tawatchaiprakobkit

ZIM Integrated Shipping (NYSE:ZIM) has been a polarizing stock ever since it emerged as a runaway winner from the pandemic. The company took advantage of blistering freight rate growth to generate unusually high profits. Due to a generous dividend policy, ZIM has earned a loyal investor base. But with freight rates in free fall, there is now growing risk that earnings – and the dividend for that matter – may be at risk. I continue to find the stock buyable on account of the strong balance sheet, but caution that this remains a high-risk position with volatility all but guaranteed.

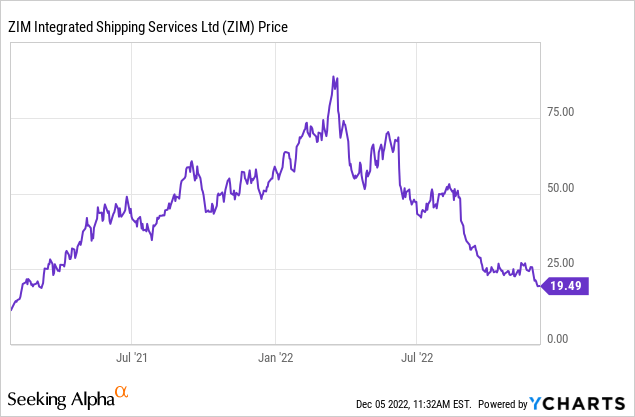

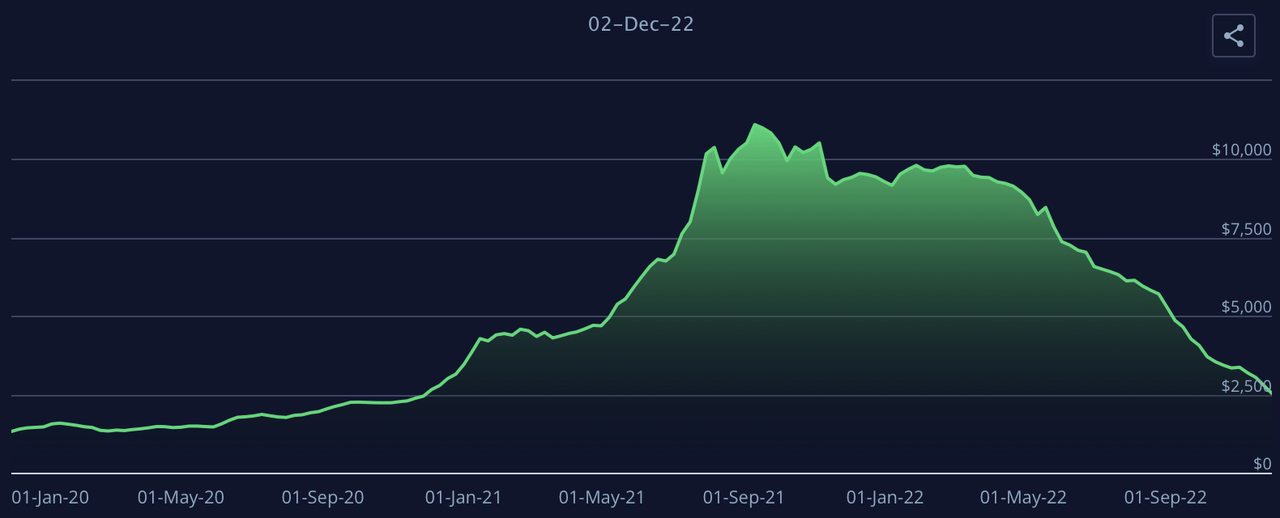

ZIM Stock Price

ZIM has fallen so much from all-time highs that it can be easy to forget that it is still trading over 30% higher than its $15 IPO price.

I last covered ZIM in September where I explained why I was buying a tiny position as I viewed the stock as offering high reward against a high-risk profile. The stock has since declined 37% inclusive of dividends – increasing the potential returns but not necessarily decreasing the risks.

