MF3d/E+ via Getty Images

SentinelOne (NYSE:S) may be exactly the kind of stock that one should be buying in this market. S is in the cybersecurity sector with one of the strongest secular growth stories around but has seen its stock dip substantially as the market is punishing profitless companies – let alone those burning cash. While the market seems to be taking its time to remember how to appreciate operating leverage, investors can take advantage of the strong buying opportunities available for the taking. S is one of the 40 stocks in the “2022 Crash List” provided for subscribers. In spite of the lack of profits, I see S generating strong returns from the current stock price.

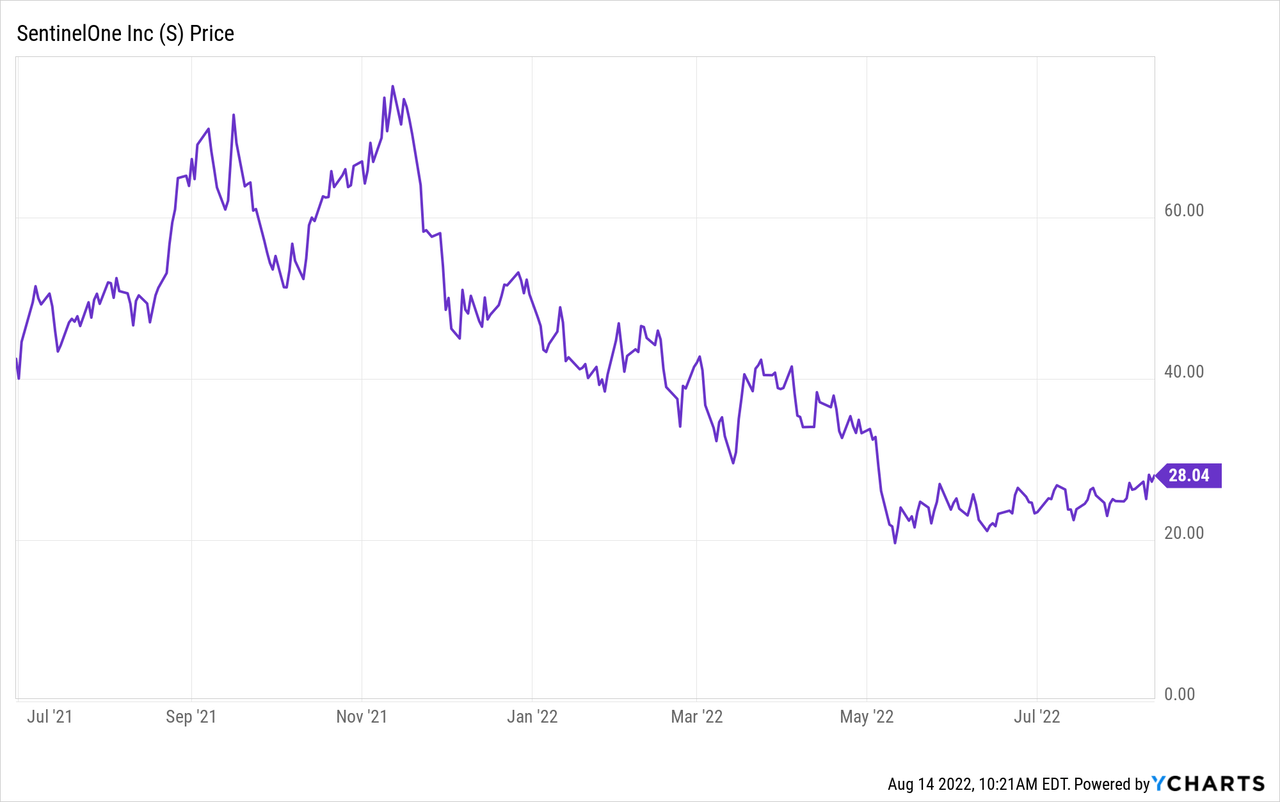

S Stock Price

S came public at $35 per share but now trades 20% lower.

This is a name which has grown by a triple-digit rate since it came public, which in conjunction with the 64% decline since all-time highs, has led to a strong contraction in valuation multiples. I last covered the name in March when I rated it a buy, though it has since fallen 9%. This is a name which continues to execute, making the lower prices a gift for long term investors.

