Hollie Adams/Getty Images News

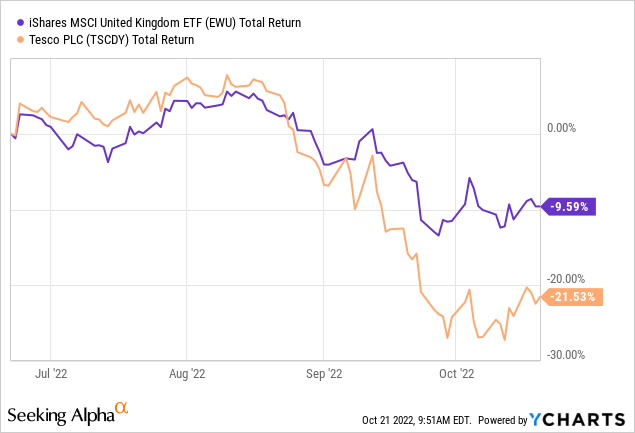

I hadn’t planned on covering U.K. supermarket giant Tesco (OTCQX:TSCDY) quite so soon following my last piece in June, but developments on the business and stock price front since then are probably worthy of an update. These shares have fallen around 15% in GBP terms in that time, extending to a 20%-plus fall for the USD-denominated ADRs and materially underperforming returns from the broader MSCI United Kingdom ETF (EWU).

Currency translation effects clearly explain a big chunk of the dollar-denominated ADR’s performance – sterling has fallen considerably over the past few months – while the underlying weakness can be chalked up to the deteriorating macro outlook for retailers in the U.K. and Europe which is now starting to bleed into industry and company-specific data. With that, recently released results covering the first half of the firm’s fiscal 2022/23 were a bit of a mixed bag, with profits down and trading conditions evidently becoming tougher.

Notwithstanding the above, these shares have become even more attractive given the extent of the sell-off, and they currently trade on a single-digit forward P/E with an implied 5%-plus dividend yield. With prospective USD investors also able to take advantage of the strong dollar to pick up cheap British assets, Tesco now offers a compelling case for value investors. Strong buy.

Inflation Starting To Bite

As the U.K.’s largest grocery chain, Tesco has been staring the cost-of-living crisis and inflation in the face for some time. Those issues aren’t anything new, but they have now started to show up in earnest in industry and company-specific figures, including in the firm’s most recent set of financial results covering the first half of its fiscal 2023.

Overall group revenue for the period came in at just under £28.2B (excluding VAT and fuel sales), an increase of 3.1% year-on-year at actual exchange rates and 3.5% in constant currency terms. That looks solid enough, though quickly becomes less impressive considering levels of both general inflation and food price inflation over the same period. U.K. retail sales (just under £20B, or 72% of total retail sales, excluding wholesale business Booker) look especially weak in that regard, increasing by just 0.7% year-on-year, though performance at Booker was stronger, with like-for-like sales up 13.9% to £4.399B as COVID restrictions in the year-ago period made for a soft comp. Group adjusted operating profit was £1.315B, down 9.8% year-on-year, with the firm’s retail adjusted operating margin down 78bps to 3.9%.

The operating environment is clearly deteriorating for the company. Cost inflation is eating into operating expenses for one, while customers trading down into own-label products and frozen foods is adding pressure to profit margins from the top line:

In June, we said that we were starting to see some small changes in customer behavior, but that it was difficult to separate them from the effects of post-pandemic normalization. We can now see tangible changes in behavior purely relating to increases in the cost of living. Whether it’s switching to Tesco own brand to take advantage of our great prices or making more subtle changes, such as switching from fresh to frozen, we can see customers prioritizing value wherever they can.

Margins are fragile and may remain so, with stickier than expected inflation and U.K. consumers’ deteriorating finances representing the biggest risks here in the medium term. Industry data remains soft, with analysis from NielsenIQ suggesting that industry and company sales are continuing to lag general price inflation due to responsive customer behavior.

Not All Bad News

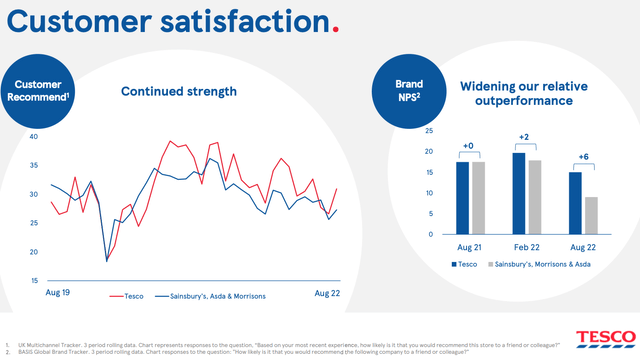

There are, however, reasons to remain upbeat. Firstly, not all of the softness here is due to the weakening macro environment. Expected post-COVID normalization explains part of it, while Tesco is also deliberately slow-walking price hikes as it prioritizes its value offering in the face of competition from hard discounters Aldi and Lidl. There is good evidence this is working, with Tesco’s Net Promotor Score widening its lead versus the remaining ‘big four’ grocers. Tesco’s overall market share also remains relatively robust, despite the gains made by Aldi and Lidl.

