LL28

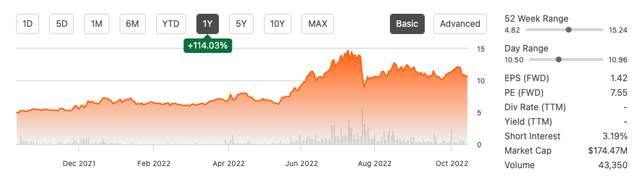

ProPhase Labs, Inc. (NASDAQ:PRPH) is small-cap biotech stock with a market cap of only $174.74 million. Over the last year, the stock price has increased by 114.03%. The company has beaten earning expectations for the previous three consecutive quarters.

One Year Stock Price Trend (seekingalpha.com)

PRPH is a longstanding biotech company; which had a complete strategic company overhaul in late 2009. Over the last three years, the compound annual revenue has grown by 132.07%. The company has outperformed the market to date, and the stock price is currently well below the one-year target of $15. I believe there is much more upside potential for this cheap biotech company with solid fundamentals. It has increased its top and bottom line performance year on year, grown its working capital, paid special dividends, and made strategic acquisitions for continued growth opportunities. Due to this stock being cheap, undervalued and well-performing, I believe investors may want to take a bullish stance on this company.

Introduction

PRPH was established in 1989 and originally named The Quigley Corp., after its founder, former CEO and Chairman Guy J. Quigley. It IPOd in 1991, and it was best known for its cold remedy, the over-the-counter Cold-Eeze product, which was established in 1992 and has since been sold to Mylan Pharma. In 2001, Quigley Pharma Inc. was created to focus on R&D for further drug development programs. After a tough proxy battle in 2009, the founder stepped down, and Ted Karkus has been CEO ever since. Post-2009, PRPH went through a complete strategic overhaul that pushed this biotech company into the growth phase we continue to see today. The change included a completely new corporate identity, from a research focus point to a new logo, packaging and a complete change to the board at the time.

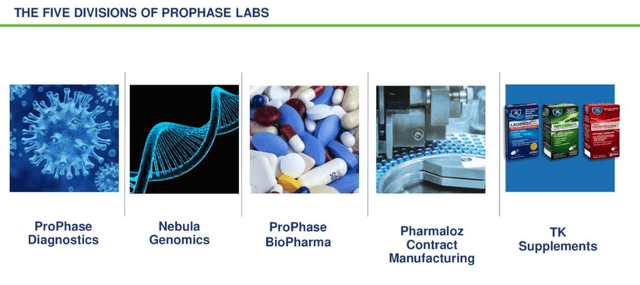

Until late 2014, PRPH had significantly high litigation costs concerning lawsuits connected to the founder and his family and the restructuring of the firm and its goals. Today, PRPH is involved in various businesses focused on genomics, biotech and diagnostics, including R&D, distribution, sales and marketing of consumer health products and dietary supplements. It has also taken on COVID-19 testing and other diagnostic processes, including cancer research.

Business Divisions at PRPH (Investor Presentation 2022)

Increasing shareholder value is a crucial aim of the company. To give you a little indication of whether the change positively impacted growth, long-term shareholders have seen returns of 782.64% over the last five years.

Company Timeline Since Proxy Battle (Investor Presentation 2022)

Financials and Valuation

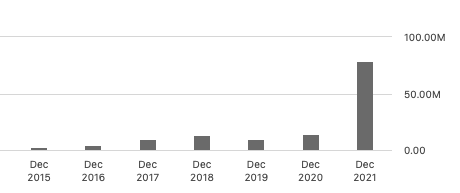

PRPH is in the growth stage of its business model, but it is already showing profitability. The company has increased its numbers year on year, grown its working capital, pays dividends and is making strategic acquisitions to increase its market share. In the graph below, we can see the incremental revenue growth over the last few years. Q2 2022 saw net revenue of $29.1 Million, an increase of 218% YoY.

