gesrey

Rose’s Income Garden – RIG

Staying green nice and green, thank you Mr. Market.

RIG rose 14.28% during October/ November with (SPY) chasing it but not catching it as it stayed ~18.3% ahead. Most everyone has fingers crossed for a Santa Claus rally, why not? Plenty of reasons, but none of them seem to matter to this market, as yet.

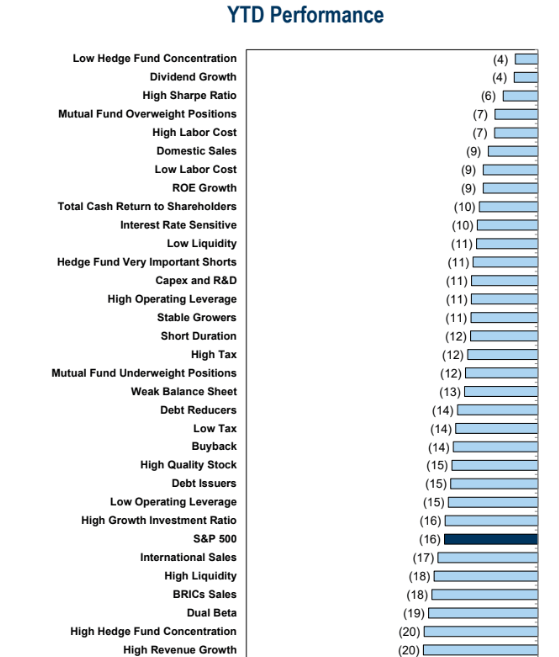

These are the facts of RIG, nothing more, but it’s important to know it is all about income and collecting dividends that grow. The YTD investment performance, for those listed, from Goldman Sachs (GS) in the chart shown below shows dividend growth investing wins in a tie at the top with low hedge fund concentration. The S&P is #16. I love knowing RIG and Rose are performing nicely as winners in 2022.

YTD investment Winners (Goldman Sachs)

November Valuation

Valuations rose, as did most indexes, and RIG also enjoyed it by rising about 6% in October; and with adding on November it is now up 14.28% in total return for those months.

November Dividend Income

20 out of 82 companies/ or ~24% of the portfolio paid; as usual, along with getting 1 raise. The stock ticker with the raise is in bold in the chart and mentioned in the comments along with the 4 companies that pay monthly.

The chart below uses the following abbreviations:

Date Rec’d = Date payment received.

Div/sh = Dividend per share paid.

Yearly $ Div = Current yearly estimated known dividend payment.

Div % Yield = dividend yield calculated using the current shown price and yearly known dividend.

Curr Price is for the end of the day market price Dec 4th.

