Hispanolistic/E+ via Getty Images

A Quick Take On Dole Plc

Dole Plc (NYSE:DOLE) went public in July 2021, raising approximately $400 million in gross proceeds from an IPO that priced at $16.00 per share.

The firm grows and sells over 300 fruit and vegetable products worldwide.

Dole faces numerous pricing, inflation, foreign exchange and macroeconomic challenges, so I’m on Hold for Dole in the near term.

Dole Overview

Dublin, Ireland based Dole was founded to grow, source and sell a wide variety of fruits and vegetables in over 80 countries in B2B and B2C models.

Management is headed by Chief Executive Officer Rory Byrne, who has been with the firm since 2006 and previously held a number of senior roles at Fyffes.

In 2021, the firm had over 40,000 employees in 29 countries operating the following asset base:

-

109,000 owned acres

-

16 owned transport vessels

-

5 salad manufacturing plants

-

12 cold storage facilities

-

75 picking houses

-

162 distribution and manufacturing facilities

The firm sells its products through distributors to major retailers and foodservice providers worldwide.

In 2021, approximately 49% of its revenue comes from North America, 45% from Europe and 6% from the rest of the world.

Dole’s Market & Competition

According to a 2018 market research report by Grand View Research, the U.S. fruit and vegetables market is expected to reach $97.3 billion by 2030.

The dried fruits & vegetables segment is expected to produce the highest growth rate due to their extended shelf life and launch of differentiated products.

The main drivers for this expected growth are a growing awareness of the health benefits of eating fresh fruit & vegetables and an increasing number of hypermarkets and supermarket chains providing a wide selection of products.

Also, while the hypermarket/supermarket segment will continue to dominate in volume, the online distribution segment is expected to grow at a faster rate during the forecast period.

Major competitive or other industry participants include:

-

Fresh Del Monte Produce (FDP)

-

Sunkist Growers

-

Nestle (OTCPK:NSRGY)

-

Chiquita Brands

-

Numerous other specialty growers

Dole’s Recent Financial Performance

-

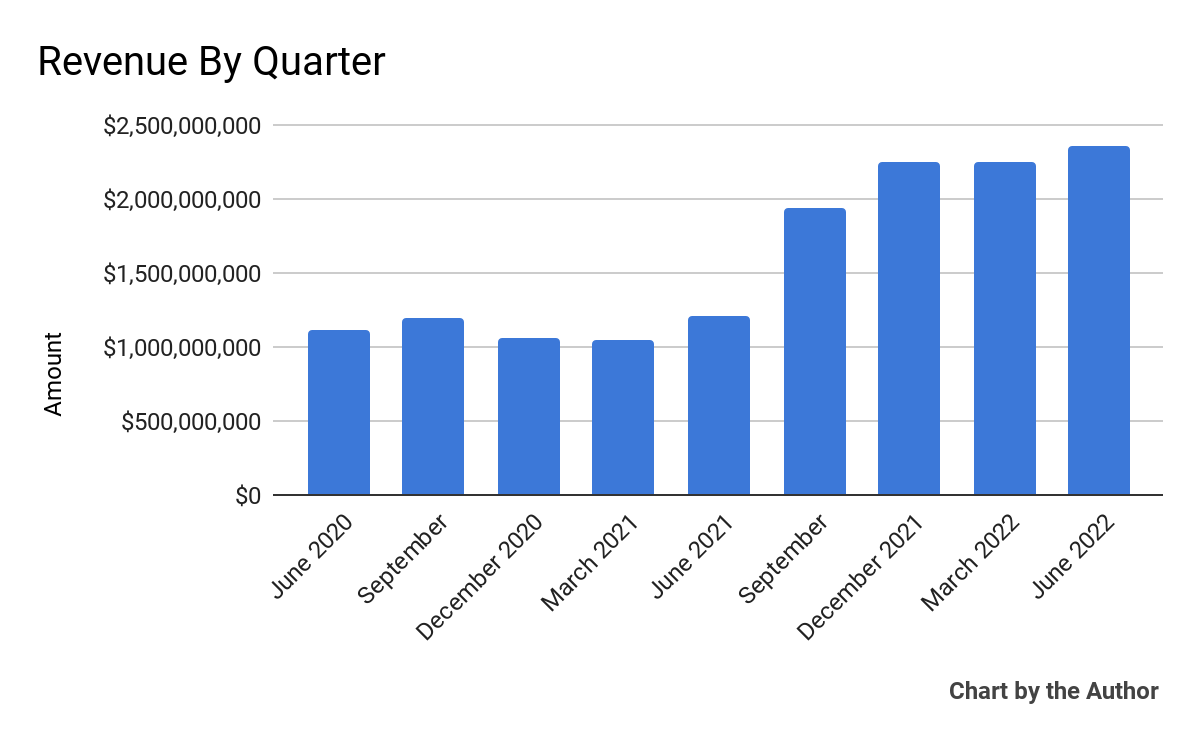

Total revenue by quarter has grown markedly in recent quarters,:

9 Quarter Total Revenue (Seeking Alpha)

-

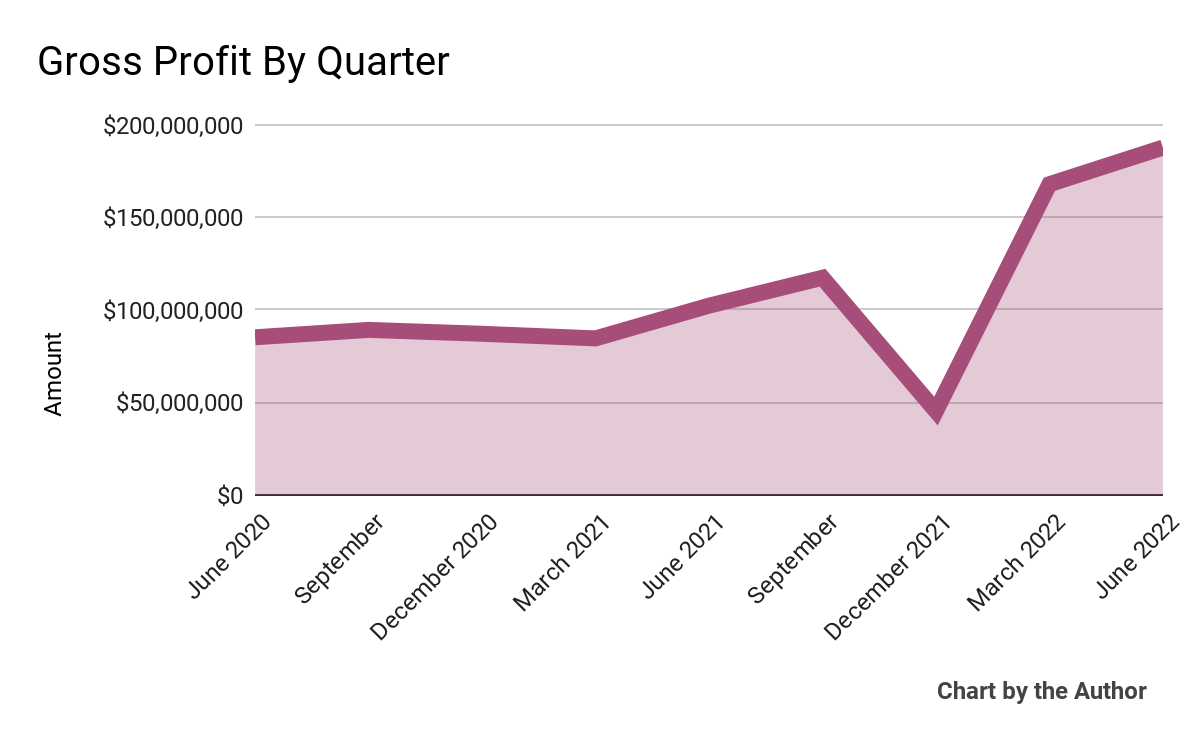

Gross profit by quarter has rebounded sharply in recent quarters after salad recalls:

9 Quarter Gross Profit (Seeking Alpha)

-

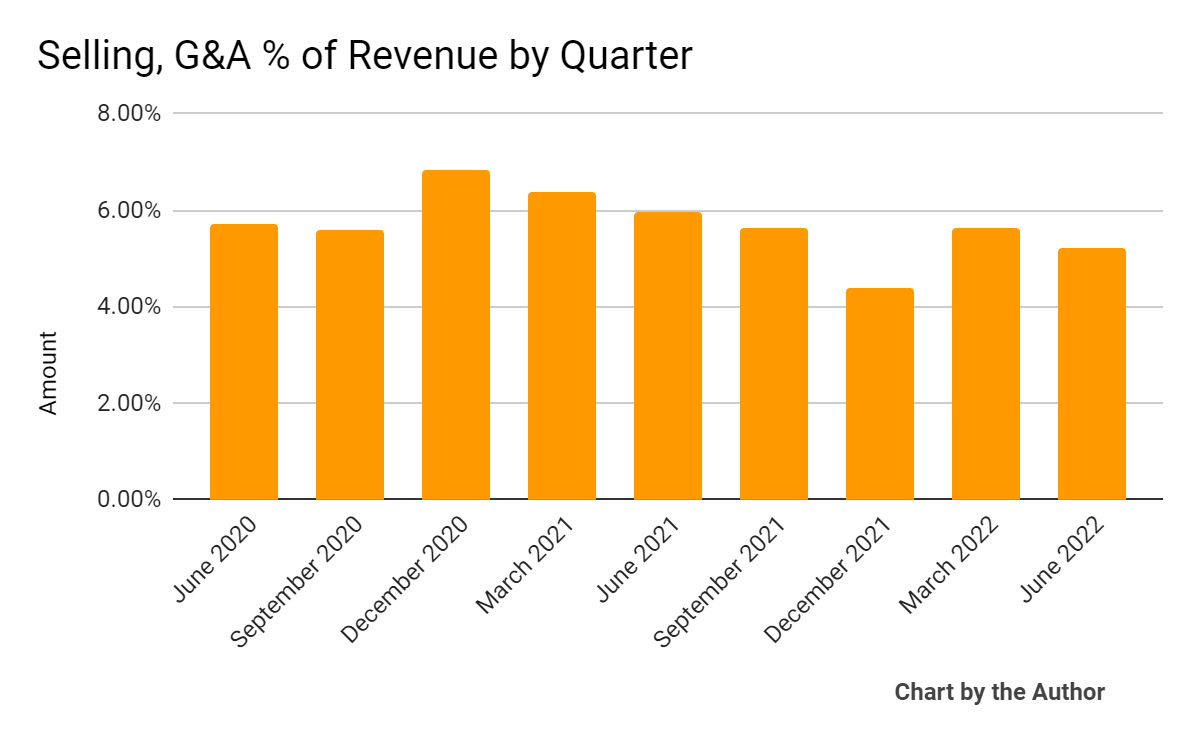

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

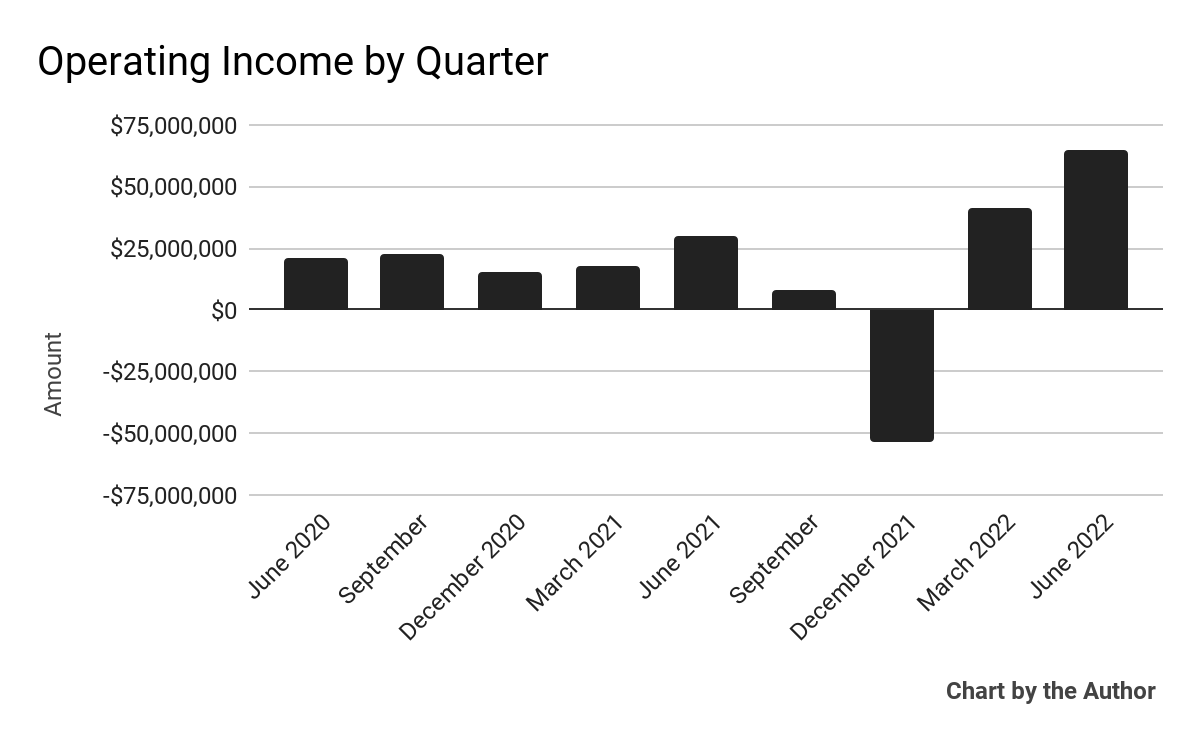

Operating income by quarter has grown in the most recent reporting period:

9 Quarter Operating Income (Seeking Alpha)

-

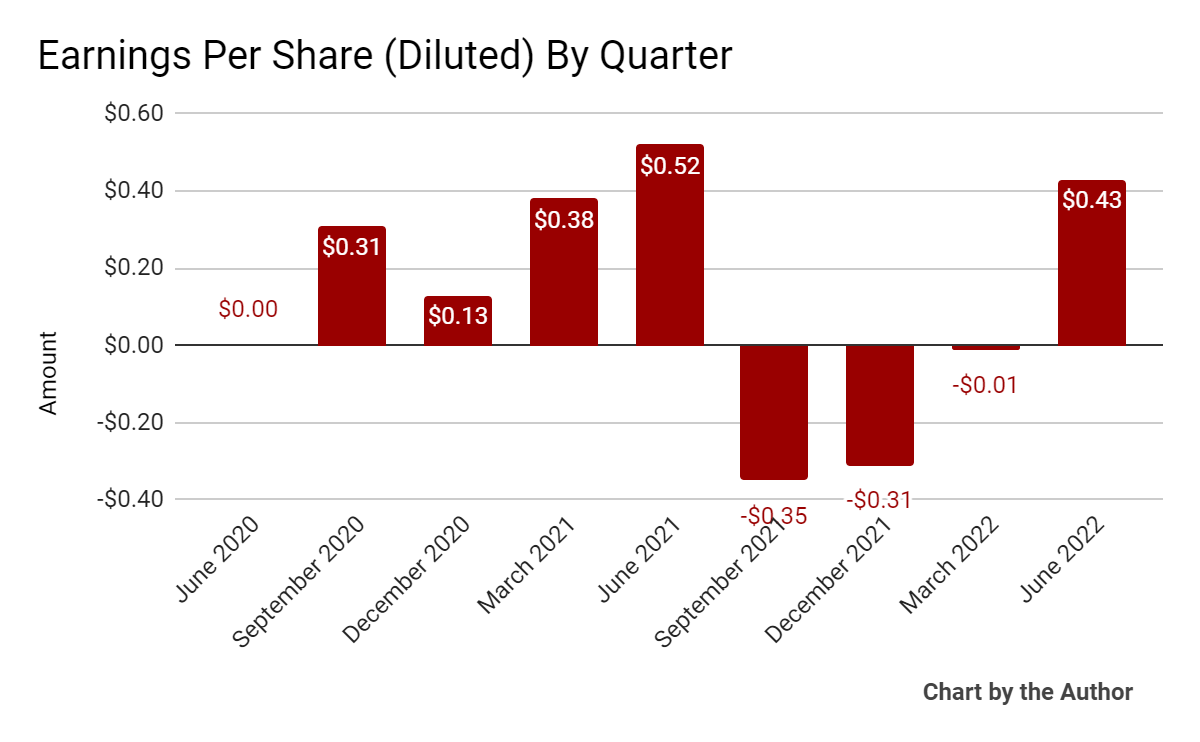

Earnings per share (Diluted) have rebounded in Q2 2022, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

