wx-bradwang/iStock via Getty Images

Utility companies deserve a special place in most income investors’ portfolios, for their durable income streams even when it seems the economy is falling apart. It’s important, however, to not overpay for these names, as that could negate years of accumulated dividends.

This brings me to WEC Energy Group (NYSE:NYSE:WEC), which is one such utility that I believe deserves a place in a well-rounded dividend portfolio. WEC has performed admirably since I last visited the stock a year and half ago, giving investors a 29% total return over this time period, far surpassing the 4.5% return of the S&P 500 (SPY). This article evaluates the merits of owning WEC and at what price point the stock begins to look attractive, so let’s get started.

Why WEC?

WEC Energy Group is a leading Midwest electric and natural gas utility serving 4.6 million customers in Wisconsin, Illinois, Michigan, and Minnesota. It’s headquartered in Milwaukee, Wisconsin, and 70K miles of electric distribution and transmission lines, with $39.6 billion in assets. Over the trailing 12 months, WEC generated $8.98 billion in total revenue.

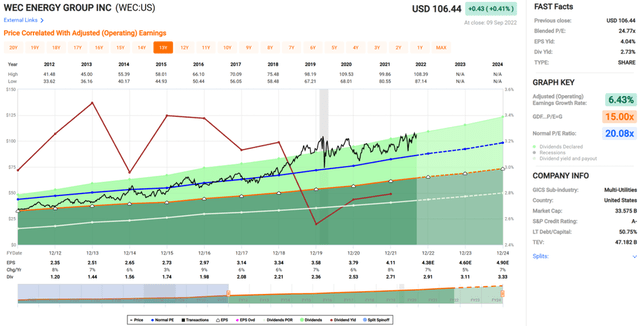

What makes WEC stand out is its impressive track record of consistent EPS growth, with a 9% CAGR going all the way back to 2004. It’s also the only utility to beat analyst guidance every year for 18 years running. This consistent outperformance has resulted in one of the best shareholder returns in the utility segment. As shown below, WEC produced a 292% total return over the past 10 years, far outpacing the 237% return of the S&P 500 over the same timeframe.

WEC Total Return (Seeking Alpha)

Meanwhile, WEC has continued to demonstrate growth, generating EPS of 91 cents per share in the second quarter, up from 87 cents in the prior year period. This was driven by elevated electric consumption due to warmer than average temperatures, and solid results from WEC’s infrastructure segment and execution of its capital plan.

Moreover, WEC is moving forward with robust investments totaling $17.7 billion across its ESG projects, which aims to generate sustainable returns over the long run through affordable, reliable, and clean energy. This includes the management expectation that WEC will use coal only as a backup fuel by 2030 with a complete exit by 2035, and an 80% reduction in carbon emissions by the end of this decade and net zero emissions by mid-century.

Looking forward, I see a continued favorable landscape for WEC, as Wisconsin, its primary state of operations, shows a very low 2.9% unemployment rate, sitting below the national average. Furthermore, increased vehicle electrification will result in increased demand for WEC’s electric generation and delivery. This is supported by GM (GM) recently announcing the availability of its all-electric Chevy Equinox by fall of next year with an attractive $30,000 price point, as the firm seeks to produce mass produce this affordable model.

In addition, a number of companies are attracted to the state for its ample land and workforce, and are expanding their operations there, as noted by management during the recent conference call:

We continue to see major investments from growing companies in our region. For example, Gulfstream Aerospace is expanding its operations at the Appleton Airport. That’s in Wisconsin’s Fox Valley, southwest of Green Bay. The company is planning to build a world-class facility for painting and finishing aircraft exteriors. This expansion is expected to open in the third quarter of 2023 and it could add 200 new jobs to Gulfstream’s existing workforce in Wisconsin.

And just last month, Komatsu Mining celebrated the official grand opening of its new headquarters here in Milwaukee. The campus is already hosting about 600 employees. It includes offices, a training center and state-of-the-art manufacturing space to build heavy mining equipment.

During the second quarter, groundbreaking also took place for a major expansion of the Georgia-Pacific paper mill in Green Bay. Georgia-Pacific is investing $500 million in its new facility which is expected to bring about 100 new jobs to the region. So with a wide range of developments in the pipeline, we remain very optimistic about the long-term future of the regional economy.

Meanwhile, WEC sports a strong A- rated balance sheet and this lends support to its healthy 2.7% dividend yield, which remains well-covered by a 65% payout ratio. WEC has a 5-year dividend CAGR of 6.8% and 18 years of consecutive raises.

It appears, however, that the market is enthused about the enterprise at the current price of $106 with a forward PE ratio of 24.3, sitting above the stock’s normal PE of 20.1 over the past 10 years. Given the relative overvaluation, I would recommend waiting for at least a 10% pullback before buying the stock. I don’t believe this to be out of the question, as WEC did see a pullback to the low $90s in mid-June, amidst general market volatility.

Investor Takeaway

In summary, WEC is one of the top names in the utility segment for earnings growth and shareholder returns. It has a clear ESG focus and is well-positioned to benefit from the continued electrification of the economy and expansion from business customers.

The company has a strong balance sheet and strong dividend growth history. However, the stock looks somewhat pricey at current levels. As such, I would recommend income investors to put this stock on their radar for potential entry on a pullback.

Be the first to comment