Boarding1Now/iStock Editorial via Getty Images

In a previous report, I marked shares of American Airlines (NASDAQ:AAL) a hold. This was mostly driven by some concerns on continued strength in demand for air travel as the global economy is cooling down and sentiment on the state of the global economy is dwindling as well as a Q3 guidance that was somewhat underwhelming. Recently, American Airlines updated its guidance, which is a good moment to re-evaluate my rating for shares of American Airlines.

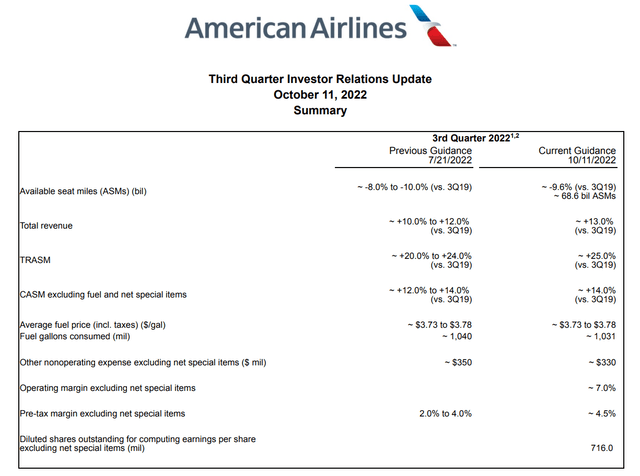

Outlook Update: Small Improvements In Q3 Compared To Prior Guidance

American Airlines updated Q3 2022 guidance (American Airlines)

What I found mostly disappointing in the third quarter outlook was that capacity recovery would be challenging. The most recent investor updates indeed confirm that the recovery trajectory is challenging. Whereas Q2 2022 capacity was down 8.5% compared to Q2 2019, Q3 2022 capacity is down 9.6% compared to the comparable period in 2019 ending up at the more negative end of the guided range. So, not a lot to be positive about there. However, my fear also was that we would see unit revenues soften and that was most certainly not the case in the third quarter as TRASM (total revenue per available seat mile) was up 25% whereas 20 to 24 percent was guided for.

Non-operating expenses will be $20 million than what had been guided for, but the cost per available seat mile will be up approximately 14%, which is at the higher end of the range. All of that combined, American Airlines bumped its operating margin by 50 basis points to 4.5%.

Is it enough to make me flip the rating from Hold to Buy? No. However, the strong TRASM in Q3 and comments from industry peer Delta Air Lines (DAL) provide some support for other airlines including American Airlines as well:

In closing, while we are mindful of macroeconomic headwinds, the travel industry is experiencing a countercyclical recovery. Global demand is continuing to ramp as consumers shift spend to experiences, businesses return to travel and international markets continue to reopen.

I believe these comments and the updated outlook provide for a stronger-than-expected Q3 and Q4. I previously shared that I believe that I believe that American Airlines needs up to 12-18 months to significantly reduce its debt and start operating at lower cash levels. At the time, I was somewhat sceptical on the persistence of a strong pricing environment. However, we are now seeing that investor updates and peer comments already seem to be de-risking that schedule by 6 months. So, most likely, I was weighing the near-term impact of inflation and global economic concerns too heavily for 2022. We don’t know what 2023 will look like, so the risk is not fully eliminated, but the continuation of a strong pricing environment is not something that I expect to be fading overnight. So, my expectation is that 2023 in large is also going to show appreciable pricing for airlines.

If you combine that with how the airline has focused its network where it is strongest to create customer value and is focused on bringing debt down, I am significantly more optimistic about American Airlines than I was three months ago.

Long-Haul Cabin Segmentation Could Pave Road For Further Upside

Delta most recently displayed significant strength in demand for international air travel. In fact, it is so strong that on Atlantic routes the capacity will be exceeding pre-pandemic levels this year. The same will likely also hold for airlines, it is basically fish swimming in the same pool or better suited for airlines birds flying in the same sky. American Airlines has a disadvantage because it does operate the Boeing 777-200ER which is less fuel-efficient than the current generation aircraft. However, the airline does have 30 Boeing 787-9s and 10 Boeing 787-8s on order.

The schedule is subject to change driven by capacity requirements as well as delivery capacity of original equipment manufacturers, but currently, American Airlines expects to take delivery of 4 Dreamliners in 2023 and 12 in 2024, which should aid in reducing unit costs. If these deliveries will be used to replace the Boeing 777-200ERs fleet or parts of it, that will further boost the unit cost reduction.

American Airlines Flagship Product (American Airlines)

Additionally, American Airlines will update its long-haul cabin product that will be more premium heavy. Starting in 2024, American Airlines will start eliminating the first class from its Boeing 777-300ERs and implement 70 flagship suites replacing the 8 Flagship First and 52 Flagship Business seats while premium economy seats will be bumped by 16 seats. Similarly, on the Dreamliner, there will be 21 seats more in Business Class and 11 more in Premium Economy.

Conclusion: Upgrading American Airlines Stock To A Buy

The guidance itself is not really a reason to flip my rating from Hold to Buy, yet I am marking American Airlines a buy now. This is based on earlier expectations from me that strong pricing would not persist and bullish comments from Delta Air Lines which pointed out the countercyclicality for air travel demand. While it remains to be seen whether that countercyclical environment will persist, I do not believe it will suddenly fade.

Additionally, as I discussed in earlier reports, American Airlines has been refocusing its business where it can create customer value and is focused on debt reduction whereas there are some competitors that seem to be more focused on promoting airline investment. American Airlines has used the pandemic to become more efficient, and I think that will pay off, and its renewed cabin segmentation is just one of those elements that show how the business is transforming in a way that I consider to be positive.

Be the first to comment