baona/iStock via Getty Images

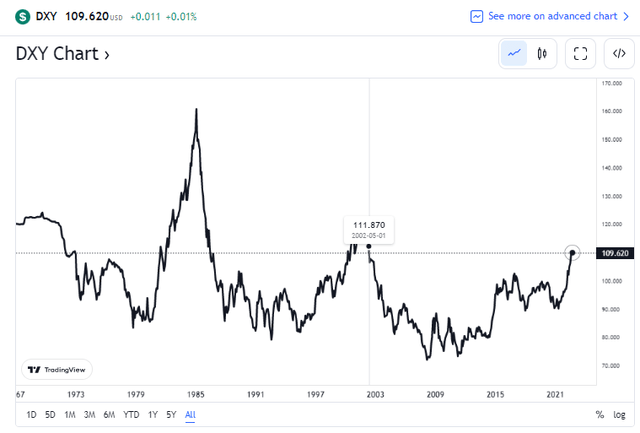

The euro gets all the press these days. After busting through parity earlier this quarter, another move lower came this week as $0.99 was breached. That move helped send the U.S. Dollar Index to fresh highs above 110 – the loftiest level since June 2002. What’s not talked about as much is the devastation that has gone on with the Japanese Yen.

EURUSD Breaks Parity, Trades Under $0.99 For A Moment

U.S. Dollar Index Is At The Highest Since June 2002

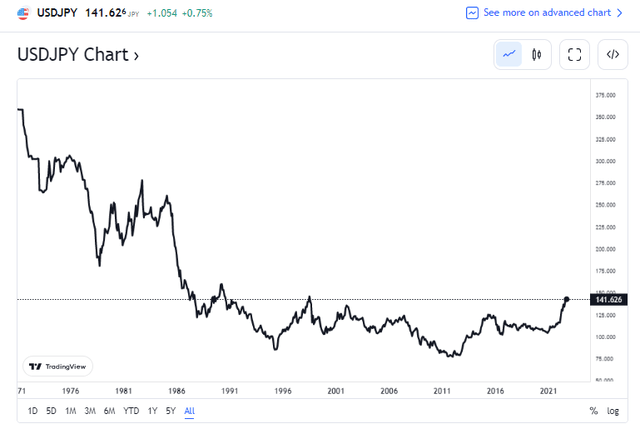

The USDJPY cross was near 100 as the calendar flipped from 2020 to 2021, and few market participants had their eyes on its price action. The yen is often seen as a safe haven currency, so when turmoil and risk-off sentiment permeates global markets, the yen is often bid up. That’s not the case this year as the global bear market presses on. Instead, USDJPY at 142 is just percentage points away from notching fresh 32-year highs.

Japanese Yen Falling Apart Vs The USD

The fundamental cause for such a big depreciation of the yen vs the dollar is simply monetary policy between the two juggernaut central banks and interest rate differentials. The expectation is that the Federal Reserve will continue hiking rates to near 4% by April next year while the Bank of Japan keeps rates relatively low. Another fundamental driver is rising energy prices and resulting trade surpluses impacting both countries’ currencies. Like Europe, Japan is quite dependent on shipments of LNG to the area – particularly in the wake of the 2011 Fukushima nuclear disaster which led to a reduction of nuclear power generation in the country.

USDJPY: Near 32-Year Highs (Strong USD, Weak JPY)

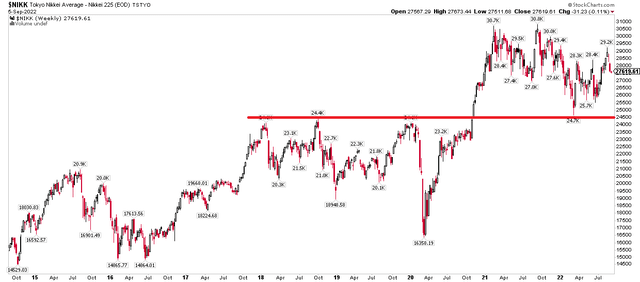

Stock market investors might care little about the goings-on with USDJPY. But they should pay close attention to it. There’s a way to take advantage of a downward trend in the yen along with gaining exposure to the Japanese stock market. The benchmark Tokyo Nikkei Average (Nikkei 225) is holding up quite well compared to other major stock market averages. Notice in the chart below that the Nikkei held the critical 24,500 level on a test of key support back in March. While U.S. and European markets continue to struggle in their own bear markets, there has been relative strength in Japan for the better part of six months.

