wundervisuals

This morning, October 13, 2022, at 8:30 AM Eastern time, the Treasury released inflation data for September. The year over year rate of 8.2% was interpreted as a “hot” number and roiled the markets a bit, immediately sending the Dow Jones Industrial Index (DJIA) down about 800 points, from positive 300ish to negative 500ish. Treasuries fell and rates rallied, especially at the shorter maturities. This happened because the odds of longer and stronger Fed rate hikes increased.

What this means for you as I Bond investors is that it may be time to think strategically and creatively about I Bonds. While I Bonds are still a minor niche in the fixed income world, they may deserve a max position in your portfolio. Quite simply, they do something no other assets does as well: keep up with inflation. Even the world of mainstream financial journalism has started to catch on, albeit about a year late. The recent high inflation rates have reached a level where the virtues of I Bonds can’t be missed, The quality of these articles has also improved somewhat although many still don’t grasp some of the subtleties which make I Bonds truly special. Andrew Bary of Barron’s came out with a reasonably accurate piece two days ago (with just a small mistake on the months applicable to the upcoming November 1 reset).

Over the past two years I have published five articles on this site attempting to give SA readers a detailed and accurate picture of the workings of I Bonds. This article will be a little different. It asks readers to straighten up in their chairs and listen carefully. The reason is that this is quite possibly the high point in I Bond yields for a while. This doesn’t mean that I Bonds won’t continue to be a great investment in the future. Many factors will continue to work in their favor. It just means that this may be the last huge pop of one-year returns from the inflation component. There’s nothing like starting a race way out in front. This may be your last chance to do this by jumping in with both feet and doubling up.

The annual limit on I Bond purchases is $10,000 per Social Security Number per calendar year with an added $5000 which may be taken as part of your tax return. The tax refund option is of course ancient history for this year. You can also double up using a Revocable Living Trust or businesses such as an S Corp. Again, it’s too late on these for the current opportunity unless you have these options already teed up. What that leaves is the Gift Option, for which there is still plenty of time – a couple of weeks. This article will feature that option.

It wasn’t until this year that I myself used the Gift Box to double up. I made my annual $10,000 buy in April and then used the Gift Box to double up. I’m about to do it a second time. You can’t actually double dip in a single year, but I Bonds bought in a Gift Box (a friend or family member must do it for you) don’t count until “Delivered” out of the Gift Box and into your regular account. To double up with the Gift Box is to make the assumption that there will be a future year in which you will be happy to skip that year’s purchase in favor of having a $10K I Bond “Delivered.” I am willing to make the assumption that there will be such a year, at least two such years in fact, as I intend to engineer another $10K Gift swap before November 1. Meanwhile, while I wait for a year to “Deliver” the bonds held in the Gift Box will earn and compound like the bonds I hold in the normal way.

The great opportunity which currently presents itself is grounded in a little anomaly in which a full year of backward looking return information is available while you decide whether you want to purchase. It’s the sort of advantage you can’t find with any other investment. The opportunity to buy a backward-looking year of returns occurs twice annually, roughly the final two weeks of April and the final two weeks of October. We are entering that latter period right now. We now have the final month of the six-month period on which the November 1 reset of the I Bond rate will be based. The obvious reason is that the October rate is not yet known. A couple of weeks is thus the amount of time you have to make your decision.

September’s rate will round out the six months which started with October 2021 (that’s the minor detail Barron’s missed, thinking it was September). We now have all six months on which the new rate will be based for the reset on November 1. The numbers sum to 3.22% (6.24% annualized). While I took the numbers upon which this is based directly from the written Treasury announcement, their rounding process has often puzzled observers. It leaves room for an error of .01% or so. If you would like to do the arithmetic yourself, start by noting that the Treasury compounds the numbers monthly. If you take that 3.24% number and add it to the all time high 4.81% (9.62% annualized) from the previous six months, you get the 8.1% which would be your annual return. All the numbers came in very close to my personal estimates. None changed my view of what the Fed is likely to do – continue raising rates. Nor did anything in the report change my view that the current yield on I Bonds will likely prove to be the peak for now.