What Were ZIM Integrated Shipping’s Expected Earnings?

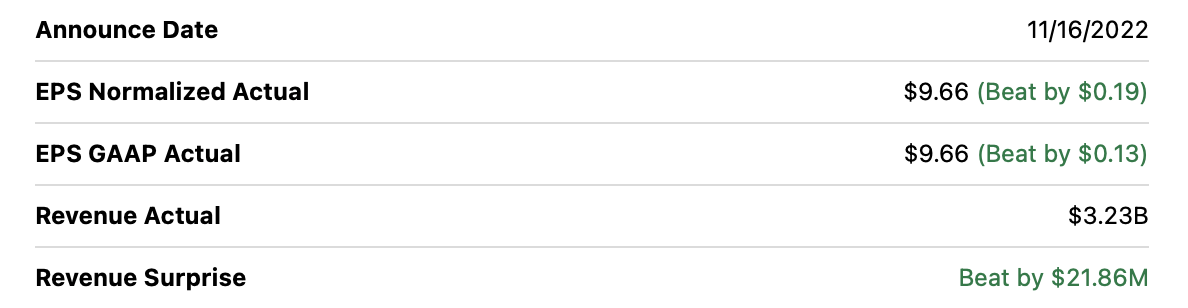

When ZIM reported earnings on November 16th, analysts were still expecting strong numbers, but the focus was clearly on forward outlook.

Did ZIM Integrated Shipping Beat Earnings?

ZIM ended up beating on both the top and bottom lines.

Seeking Alpha

Those beats, however, did not do much to change the downward trajectory of the stock price, which had fallen 50% since the previous earnings report and has trended lower since.