What is SentinelOne?

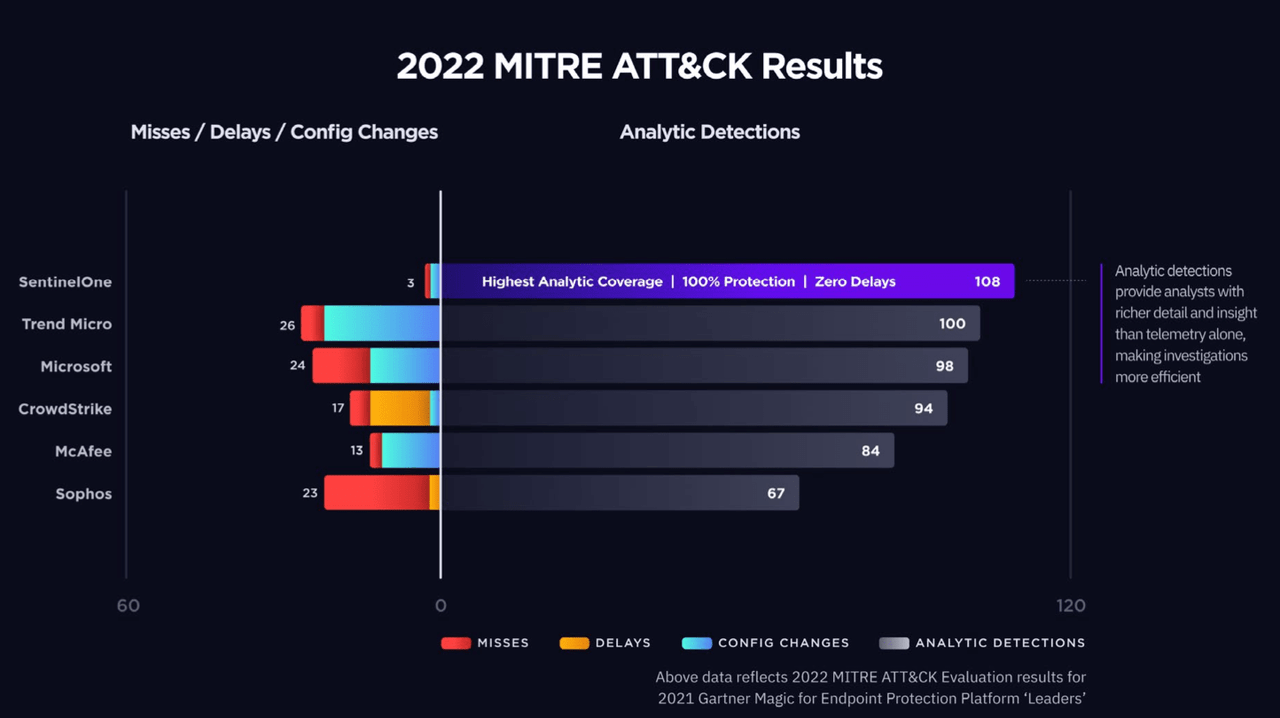

S is a cybersecurity stock, one that competes neck-to-neck in endpoint protection with the more well-known leader in CrowdStrike (CRWD). Endpoints refers to devices like phones, computers, and other mobile devices. S touts its primary differentiator as being its use of artificial intelligence in speeding up the identification, investigation, and resolution of cyberattacks. The 2022 MITRE ATT&CK results for endpoint protection showed the outperformance of S’s products – more threats detected at higher efficiency.

FY23 Q1 Shareholder Letter

This is a name which should benefit from the overall growth of the cybersecurity market while also possessing the potential to take market share within it as well.

