Torsten Asmus/iStock via Getty Images

Inflation & The European Central Bank (ECB) Rate Hike

Considered a ‘catch-up play’ that resulted in the biggest rate hike in the European Central Bank’s history, economists call the 75-basis point hike an unprecedented move that may spell trouble. But go big or go home! Will the hawkish move curb inflation, or will it result in stagflation or recession – if not already in a recession?

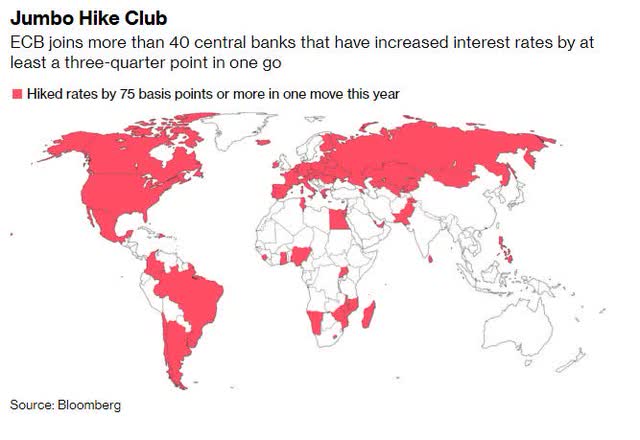

Forty central banks around the globe have increased rates over the last year, and as Russia’s stronghold on Ukraine persists, threats to cut off energy supplies may lead to a frigid winter in Europe.

Central Banks Rate Hikes (Bloomberg)

Like critics regarding Powell’s handling of U.S. inflation, runaway inflation has people questioning why the ECB waited so long to act when inflation in the Eurozone jumped to a whopping 9.1% in August. As the Euro reels from high interest and inflationary effects, the currency is plunging as the U.S. dollar gains.

Despite the ECB’s jumbo-sized hike, the STOXX Europe 600 Index (STOXX) closed up 0.5% following the announcement as investors weighed the future of interest hikes and the fall in currencies.

Eurozone Inflation Jump to 9.1% (Eurostat & Bloomberg)

U.S. Dollar Gains as Euro and Pound Fall

The US economy is slowing, but not at the same pace as other countries. And with the US Federal Reserve’s foot on the accelerator, this may bode well for the US dollar and bad for foreign currencies. As nations around the globe give way to multiple rate hikes and the markets prepare for hawkish measures, with impending slowdowns across economies, now is not the best time to invest in currencies.

The Euro and British Pound (GBP) is getting pounded, with the GBP falling 15% against the USD and the Euro dropping to a 20-year low. These circumstances and market volatility have prompted many investors to go to cash. Although I am a proponent of keeping some powder dry – and I mean U.S. dollar-denominated currency – given the slide in currencies around the globe, the USD is rallying.

Following a March interview with renowned Wall Street investor George Ball, I wrote:

“Raise Cash: According to Ball, cash is the ultimate king when markets are volatile, and this environment is a prime opportunity for investors to raise cash. An investor who usually holds 5% of their portfolio in cash, with the remaining in stocks and bonds, should consider increasing their cash position to 10%-20% of their portfolio, with the remainder divided in the normal 60/40 allocation between stocks and bonds.”

Where energy and utilities are at the forefront of discussions, I have highlighted two U.S. stock picks in the utility sector. “Troubling” factors abroad can affect investments, and with foreign equities down more than U.S. equities, it’s natural to be enticed to invest abroad. However, as we look at the backdrop of Europe and the UK with declining currencies, soaring inflation, particularly dire energy circumstances, and cost of living, the U.S. has similar concerns of a lesser magnitude. For these reasons, I’m highlighting U.S. stocks that are quant-ranked strong buys, which typically serve as a defense and offer recession-resilient characteristics.