You probably didn’t pay much attention to the negative July and August month over month numbers (see the tables below). Like most casual observers you probably thought inflation was rising like crazy every month. That’s true in a sense, as the year over year numbers remained high, but those negative July and August M/M numbers are important because they provide a mild suggestion that whatever the Fed and various economists think, there is factual evidence that inflation is at least leveling off. If that continues, your chances are good for having a low inflation year or two before too long in which it will make sense to skip ordinary I Bond purchases and have the bonds in your Gift Box “Delivered.”

The importance of those late April and late October periods cannot be overemphasized. That’s the period you have to choose to buy or not to buy with complete information available as to your first year of returns. Normally it’s just a help in deciding when to buy your annual $10K. This year it may be choosing whether to double up (or more) by being creative in the use of the Gift Box option.

Doubling up is an action that asks you to become informed about the ins and outs of I Bonds and the Gift Box and have at least a rudimentary knowledge to help you frame a few questions. Where is inflation headed? Nobody really knows, of course, but use the Kenneth Arrow Principle which evolved from his work as a weatherman for the D-Day invasion. He informed the top brass that weather estimates were no better than random, but was told to produce a number anyway for planning purposes. Will the actions of the Federal Reserve fail to slow inflation, succeed without harming the economy, or produce a major deflationary event? Same answer, like whether it will be raining ten days from now. At what point in the future might the inflation component of return be low enough that you could reasonably choose to forego an annual purchase in order to have a Gift Box I Bond Delivered? Sort of the same answer. There’s also the overarching question as to how close we may be to the end of super-high inflation. Once again, same answer. Now that we know the answers to those questions. I will focus on some things we can know and need to know.

I usually tell readers who have already read a couple of my I Bond articles that it’s OK to skip the next four sections. This time I suggest at least a skim even for long time readers. The basic workings of I Bonds will remind you of those books which yield up deeper insights each time you read them (both my grandmothers would have started with the Bible for which you would need the exchange rate for dollars/shekels). The basic principles remain the same, of course.

What Are I Bonds And How Do They Work?

I Bonds are a form of US Treasury Savings Bond which is inflation-adjusted. Like ordinary EE Savings Bonds, I Bonds are backed by the full faith and credit of the United States Government. Savings bonds have been around since 1935. Under a temporary name change to War Bonds, US Savings Bonds helped fund World War II. I Bonds have been around since 1998.

I Bonds produce returns with two components. The first is a fixed rate which provides the “real” return – real meaning inflation-adjusted. For new purchases this rate resets semiannually on May 1 and November 1, or the next business day if the first day of the month happens to fall on a holiday. Once you purchase an I Bond the real rate in force at that time continues for 30 years until the bond matures or until the owner chooses to redeem it. The second component of I Bond return is the inflation rate as represented by the Urban Consumer Price Index (CPI-U). One can argue about the defects of the Urban CPI but it’s what is used for all important measures such as resets of Social Security payments. The inflation rate used for I Bonds is reset semiannually at the same time the fixed rate is reset, on May 1 and November 1, and the accrued value of your I Bond is updated so that the return compounds semiannually. I’ll repeat for the purpose of clarity that the fixed rate doesn’t change for bonds you already own. The inflation rate is updated every six months starting from the date of purchase. It is then updated every six months. If this seems complicated, TreasuryDirect was kind enough to provide this table:

| Issue month of your bond | New rates take effect |

|---|---|

| January | January 1 and July 1 |

| February | February 1 and August 1 |

| March | March 1 and September 1 |

| April | April 1 and October 1 |

| May | May 1 and November 1 |

| June | June 1 and December 1 |

| July | July 1 and January 1 |

| August | August 1 and February 1 |

| September | September 1 and March 1 |

| October | October 1 and April 1 |

| November | November 1 and May 1 |

| December | December 1 and June 1 |

How Much Money Can You Invest Annually In I Bonds?

