courtneyk/E+ via Getty Images

Relmada Therapeutics (NASDAQ:RLMD) crashed recently when a phase 3 study of their drug, REL-1017, in major depressive disorder (MDD) failed. RLMD still has two phase 3 readouts ahead, this article takes a look to see if there is any hope of success for the name.

RELIANCE III

On October 13, RLMD announced that their RELIANCE III study, of REL-1017 as monotherapy in major depressive disorder, had failed to meet the primary endpoint. The change in Montgomery-Asberg Depression Rating Scale (MADRS) after 28 days was 13.9 in the placebo group and 14.8 in the REL-1017 group. An 0.9 point difference is not only minor in terms of clinical significance to patients, it wasn’t statistically significant.

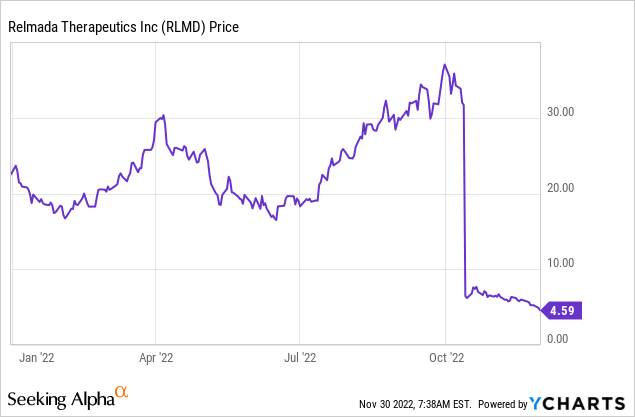

Figure 1: RLMD trading, year-to-date. The stock tanked with results from RELIANCE III and has continued to sell off since.

The company noted a high placebo-response at some sites involved in the trial as a potential factor in the failure.

To better understand the paradoxical results, a post-hoc, exploratory analysis using the band-pass method (Merlo-Pich et al, 2010²) was conducted. The band-pass analysis excludes sites with implausibly high or low placebo responses (defined as a mean decrease from baseline in MADRS10 score greater than 14 and less than 3 points) and showed a meaningful difference between REL-1017 and placebo (>4.9 points on the MADRS, p<0.05).

RLMD October 13 press release, noting the band-pass method.

While RLMD claims that the issue is a high placebo response rate, and notes a potential analysis method that supports the idea that the drug might work if implausible placebo response rates are excluded, I’m still not convinced that if the study were run again, it would succeed. In 2019, Whitlock et al. published an analysis of 122 MDD trials from 1983-2010. Their results suggest that placebo response rates are correlated to response rates in the active arm of a study. As such I find the idea, that high placebo-response rates cause trials to fail, to be a theory. It isn’t something that is supported unequivocally.

Re-analysis of the data set showed the active and placebo responses to be highly correlated, to the degree that would be expected assuming placebo additivity, when random variability in both active and placebo response is considered… Attempts to reduce the placebo response are unlikely to increase the treatment effect since they are likely to reduce drug nonspecific effects in the treatment arm by a similar amount.

Whitlock et al., 2019, Innov Clin Neurosci 16(07-08):12.

RELIANCE I & II

While the RELIANCE III monotherapy study has failed, RELIANCE I and II have the important difference of treating patients with inadequate response to 1-3 antidepressant treatments. Patients in these studies continue to take their current antidepressant, which isn’t working adequately, and add on REL-1017 or placebo. This adjunctive setting (aMDD) is more similar to RLMD’s phase 2 study (which actually succeeded) and so some investors might be hoping the drug can perform here as it did in phase 2. For me to say the aMDD setting is the best hope (RELIANCE I & II) when I originally thought the MDD setting (RELIANCE III) was RLMD’s best shot at success, would be a bit rich. Still that is a big part of the current bull thesis, the idea that the phase 2 success was in aMDD, and so perhaps that is the strong point of the drug.

