da-kuk

Invesco India ETF (NYSEARCA:PIN) is a reasonable way to play the potential growth of Indian influence on the global economic stage. Exposures to foreign countries outsourcing is already baked into PIN, but general advantage in Indian energy, as well as good support to financials and general industry from an advantaged cost situation, altogether help India actually deliver on the BRIC promise. India of all of them are best positioned when looking through the mercantilism lens. PIN is a buy.

India’s Advantage

India’s advantage is primarily political. It has enough agency to be able to work its own agenda without incurring the ire of the US, unlike Europe. With its defense budget allocated substantially to Russian products, but also years of economic integration with Russia, India had no interest in condemning Russia.

One of the key reasons why India doesn’t need to condemn Russia is that it can be assured that they are no friend of China. Besides Pakistan, almost all their armaments are focused on the danger of Chinese incursion from the north. That is why they bought a whole load of Rafales from Dassault Aviation (OTCPK:DUAVF). Their integration with Russia substantially supports their pretty explicit concern with Chinese military incursion. No one important is asking them to condemn Russia.

The upshot though is the pretty massive Indian refinery complex is getting supplies of Russian oil at about 30% discounts, and selling refined products at full price to global markets, where refined products have shot massively up both on lacking feedstock for western producers, but also the fact that refining capacity has fallen since before the pandemic. Indian refinery assets are some of the most advantaged in the world right now. 10% of PIN is in Reliance Industries which has the Jamnagar refinery. This refinery is the very largest in the whole world, it is a super-refinery actually – more like a city-sized plant.

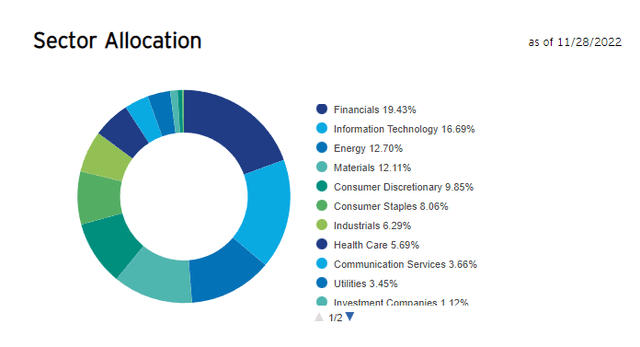

Besides being able to upsell Russian oil just like that, India also benefits from the fact that China’s lot is thrown in with Russia, more or less. India is a much more reliable trading partner to the west, and they are likely eyeing the opportunity to become an import source for the west. Companies like Infosys (INFY) which is 7.5% of PIN already show India’s importance in the world of outsourced work, but if India becomes more relevant for manufacturing products imported by the west this would be good for all their sectors, including financials who can finance and insure a growing manufacturing complex, but also local IT and materials. These are the big representations in PIN.

Finally, there is the demographic advantage. Ray Dalio liked to talk about China as the winner in the new world order. The one-child policy, in our opinion, single-handedly smashed that possibility. That policy has successfully changed their course from an increasingly dominant force to a population that is rather precipitous and could decline soon, not far off from the sort of decline seen in Japan. It took 40 years of stagnation for Japan to assure the decline of their population. 20 years of that disaster policy was a shockingly poor move, and actually puts them in decline while major players in the west, including the US, actually has great demographics. While it was supposed to be a way to get out of the middle-income trap, the worsening geopolitical position just makes it less likely that they can gain that technological dominance over the US, which is the pre-requisite for being able to rely on things like massive financial account surpluses to be able to run huge deficits. Moreover, they’ll probably never have the reserve currency, so their hope of challenging the US which has the most exorbitant possible privilege when it comes to government finances gets dashed some more.

Bottom Line

If you want to make a tech-heavy, broad bet on improving Indian standing in the world order, PIN is a good way to do it. They have massively advantaged industry for as long as sanctions and counter-sanctions go on between Europe and Russia. Their inflation, much like the US, is more demand than cost push. A lot of it is coming from food and logistics inflation. Both of those should calm down. Also India can use protectionism to control local food prices, since most of their food gets exported. Tariffs are effective to keep things cheap for locals. The yield curve favors banking and insurance. The 20x PE of the ETF feels appropriate for an ETF that is supported by a growing economy, especially one that now has massive advantages in being one of the few bridges effectively integrating Russian capacity with the west that they fully levy with their large refining capacity. A 0.78% expense ratio is above average, however, and investors may want to select maybe one or two of the main sector holdings from each category to cheaply build an Indian exposure themselves. Still, we like the composition we see in PIN.

Be the first to comment