Michael Derrer Fuchs

Credit Suisse (NYSE:CS) is currently trading at 0.23x tangible book. Deutsche Bank (NYSE:DB) is trading at 0.3x tangible book value. These are very distressing valuations for banks, even so for European banks.

CS, however, is in deep trouble due to a steady stream of risk management scandals in its investment bank, including the Archegos Capital fiasco that cost it over $5 billion. I have written on this episode previously here and noted the followings:

Beyond the financial loss, there are other significant downstream implications for CS in the short and medium term. Whilst the current share price appears attractive in the context of the long-term valuation of the stock, I am not quite ready to buy the dip. There appear to be major risk management matters plaguing its investment bank and fixing these will likely be a protracted and costly process.

DB, on the other hand, is in excellent shape and has executed the strategy envisioned by DB’s CEO, Mr. Sewing, marvelously. It is on a credible path to earning greater than 10% RoTCE by 2025, powered by strong tailwinds from the paradigm shift in the interest rates settings in the Eurozone. It also has a low-risk business model, which means it is likely to side-step the type of banana peels CS has stepped on.

The problems with Credit Suisse’s business model

On the face of it, CS has a very attractive business mix that leans on capital-light wealth management business (~two-thirds of the bank) and is complemented by an appropriately sized investment bank (~one-third of the bank). It sounds almost similar to a European version of Morgan Stanley (MS), but there are differences, of course.

CS investment bank is geared mostly to credit markets and capital markets issuances. These are areas that are quite challenging in the current macroeconomic environment. Also, due to the Archegos Capital debacle, it was forced to retreat from the Prime Finance business, which is typically a very lucrative and profitable business line for investment banks. Also, in the current environment, its areas of strength in the leveraged finance, M&A, and SPAC deal activity are very much muted. CS has also taken material (but yet unquantified losses) on the leveraged buyout of Citrix. On the flip side, CS has little exposure to FX trading, rates, and commodities which are more stable annuity-like trading businesses. These business areas are currently benefiting strongly from the recent market volatility.

Together with the colossal risk management lapses, the CS investment bank is now in a tailspin. This is driving up its funding cost and can easily turn into a death spiral as key rainmakers desert the ship. This has already begun to play out with the departure of key executives to Citigroup (C) and others that are “pursuing other opportunities”.

The management team has no options but to restructure and downsize the investment bank and do so as quickly as possible. CS is expected to deliver its strategy update on the 27th of October.

The problem is that restructuring an investment bank is a long, protracted, risky, and costly exercise. Firstly, CS will need to raise a significant amount of capital, and in the current environment and considering its market cap, this is going to be extremely dilutive for existing shareholders.

Secondly, CS will likely need to set up a non-core bank where it would look to unwind long-term trades over several years and/or sell these at a significant loss. This non-core unit will likely bleed losses for many years as was the experience in DB and Barclays (BCS) multi-year restructures.

Thirdly, the management team will need to figure out how to retain key staff in the firm, especially as the U.S. banks are aggressively expanding into the European capital markets.

Finally, the regulators will extract their pound of flesh as well. CS will need to deliver a multi-year credible program designed to enhance its control infrastructure. This will take years to achieve and be very costly.

In summary, this will likely be a multi-year story with no guarantee of success. Importantly, shareholders will come last on the priority list as CS will need to balance other stakeholders’ requirements.

Deutsche Bank restructure is a success

After several failed attempts, Mr. Sewing stabilized the Deutsche Bank ship. The management team has delivered on the cost-cutting program with typical German efficiency. The investment bank is focused on the bread and butter of trading income comprising FX, rates, and credit trading. As such, the investment bank looks like it is sustainably earning its cost of capital as well as continuing to take market share. DB has completely exited the Equities trading business and therefore has managed to side-step some of the risks the likes of CS have faced. Importantly, DB’s accrual businesses of the corporate and private banks are doing well and showing strong revenue growth.

DB is well on the path of delivering 8% RoTCE for 2022 and with a credible path to greater than 10% in 2025 and this is in spite of the macroeconomic headwinds and expected deep recession in the eurozone.

There are strong tailwinds as well for DB. Principally, it is the long-awaited departure from negative rates settings in the eurozone. Negative rates settings completely disrupt the maturity transformation business model of deposit-taking institutions and are a key reason for the decade-long underperformance of European banks compared to their U.S. peers.

DB forecasts that it will generate an additional EUR700m+ from rates in 2022 and EUR2.5 billion by 2025. Considering the market cap of Deutsche Bank is only ~EUR16 billion, this is clearly very material.

DB is also expected to return EUR8 billion of capital to shareholders by 2025.

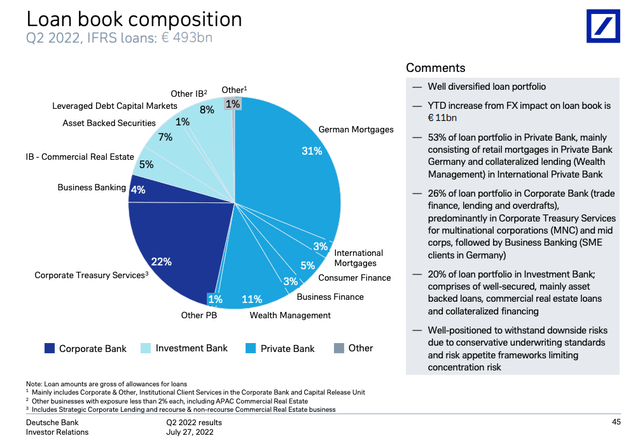

Finally, DB’s credit risk profile is super conservative and should fare well even in a deep recession scenario. The biggest part of its book comprises moderate LTV German mortgages as can be seen below:

Final thoughts

I am avoiding CS for the time being. At least until the strategy is outlined on the 27th of October. I expect there will be a capital call soon – there is no real way of restructuring the investment bank without raising equity. There is no quick fix, this will be a protracted and costly exercise and shareholders’ interests are not necessarily at the forefront. I suspect the share price will decline further, given the uncertainties. At some point, CS may become investible again or even become a takeover candidate. The wealth management franchise is exceptionally attractive for many suitors. In the interim, I expect the bleeding to continue, including the departure of key staff to competitors. The investment bank is seriously at risk of a death spiral.

On the flip side, DB is an extremely attractive risk/reward play at the moment. I expect the share price to double when/if macro uncertainties pass and the benefit of interest rates are playing through in the financials. In my view, the perceived risks are overblown. There is no longer a restructuring risk premium attached to this bank and thus the current share price does not make sense. I remain very bullish even though I expect a deep recession in the eurozone in 2023.

Be the first to comment