Source: Tesco 1H 2022/23 Earnings Presentation

Furthermore, despite the increasingly uncertain environment, Tesco has only slightly softened profit guidance, with the firm now seeing retail adjusted operating profit coming in at between £2.4B and £2.5B. That represents the low-end of previous guidance of between £2.4B and £2.6B, while adjusted operating profit guidance at Tesco Bank remains between £120m and £160m. Retail free cash flow guidance has actually been increased – with management now guiding for “at least £1.8B” versus prior guidance of between £1.4B and £1.8B.

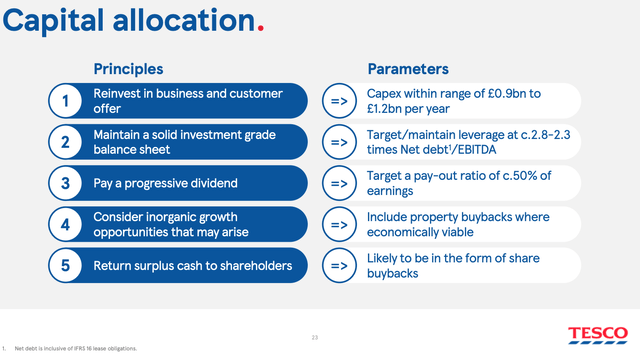

Source: Tesco 1H 2022/23 Earnings Presentation

Finally, Tesco’s ongoing share buyback program will support earnings per share in the event that underlying profits decline. Management noted that £450M of the firm’s £750M buyback authorization had been used in H1, implying a further £300M left over the next six months. That equates to a little over 2% of current diluted shares outstanding based on the prevailing market price.

An Attractive Value Proposition

Tesco shares currently change hands for just under £2.10 each in London trading, equal to around 10x estimated fiscal 2023 earnings per share. The dividend yield is currently above 5% based on the previous year’s payout, which, if anything, underestimates the forward yield given management’s commitment to paying a progressive dividend.

Source: Tesco H1 2022/23 Earnings Presentation

Tesco is an inherently low growth business, given its dependence on U.K. Retail. The U.K. grocery industry does not enjoy strong growth prospects for obvious reasons, while what little growth there is will accrue disproportionally to the hard discounters as they continue to gain market share – more so now given the rapidly increasing cost of living and deteriorating consumer finances.

Nonetheless, Tesco shares now look meaningfully undervalued. I still have a fair value of around £2.70 per share for the retail business – with that based on discounting low single-digit per annum long-term annualized retail free cash growth. That’s circa 30% higher than the current share price and does not include the value of Tesco Bank, which contributes around 5% of group operating profit and carries circa £1.5B in tangible net asset value. As a very rough guide, I’d add another £0.15 per share for the bank, bringing my overall fair value estimate to £2.85 per share and 35% above the prevailing share price.

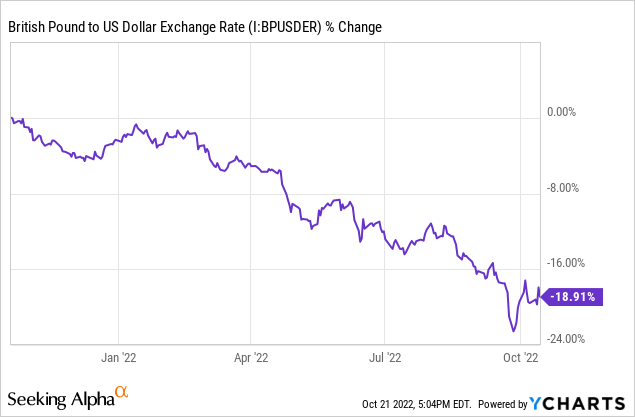

Finally, U.K. assets in general appear cheap to USD holders. Like most currencies, the U.K. pound has fallen significantly versus the dollar in recent quarters.

That weakness will probably persist so long as the Fed keeps hiking rates, although there is potential medium-term upside from currency when that ends. All told, that amounts to a very attractive value proposition for Tesco shares, with prospective investors also able to pick up a decent dividend in the meantime. Strong buy.

Be the first to comment