Discussing the issue further, Maurizio Fava, the principal investigator for the studies of REL-1017, noted that the COVID pandemic could have caused stress-induced depressive episodes, in patients who don’t have a prior history of depression. These patients might not be ideal to test a drug on.

… And as we see often, stress-induced and depressive episodes have a high probability of spontaneous remissions. They get better on their own. But if they get better on their own, they get better on placebo as well.

In the 301 study, we have patients who have to be on antidepressants, have to have failed to respond to antidepressants. They have to be in treatment with a psychiatrist. And so they are very likely to have recurrent forms of depression, so more bona fide conditions, medical conditions…

Maurizio Fava, Chief of Psychiatry at Mass General, RLMD’s Q3’22 earnings call. 301 study refers to RELIANCE I.

This is another theory at the end of the day, but it isn’t that farfetched that COVID can impact studies in the MDD setting more than the aMDD setting. Perhaps the results of Whitlock et al., wouldn’t hold up in the context of COVID impacting placebo response rates in depression trials.

RLMD should be able to give us more color on what happened in RELIANCE III, because some of the same sites that had issues in RELIANCE III have also been involved in RELIANCE I. A good result for bulls would be that RELIANCE I succeeds, showing REL-1017 works well in aMDD, but the company nonetheless notes that these sites indeed still had higher placebo response rates. That would bode well for future studies in the MDD indication, despite RELIANCE III failing.

Results from RELIANCE I are expected before year-end, with results from RELIANCE II now expected in 2023. RELIANCE II will avoid the issue with the sites that are a potential factor for RELIANCE III’s failure. So even if RELIANCE I has the same issue as RELIANCE III with some sites seeming to impact the analysis, RELIANCE II shouldn’t suffer from that issue.

Financial Update

RLMD had cash, cash equivalents and short-term investments worth $184.2M at September 30, 2022. R&D expense for Q3’22 was $30.5M and G&A was $8.2M. Net cash used in operating activities was $67.9M in the first nine months of 2022, so at the current rate of burn, RLMD won’t be running out of cash soon.

While the RELIANCE III study is now complete, RLMD’s earnings call contained news that the company could initiate new studies in 2023. There were 30,099,204 shares of RLMD’s common stock outstanding at September 7, 2022, corresponding to a market cap of $138.2M (at $4.59 per share). As such RLMD has been trading below cash, to be fair that isn’t uncommon for pre-commercial stage biotechs this year. Further, there are ~4.5M warrants outstanding with a weighted exercise price of $11.50.

Conclusions

Overall I think the cash position of the company, and the fact that it trades below cash, will limit the downside if RLMD announces unimpressive results from RELIANCE I in the coming days. Those going long at $4.60 might only see the stock drop 30-40% rather than 80%. I can’t see RLMD dropping 80%, to $0.92 if RELIANCE I fails, when the company is sitting on over $5 a share in cash. So the idea of a long would be playing a binary catalyst where the downside is limited but the upside is potentially several fold (the stock was at $35 prior to the RELIANCE III failure, and if RELIANCE I succeeds, the bull case is back on, including the MDD indication).

Still Occam’s razor says the drug failed because it doesn’t work, that the larger phase 3 study failure trumps the smaller phase 2 success, and the same sites being involved in RELIANCE I as RELIANCE III could still cause it to fail if there is an issue with those sites. I rate RLMD a hold and I’ll be waiting eagerly to see results from RELIANCE I, particularly with regards to any information about the sites supposedly causing issues, which aren’t playing a big role in RELIANCE II. If RLMD continues to slide before RELIANCE I reports results, say below $4, I would arguably change my mind from rating it a hold, to rating it a buy, because the downside on failure would be even more limited and the company does have a chance of success. The obvious risks of any long at that point would include, but are not limited to; failure of RELIANCE I, a delay in reporting results from RELIANCE I and further delays being announced in RELIANCE II.

Be the first to comment