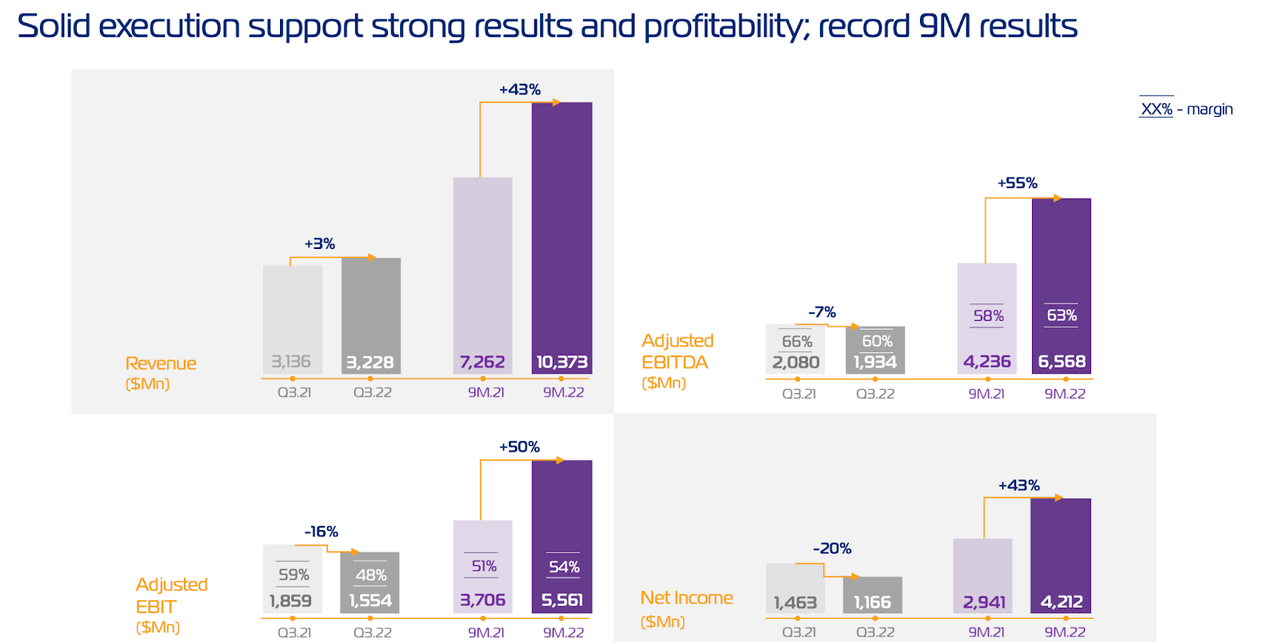

ZIM Stock Key Metrics

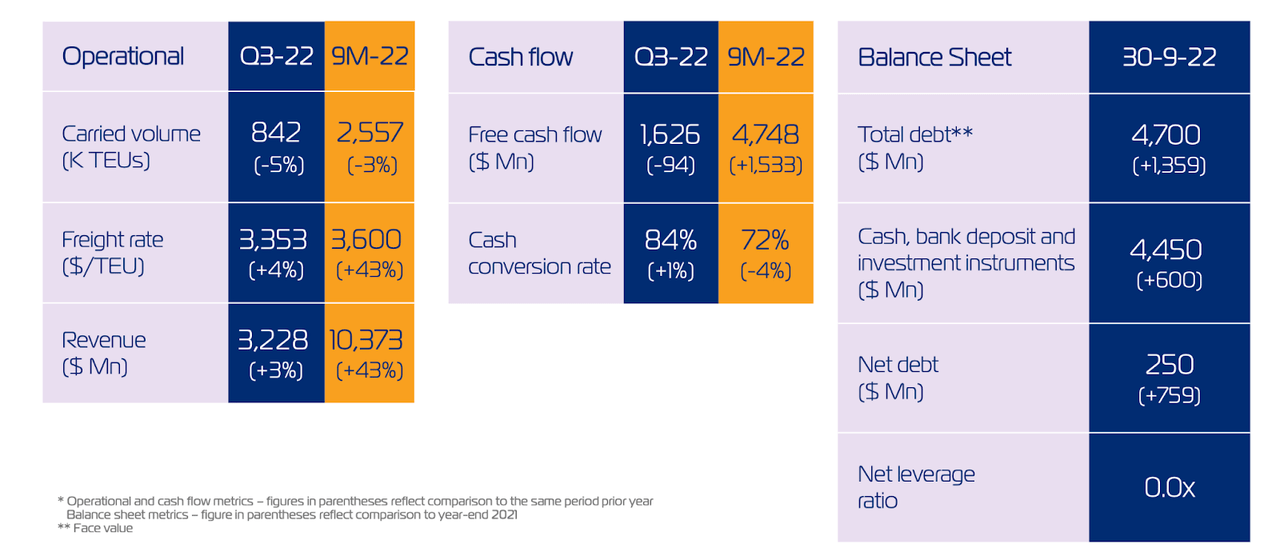

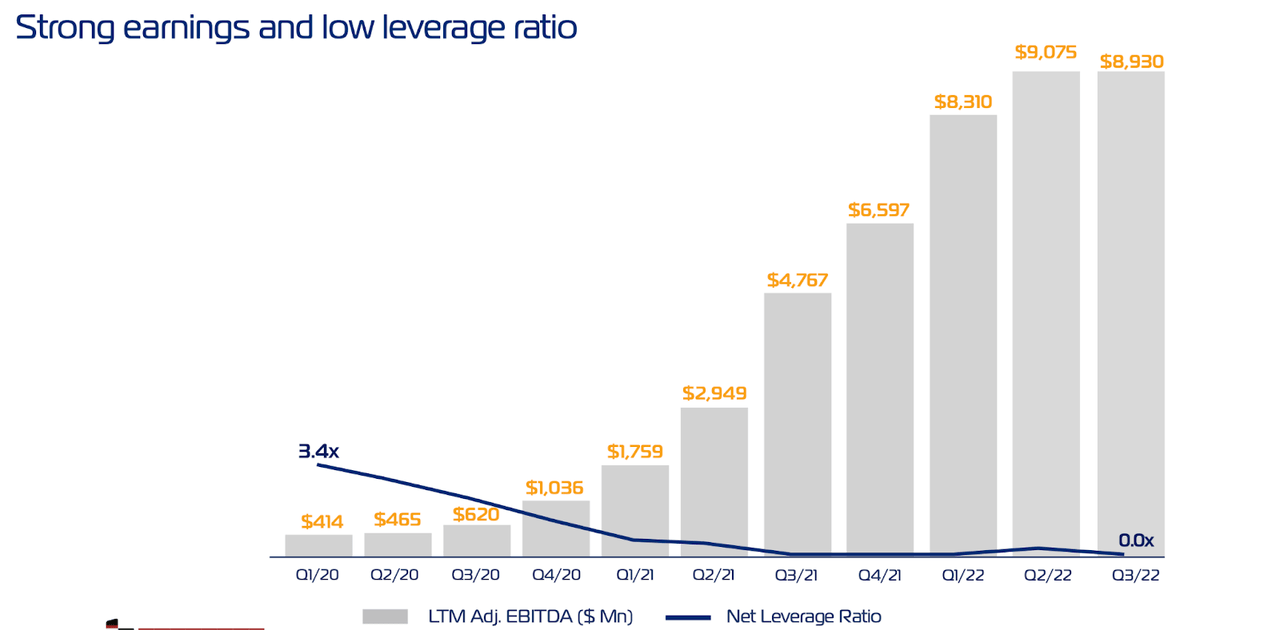

The latest quarter saw strong year over year growth on revenues, adjusted EBITDA, and net income. This is a company which converted 84% of adjusted EBITDA into free cash flow in the latest quarter.

2022 Q3 Presentation

As usual, elevated pricing was the main driver of the growth and that was offset by lower volumes. In prior quarters, the lower volumes were mainly driven by congestion, but as discussed on the conference call, ZIM is now indicating some impact from a “normalized level of consumer demand.” Inflation and the recessionary environment are now taking a toll.