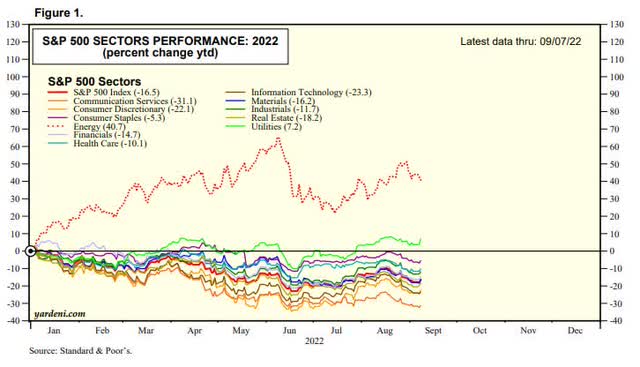

Energy Stocks Are Still Crushing YTD Performance

Many companies are beaten down this year. Earnings misses are pushing stocks lower, causing rallies to massive selloffs. Meanwhile, energy continues to be the top performing sector with XLE +41.08% YTD, which is also why several of my Alpha Picks are within the sector as the best of Seeking Alpha’s Quant model.

S&P 500 YTD Sectors Performance (Yardeni Research/Standard & Poor’s)

Considering the performance above, energy and utilities have maintained a stronghold amid underwhelming earnings. For these reasons, I’ve chosen three stocks: two utility companies, one of which engages in energy exploration, and a unique industrial company.

1. NRG Energy, Inc. (NYSE:NYSE:NRG)

- Market Capitalization: $9.59B

- Dividend Yield (FWD): 3.36%

- Quant Sector Ranking (as of 9/8): 3 out of 103

- Quant Industry Ranking (as of 9/8): 1 out of 40

Inflation continues to run hot globally, so finding recession-resilient stocks, especially those that offer attractive yields and solid dividends for a steady income stream, can come in handy. As I wrote in a June article titled 3 Recession-Resilient Dividend Stocks, NRG is not only a top-value stock, but it also offers growth prospects.

On a longer-term bullish trend, NRG Energy Inc. and its subsidiaries deliver electricity using natural gas, fossil fuels, solar, and related products and services to nearly six million customers. Because utility companies offer heat, air conditioning, and light that are considered necessities, it goes without saying that this stock may be perceived as an inflation hedge, and we rate it a strong buy.

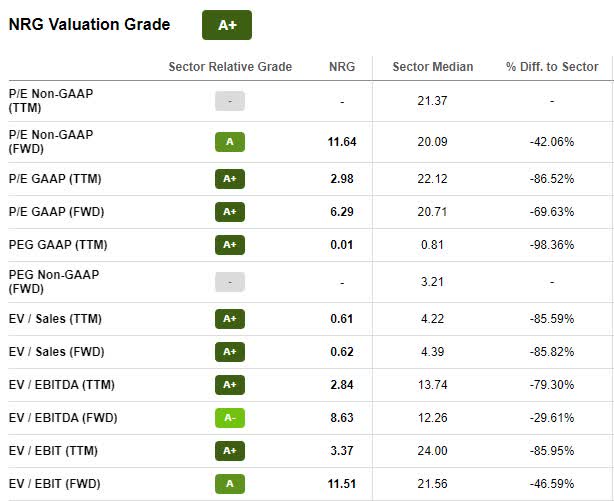

NRG Valuation And Momentum

NRG comes at a significantly discounted valuation, trading below $45 per share. As utility costs continue to rise, energy companies pass price increases onto consumers, who are forced to absorb and pay. This stock’s upward trend makes it a significant consideration for a portfolio.

Possessing a forward P/E ratio of 6.29x, 69.63% below its sector, and an A+ PEG (TTM) ratio, NRG is severely undervalued.

NRG Stock Valuation Grade (Seeking Alpha Premium)

NRG is -6.60% over the last year, so buying a slight dip while also considering its discounted value may make this stock a worthwhile pick for your portfolio. NRG has continued upward momentum and outperforms its sector peers’ six- and nine-month quarterly price performance. With the Fed indicating that rates will continue to rise and NRG’s $3.625 acquisition of Direct Energy, the company is poised for growth and profitability.

