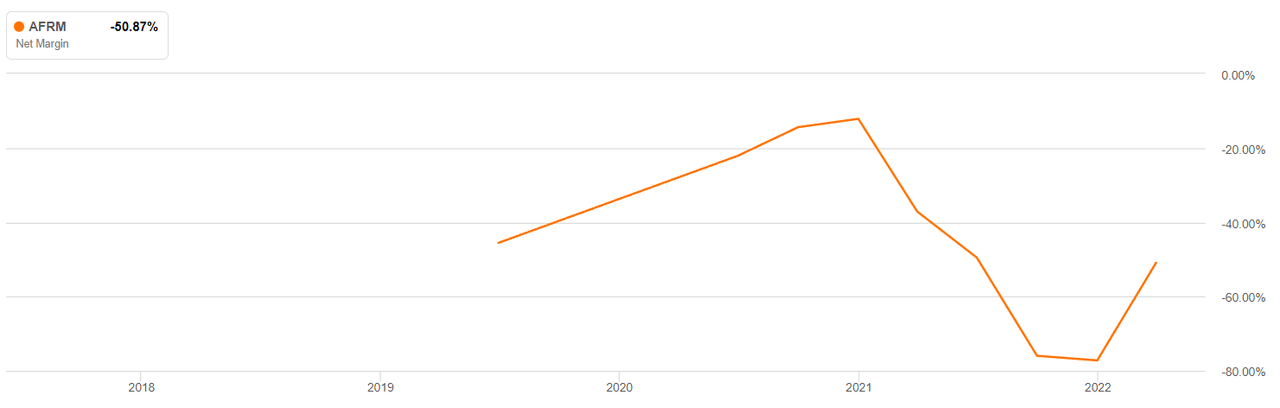

AFRM Net Margin (Seeking Alpha Charting)

As the company grew revenues and aggressively issued new loans to collect (1) merchant fees,(2) interest income, and (3) gains on sales of loans, the net income margin dropped steadily. In Q4 2021, the company was basically losing the same amount of revenues in net income (-80% net margin). And all this was happening with 0% interest rates and contained inflation. How will these margins change within the current macro environment? Probably not well, and thus we should expect increasing pressure on their cash-burn rate.

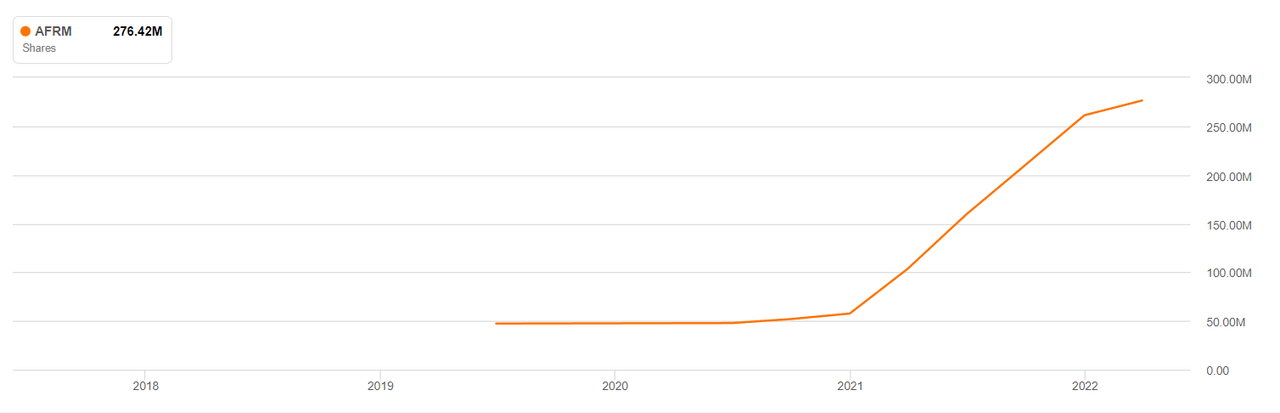

Dilution will play a significant role, as share-based compensation amounted to more than $280 million in 2021, and total common shares outstanding increased from 122 million in March 2021 to more than 280 million in March 2022(!). It is more than 2x the float, just to fund employees’ compensation and general expenses.