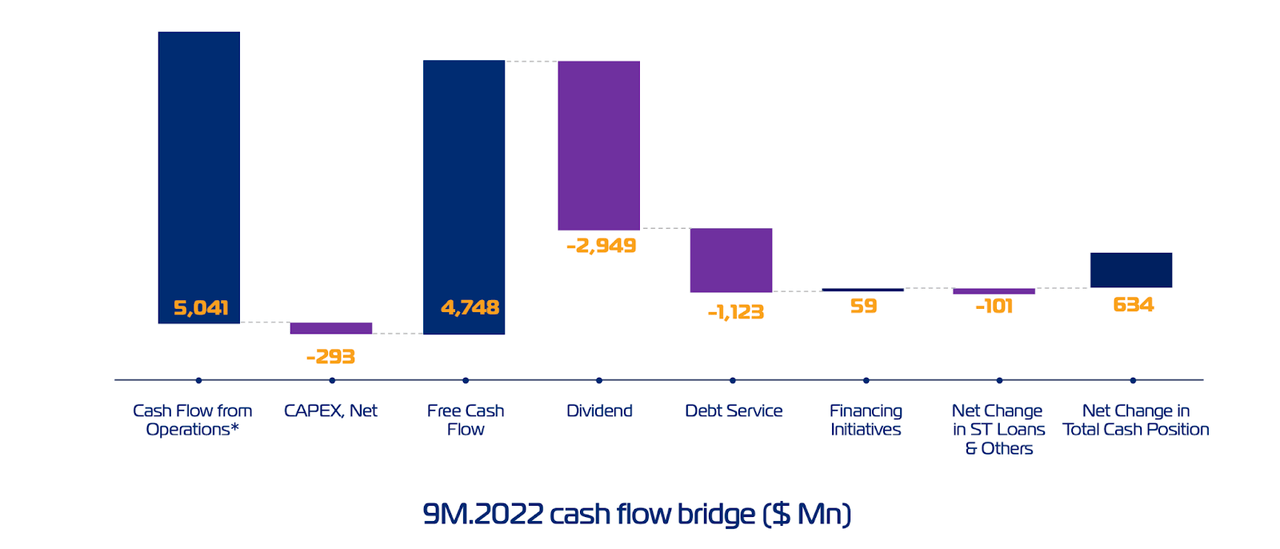

ZIM generated so much free cash flow (to the tune of $4.7 billion) that over the first nine months of this year, it was able to pay $2.9 billion in dividends (the market cap recently stood at $2.3 billion), pay down $1.1 billion of debt, and still increase its cash position by $634 million.

2022 Q3 Presentation

I have frequently seen analysts tout the large “net cash” position on the balance sheet. ZIM ended the quarter with $4.7 billion of cash and no debt. This means that net cash far surpassed the total market cap. There’s an issue with that assessment, as it ignores the lease liabilities. Recall that ZIM charters the majority of its ships, meaning that it essentially rents the ships from ship lessors. ZIM defines debt as including those lease liabilities and stated its balance sheet as having a net debt position of $250 million as of the latest quarter.

2022 Q3 Presentation

Management stated the following regarding its cash balance and capital allocation below:

Today, the capital allocation priority continues to be the same as before, which is ensuring we continue to invest in growing our commercial prospects, securing capacity and renewing our equipment. We continue to look also at options to potentially grow inorganically and look at potential M&A transactions. That is something that we continue to look into even though there is no rush for us to secure in this respect. And lastly and very importantly, we want to continue to be true to our commitment to our shareholders, which is to return significant capital back to them.

Based on that commentary, I surmise that ZIM does not view the $4.4 billion of cash as a net cash position, as it otherwise would be aggressively repurchasing stock (as it would be a “net-net”). Investors should be careful to not give so much credit to the cash on the balance sheet as it appears that ZIM management intends to use the cash to grow its fleet.

