Scott Olson

Thesis

With an ongoing bear market many investors erroneously seem to believe that buying puts on the S&P 500 (NYSEARCA:SPY) will automatically protect them from further losses. In our opinion, they could not be more erroneous in their assumptions. Buying a put on the S&P 500 with a specific strike provides for two outright benefits:

- mark-to-market impact going forward from the bought option

- protection upon put maturity which is strike and premium dependent

The main input into options pricing is volatility. Implied volatility is already elevated creating an environment where put options on the SPY are already fairly expensive. In this article we are going to show you that the payout profile for an SPY put in the current environment is very much dependent on the velocity of the losses rather than just purely on how much the market will sell-off.

For the purposes of our analysis and the article we are going to use a December 30th, $360 strike put option on the SPY that is priced at $10.56 per contract as of the writing of this article. Under the current pricing environment, the option needs the SPY to be below $349.44 (-10.9% below spot levels) to offer an investor any benefit upon maturity. Similarly, from a mark-to-market perspective, the option needs a significant (-6% or more) market sell-off now in September/October to offer an investor any portfolio protection. A slow SPY grind down that does not result in a price lower than $350 upon maturity is a scenario where an investor would get no advantage whatsoever from buying the option.

Where is the pricing now

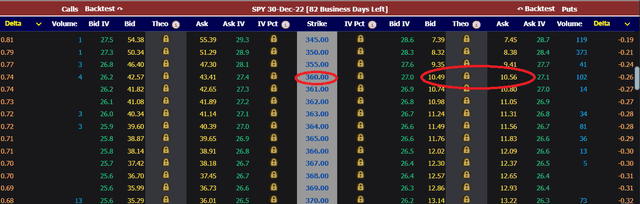

Courtesy of Market Chameleon, let us have a look at where the market is now for December 30th put options on the SPY:

Options Pricing (Market Chameleon)

For our analysis we are going to use the $360 strike December 30th put option on the SPY. We can see that the bid/ask is 10.49/10.56 so we are going to use 10.56 for our analysis.

Mark-to-market simulation

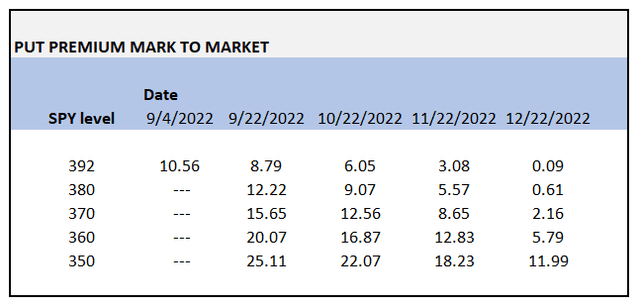

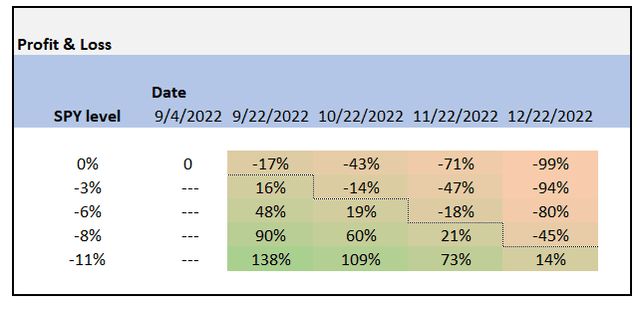

What we are going to do is assume an investor buys the above put and then run scenario analysis to see how the option performs from a mark-to-market / profit & loss perspective. The analysis is run utilizing a binomial options pricing methodology:

Table 1 (Put Premiums) (Author) Table 2 (Option P&L) (Author)

What we have done in the above tables is simulate the option price under different market scenarios and time scenarios. For example, Table 1 shows the premium for said option at different SPY price levels. If we look on the first row of the table, we can see the option premium as of now (i.e. 10.56) and next what the option would be worth at the end of September if SPY remained at current levels (i.e. 392). We can see that in this scenario the option would be worth less at the end of September. Table 2 summarizes the profit & loss under the various scenarios. For the September 392 market level, we can see the option loses -1.77 in premium.

Similarly, if we look at a SPY market level of 370 to be achieved say end of October (10/22/2022 in our table), we can see that the option premium would be 12.56, hence the profit would be around $2/contract. We can see here that in order for an investor to make money from buying this put they would need SPY to go below 380 by the end of October, otherwise there is no gain to be had. Similarly, if the SPY goes to 370 and stays there, the investor will actually start losing money come end of November. A better visual representation of the Profit & Loss table is below:

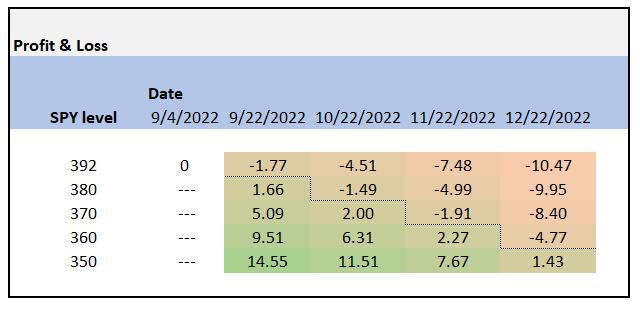

A couple of major takeaways from the above table are:

- with the current pricing on the December $360 strike put an investor needs a front ended steep sell-off in order to make money

- if the SPY price is not lower by more than -6% by the end of November, the investor is loosing money

- most gains are realized if the market sell-off by -10% or more in September or October

- if the market is slow to lose value an investor needs at least a -8% loss in the SPY for the option to make money

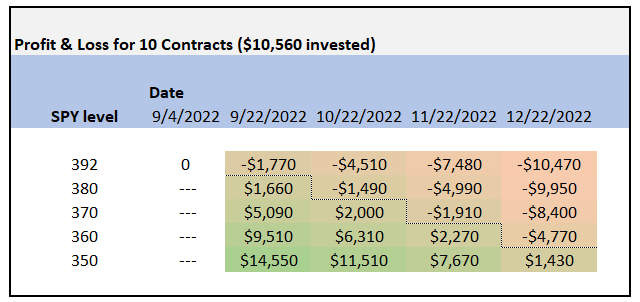

To simplify the visual representation of the outcome let us assume an investor buys 10 contracts of the Dec 30th $360 strike put:

Table 4 (P&L 10 contracts) (Author)

On day 1, the value of the transaction is $10,560 ($10.56 x 10 x 100) and that is the maximum loss an investor can sustain. We can clearly see that most of the gains are in the lower left side of the quadrant, which equates to a steep market sell-off in September/October. The worst outcome is a slow grind lower, which actually results in the put option generating losses for the investor (i.e. you would be better off from a portfolio perspective but just not buying the option).

Conclusion

Buying a put option on the S&P 500 index does not provide for a linear portfolio protection. In today’s elevated volatility pricing environment, a December 30th $360 strike put option on the SPY will only help an investor’s portfolio if the market experiences steep (-6% or more) front loaded loses. A slow grind down in the index that does not result in a price lower than $350 for the SPY upon maturity creates a scenario where the analyzed option does not provide for any benefit to a portfolio and could actually add mark-to-market loses and volatility.

Be the first to comment