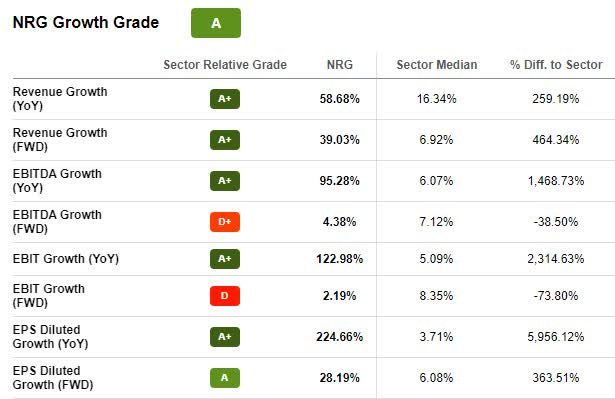

NRG Growth And Profitability

NRG is a defensive, lower-volatility investment with income production. Taking advantage of strong energy demand in Texas and increasing prices throughout the nation, NRG supplies more than 3.7 million customers with energy. NRG is one of the largest independent power suppliers in the United States. With renewable energy goals on the horizon, NRG signed renewable Power Purchase Agreements (PPAs) to serve geographically diverse Texas areas.

NRG Growth (Seeking Alpha Premium)

Cash flow and NRG’s overall financials look great. Despite some headwinds that included lower power volumes and a $298 million decrease in adjusted EBITDA due to outages from Winter Storm Uri, guidance remains strong. NRG recently reported 2022 Q2 EPS of $2.16 and revenue of $7.28B (+38.9% Y/Y).

“We continue to navigate through volatile market conditions and are increasing our capital available for allocation by $140 million. We continue to make good progress in achieving our strategic growth priorities, particularly on direct energy integration. And finally, our share repurchase program continues with approximately $600 million in remaining capacity to be executed this year.” – Mauricio Gutierrez, NRG President & CEO.

Cash from operations remains strong, sitting at $3.3B, and with an overall A profitability grade, shareholders should feel at ease with the company’s solid dividend scorecard and growth attractiveness.

NRG Dividends

NRG has performed well by transforming its business through improving its credit profile, selling its Northeast power generation fleet, and closing Midwest plants which allowed it to cut costs and improve its balance sheet. During periods of extreme market fluctuation, utilities like NRG can offer a steady income stream. NRG uses its cash for dividend payouts and stock buybacks through the abovementioned measures.

With a 3.31% dividend yield and nine consecutive years of dividend payments, shareholders can feel confident that NRG plans to continue its trajectory and consistently pay out a dividend.

NRG Dividend Scorecard (Seeking Alpha Premium)

The goal for investors is to make money. Given NRG’s lower perceived volatility while continuing to offer income in a down market, I believe the right sectors and industries will achieve the desired income stream. In addition to NRG, my next utility pick is also one to watch.

2. National Fuel Gas Company (NYSE:NYSE:NFG)

- Market Capitalization: $6.41B

- Dividend Yield (FWD): 2.68%

- Quant Sector Ranking (as of 9/8): 7 out of 103

- Quant Industry Ranking (as of 9/8): 1 out of 13

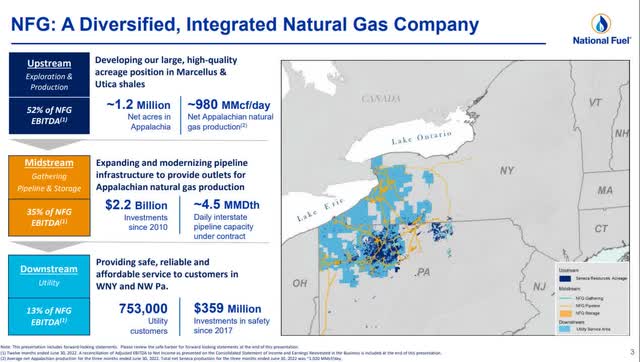

Dividend King, National Fuel Gas Company (NFG) operates a diversified energy business through three segments: Upstream exploration & production, Midstream gathering, pipeline and storage, and Downstream utility.

NFG Company Divisions Overview (NFG 2022 Q3 Investor Presentation)

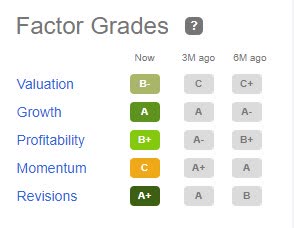

I wrote about NFG in June as a Top Utility Stock to Buy because it offers a steady stream of dividend income to help offset increasing utility bills. Like NRG, NFG is a dividend-paying utility stock, which tends to be defensive, and whether some of the market fluctuations result from investor fear, inflation, and interest rate hikes. Offering solid factor grades that rate investment characteristics on a sector relative basis, NFG’s below Valuation grade indicates the stock comes at a relative discount. With a forward P/E ratio of 12.56x, a nearly 40% difference to the sector, and a -72.53% forward PEG differential, NFG is undervalued.

