Shannon Finney

Company Overview

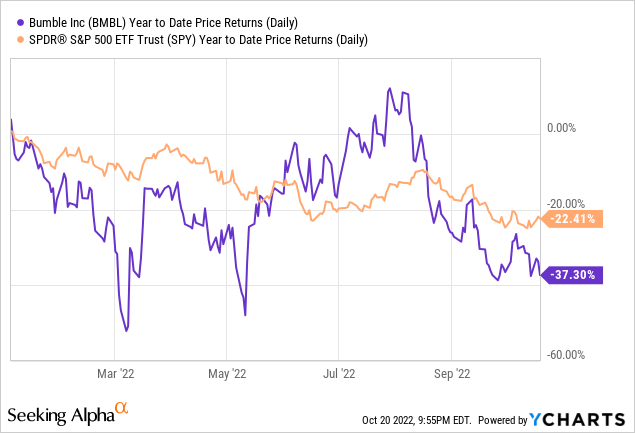

Bumble Inc. (NASDAQ:BMBL) is an online dating service that operates three platforms: Bumble, Badoo, and Fruitz. These services aim to connect people and create relationships, with Bumble as the main app of the business. The Bumble app facilitates romantic relationships, friend searches, and even career matching in one platform. Bumble raised $2.2 billion from its IPO in February 2021, and traded on the first day at an $8.6 billion valuation. Since then, the valuation has more than halved, with the company’s market capitalization at around $4.37 billion. Year-to-date, Bumble has substantially underperformed the market, losing -37.3% this year compared to S&P 500’s decline of -22.41%.

Q2 Earnings And Outlook

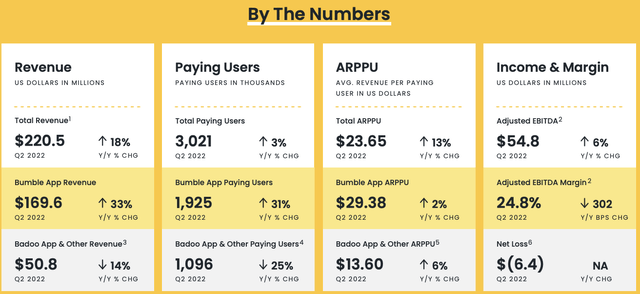

Bumble’s Q2 financial results have been solid, with an 18.4% YoY revenue growth. Most importantly, the Bumble App’s revenue grew 33.2% on a year-over-year basis, and made up more than three-quarters of the company’s total revenue. In the same time frame, Bumble saw Badoo App’s revenue decline by 13.7%, and demonstrates the importance of Bumble App in the company’s financial performance. Furthermore, net loss for the quarter shrunk to $6.4 million from $11.1 million, and on a % of revenue basis, the loss is now minimal at -2.9% of revenue compared to -6.0% in revenue a year ago. Financial outlook for Q3 was conservative, with a revenue estimate ranging from $236 million to $240 million, which represents an 8% quarter-over-quarter growth. This estimate was based on estimations of foreign currency headwinds as well as the Ukraine conflict. For the Q3 earnings announcement on November 9, 2022, we would like to see the company’s financial performance in light of worse than expected macroeconomic environment in the last quarter, and also see the revenue contributions from the growth in the Bumble App.

Q2 Earnings Release

All Around Strong Growth Trends

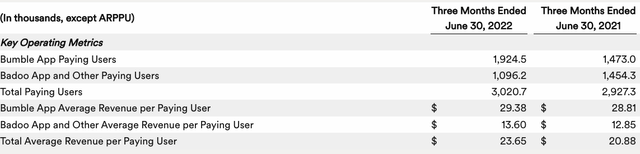

In addition to financial performance, the company has had strong improvements in key growth metrics – most notably the number of Bumble App Paying users and ARPPU (Average Revenue Per Paying User). We believe that Bumble will be the central app that will dictate the company’s financial fortunes, and we see this long-term strategy as a platform for meeting people from relationships, career coaches, and friends to be an enticing proposition. On a year-over-year basis, the number of Bumble App Paying users went up by 31%, which is staggeringly high for an app that’s been around for years. Though ARPPU has been stagnant with only a 2% YoY growth, we believe this low growth is fine for now to gain more users, and then the company can work to optimize the ARPPU.

Q2 Earnings Release

Growth Potential Of Bizz

Bizz has been a fairly recent addition to the Bumble platform designed to connect people for career pursuits and networking. Though it is too early to tell the overall success of Bizz as a service, we believe that management’s continued push for innovation and willingness to diversify the platform are well represented through its push of the Bizz platform. Furthermore, Bizz is operating in a market with tremendous growth opportunities. Estimates project that “Network As-A-Service” market will grow at a stellar CAGR of 33.2% by 2030, growing from a miniscule $10.5 billion market to $140 billion market. Though there will be many competitors, we believe that Bizz will provide meaningful revenue contribution in the long-term as it develops a solid footing in the market and see synergies across users using other aspects of Bumble’s platform for finding friends and romantic relationships.

Valuation

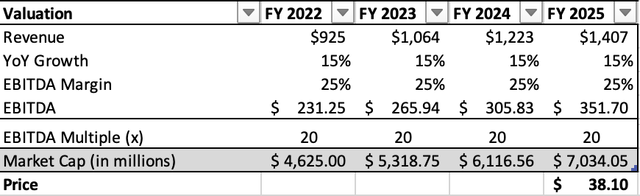

We value Bumble’s valuation in 2025 by using revenue growth assumptions, current EBITDA margins, and a reasonable EBITDA multiple. Management forecasts a FY 2022 revenue guidance between $920 million and $930 million. Using the midpoint of the guidance, and a modest 3 year 15% growth of the revenue, we derive $1.4 billion in annual revenue in FY 2025. We believe this growth is reasonable as it is half the current growth of Bumble App, and we believe there will be additional levers for the business to increase the ARPPU and therefore also increase the revenue. Currently, the Adjusted EBITDA Margin of the business is 24.8%, and assuming slightly higher efficiency, we use a 25% EBITDA margin for FY 2025. For our EBITDA multiple, we use the current EBITDA multiple of Match Group as a reference point, which is around ~21x. Therefore, using a 20x EBITDA multiple gives us a valuation of $7.0 billion, which is $38.10 per share. That represents a potential 73% upside in the next three years!

SWMC Valuation Model

Risks

Economic risks are pertinent to most companies in the stock market today. However, similar to our findings for Match Group, the market for seeking relationships is likely to be recession-resilient due to studies that find that even during a recession, there continues to be a “need for human connection”. In addition, with diversified service offerings like Bumble Bizz, we can see the Bizz platform serving as a potential beneficiary in an economic downturn as people may seek more networking opportunities and career coaches to help them navigate the uncertain job market. In addition to the resiliency of the business model, the company has $334.6 million in cash and in the last quarter had a positive Free Cash Flow of $22.4 million. Positive free cash flow in addition to ample liquidity should provide additional assurance that the company will be able to navigate through any economic turmoil that may happen in the immediate future.

Takeaways

Given Bumble’s strong financial performance, we believe that Bumble is a “Buy” before going into Q3 earnings. The company has shown to continue to innovate and find ways to win over users, despite the heavy competition. The growth trajectory of Bumble is alluring, and based on our valuation exercise, we believe that the company is significantly undervalued and has a 73% upside in the next few years. Overall, we believe Bumble can make a good investment opportunity for those seeking growth.

Be the first to comment