AFRM Number of shares (Seeking Alpha Charting)

This is what the share count looks like. AFRM shareholders are basically seeing their participation cut in half every quarter, with more to come as the company struggles to contain SG&A expenses (which doubled while revenue was up 50%) and loses gains from sales of loans.

To assess a fair price for Affirm Holdings, given the high uncertainty behind its unprofitable, unstable business model, I will use a scenario-based analysis with different assumptions.

-

Best case scenario: AFRM is able to quickly turn profitable by substantially reducing the workforce, SG&A expenses, and dramatically improving the economics of the origination process. They start focusing on more stringent origination policies and reduce the acceptance rate of loans, which will eventually mean lending only to individuals with 700+ credit scores.

Indeed, the improvement on their avg loan credit quality would allow: (1) lower coupons on the securitizations, (2) probably faster payback by the borrowers, and so a much less risky business model. Under this scenario AFRM:

-

Will break even in terms of net income in 2022 and start generating a positive net income in 2023 with net margins around 20%.

-

Revenues at $800 million, net income at $160 million in 2023, valued at 20x P/E, fair price at $11. This multiple is derived by assessing the market will value the company as fast-growing and thus being generous in terms of multiples.

-

The probability of such a scenario is set at 20%.

-

Moderate case scenario: AFRM is able to contain expenses in FY 2022 and thus keep the losses within $200 million ($430 million loss in FY 2021), revenues, just like in the first scenario, will take a hit due to lower income from sales of loans and merchant fees.

-

Revenues at $800 million, net income negative of $200 million for FY 2022.

-

In 2023 break even and will cautiously start generating earnings in 2024, at a 10% net margin, which means $100 million net income by 2024 assuming revenues of $1 billion. Using a 15x P/E, the fair price is $5.

-

The probability of such a scenario is set at 40%

-

-

Worst case scenario: AFRM will continue to generate the same bad-quality loans with near-subprime clients. The rising interest rates will disrupt both their interest income and gains on sales of loans, meaning revenues will decline by some 15% in 2022. SG&E expenses will remain high, and they will reach a net loss of $800 million in 2022.

-

Continue to burn cash, dilute shareholders through 2022, 2023, and 2024.

-

Revenues at $750 million in 2022, the cash burn rate will continue to stress their cash pile, and eventually, they will file for Chapter 7 or 11. Fair price at $0.

-

The probability of such a scenario is set at 40%.

-

The weighted average fair price resulting from this analysis is $4.2, or around $1.1 billion in fair equity value. This highlights the operational weakness and the threat posed by rising interest rates to the survival of AFRM business model (this is why probability of default is set at 40%).

Risks – What could go right for Affirm?

The main point is the economics of their loans, so the overall quality (in terms of credit scores), the average payback period, and the operating expenses associated with its business model. Indeed, “marketing” and “Tech and data analytics” were $250 million in Q1 2022, with $350 million in revenues(!). If they are able to substantially reduce these expenses while not impacting demand for their loans, they may be able to reduce the cash-burn rate so much that they could easily gain enough time to fix their business model.

Also, with a major reduction of maturities of their loans, now at 33 months for 0% APR loans, and 10 months for interest-bearing ones, they could offer lower coupons on the securitization deals (i.e., gains on sales of loans to pick up again) and substantially decrease risk also of owned (retained on the balance sheet) loans. Under these scenarios, Affirm stock will probably have some relief and move back to a more generous valuation, even if it will take many quarters.

Conclusion

Affirm Holdings came to the market offering an innovative, so-called fintech solution that aimed to disrupt the market of consumer finance. After many years, an IPO, and dozens of multi-million dollar securitization deals, the company showed great weakness. Now, in the middle of rising interest rates and skyrocketing inflation, 2022 and 2023 could be years of great stress for Affirm, which seriously face bankruptcy risk and at this price is generously overvalued.

Be the first to comment