Justin Sullivan/Getty Images News

Introduction

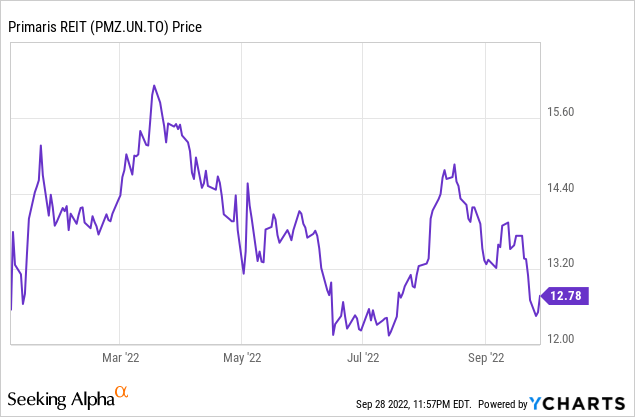

Primaris (PMZ.UN:CA) (OTC:PMREF) is one of Canada’s newest rates as this entity contains the assets that were spun off by H&R in 2021. Primaris’ share price hasn’t really gained any traction since the spinoff as the demand for and general interest in REITs started to wane just months after completing the spinout. And while the situation hasn’t gotten any easier for commercial REITs, I think low-debt REITs like Primaris (with a LTV ratio of less than 30%) deserve more attention.

Primaris has its primary listing in Canada where the stock is trading with PMZ.UN (sometimes PMZ-UN) as its ticker symbol. The average daily volume is in excess of 200,000 shares. Primaris currently has 100.2M units outstanding resulting in a market capitalization of just over C$1.3B.

A strong first half of the year on all metrics

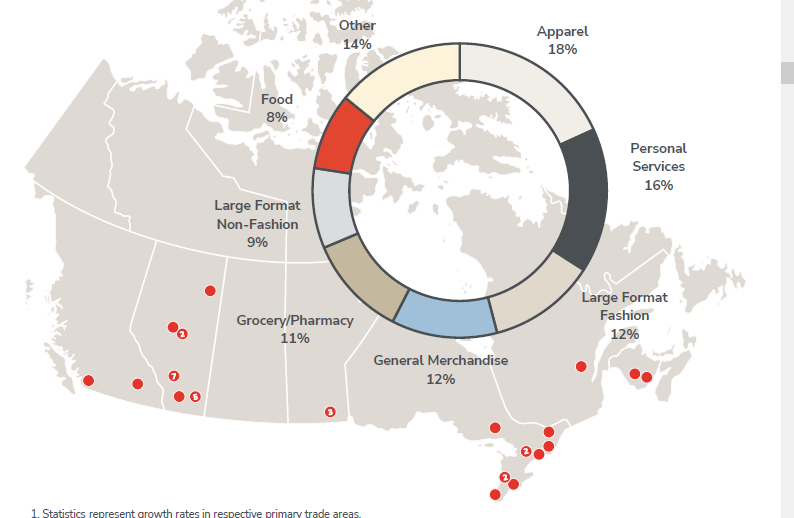

Although Primaris is a commercial REIT, not all commercial REITs are equal. As you can see below, about 19% of the rental income comes from grocery, pharmacy and other food-related tenants.

Primaris Investor Relations

While this still means 81% of the rental income is coming from other stores and operators, the grocery stores are an important anchor tenant as they create the footfall which ultimately also benefits all other tenants.

Primaris Investor Relations

As you can see above, the top-10 tenants reads like a ‘who is who’ in the Canadian retail space. Canadian Tire, Walmart and Loblaws are important anchor tenants drawing in the crowds. In the top-20 I’m mainly worried about the exposure to Hudson’s Bay but fortunately this only represents 1.3% of the annual rental income.

