NicolasMcComber/E+ via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

I suspect that more investors are aware of Covered Call (CC) strategies, where investors own the underlying stock and write a Call option against some or all of their position to mostly enhance their income. Some Cash Secured Put (CSP) writers employ a CC strategy after being assigned as a means of exiting their position. In both cases, the writer is trading potential future capital gains for current income. Like others, my CSPs are done to enhance the return on the cash I want to hold.

While there are plenty of choices for investors wanting a fund to execute a Covered Call strategy for them, the WisdomTree CBOE S&P 500 PutWrite Strategy ETF (NYSEARCA:NYSEARCA:PUTW) is the only ETF I know of that executes a “pure” CSP one. Other ETFs might use Puts either as a buyer or limited seller, but that is usually only a part of the overall strategy of the fund.

This article addresses the question: For investors not wanting to execute their own CSP strategy, is PUTW a good substitute? Of course, the answer isn’t that simple since as it would depend on how an investor executes their CSP strategy. As will be explained, I use what I consider a conservative one.

For investors comfortable writing their Put options, DIY has advantages over PUTW. For others, not sure the ETF provides value to most investing goals.

Understanding the WisdomTree CBOE S&P 500 PutWrite Strategy ETF

Seeking Alpha describes this ETF as:

The investment seeks to track the price and yield performance, before fees and expenses, of the CBOE S&P 500 PutWrite Index (the “index”). Under normal circumstances, at least 80% of the fund’s total assets will be invested in component securities of the index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities. The index tracks the value of a cash-secured put option sales strategy, which consists of selling (or “writing”) S&P 500 Index put options (“SPX Puts”) and investing the sale proceeds in one- and three-month Treasury bills. PUTW started on 2/24/2016.

Source: seekingalpha.com PUTW

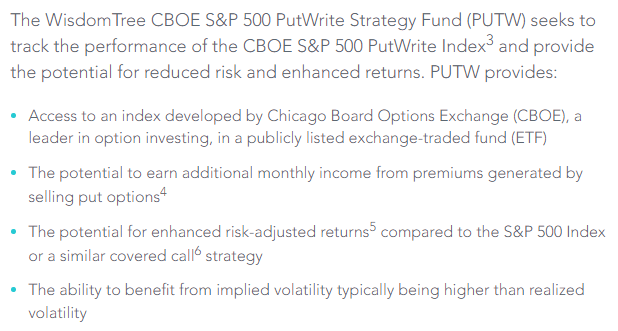

PUTW lists AUM being around $100m, reasonable but not large. The managers charge 44bps to investors. That would be compared to an investor’s trading costs. I estimate that for my CSP activity to be under 5bps. PUTW is very erratic in providing income to investor, with the last distribution being in 2020. WisdomTree provides these benefits of own their ETF:

wisdomtree.com PUTW

While the first point is obviously true, I will attempt to evaluate the other three listed benefits, but I start with explaining the index used. CBOE describes their Index as:

The Cboe S&P 500 PutWrite IndexSM (PUT) tracks the value of a hypothetical portfolio of securities (PUT portfolio) that yields a buffered exposure to S&P 500 stock returns. The PUT portfolio is composed of one- and three-month Treasury bills and of a short position in at-the-money put options on the S&P 500 index (SPX puts). The number of puts sold is selected to ensure that the value of the portfolio does not become negative when the portfolio is rebalanced.

The PUT portfolio is rebalanced monthly, typically on the third Friday of the month when SPX options expire. A new number of SPX puts is then sold.

Source: cboe.com Index

CBOE has posted a Methodology PDF on how the Index works. I summarized the key points:

- Roll Date Transactions: At each roll date, any settlement loss from the expiring SPX puts is financed by the Treasury bill accounts and a new batch of at-the-money SPX puts is sold. The revenue from their sale is added to the Treasury bill account.

- Number of SPX Puts Sold: The number of SPX puts sold is chosen to ensure full collateralization. This means that at the expiration of the puts, the total value of the Treasury bill investment(s) must be equal to the maximum possible loss from final settlement of the put options

- Selection of the “At-the-Money” Strike Price: The strike price of the new SPX puts that are sold is the strike price of listed SPX puts that is closest to but not greater than the last value of the S&P 500 Index reported before 11:00 a.m. ET.

- Sale Price of Put Options: The SPX puts are deemed to be sold at a price equal to the volume-weighted average of the traded prices (“VWAP”) of put options with that strike during the half-hour period beginning at 11:30 a.m. ET.