What To Expect After ZIM Earnings

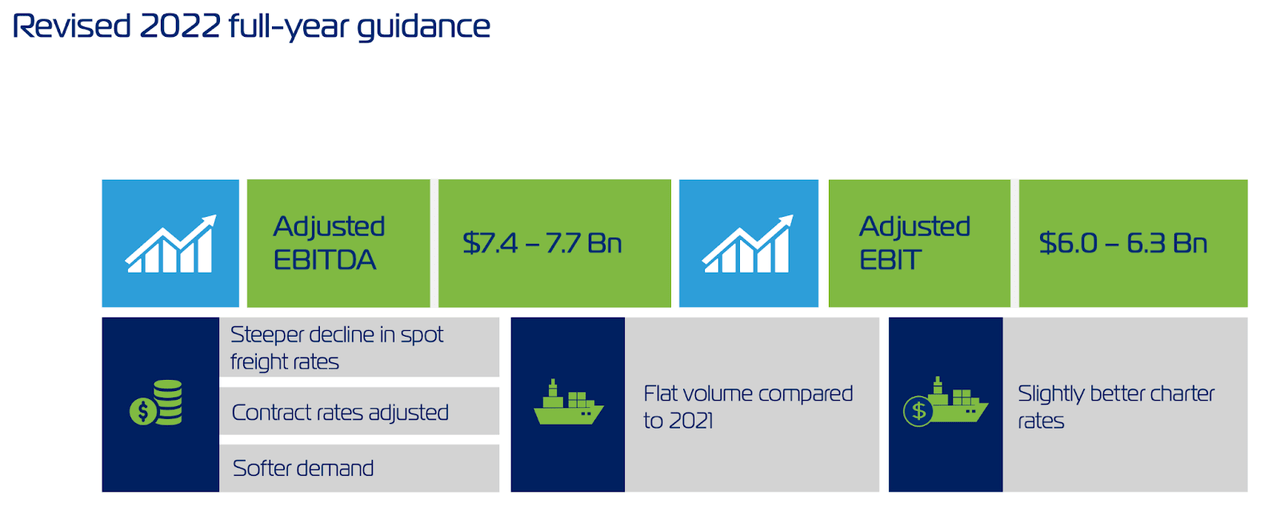

Looking ahead, ZIM adjusted its guidance lower as it now expects to generate adjusted EBITDA between $7.4 billion to $7.7 billion, compared to the previous guidance of $7.8 billion to $8.2 billion and adjusted EBIT between $6 billion to $6.3 billion compared to the previous projection of $6.3 billion to $6.7 billion. That guidance implies $1.1 billion of adjusted EBITDA in the fourth quarter – representing a steep decline from the $2.36 billion generated in the 2021 4th quarter.

2022 Q3 Presentation

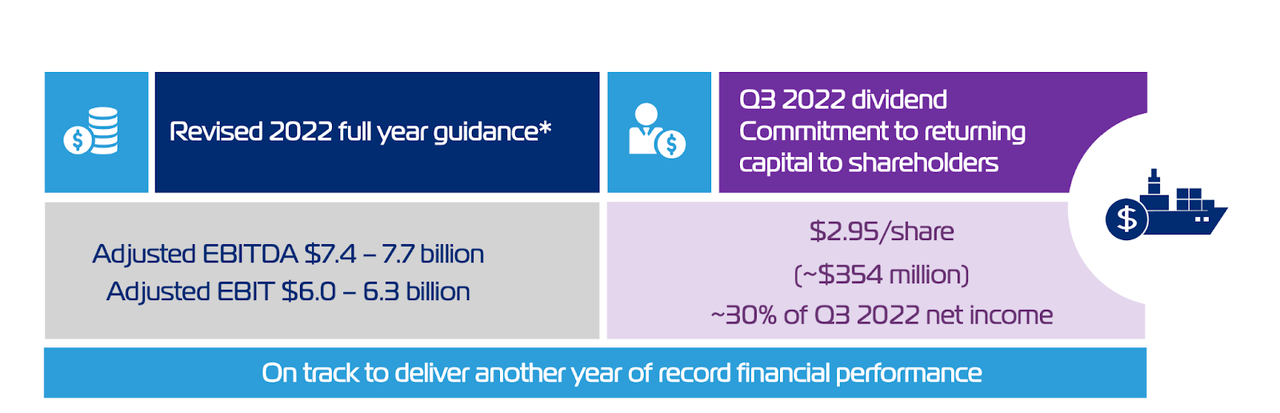

This should not have come as a complete surprise, as it should have been clear that ZIM was over-earning during a period of tight supply. But perhaps investors are more focused on forward dividend payments. ZIM reiterated its commitment to returning 30% of net income to shareholders.

2022 Q3 Presentation

That said, some investors may have been hoping for a large special dividend payout, similar to what the company has paid in the past. Management gave its update below:

It’s a little bit too much premature today to opine as to where we will land the consideration that will be taken at the time will be obviously how did we close the year, but also as importantly, what do we think the outlook is ahead of us, and there is lot of unknown data at this point, which again I think make us say that it’s a little bit too early –too premature to opine on what might be the year two payment next year.

That commentary shows less optimism than before and does seem to imply that investors should not be expecting a large special dividend this year, if any.

Is ZIM Stock A Buy, Sell, or Hold?