|

Date |

Div / |

$ Yearly |

Div % |

Other Dividend |

Curr |

||

|

Ticker |

Rec’d |

share |

Dividend |

Yield |

Comments |

Price |

|

|

(PFLT) |

PennantPark Floating |

1 |

0.095 |

1.14 |

9.89% |

Monthly Pay |

11.53 |

|

(BMY) |

Bristol-Myers |

1 |

0.54 |

2.16 |

2.66% |

raise due next |

81.13 |

|

(CVS) |

CVS Health |

1 |

0.55 |

2.2 |

2.14% |

raise due next |

102.58 |

|

(T) |

AT&T |

1 |

0.2775 |

1.11 |

5.84% |

19.02 |

|

|

(VZ) |

Verizon |

1 |

0.6525 |

2.56 |

6.71% |

raise from 64c |

38.18 |

|

(SLRC) |

SLR Inv Corp |

2 |

0.1367 |

1.64 |

10.91% |

Monthly Pay |

15.03 |

|

(MA) |

Mastercard |

9 |

0.49 |

1.96 |

0.54% |

raise due next |

360.06 |

|

(GD) |

General Dynamics |

5 |

1.26 |

5.04 |

1.97% |

255.74 |

|

|

(DNP) |

DNP Select Income |

10 |

0.065 |

0.78 |

7.01% |

Monthly Pay |

11.13 |

|

(DLNG-A) |

Dynagas Lng Prf A |

14 |

0.5625 |

2.25 |

9.36% |

Fixed Preferred |

24.05 |

|

(CEQP-) |

CEQP Prf |

14 |

0.2111 |

0.8444 |

9.33% |

Fixed Preferred |

9.05 |

|

(OHI) |

Omega |

15 |

0.67 |

2.68 |

8.87% |

30.23 |

|

|

(BTI) |

British Am Tobacco |

22 |

0.6355 |

2.98 |

7.04% |

Vary w Exch Rate |

42.31 |

|

(ABBV) |

AbbVie |

15 |

1.41 |

5.64 |

3.45% |

Next raise to 1.48 |

163.66 |

|

(NNN) |

National Retail Prop |

15 |

0.55 |

2.2 |

4.76% |

46.2 |

|

|

(RITM.PD) |

Rithm Prf D |

15 |

0.4375 |

1.75 |

9.08% |

Fixed Preferred |

19.27 |

|

(NYCB) |

NY Com Banc |

17 |

0.17 |

0.68 |

7.51% |

No raise expected |

9.05 |

|

(DAC) |

Danaos Shipping |

30 |

0.75 |

3 |

5.45% |

55.03 |

|

|

(SBRA) |

Sabra |

30 |

0.3 |

1.2 |

9.18% |

13.07 |

|

|

(ARDC) |

Ares Dynamic Fund |

30 |

0.1025 |

1.23 |

10.20% |

Monthly Pay |

12.06 |

There are 7 companies with a dividend yield of 7% or more including the monthly payers PFLT, SLRC, DNP, and ARDC. They all have been reliable with ARDC having raised its payment in August. I am not expecting raises from the others as they already offer nice income, but will not argue if it happens. RIG is on track to garner around 6% yield if the ATT spin off value is included as a dividend. The spin off, Warner Bros. Discovery (WBD), certainly is nothing to be happy about, at least not yet, and that value is stuck in the accounting list. It also does not pay a dividend and not expected to do so for some time.

Future Income

Future income yield is ~4.6% heading into 2023, but the final tally is far away. The lower yield is secondary to higher portfolio value, shipping stocks with unreliable steady income and having more cash to buy bargains as they should arise. The goal of RIG is to have a minimum 4% yield which is still being met.

November Transactions

Add on -1

Danaos

Danaos is a seaborne international transportation service with a $1.15 billion market cap and a composite credit rating of BB-. It owns and charters container ships to liner companies. It was founded in 1963 and operates out of Piraeus Greece with a tax center in The Marshall Islands.

Valuation

3 Yahoo Finance analysts suggest an average price of $90 with a range between $65 – $125. Morningstar comes close with a fair value of $91.67 and to buy it at a very cheap low price of $52.91. It is sitting nicely very close to that low valuation and owning a very small amount in RIG, it was time to add some more, as I got the first shares as an idea from The Fortune Teller at The Wheel of Fortune in 2021.

The Dividend

The dividend was restarted at $1.50 in 2021 and raised 100% to $3.00 shortly thereafter into 2022. It has been suggested they could easily raise it again but the conservative nature of management has not done so, as it is mostly buying back shares, a good idea because of the lower valuation right now. The yield is sitting nicely now at ~5.4%.

Trim -2

Portfolio management is important and RIG has goals to limit each stock value size along with each sector size. RIG has a huge sector size in healthcare, in particular owning quite large stakes in AbbVie and Bristol-Myers. These 2 stock trims were done primarily to decrease the value size and taking some profits along with it. It was done probably too soon, but taking a profit is always delightful and one of RIG management goals. Note I have written a recent article about Amgen (AMGN) and Merck (MRK) some of my other happily owned healthcare stocks. They have not been trimmed, as yet, but I am watching closely, as MRK is an oversized position as well.

Cash is now at 11.8%. It will be used for value buys when the market finishes capitulation to rising rates, inflation and employment issues; hopefully soon, most likely sometime in 2023.

Summary and Conclusion

The goal of RIG is first and foremost income and retaining value being very important. Quality high credit rated and safe value line companies comprise the majority of the common stock and investments in it.

The Rose portfolio/ RIG continues to outperform SPY by double digits, has a 5% dividend income yield along with 11.8% cash; which should offer some favorable future value purchases.

The WTB/ Want To Buy/ list is current for all RIG positions with a Buy under price and Strong Buy prices. The non-RIG stock picks also have those price targets and some DGR statistics, along with current 52 week high and low prices shown which are on continuous evaluation for purchasing if not by me, but perhaps for subscribers. I enjoy watching, evaluating and the hunt for great stocks to own is an ongoing pursuit for investing happiness.

RIG is found listed and remains exclusive at The Macro Trading Factory where there are 2 major portfolios offered. This blog here explains it all and even the special rate offer that lasts until New Year’s Day 2023.

– FMP is funds only and exclusively managed by The Macro Teller with that portfolio out performing SPY by 23.6%, the value green at 10.2% while holding 63.5% cash.

– RIG, as mentioned, has ~80 investments and is managed by RoseNose.

The volatility and uncertainty of the current market, inflation, The Fed interest rate increases, housing market, and midterm elections will keep the cash in the portfolio for now. The end of 2022 and into 2023 should offer better opportunities and a better outlook for the what and where to invest.

Happy Investing to all!

Be the first to comment