- Final Settlement Price of Expiring SPX Puts: At expiration, the SPX puts are settled to a Special Opening Quotation (or SOQ, ticker “SET”) of the S&P 500.4 The SOQ is a special calculation of the S&P 500 Index that is compiled from the opening prices of component stocks underlying the S&P 500 Index.

PUTW holdings review

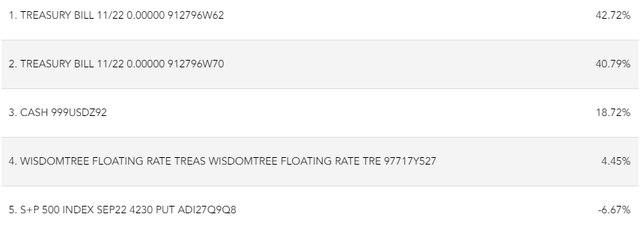

PUTW uses European, not American style options. What that means is the options cannot be assigned against PUTW until expiration day.

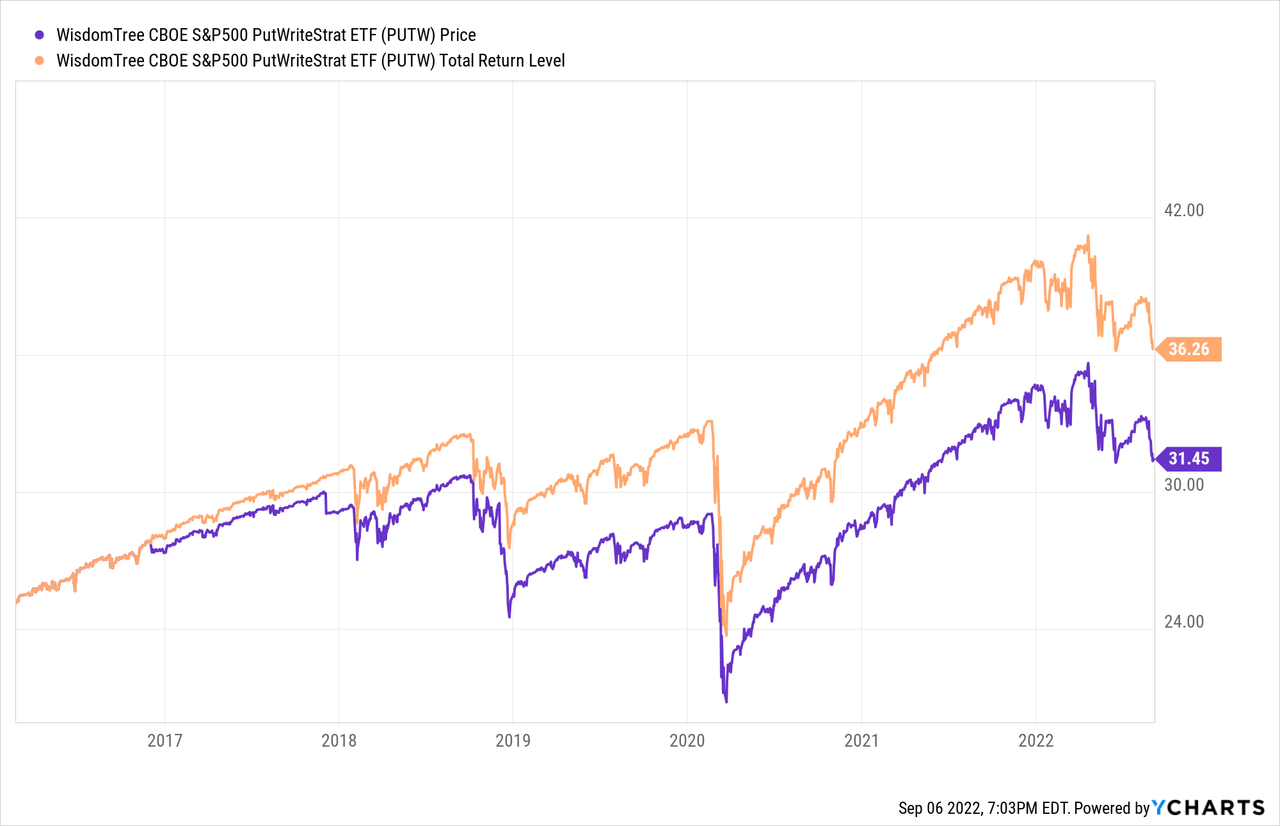

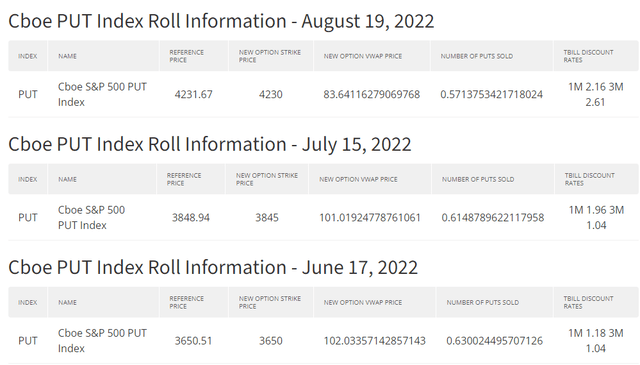

The top holding is a 182-day T-bill issued 5/19/22 and expiring 11/17/22, yielding 1.522%. The second T-bill was issued a week later with a coupon of 1.56%, maturing 11/25/22. The WisdomTree fund currently yields .6%. As policy states, and shown next in the Roll data, the Puts are written ATM.

Notice how the market has rallied since June, forcing PUTW to use higher strikes. Such periods should mean the Puts expire OTM and PUTW pockets 100% of the premiums written. Declining markets should result in Puts closing ITM, with the ETF possibly suffering a loss.

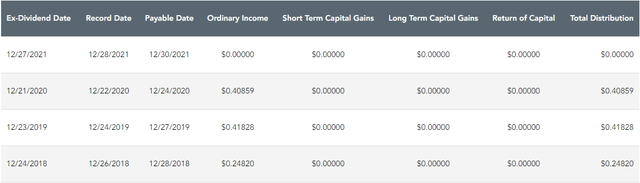

PUTW distribution review

The monthly income from premiums was obviously referring to PUTW itself, not investors who have only see payouts toward the end of most years.

Evaluating PUTW strategy

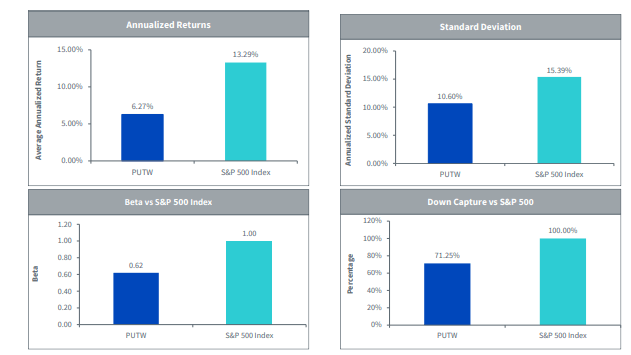

WisdomTree compares PUTW against the S&P 500 Index since those are the options used. The data is from inception until 6/30/22.

wisdomtree.com Strategy PDF