S Stock Earnings

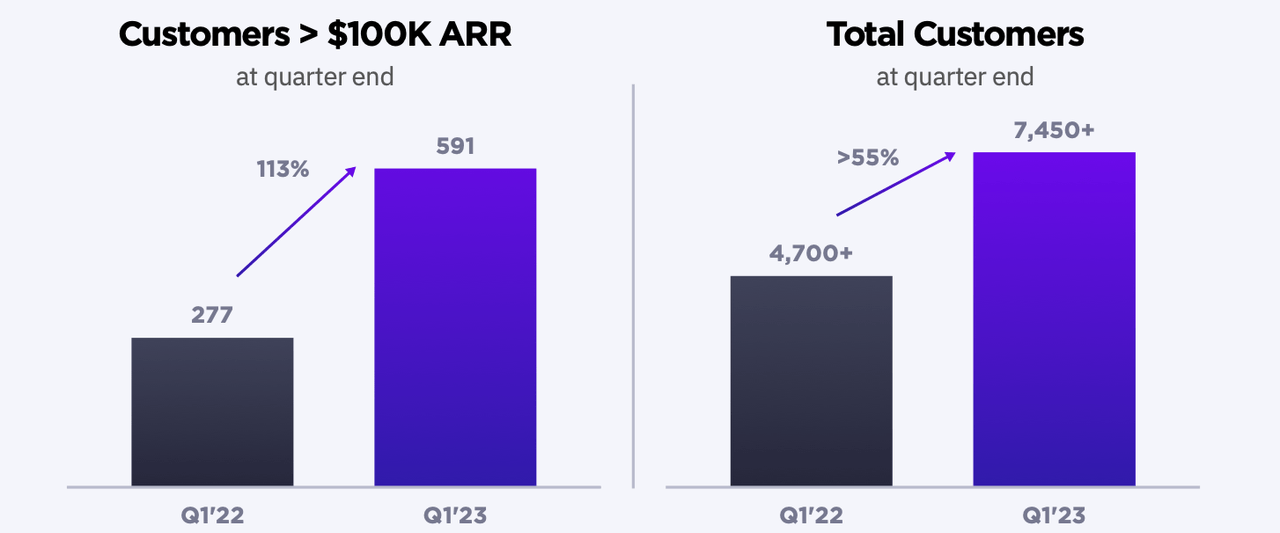

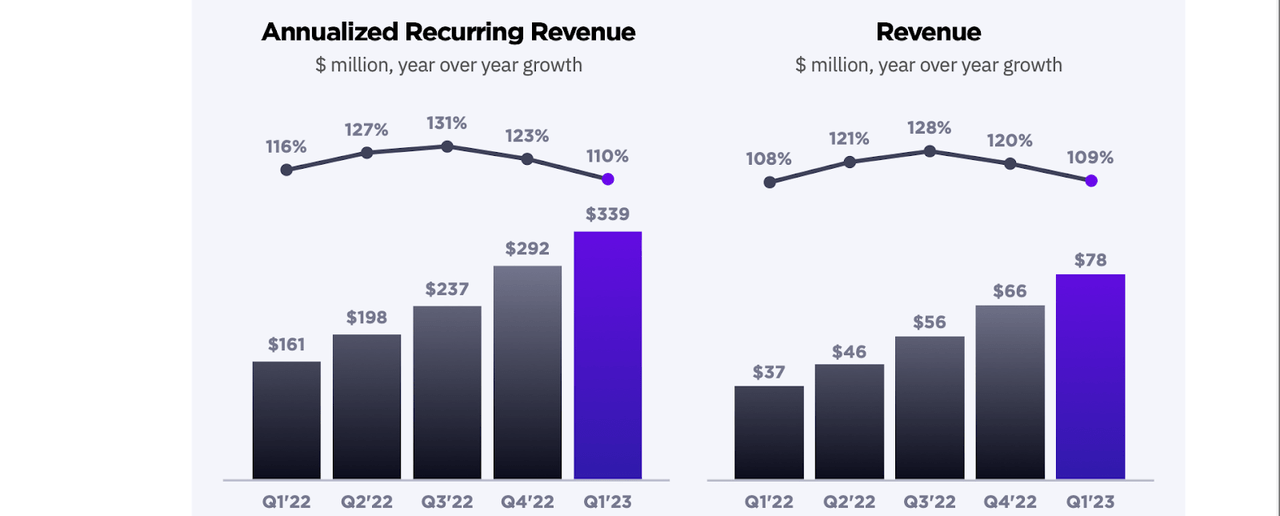

In the last quarter, S grew its total customer base by 55%.