You can currently buy up to $10,000 annually of electronic I Bonds in a TreasuryDirect account. That’s $10,000 per Social Security Number. You can buy the same amount for your spouse and each of your children. You can also request that up to $5000 of your Federal income tax refund be received in the form of a paper I Bond which will be mailed to you whenever the IRS gets around to sending refunds. If you want to do this you should overwithhold for that amount.

On September 27 Senators Mark Warner (D-VA) and Deb Fischer (R-NE) introduced a bill that would enable investors to buy up to $30,000 of I Bonds per year for years when inflation is 3.5% or more. This was the original amount back in 1998 but the Treasury reduced it to the present $10K after deciding it was too good a deal. Designing and implementing the proposed change would require working out a few complicated details. The Senators failed to provide instruction as to how or when that 3.5% inflation rate should be calculated. It also happens to come in a year when the total amount of I Bonds purchased through September jumped from $252 million through September 2020 to $2.23 billion so far in 2022 – roughly ninety times as much. I wonder how enthusiastic the Treasury would be to see that number triple. In any case the change won’t happen this year and may be moot if inflation falls. The short version: I Bond investors shouldn’t hold their breath waiting for Congress to improve the deal.

How Do I Bonds Provide An Edge?

I can’t think of another investment that has so many factors working in its favor. Like all Treasury Bonds, I Bonds are not taxable by States and Municipalities. Another advantage of I Bonds is that you can choose to defer paying Federal taxes until maturity or redemption. This can be helpful if you or your heir (whom you designate with each purchase) expect to have lower taxable income at some point in the future. Under some circumstances I Bonds are tax free when used for educational purposes – read the fine print, though. All of the terms included in this paragraph are also true of EE Savings Bonds, by the way, which I discussed in an earlier article.

One of the most important but seldom noticed qualities of I Bonds is that they are not only an excellent inflation hedge, but a hedge against deflation as well. The reason is that the inflation component of the composite return never dips below zero. The fixed return earned for a six-month period may dip for bonds with a positive fixed rate if inflation is negative for a full six months, but the current zero rate takes this off the board. With the current zero fixed rate, the combined value will never drop. In the event of a deflationary period the accrued value of the I Bond would simply freeze at its highest level. When inflation returns, as it always has, the total value of the account begins to compound again from the highest level it has reached. I will note here, answering a question that came up in past comments, that everything is kept in your TreasuryDirect account until you cash in the I Bond. The interest is not paid out and taxed. You cannot move an I Bond into a brokerage account.

I Bonds are probably the most flexible investment available. This is because their duration is any date you choose from one year to their maturity date of 30 years. You cannot redeem your I Bond during the first year, but after that you choose any moment you wish if for any reason you want to get out. You can use them as a place to park cash for the short to intermediate term or leave them in place and continue to have an assured long-term hedge against inflation. I have never redeemed an I Bond.

For the first five years the price paid for redeeming a bond is giving up one quarter (three months) of returns. After five years of owning an I Bond, the forfeiting of one quarter’s returns no longer applies. Beyond that there are no special rules or asterisks attached to cashing out until the final maturity at 30 years. There are, by the way, no commissions or other costs involved in buying or selling I Bonds. Paper bonds – now available only as part of your tax refund – can be bought at price intervals from $50 to $10,000 while electronic bonds may be bought in penny increments starting at $25. You could, for example, buy an I Bond with a face value $25.23.

Why I Bonds Have Continued To Beat TIPS

This should have been the year TIPS outperformed I Bonds. For two and a half years whenever I wrote about I Bonds I could point out that their zero per cent real yield sounded bad but actually beat the real yield on everything else, including TIPS. It was a close call last May 1, zero again for I Bonds versus negative .01% for TIPS. Over the following six months, however, the real yield on TIPS has climbed strongly to 1.89% when last I looked. So TIPS turned the tables and crushed I Bonds, right? Nope. Sorry. I Bonds, still at zero real yield, once again trounced TIPS.