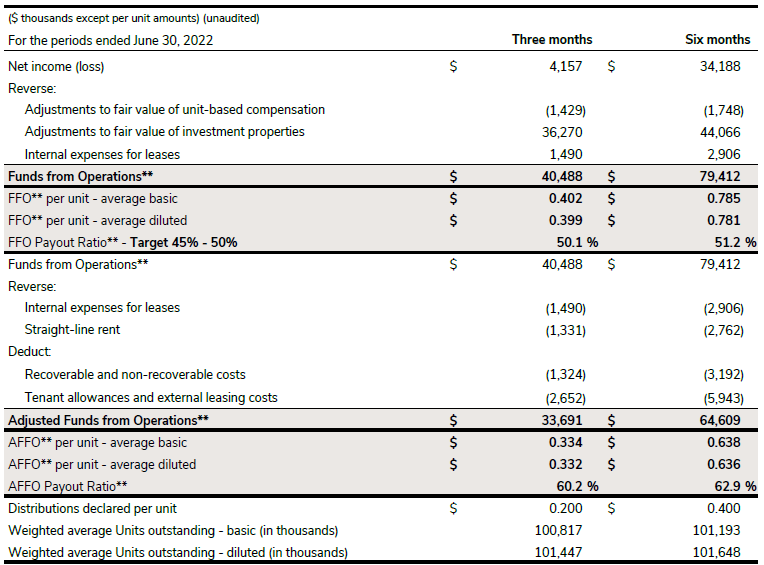

As you know, it’s useless to judge a REIT based on its income statement so I’d rather focus on the FFO and AFFO result generated by Primaris. The table below shows a useful overview.

Primaris Investor Relations

As you can see above, the company reported an FFO of C$40.5M in the second quarter of the year while the Adjusted Funds From Operations came in at just under C$34M. On a per-share basis, the FFO was just over C$0.40 per share while the AFFO came in at C$0.334/share. On an annualized basis, this basically means Primaris is currently trading at just around 10 times its AFFO. And keep in mind this is based on the average unit count of 100.8M shares during the quarter while the current share count is just 100.2M units. This would have increased the AFFO further to C$0.336 for the quarter.

Primaris currently pays a distribution of C$0.80 per year. This means the current distribution rate is C$0.20 per quarter and this is extremely well covered by both the FFO as well as the AFFO. Based on the current share count, the distribution is costing Primaris approximately C$20M per quarter which essentially means the REIT retains about C$13-14M per quarter in AFFO on its balance sheet. That cash could be used to fund development projects but as Primaris considers its share price to be too cheap, it spent about C$20M on share buybacks in the first semester and the majority (C$17.4M) was spent in the second quarter.

As Primaris paid on average about C$14 per share, it was buying back stock at a discount of in excess of 35% compared to its official book value. By buying back stock at a large discount, the NAV/share of the remaining shares was positively impacted by C$0.31 while the annualized FFO increases by C$0.02 per year.

I like Primaris’ prudent approach as it uses a dividend policy targeting a 45-50% payout ratio based on the FFO and this leaves plenty of cash on the table to continue to pursue share buybacks. And buying back stock will also help to reduce the payout ratio to less than 50% again.

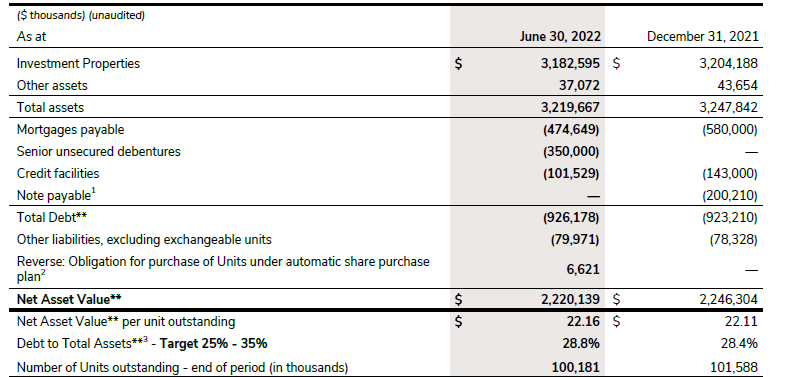

The balance sheet is exceptionally robust

As commercial REITs tend to be more exposed to economic shocks (as the turnover of tenants tends to be higher than in other types of real estate assets) I think it is important to run a very conservative balance sheet. And that’s exactly what makes Primaris so appealing.