Nikkei Holds Key Support

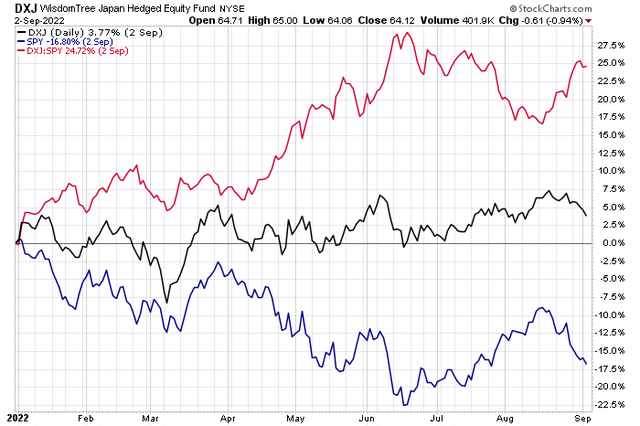

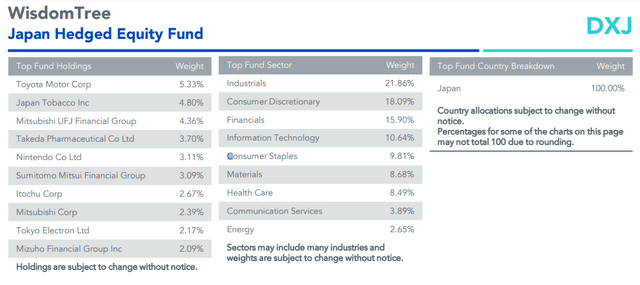

Couple a falling yen with a somewhat resilient Nikkei, and there is an opportunity for active investors. The WisdomTree Japan Hedged Equity ETF (NYSEARCA:DXJ) gives investors exposure to Japanese dividend-paying companies while hedging the USDJPY pair (shorting the yen). So far in 2022, DXJ is up just 4% total return – nothing too impressive on an absolute basis. Compared to the S&P 500 ETF (SPY), however, DXJ is up 25%, and not far from multi-year highs.

DXJ YTD Returns: Up 25% On The S&P 500

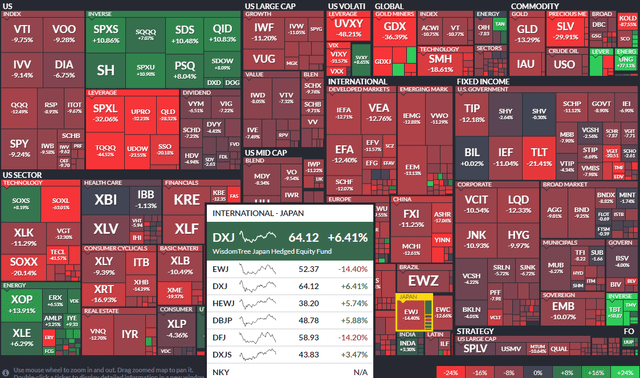

ETF Performance Heat Map Last Six Months

Diversified Sector Exposure

If there’s continued downward momentum in the yen and Japanese stocks, in general, keep up their relative strength, DXJ looks to be a great play heading into year-end. Moreover, I expect some bullish ‘window dressing’ to go on into the end of the quarter and possibly the year as money managers seek to show clients strong assets in their portfolios. DXJ will certainly be near the top of the list in terms of risk-adjusted returns. Along with a diversified mix of sector exposures, the fund pays a high 3.6% dividend yield, according to WisdomTree ETFs.

DXJ: Slow & Steady Gains In A Year Of Global Equity Volatility

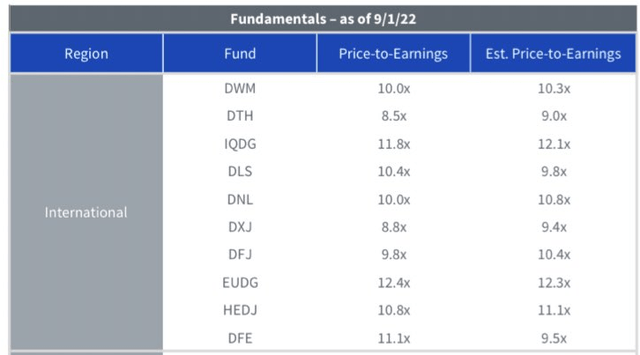

Notice the trend since early last year – just steadily up and to the right. We don’t see many charts like that with such low volatility within an uptrend. I think DXJ could be a great play as we approach the end of the year. On valuation, Japanese stocks are downright cheap, too.

Be the first to comment