The charts show that PUTW generated under 50% of the CAGR that the S&P 500 Index did. The ETF did achieve its goal of reduced Beta, StdDev, and less downside exposure. That said, Point #3’s goal was enhance risk/reward and based on both Sharpe and Sortino data, they failed there.

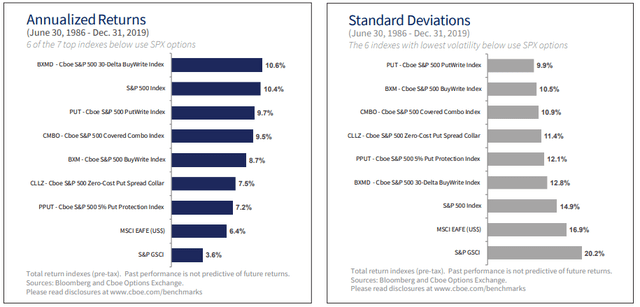

With PUTW itself starting in 2016, I did find some data with more history. The first cover 1986-2019.

Using this data, the PutWrite strategy placed 3rd in CAGR and 1st with the best StdDev; these during a period when the S&P Index was up over 10% annually. Using data provided by CBOE, from 2007 until the end of August’22, the strategy only returned 5.7% annually. The S&P 500 Index returned 8.6% during that time frame.

Short review of my strategy and results

I started executing a CSP strategy again once I retired in 2019 from a job that barred that activity. Since then, I have started writing quarterly articles on what I did, why, and how I did. I have also covered possible tactics for CSP investors:

The above can provide a good background on my approach, but these points summarize it well:

- I use cash I want to hold to cover my trades; never on margin.

- My target is to clear 6-9% using this strategy. My other assets provide growth to my portfolio.

- 8 write 10-15% OTM strikes, usually 2-3 months out, where most probabilities of being assigned are under 20%. Actual assigned trades were less, even 0% most quarters. I have started closing early and rolling more. I will write tight Covered Calls if assigned and not too much ITM hit.