Annual Revenue Results (seekingalpha.com)

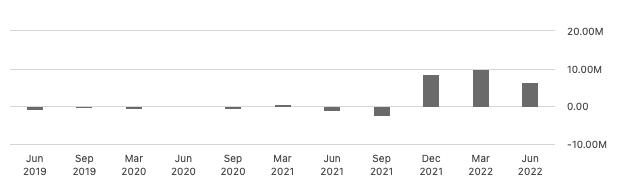

In the graph below, we can see the normalised net income by quarter. The second and third-quarter results are typically weaker due to the seasonality of off-the-counter products more frequently sold outside of the summer months. Net income for Q2 2022 was a record $7.4 million, an increase of 633% YoY.

Normalised Net Income – Quarterly (seekingalpha.com)

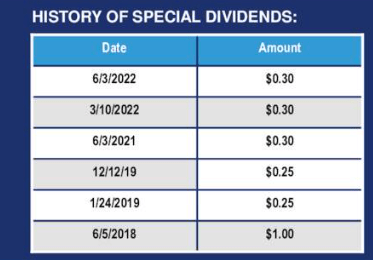

The company has a solid net working capital of $53.53 million, cash and cash equivalents, and marketable securities of $27.5 million. Its working capital is sufficient for further growth opportunities in addition to its stock repurchasing program of $6 million. Furthermore, the company also paid cash dividends of $0.30 per share last quarter. In 2021 it made its largest acquisition, Nebula Genomics, for $15 million.

Special Dividend History (Investor Presentation 2022)

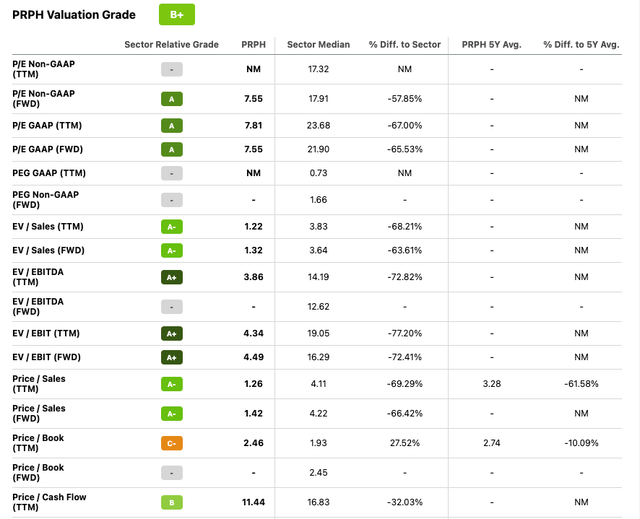

If we look at PRPH relative to the average performance in the pharmaceuticals industry and healthcare sector, by looking at Seeking Alpha’s Quant rating, we can see that the company is looking very promising and undervalued compared to its financials. It has a price-to-earnings ratio of 7.81. The sector average is more than double this.

Quant Valuation (seekingalpha.com)

Risks

The company has a seasonal performance rate. Historically the third quarter is the company’s weakest quarter regarding performance. The products and even COVID-19 testing are seasonally based on the weather, and fewer people get cold in the summer months. Furthermore, COVID-19 testing depends on regulations and school procedures regarding how many people are likely to be tested. It is said that this could increase with fewer people wearing masks in public spaces.

In the medical field, companies can benefit from certain funds and incentives. However, these can also be put on hold or terminated, which has an immediate impact on the performance of the business. HRSA funded 70% of PRPH’s business to give uninsured customers the possibility to get tested. The government had insufficient funds to continue the program, which immediately impacted the revenue potential for PRPH.

Furthermore, the company carries a certain amount of debt which could become an issue if it cannot raise sufficient capital to pay off its obligations promptly. PRPH has $16.7 million in liabilities due within the next twelve months and another $13.1 million in the next period of commitments. It has more liquid assets than its total liabilities, but it is something to be cautious of.

Final Thoughts

One of the critical issues with this stock is that it does not have much investor interest. It has rewarded its long-term investors with some impressive returns. After reviewing the financials and the valuation of ProPhase to its industry, the company is undervalued, and there seems to be remarkable upside potential in the future, especially regarding the latest acquisition. The company is diversifying its testing labs, which will further aid its research and development programs in the future. For this reason, I believe that investors may want to take a bullish stance on this cheap and small stock.

Be the first to comment