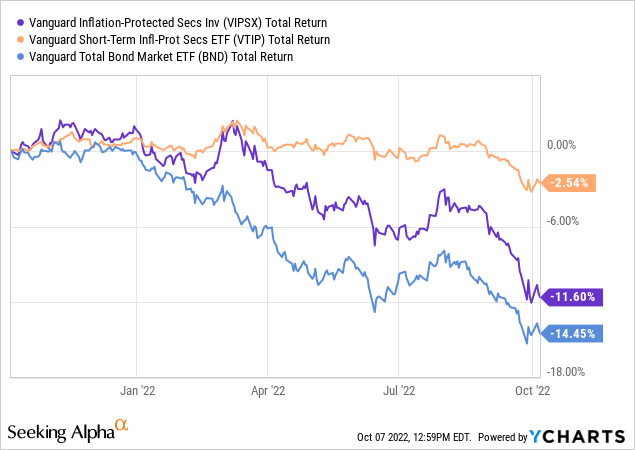

The trouble with TIPS is that, unlike I Bonds, they trade every day. Their poor performance stems from the fact that they are in some ways like ordinary bonds, which are priced inversely to interest rates. Their real return went up rapidly from May 1 to the present, but interest rates, thanks to the Fed, ran up even more rapidly. Here’s what it looks like on a chart, comparing both the long term Vanguard Inflation-Adjusted Securities Fund (VIPSX) and the Vanguard Short Term Inflation-Protected Securities ETF (VTIP) to the Vanguard Total Bond Market ETF (BND)?

What you see is that the bond aspect of the longer duration Vanguard Inflation-Protected Fund was pulled down hard by the same force that pulled own the Total Bond Market ETF. Sorry, TIPS holders, sometimes you just can’t win for losing. In the long run, of course, individual TIPS held to maturity will return exactly the real yield promised at the point of issue plus inflation. That’s assuming, of course, that you didn’t pay a premium. Holders to maturity should do fine.

The key question involving that big jump in real return is whether it will prompt the Treasury to bump up the real yield for I Bonds on November 1. They could look at it a few ways, including the several advantages of I Bonds (such as full deflation protection), but it is fairly likely that they will increase the I Bond fixed real return, perhaps by 0.10 to 0.30 per cent. I wouldn’t hold off on buying in October for that small increase. If they should stun the market by something like a 50-100 basis point increase, you can take comfort in the fact that you will get another shot at in January.

The Two Time Frames At Work In An I Bond

How would you like it if every six months the stock market gave you a two week period in which you could buy an index at its price exactly a year in the past? Crazy not to take the market up on that option, right? If the market is up nicely, you buy. If not, you do nothing else with your money and wait for the next potential opportunity which will come along in exactly six months. That’s pretty much what I Bonds offer in the two weeks leading up to May 1 and November 1 every year. We all see it. The implications just don’t occur to most of us. It’s hidden right there before your eyes. It’s also the reason a large number of articles on I Bonds suddenly appear in mid-April and mid-October. It’s so obvious that we don’t stop to think how the larger picture comes together.

When I first looked into I Bonds in 2000 I actually saw them that way. They were an alternative asset – an alt, as we say now – which had been created by the Treasury to serve as a solution to inflation risk for small investors. TIPS, invented a year earlier, were supposed to do the same thing but came with the unanticipated problems described in the above section. I Bonds solved those problems, combining safety and high predictability with the universal goal of defending against inflation. You could buy up to $30,000 worth at that time with a real yield of 3.6% over 30 years plus the inflation rate which was then 3.4%. That combined 7% return seemed to be too good to be true, especially so as I saw the dot.com stocks crashing and expected a weak return in equities for the next ten years. I was right on both accounts. The Treasury took three years to come to the same conclusion and dropped the annual amount to $10,000 while slashing the real return drastically. I had fortunately already bought a chunk but would have bought a heck of a lot more if I had seen the Treasury wising up so fast. My initial purchases have now quadrupled, beating equities, by the way.