NFG Factor Grades (Seeking Alpha Premium)

NRG also offers solid Growth the Profitability potential, showcasing an A+ Earnings Revision grade and B+ Profitability grade, making NFG one of the most profitable companies in its sector.

NFG Growth And Profitability

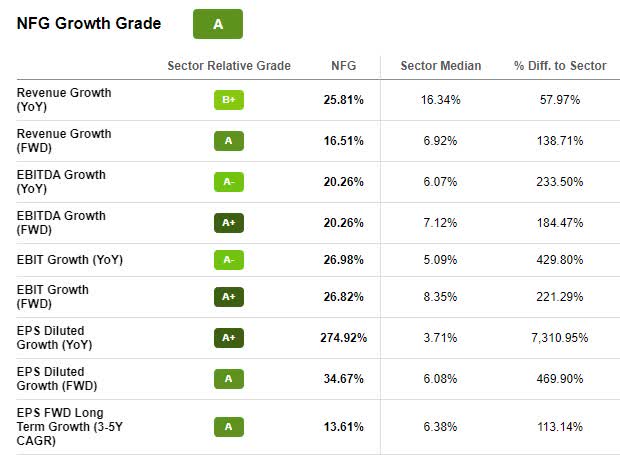

Like many energy and utility companies, NRG has been on an uptrend. Year-to-date, the stock is +11.34%, and over the past year, +36.60%. Despite revenue of $502.62M missing by $38.66M, EPS of $1.54 beat by $0.11, and analysts remain optimistic as there were four FY1 Up revisions within the last 90 days. Geopolitical issues abroad have benefited this company as skyrocketing prices have advanced NFG’s growth prospects, contributing to a 60% increase in adjusted EBITDA and higher production, up 16% over the last year, with the executive team’s forward outlook for the business continuing to improve.

NFG Growth Grade (Seeking Alpha Premium)

The $280M cash sale and $30M contingent of NFG’s Sentinel Peak operations in California should prove very beneficial, given California’s continued power grid issues and the challenging regulatory environment. Through the Sentinel Peak sale, NFG has been strategic in its operations to ensure operational and financial success and to add to its already solid balance sheet to contribute to its consistent dividend payout.

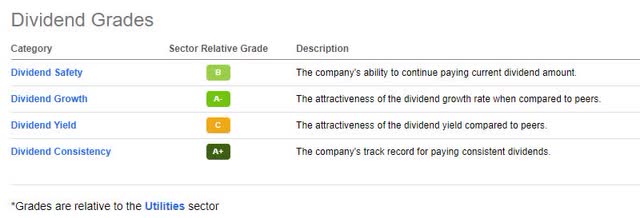

NFG Dividends

After paying a dividend for a consecutive 119 years, it doubled its rate of increase to its dividend in June. Declaring a $0.475/quarterly share dividend and a forward dividend yield of 2.70%, this stock’s dividend growth streak is beyond impressive.

NFG Dividend Scorecard (Seeking Alpha Premium)

Income-oriented investors want a steady stream of consistent payouts to help offset inflationary concerns. Look no further! NFG, along with the next strong buy, has excellent fundamentals and makes for a great portfolio consideration.

3. C.H. Robinson Worldwide, Inc. (NASDAQ:NASDAQ:CHRW)

- Market Capitalization: $13.99B

- Dividend Yield (FWD): 1.93%

- Quant Sector Ranking (as of 9/8): 17 out of 616

- Quant Industry Ranking (as of 9/8): 1 out of 14

C.H. Robinson Worldwide, Inc. (CHRW) is a unique pick because I would not usually select an industrial stock in the current environment. Still, this pick is a long-term investment consideration, despite a possible contraction amid inflation and rate hikes exacerbated by geopolitical factors. However, no risk, no reward, and CHRW dominates the unique air freight and logistics industry, a +$80B asset-light highway brokerage market, as the largest third-party logistics provider in the United States.

With its subsidiaries, CHRW offers freight and transportation services worldwide as a leader in shipping and logistics. Trading at a relative discount with bullish momentum, investors are beginning to purchase shares of this stock, increasing its value and contributing to its longer-term uptrend.