FY23 Q1 Shareholder Letter

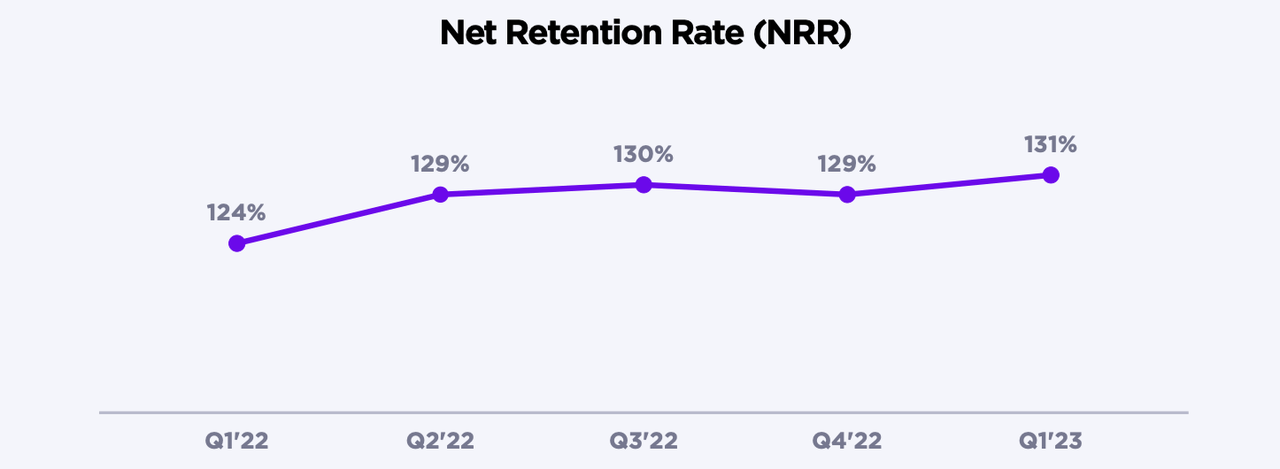

It coupled that strong customer growth with accelerating net retention rates of 131%.

FY23 Q1 Shareholder Letter

Put these together, and S was able to grow revenue by 109%.

FY23 Q1 Shareholder Letter

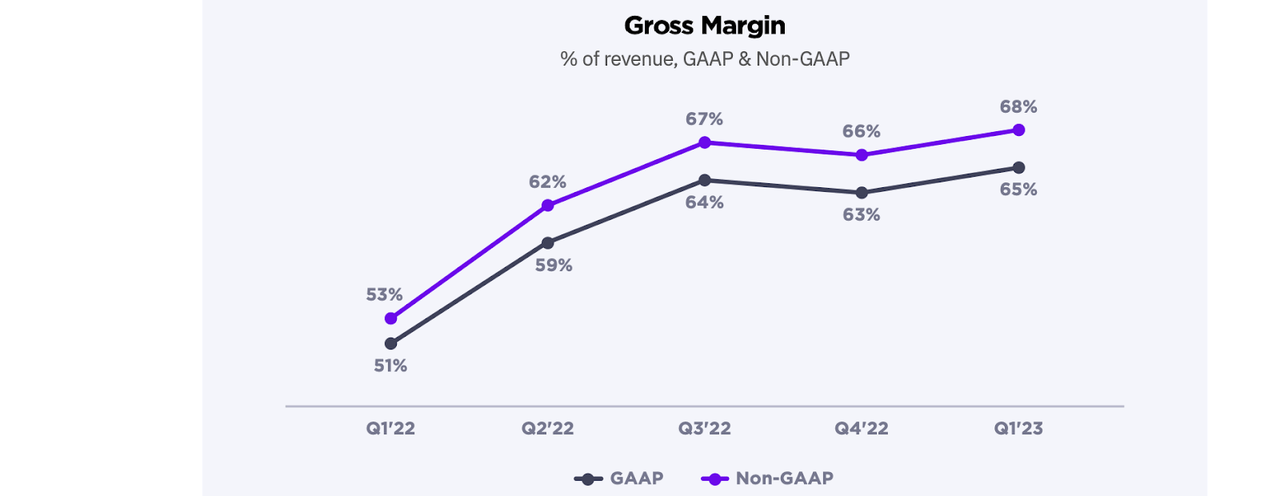

Many tech stocks have crashed over the past year. It is not every day that you get to buy stocks of companies growing this fast for this cheap. S has seen vast improvements in gross margin over the past year.

