Bet_Noire

Asset-light refers to utilizing hosting partners for mining services rather than handling the mining operation directly at owned and operated sites. While I think asset-light probably makes a lot of sense when times are good, when times are bad, too many third parties theoretically add an element of risk that the vertically integrated organizations don’t have to deal with. Bit Digital (NASDAQ:BTBT) seems to be learning that the hard way.

Bit Digital

At a $90 million market cap, Bit Digital is one of the smaller Bitcoin mining companies that is listed publicly. The company uses the asset-light approach to Bitcoin mining and has location footprint in North America that includes New York, Texas, Georgia and Nebraska.

For the month of August, Bit Digital generated 145.3 BTC from its operations and claimed a crypto treasury balance of 919.2 BTC and 3,684 ETH – those crypto stacks have a current market value of $17.5 million in Bitcoin and $4.8 million in Ethereum. The company also owns 38,594 Bitcoin miners, just 29% of which have been deployed with Bit Digital’s hosting clients.

Third Party Woes

Late last week the company disclosed that Blockfusion, one of Bit Digital’s hosting partners in the New York, was served a cease and desist by the city of Niagara Falls. This cease and desist is linked to zoning requirements:

the Notice orders the cease and desist from any cryptocurrency mining or related operations at the facility until such time as Blockfusion complies with Section 1303.2.8 of the City of Niagara Falls Zoning Ordinance

According to Blockfusion, the order took effect on October 1st and an application for a renewal of the previous permit could take months:

Blockfusion has further advised that it is preparing applications for new permits based on the Ordinance’s new standards and that the permits may take several months to process. Bit Digital management continues to monitor the situation.

Given the state of New York’s potentially antagonistic approach to Bitcoin mining, it might be wise to assume Blockfusion’s application could take a considerable amount of time. The problem for Bit Digital currently is 17% of its active mining fleet is housed at Blockfusion. This is production that may be difficult to migrate to another hosting site because Blockfusion isn’t the only provider dealing with problems.

An even bigger client for Bit Digital is Compute North. Compute North recently filed for chapter 11 bankruptcy:

The bankruptcy is perhaps the biggest bitcoin mining news to emerge in 2022’s down market. Compute North provides hosting services for $700 million worth of equipment for some 84 mining entities, including publicly traded companies such as Marathon Digital Holdings.

While Compute North has claimed the bankruptcy filing won’t immediately impact operations, the reality is there is now a risk to the company’s previous agreements. This could theoretically be an opportunity for some of the larger players in the Bitcoin mining space. But in my view, any potential amendments to previous agreements may have a large impact on Bit Digital specifically. In Bit Digital’s Q2 filing, the company stated that 20 MW of its current hosting comes from Compute North with a total of 48 MW from the host provider in the future:

As of June 30, 2022, Compute North provided approximately 20 MW of capacity for our miners. Our overall expected future hosting capacity with Compute North is approximately 48 MW.

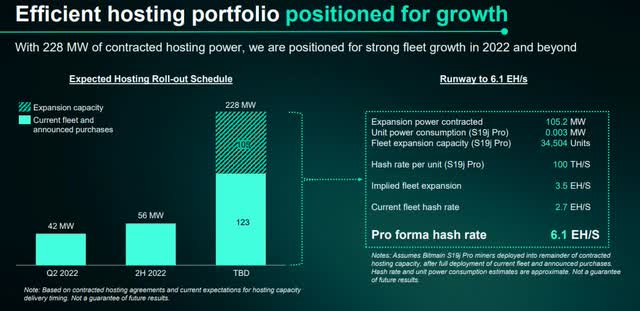

Given the 42 MW figure from Bit Digital’s current fleet and the 123 MW capacity figure that announced purchases should ultimately provide, Bit Digital is highly reliant on Compute North for its current and future mining operation.

Just under half of Bit Digital’s current fleet is energized by a company that just filed for bankruptcy and an additional 17% of Bit Digital’s non-Compute North capacity is now turned off with no real ETA for coming back online. It should probably go without saying, but this is not an advantageous position to be in and the asset-light model is getting seriously tested while the mining industry deals with the double whammy of higher energy costs and lower Bitcoin prices. For asset-light miners, we will likely see more of those energy costs passed on to host users than we did in Compute North’s previous deals.

Broad BTC mining challenges

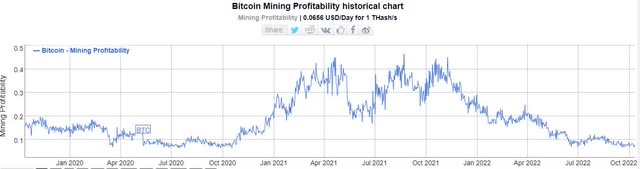

The sustainability of profitable Bitcoin mining depends entirely on higher BTC prices in perpetuity. The main reason for this is the block reward. With the block reward projected to be cut in half in 2024, miners need higher Bitcoin prices to continue operating at a profit if the cost to mine remains the same or even increases with higher electricity costs.

As it stands, miner profitability is already at 24 month lows and that figure could conceivably trend even lower if Bitcoin’s price continues to decline while hash rate rises.

New Revenue Streams

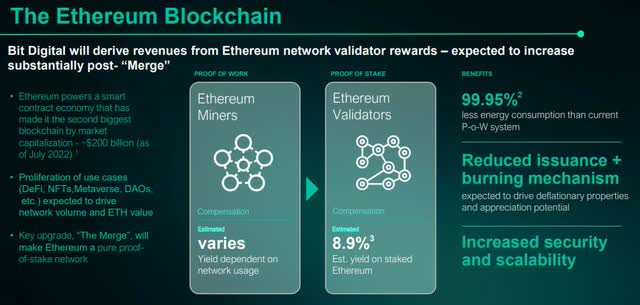

To the company’s credit, Bit Digital does seem to be aware that alternative revenue streams are necessary in an industry that is currently dealing with changes. For instance, Bit Digital didn’t mine any Ethereum (ETH-USD) in the month of August and stated in its September investor presentation that it intends to start staking Ethereum for more stable rewards.

But if Bit Digital is to shift to a model where a large percentage of its revenue comes from Ethereum staking, it will likely have to ramp up the ETH in its treasury to generate a meaningful return as a new revenue segment. I think there are other publicly listed companies that are in a better position to benefit from Ethereum’s shift to proof-of-stake consensus and I shared one of those ideas with BlockChain Reaction subscribers back in September.

Summary

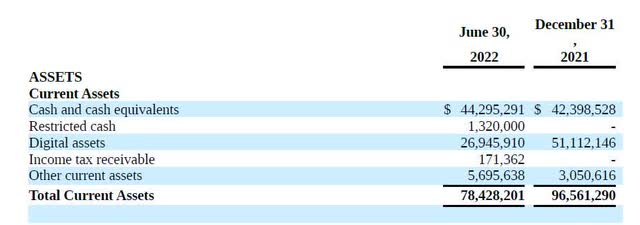

The good news for Bit Digital investors is the company doesn’t have much debt and has plenty of cash on the balance sheet to pivot its model should it decide to do so.

The company owns thousands of mining machines that have yet to be energized. Those are assets that could be liquidated or moved to a facility that can handle the capacity if there is an opportunity to do so. As I understand it, the entire point of the asset-light model is to be nimble and have optionality. This would seem to be the time Bit Digital should exercise whatever optionality it has from its assets and agreements. I don’t think Bit Digital is a “sell” down here. But I can’t call it a “buy” either. I’d want to see some clear guidance from the company in its September production update in the coming days. If Bitcoin’s price does rally, there are other publicly listed miners that will benefit more from that rise.

Be the first to comment