CHRW Stock Momentum (Seeking Alpha Premium)

Year-to-date, CHRW is +6.13%, but over the last year, is up 31.14%. The stock trades at $114 per share and possesses an A- Momentum grade. Looking at the table above, CHRW outperforms sector peers quarterly. Not only is the company’s price performance steadily increasing, but it has also capitalized on the need for shipping and logistics around the world, beating top and bottom-line results.

CHRW Growth & Profitability

Strong 2022 Q2 results led to record profits, despite an increase in transportation and fuel costs. EPS of $2.67 beat by $0.68, and revenue of $6.80B beat by 22.88% Y/Y. CHRW managed to retain and gain share with customers through organic growth and terms via agreements.

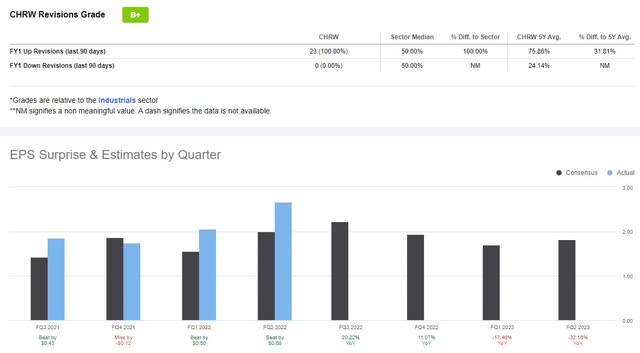

CHRW Revisions & EPS (Seeking Alpha Premium)

CHRW maintains a strong balance sheet with nearly $1.1B of liquidity, and Q2 results were positive, with 23 analysts revising up in the last 90 days. CHRW is focused on cutting costs that led to an $8.5m reduction compared to Q2 of 2021.

“Q2 net income was $348.2 million, up 80% compared to Q2 last year, and we delivered record quarterly diluted earnings per share of $2.67, up 85% year-over-year. As a reminder, our Q2 net income included the $25.3 million gain from the sale and leaseback of our Kansas City Regional Center and a $10.3 million loss on foreign currency revaluation. Turning to cash flow. Q2 cash flow generated by operations was approximately $265 million compared to $149 million in Q2 of 2021. The $116 million year-over-year improvement was primarily due to the $154 million increase in net income” – Mike Zechmeister, CFO.

CHRW’s track record of dividend growth, dividend safety, and dividend consistency are stellar. Although their debt balance is up $901M from the previous year, this results from working capital and share repurchases. The company returned nearly $409M to shareholders, which included $337 share repurchases and $72M in dividends, showcasing its commitment to shareholders. Let us review the dividend grades below.

CHRW Dividends

CH Robinson has paid a consecutive dividend for 15 years. Although its forward dividend yield is only 1.94%, as you can see below, its overall dividend scorecard is stellar, offering an A dividend safety grade, which indicates a company’s ability to continue paying dividends.

CHRW Dividend Scorecard (Seeking Alpha Premium)

As expressed above, income-oriented investors want steady payouts to offset the hit they may be experiencing from other investments and to hedge against inflation. CHRW, along with NRG and NFG, are quant-rated strong buys with excellent fundamentals and makes for a great consideration in portfolios.

Conclusion

Utility stocks like NRG and NFG have thrived in the current environment and are attractive on value, growth, and profitability metrics. Both possess strong forward revenue growth, with NRG at 39.03%, NFG at 16.51%, and strong gross profit margins while trading at discounts. With energy at the forefront of cost of living concerns and rising prices, NRG and NFG can pass off costs to consumers and should maintain a steady volume of consumer demand.

CHRW’s forward revenue growth is 12.40%, 16.12% forward EBITDA growth, and all three stocks have solid dividend scorecards. I selected these three stocks as potential beneficiaries from tailwinds that include consumer necessity. Even if there are some economic declines, price competition, and factoring in macro headwinds, many investors are dedicated to putting their money to work by finding discounted stocks that trade at lower prices relative to fundamentals. My three stock picks offer a hedge against inflation while providing growth opportunities. If you’re interested in other value or growth stocks, search our Top Value Stocks or Top Growth Stocks for ideas. Our tools help ensure your portfolio contains strong investments that increase over time.

Be the first to comment