FY23 Q1 Shareholder Letter

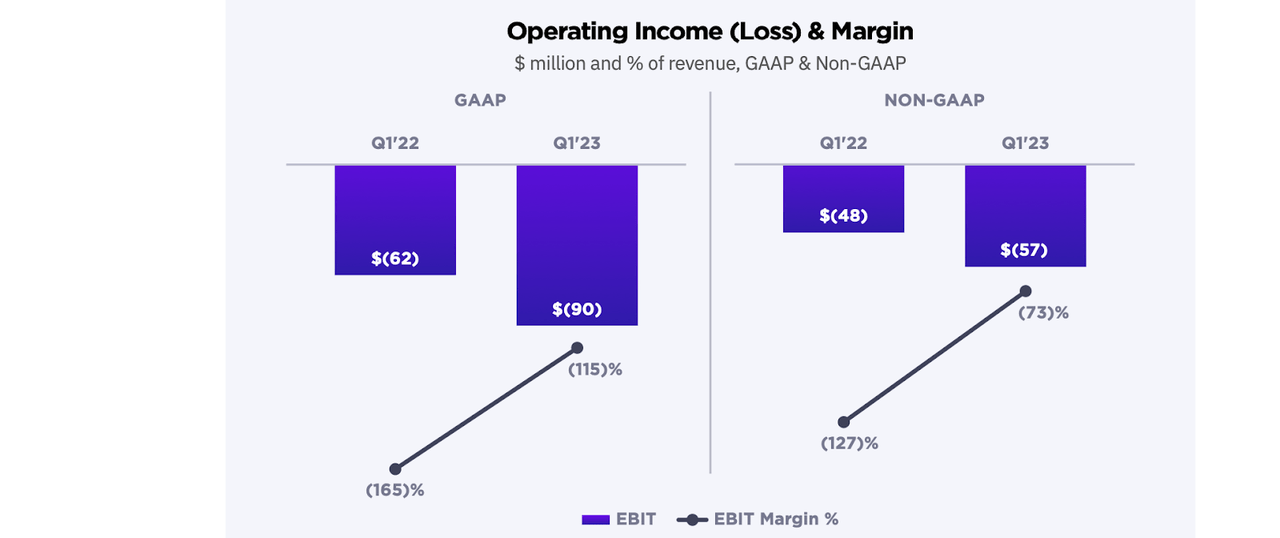

I expect gross margins to continue to improve as the company increases its revenue base. The one potential negative is that S remains unprofitable on both a GAAP and non-GAAP basis, though it did realize some operating leverage.

FY23 Q1 Shareholder Letter

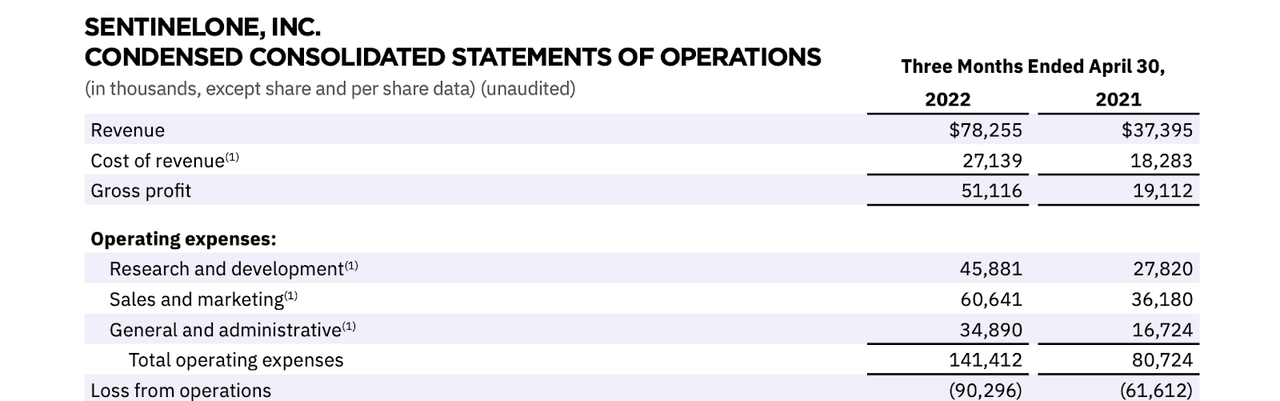

We can see below that S has been aggressively increasing its R&D and S&M expenses.

