Justin Sullivan

ConocoPhillips (NYSE:COP) has seen its share price drop almost 30% over the past month and a half, pushing its market cap to $110 billion from almost $150 billion. That weakness has pushed the company’s dividend towards 3.5%. As we’ll see throughout this article, the company’s impressive acquisition strategy combined with financials make it a valuable investment.

ConocoPhillips Acquisition Strategy

ConocoPhillips has had some of the best acquisition strategies in the business in our view, being one of the few companies to take advantage of the COVID-19 downturn.

The company bought Royal Dutch Shell’s Permian Basin infrastructure, receiving 225 thousand acres and 600 miles of midstream assets while spending $9.5 billion to do so for the all-cash offer. The company also acquired Concho Resources, with additional shale resources, for almost $10 billion. These $20 billion in acquisitions were made at an opportune time.

That acquisition strategy was made as numerous other companies were fearful. In our view, it has helped cement the company’s assets during one of the strongest bull markets in years.

ConocoPhillips Financial Performance

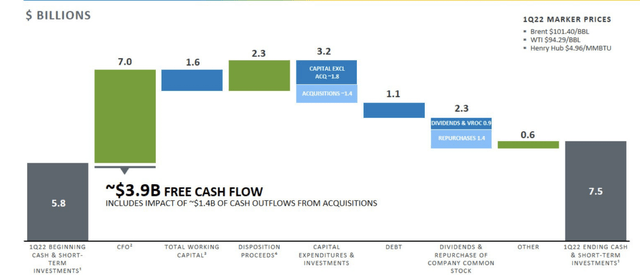

From a cash flow perspective, ConocoPhillips has continued to perform well financially.

The company earned $3.9 billion of FCF for the quarter. That gives the company an annualized FCF yield of almost 15%. The company paid a 3.5% dividend yield, and it spent 50% more than that for the quarter on share repurchases. That takes the total direct shareholder yield for the company almost 9%.

For the year, the company is expecting to produce more than 600 million barrels, with almost $8 billion in capital expenditures in the year (~$13 / barrel). The company expects each additional $1 / barrel will be roughly $115 million in additional income, which at current prices points to an additional $1 billion in income for 2022 versus 2021.

We expect the company to be able to use this cash flow for significant shareholder rewards.

ConocoPhillips Shareholder Return Potential

ConocoPhillips can drive substantial shareholder returns. The company has recently increased its guidance for 2022 shareholder returns to ~$10 billion, or a 9% return. That goes hand-in-hand with the company’s $5 billion in debt reduction target, both of which we expect it can complete before the end of 2022.

The company’s dividend will consume roughly $3.5 billion. That leaves $6.5 billion for share buybacks, a number the company can comfortably afford and enough to repurchase ~6% of its outstanding shares. The company has just under $20 billion in long-term debt, a level it doesn’t need to rush to repay, but one that it can save on interest expenses by doing so.

From this combination of things, we expect the company to continue generating double-digit overall shareholder returns at ~$100 / barrel. These reliable returns from a reliable portfolio of assets help to highlight how the company is a strong investment opportunity.

Options Investment

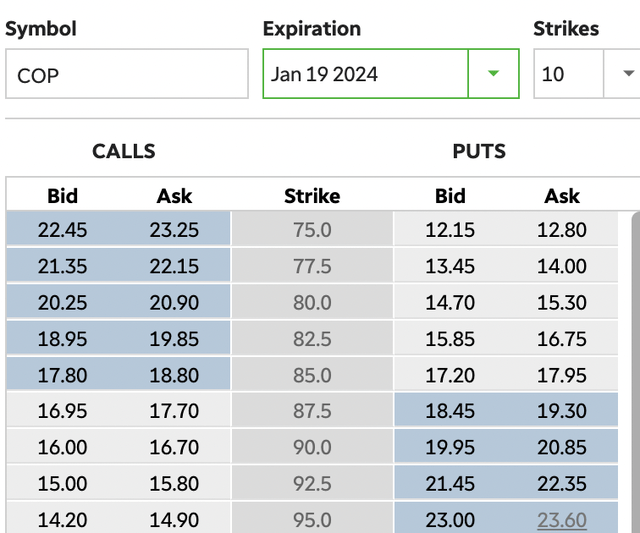

For those looking to invest, we also recommend taking advantage of the company’s options.

The company’s current stock is just under $90 / share. Investors can sell a cash secured PUT for 18 months form now at $75 / share with a midpoint of roughly $12.6 / share. There’s two scenarios here, both which we see as a valuable opportunity for interested investors.

The first is that the stock price finishes above $75 / share. In that case you keep $12.6 / share, or a double-digit yield on your cash. The second is the stock price finishes below $75 / share. That means you get to invest at a cost basis of just over $62 / share meaning a mid-single digit dividend yield and a roughly 30% discount.

Those are strong returns as an alternative, with less volatility than a standard investment in the company.

Thesis Risk

The largest risk to the thesis with ConocoPhillips as a pure upstream company is crude oil prices. The company had $95 / barrel in 1Q 2022 realizations, 94% of the average Brent price for the month. The company’s historic average is 94-96%, so we expect that to continue going forward. Since that time, Brent prices have averaged above that level.

Conclusion

ConocoPhillips has an impressive portfolio of assets. The company’s share price has dropped almost 30% over the past month, representing a unique opportunity to invest. At the same time, the company was intelligent throughout the COVID-19 related price collapse, using good sense as it added to its position.

We recommend investing in ConocoPhillips at this time. The company can generate highs-single digit direct shareholder returns, along with double-digit shareholder returns when counting debt pay down. Regardless of how the company’s cash is spent we expect the company to generate valuable shareholder returns and recommend investing.

Be the first to comment