- I trade the same stocks over and over, reducing the research time needed.

- Unlike some of my readers who have 50+ open positions, having 10-20 open positions at one time is my usual level.

- Most of my trading is in tax-deferred accounts.

As expected, better markets result in better results. I imagine each CSP investor calculated their CAGR differently. While I calculate each trade separately, I simplified it for my quarterly reports to Premiums earned*4/Cash a held for the strategy, regardless if invested. It gets more tricky if I am holding stocks where I wrote Calls against. Using only the CSPs, regardless of assignment or not, my premiums earned are about $67,000 over the last three years, which would mean about a 9% ROI. While my XLS records aren’t perfect, out of my 210 Put trades, assignments were under 20, most then exited at a profit. There are some underwater assignments from 2022Q2 still open.

PUTW versus DIY

There are some critical differences between PUTZ and my DIY strategy should explain why my estimated CAGR far exceeds the 5% CAGR the ETF generated over the same time.

- With the S&P 500 Index down in almost half the months, and only two times with extended drops, using deep OTMs would have experience less losses, though lower premiums in some cases.

- Indices generally have lower volatility than most of the stocks I used. That would offset some of the premium decrease I earned by using OTM strikes.

- PUTW is 100% invested 100% of the time, I wasn’t. That would affect results, both good or bad.

- PUTW only uses 1-month European-style Puts. I use American-style Puts of varying length. If done right, that should favor a DIY strategy, as could not being 100% invested at times.

Portfolio strategy

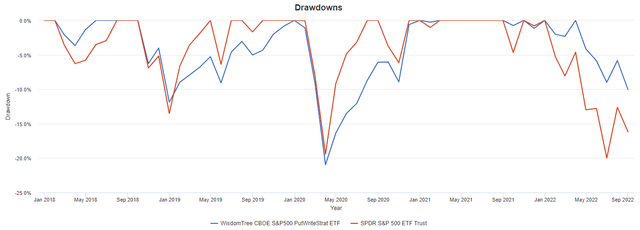

One reason to use 10% OTM strikes within a CSP strategy is to avoid losses when the market collapses as it did because of COVID and again this past spring. The sharper the fall, the less PUTW showed the ability to offset those declines as shown next.

I see these as the pros/cons of investors executing their own CSP strategy, pretty much independent of how they choose to do it.

Pros:

- Income on a timetable set by the investor. With weekly options available, there is great flexibility here. Recently I reviewed using CSPs in place of CDs: Using Cash Secured Puts, Not CDs

- Ability to pick the risk level desired and the ability to change as the market moves. By employing a Probability Calculator, one can pick the strike price based on that data.

- Greater flexibility to the amount of CSP exposure you want. With an ETF, you would need to by buying/selling shares to accomplish that.

Cons:

- If done in a taxable account, each trade has the potential to generate a taxable event. With an ETF, only distributions and selling the ETF do.

- No control over when payout will occur, if ever.

- Takes more time as each trade needs to be researched, executed, and monitored. Good option writers never but & forget as rolling or closing out need to be considered.

- Other option strategy ETFs might better meet the needs of investor. Most Covered Call ETFs provide high levels of steady income.

Final thoughts

I did not try to explain the 4th point about Implied versus Realized Volatility but suggest interested investors read PUTW: Monetizing The S&P 500 Implied Volatility to gain some understanding on that topic.

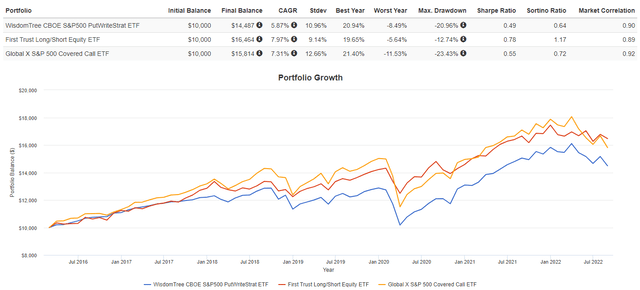

For investors who expected/wanted PUTW to provide income, I suggest researching Global X S&P 500 Covered Call ETF (XYLD). For those who were interested in the low StdDev feature of PUTW, a long/short equity ETF like the First Trust Long/Short Equity ETF (FTLS) might fill the bill.

In another case of good timing, Binary Tree Analytics just published SPY: If You Think Buying Puts Will Protect You, Think Again. While it centers on why Put buying fails to protect, the concept helps explain why PUTW hasn’t done as well as desired.

Be the first to comment