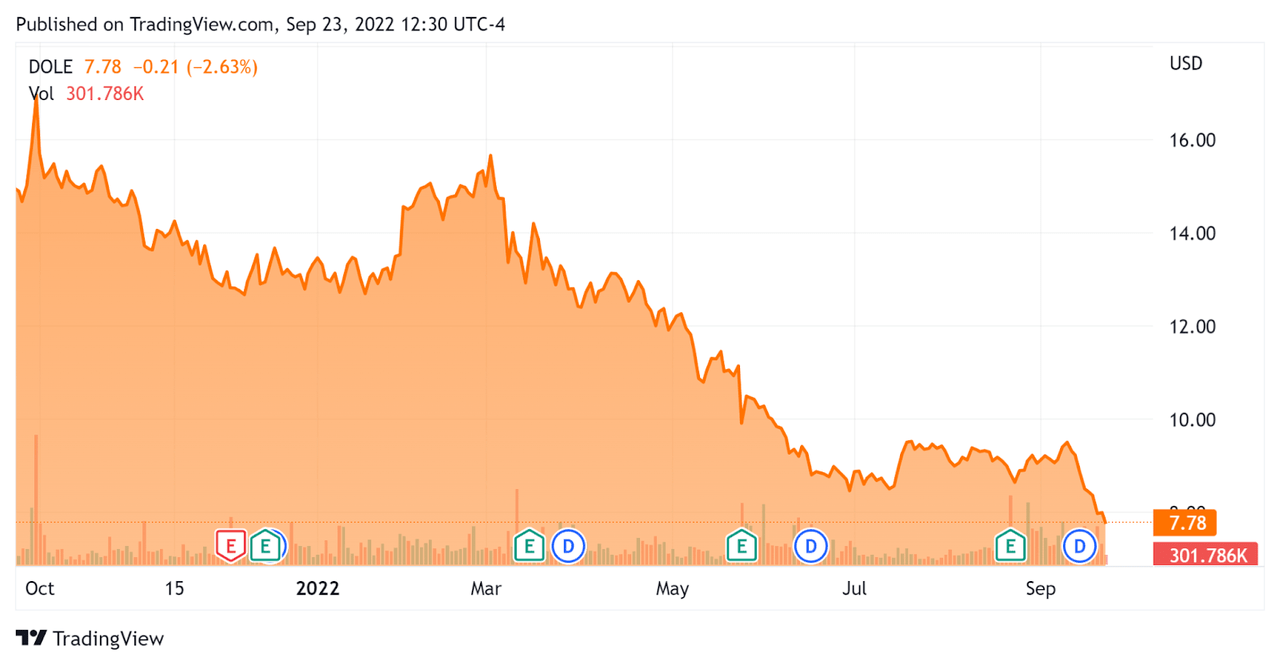

Since its IPO, DOLE’s stock price has fallen 47.7% vs. the U.S. S&P 500 index’s drop of around 17.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Dole

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.26 |

|

Revenue Growth Rate |

95.4% |

|

Net Income Margin |

-0.2% |

|

GAAP EBITDA % |

2.1% |

|

Market Capitalization |

$756,180,000 |

|

Enterprise Value |

$2,320,000,000 |

|

Operating Cash Flow |

$136,410,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.24 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Fresh Del Monte Produce; shown below is a comparison of their primary valuation metrics:

|

Metric |

Fresh Del Monte |

Dole Plc |

Variance |

|

Enterprise Value / Sales |

0.44 |

0.26 |

-40.9% |

|

Revenue Growth Rate |

3.5% |

95.4% |

2601.4% |

|

Net Income Margin |

0.85 |

-0.2% |

-100.2% |

|

Operating Cash Flow |

$84,100,000 |

$136,410,000 |

62.2% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Dole

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the integration efforts and rebranding efforts of the Total Produce businesses.

However, the firm has felt the negative impacts of higher input costs, including transportation, as supply chain challenges continue.

The company has seen strong demand in its North American fresh fruit division, but ‘disappointed with the progress we have made in our vegetable business.’

As to its financial results, revenue dropped 4% year-over-year due to foreign exchange headwinds as a result of the strong U.S. dollar against the EMEA region’s results. Without the FX impacts, revenue would have increased 3.2%

Adjusted EBITDA also decreased on an as-reported basis, ‘primarily due to the strong prior year comparison in Fresh Fruit and to a loss in Fresh Vegetables.’

For the balance sheet, the firm finished the quarter with $244.4 million in cash, equivalents and short-term investments and total debt of $1.182 billion on adjustable interest rate loans.

Management hedged the variable rates to effectively lock in the rates through interest rate swaps and reduced its expenses, but sees full year 2022 interest expense to still be $60 million.

Over the trailing twelve months, free cash flow was $49.1 million with $87.3 million in capital expenditures, which will likely increase for the full year 2022 to $110 million.

Looking ahead, management sees continued challenges in its vegetable segment, with consumers pulling back on value-added products which have a higher retail selling price.

In response, management reduced its full-year 2022 adjusted EBITDA guidance by 5.5% to $340 million at the midpoint of the range.

Regarding valuation, the market is valuing Dole at a lower EV/Revenue multiple than competitor Fresh Del Monte.

The primary risk to the company’s outlook is continued slowing macroeconomic activity, which pressures consumers to substitute lower priced vegetables and fruits for higher priced value-added products.

Another risk would be continued inflationary pressures, especially in transportation costs, where the company may have difficulty continuing to pass on price rises to consumers without seeing increased substitution to lower priced products.

Also, Dole’s debt load is subject to higher interest rates while the U.S. Federal Reserve continues to raise rates, as is the company’s foreign exchange exposure due to a strong U.S. dollar.

Given these numerous risks and headwinds, I’m on hold for DOLE stock in the near term.

Be the first to comment