What I now understand is that I Bonds exist in two distinct time frames, one short and one long, or more accurately one in the past and one in the present and future. The past is the one-year inflation rate which can be known with certainty at the time of purchase in the second half of October and April. In that respect I Bonds are like one-year CDs. You know exactly what you are going to get for one year. Over the past fifteen years I Bonds have at least kept up with the best CDs and often beaten them. Right now, with the inflation yield above 8%, I Bonds trounce CDs. You can buy them, wait a little over fourteen months (nominally fifteen months, giving up the income from the last three, but closer to 14 if you buy in a few days but get the entire income for October) and then decide whether to cash out or let it roll. You can always cash out after a year, but if you choose to hang on for up to 30 years you get an even better deal. What you is get is an investment that compares not to CDs, but to a stock index in which you have been given a head start and which will never have a down year.

We are presently in the two-week window during which the first full year’s return is known. It’s that second time frame for I Bonds – the full 30 year future – which deserves your close attention. It harkens back to my original observation in the year 2000, which I continue to think was the primary thing the Treasury had in mind. I understand that it is easy to be blinded by the recent super-high one year returns, but in reality I Bonds are a much more powerful instrument. A primary purpose of risk investments – for most people THE primary purpose – is keeping up with inflation over the long run. Stocks are pretty good at doing that but not perfect. Reread that sentence. If you didn’t know it already, file it away in bold print inside your head.

I Bonds are constructed to do exactly what you hope your stock portfolio will do – act as a storage vehicle for the purchasing power of your money over the long haul. You might reread that sentence too. Many investors think the goal of their stock portfolio is to outperform some index, but in reality the goal for most investors should be simply to retain the purchasing power of their savings. Even risk assets like equities often fall short of that goal or fail to provide the amount set aside at the precise time you need it. I Bonds held for the long term never present that problem. For that reason you should always consider their long-term time frame as a risk-free alternative to riskier assets with more volatility. That first year of known return may be a great alternative to CDs, but it’s also an incredible edge you never get when investing for the long term in stocks. You can reach backward and pull forward twelve months of known returns, which right now are exceptional to a degree I don’t expect to see again in my lifetime.

How Is Inflation Measured And Where Is It Headed?

When it comes to inflation a lot depends on where you measure from. If you looked back fifty years you would say, Gee whiz, inflation is up over 200%. That’s true enough, and you can estimate it for yourself with everything from gas prices to old restaurant menus, but it doesn’t really tell you much about the present or the recent past. All it really tells you is that over the long run inflation is persistent and will steadily shrink the future purchasing power of your money.

If you told your neighbor inflation was 200% you would be right in a sense, but you would get a funny look. Most just say inflation is high and leave it at that. What they usually mean is that prices are high, which means that they haven’t yet gotten used to high prices. What they call inflation may actually be the new normal. Some high prices correct themselves quickly on the principle that the cure for high prices is high prices. That’s why food and energy are taken out of the core. Other prices, such as rents and labor costs, tend to lag and be sticky. The important thing to remember is that high prices are an absolute number. Inflation is a rate of change. As such it is measured against a given point in the past.

What you really need to understand is that even in the fairly short run – let’s say one year – inflation is measured on two different time frames. One is year over year (Y/Y) and the other is month over month (M/M). The most common presentation of inflation is in year over year terms. News reports almost always use this number because it makes for a catchy and scary headline and gets your attention. It also happens to be the way I Bonds measure inflation, although they do it twice a year in six month chunks although compounded monthly (TIPS, however, do it monthly). You probably won’t be surprised to learn that inflation as measured year over year has been rising spectacularly.

The current backward-looking inflation report was 9.62% annualized, an irresistible headline number which contributes 4.81% to the current one year backward looking I Bond yield. With the previous backward-looking and now outgoing six-month number of 3.56% (annualized 7.12%) the one year backward I Bond yield sums to the 8.37% received for year one by those of you who took my advice and bought I Bonds last April. Going forward you will get the 4.81% again plus the six month return just announced. That’s the wonderful deal with I Bonds. You can look backward and if you like what you see, buy it.