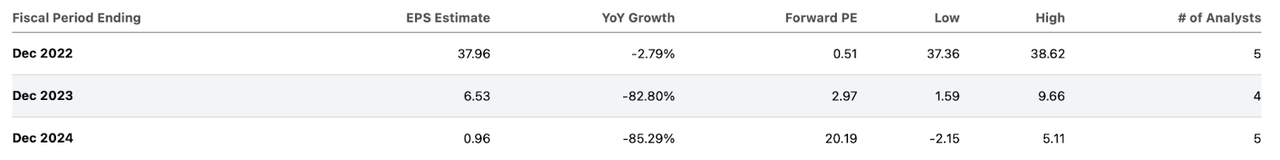

With a stock as volatile as ZIM, it is difficult to assign a fair value or buy recommendation on the stock. ZIM trades at just 0.5x 2022e earnings. That’s incredibly cheap. But much of those earnings have already been paid out to shareholders when the stock was at much higher prices, and earnings are set to plummet. Yet even after a projected 83% plunge in 2023 earnings, the stock is trading at less than 3x those estimates. That still looks really cheap – especially for a company with such high free cash flow conversion rates. The issue is that earnings are expected to plunge another 85% in 2024, at which point the stock would be trading at 20x earnings. That does not look nearly as cheap.

Seeking Alpha

Assuming ZIM continues to pay out 30% of earnings, then ZIM might pay out roughly 15% of its market cap back as dividends by 2024. Even then, the stock still does not look cheap. Consider that when I wrote my last article, ZIM was still expected to earn $5.45 in EPS in 2024. Earnings projections have clearly been downsized. Why has this happened?

ZIM soared after the pandemic due to soaring freight rates. It appears that it is now crashing because of crashing freight rates.

As we can see below, the Global Container Freight Index (US$ per 40ft) has crashed over the past year.

Freightos Data

There is now little reason to believe that rates will not go back down to pre-pandemic levels. Consider that even ZIM management, who should have a greater grasp of the outlook for freight rates, did not see this coming. In the first quarter of this year, they stated that “structural changes in container shipping, vertical growth strategy being pursued by various liners and higher cost incurred by all players will keep freight rates from declining to pre-COVID levels when rates finally normalize.” Then in the second quarter, management stated that they “expect the new 2023 more regulation and the agenda to the Carbonite shipping to partially offset growth in supply and support freight in the mid- to long-term.”

I’m not posting these quotes to ridicule management. My point is that it is extremely difficult to predict freight rates – investors may have grown complacent after seeing freight rates soar quarter after quarter post-pandemic.

Yet it is not all bad. It is important to note that there will be long term benefits from the earnings renaissance of the past few years. Because ZIM was paying down debt alongside distributing dividends to shareholders, it was able to reduce net debt from $1.4 billion to just $250 million as of the latest quarter.

2022 Q3 Presentation

Even if adjusted EBITDA were to decline to pre-pandemic levels, leverage would still be very conservative.

What’s more, ZIM has lower charter risk in the near term. Whereas it has 62 vessels coming up for renewal over the next two years, during the same time period it also has an expected delivery of 46 chartered newbuild vessels. I mention this because one risk for ZIM has been the potential for rising costs from increased charter rates.

The problem with ZIM stock is that due to the high volatility of earnings, it may never be able to command a premium valuation. This means that even during periods of trough earnings, the stock may still trade at very low P/E multiples. I wouldn’t be surprised to see the stock trade at 3x to 6x earnings multiples at cyclical lows even though one could make an argument that the conservative balance sheet warrants some valuation support. That said, I still find the stock buyable because the neutral debt balance sheet limits the downside as I can see the company remaining profitable even if rates return to pre-pandemic levels. The main risk here (beyond that of plunging freight rates and volumes) is management incompetence. It is possible that management decides to aggressively use its cash balance to increase its fleet size but without adequate return on investment. In such a scenario, the company would see increased leverage at the trough and thus increased risk. Investors should closely monitor how management works through the upcoming storm. I rate ZIM a buy, but note my tiny position sizing as risks remain very elevated here.

Be the first to comment