FY23 Q1 Shareholder Letter

In the current market, it can see heretical to claim that long term investors should prefer operating losses. Yet in the case of S, I will make that claim. This is the kind of company that can realize strong growth once it adds a new customer – it makes perfect sense for the company to be trying to add as many customers as it can while simultaneously improving its product as fast as it can. This aggressive investment hurts in the near term due to the cash burn, but may pay off big in the long term if the company can sustain elevated growth rates for many years.

The company ended the quarter with $1.6 billion of cash versus no debt. The company did spend $352 million subsequent to the quarter to close its acquisition of Attivo Networks. That $1.2 billion of cash is enough to sustain as many as 5 years of operating losses (based on full year guidance) and makes up 18% of the current market cap.

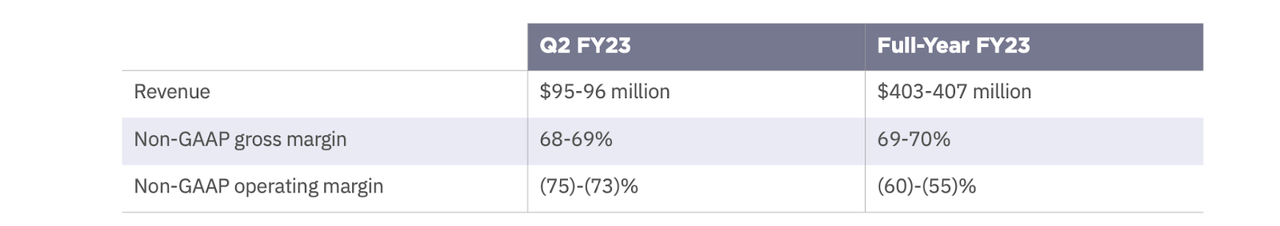

S increased full-year revenue guidance from $370 million to $407 million, representing 99% year over year growth.

FY23 Q1 Shareholder Letter

The new guidance does take into account its acquisition of Attivo – on the conference call, management noted that it expects Attivo to contribute around $45 million of ARR. The new guidance seems to suggests a guidedown for “old S,” but the resulting 99% growth rate is still nothing to sneeze at, especially at these valuations.

Is S Stock A Buy, Sell, or Hold?

S is now trading at under 19x forward sales. In comparison, CRWD trades at 21x forward sales and Zscaler (ZS) trades at 24x forward sales, in spite of both having slower forward growth rates. Consensus estimates call for growth rates to slow down rapidly.

Seeking Alpha

I expect S to beat on those conservative estimates, but even using those estimates, the stock looks cheap here. I can see S sustaining a 30% net margin over the long term. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see S trading at 18x sales by January 2025, representing a stock price of $63 per share. That reflects around 40% annual returns over the next 2.5 years. What’s more, I could see the 1.5x PEG ratio proving too conservative due to the historic attractiveness of the cybersecurity sector – a 2x to 2.5x PEG ratio is not out of the question. There are clear risks here. First, unlike CRWD, S is guzzling cash. The company would need to sustain strong growth in order to realize operating leverage. That places its risk profile in a different category than CRWD – whereas CRWD is aiming to justify its premium valuation, S needs to further justify its financial solvency. The large net cash position should give the company several years to prove out its vision, but any dramatic slowdown in growth rates would be a clear red flag. I view S to be recession resistant in that demand for cybersecurity products should not wane with the broader economy. That said, cybersecurity providers carry a unique risk in terms of protecting their reputation – if S suffers a cyberattack that damages its reputation, then its growth story may become impaired. At these prices, I view the upside potential as more than offsetting the downside risk. I rate the stock a buy and own a small stake in the company myself – a little goes a long way here.

Be the first to comment