Primaris Investor Relations

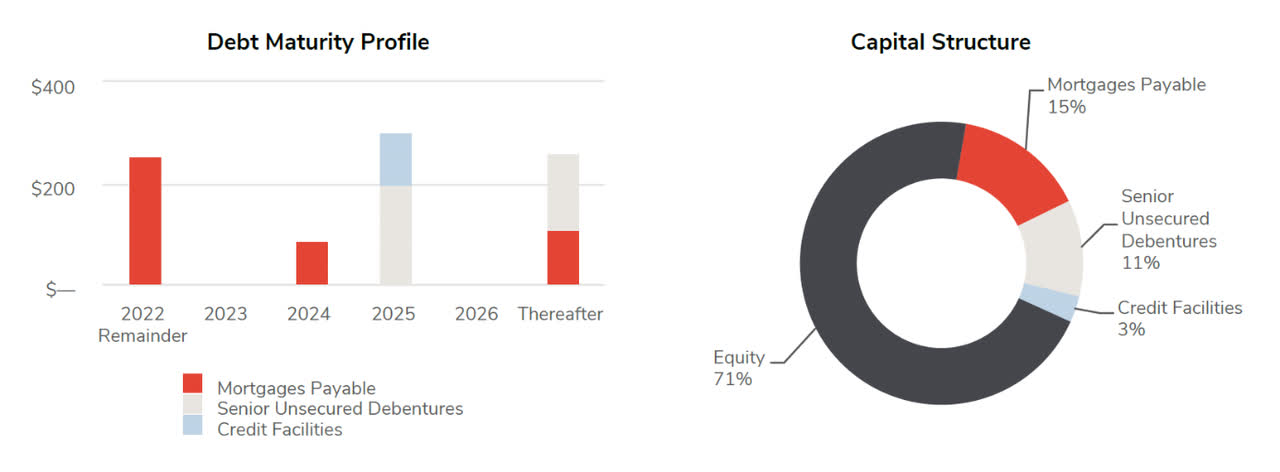

As of the end of June, the total debt was just over C$926M and this primarily consisted of mortgage debt. Considering the estimated value of the real estate assets exceeds C$3.2B, the LTV ratio is just under 29%. And that’s not a coincidence as Primaris has an internal target to use very moderate amounts of leverage as its self-imposed maximum LTV ratio is just 35%.

The maturity dates of the debt is also well spread out in time. A substantial portion is due in Q4 of this year, but Primaris already disclosed it has signed an agreement for a C$200M term facility to help refinance the mortgages due.

Primaris Investor Relations

Investment thesis

The low debt level also means Primaris should not be hit as hard by increasing interest rates as other REITs. The average cost of debt is already getting close to 4.5-5% so even if the cost of debt would increase to 7% the interest expense would increase by just C$18M in absolute numbers. An increase that could and should be mitigated by inflation-linked rent hikes. With a current rental income of C$220M per year, a rent increase of 2.5% over the next four years would already mitigate the impact of a 7% interest rate on the debt.

The low debt levels create a lot of financial flexibility for Primaris. The distribution is safe and the REIT is trading at a discount of almost 40% to its NAV (and that NAV is based on a 6.5% capitalization rate).

I have been on the sidelines since the IPO as I wanted to keep an eye on Primaris for a few quarters but I like what I see and the conservative way the balance sheet is run is exactly how I would do it. I may initiate a long position in the next few weeks.

Be the first to comment