What makes those numbers so persistently large over the past year is not just a matter of what is happening right now. It also reflects what the situation was a year ago at the point against which the present is measured. For that reason, headline numbers like 8.37% are misleading. If you look at the M/M numbers from July, August, and September of 2021, you will see that the M/M increase was relatively small. Remember that the one year change in inflation is derived not just from the top line increase, but from the base index number subtracted, which was relatively stable. The index number didn’t really kick into high gear until October 21, so that the last two months and just announced September number benefit from easy comparisons. Five months of easy comparisons kept the favored Y/Y numbers relatively flat. The peak and likely pivot point came in at 9.1% Y/Y in June. Those comparisons will be harder going forward, pulling the Y/Y number downward and continuing to whittle away at the already falling number of 8.2%. Year over year numbers are stale because half the story is in the subtrahend which dates back a full year and is starting to rise.

The M/M numbers tell a different story about what is happening at the present. The month over month number is a lot closer to a derivative as described on about page three of your first year calculus book. Unfortunately we can’t get an instantaneous rate of change for inflation except in places like Zimbabwe and Argentina, where at one recent point the only time gap was the period necessary for merchants to walk around their shops posting higher prices on everything. Note that at least for Argentina this example of in-store prices is a true fact; you can read about it in SA pieces by Scott Grannis who was actually there at the time and has mentioned this phenomenon in articles written as Calafia Beach Pundit. Here’s the key data describing the recent direction of inflation by both measures:

| Apr22 | May22 | Jun2 | Jul22 |

Aug22 |

Sep22 | |

| Index | 289.109 | 292.296 | 296.311 | 296.276 | 296.172 | 196.808 |

| M/M | .56 | 1.10 | 1.27 | -.01 | -.04 | .22 |

| Y/Y | 8.3 | 8.6 | 9.1 | 8.5 | 8.3 | 8.2 |

Six Month Percentage Change: 3.24% (6.48% annualized)

| Oct21 | Nov21 | Dec21 | Jan22 |

Feb22 |

Mar22 | |

| Index | 276.859 | 277.948 | 278.802 | 281.148 | 283.716 | 287.504 |

| M/M | .83 | .49 | .31 | .84 | .96 | 1.34 |

| Y/Y | 6.2 | 6.8 | 7.0 | 7.5 | 7.9 | 8.5 |

Six Month Percentage Change: 4.81% (9.62% annualized)

| Apr21 | May21 | Jun21 | Jul21 |

Aug21 |

Sep21 | |

| Index | 267.054 | 269.195 | 271.696 | 273.003 | 273.567 | 274.310 |

| M/M | .82 | .80 | .93 | .48 | .21 | .27 |

| Y/Y | 4.2 | 5.0 | 5.4 | 5.4 | 5.3 | 5.4 |

Six Month Percentage Change: 3.56% (7.12% annualized)

The above tables provide the history of I Bond yields over the past eighteen months. The bottom two detail the history which produced the 8.37% outgoing one-year return (the sum of 3.56% and 4.81%). The top table shows the path to the November 1 reset which will combine your second and last chance for the 4.81% half-year bonanza from October 2021 through April 2022 with the number announced today. I suggest you grab it if you haven’t already done so.

What the top table provides is detailed information about what is happening right now. What the most recent M/M numbers suggest is that the various price changes which add up to the overall CPI came in at a flatter rate of change for inflation as a whole. Is this temporary or is it part of a longer term flattening? We can’t know for sure, but there is a chance that inflation has begun grinding down toward a more normal rate. Subtracting the current five-year real return on TIPS (1.89%) from the five year ordinary Treasury Note (4.24%) gives you the five-year inflation expectation of 2.35%. Doing the same thing with the ten-year TIPS (1.66%) and Note (3.98%) produces a ten-year inflation expectation of 2.32%. These numbers are moving rapidly as I write this and may differ slightly from the numbers you find as you read this article. In the past I wouldn’t have paid those numbers much attention, but now that I have $10K in the Gift Box and am about to add $10K more, thinking about probable future numbers becomes more important.

How To Think When Using The Gift Box

Reader comments to previous I Bond articles prompted me to study up on the Gift Box in April and after studying up quite a bit I worked a reciprocal Gift Box exchange in my family and put together an article on the Gift Box here. The only real complaint about I Bonds is that you can’t buy enough of them. It’s just that $10,000 annually per Social Security number on a routine basis plus a $5000 paper bond as part of your income tax refund. The Gift Box and a few other workarounds – a Revocable Living Trust or your personal business – may enable you to do more. While only the Gift Box option is timely for present action, I suggest that those who are interested in the other options Google The Finance Buff/I Bonds. He does an excellent job in laying out the details of the other options for doubling and also provides an excellent guide to the workings of the TreasuryDirect site.

The premise for doubling up with Gift Box I Bonds is simple:

- Buy when the known inflation component is exceptionally high. That includes any time between the moment you read this and November 1. I actually suggest a few days earlier to be sure you don’t get pushed into November by a glitch or slow processing.

- Have the I Bond “Delivered” into your account in a future year when the known return prospects are lower.

- You may do this as a Gift to a friend or family member, or you can pair up to do this reciprocally. It’s a tactic often used by husband and wife or other family members with one another.

- You may repeat as many times as you want but be aware that you will need to forego an annual purchase for each $10K you wish to eventually have “Delivered.”

The Delivery part is the reason for devoting a little thought to the probabilities concerning inflation over the next few years. If you are old like me you have to take into account the potentially limited amount of time to carry out the strategy or educate others as to how they should proceed if you are not around.

The financial universe has a mind of its own, of course. Except for the 1970s large bursts of inflation have been relatively brief and often followed by a year or two of low inflation. There was a four-year burst of inflation in the middle teens during and immediately after World War I and the 1918 Pandemic followed by two severe years of severe deflation. In fact the highest monthly print of US inflation was in June 1920 (23.8%) and the highest deflationary print was exactly a year later in June 1921 (-15.8%). It makes sense if you just think of it as a manic form of price discovery following the war and the large number of deaths from Spanish flu.

A similar thing happened after World War II with strong inflation from 1946 through 1948 followed by a mildly deflationary year in 1949 roughly cancelled out by an equally mild inflationary year in 1950. In both cases, if I Bonds had existed and you had wished to deliver a couple of Gift Bonds, you would have had an excellent environment in which to do so. That being said, while there is no limit on the Gift Box I Bonds you can buy in $10K increments, you need to remember that you can only deliver the $10K limit per year. There’s a practical vanishing point for deliveries.

Conclusion

All in all, the years after the two World Wars probably provide the best analog to the present. I lived through the 1970s and this doesn’t feel like the 70s. The extreme inflation of that period had built gradually for more than a decade. The present economy is fairly likely to hit a bump with or without the help of a rate increase overshoot by the Fed. You certainly see hints of it in the top table of the previous section. The future is, of course, unknown and unknowable, but with I Bonds you will do reasonably well no matter what the economic environment. That’s the key point to remember about I Bonds.

If high inflation kicks back into gear you simply hold on to all of your I Bonds and any Gift Box Bonds not yet delivered to you. Even if there is a long and severe swing in the deflationary direction you will do fine as your past inflation returns freeze and the current zero fixed rate protects you from any loss to deflation. Your return in a period of deflation will come in the form of the increased buying power as prices fall. Bottom line with I Bonds: heads you win, tails you also win.

If for any reason you have not bought I Bonds yet this year, buy them now (if you have the spare cash, of course). Don’t hesitate to ask questions. Just put them into your reader comments so that all readers can benefit. I’ll set aside an hour a day to read and answer.

Be the first to comment