Marcos Silva

Thesis

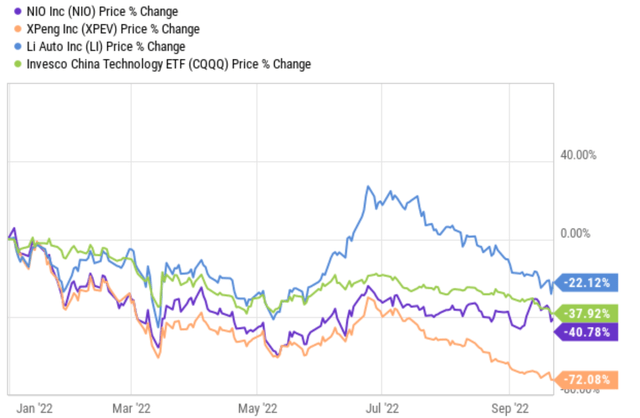

China EV leaders NIO (NYSE:NIO) and XPeng (NYSE:XPEV) have both recently reported their Q2 earnings. In their latest financial reports, both reported not only another quarter of net losses but also substantially larger losses. In Q2 of 2022, NIO net losses came in at RMB2.56 billion, an enormous increase of 369.6% YoY. And XPEV’s net loss was RMB2.72 billion, also a concerning increase of 126% YoY. The widened losses, combined with other macroeconomic concerns, send their share prices sharply downward. To wit, XPEV has lost a total of 72% YTD. Meanwhile, NIO suffered a total loss of 40% during the same period. To put things into perspective, the other leading EV player in China, Li Auto (LI) suffered the least losses at 22% YTD.

The thesis of this article is that the above fundamental deterioration and price movements may only be the beginning. I see a realistic probability for both players to enter a prolonged EV winter for several reasons. Besides the chronic issue of their net losses, there are a few strong headwinds in the developments also, including the intensification of the competition, lingering lock-down effects, possibilities for new lockdowns, and also an overall China economy recession, as detailed immediately below.

Q2 recap

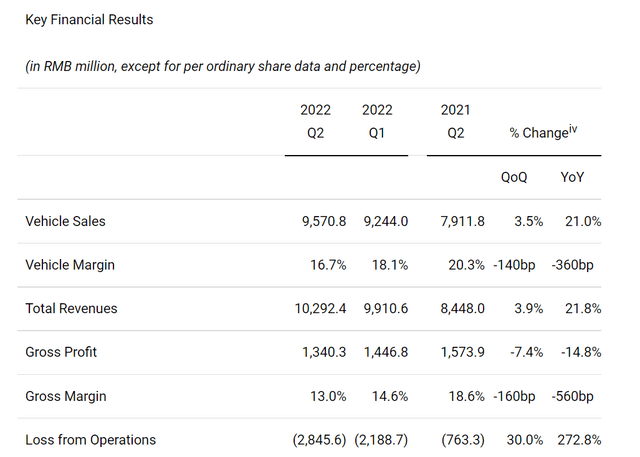

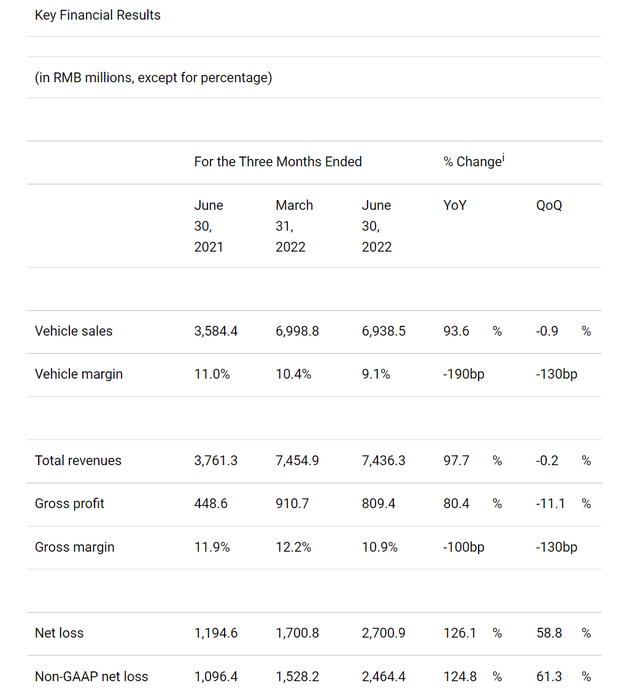

As aforementioned, both EV makers reported widened losses in the second quarter of 2022. The first chart shows the key financial results for NIO, and the second chart is for XPEV. As seen, on the positive side, NIO’s total revenues reached RMB10.29 billion, an increase of 22% YoY; and XPEV revenues reached RMB3.76 billion, an increase of 98% YoY.

However, in terms of net profit, the performance of these EV leaders is a bit embarrassing. NIO reported a loss from operations of RMB2.8 billion, an increase of 272% from the previous year. Gross margin also contracted to 13% from 18.6% a year ago, a whopping decrease of 560 basis points. XPEV reported a net loss of RMB1.2 billion, an increase of 58% from the previous year. Its gross margin also contracted by 130 basis points a year ago to the current level of 11.9%.

Admittedly, the EV industry enjoys rapid development and strong government support in China. However, traditional car companies are also entering the field of new energy vehicles and directly competing with pure EV players such as XPEV and NIO. Going forward, I am very concerned about the chronic net losses and also foresee new headwinds for both stocks, as detailed next.

NIO 2022 Q2 earnings press release XPEV 2022 Q2 earnings press release

CAPEX and the growth premise

And as you already know, besides negative earnings, both NIO and XPEV currently (and historically also) suffer a negative free cash flow (“FCF”). What is more concerning is that their CAPEX would be in danger also if the negative FCF continues. The market has been valuing these stocks entirely based on their future growth potential. And once growth CAPEX is in jeopardy, it could trigger a dramatic reassessment of their valuation.

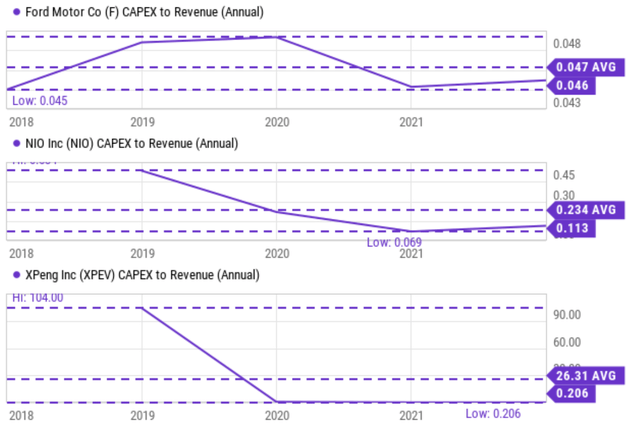

And there are signs of such danger, as shown in the chart below. Here I will use the CAPEX spending of Ford (F) to provide a baseline to anchor the discussion. Like F, many of NIO and XPEV’s competitors in China have an existing traditional car segment that is profitable, and I assume the CAPEX expenditures from these competitors would be similar to F. Examples include SAIC Motor Corp (formerly Shanghai Automotive Industry Corporation) and also the Great Wall Motor Co (“GWM”). SAIC is currently the largest of the “Big Four” state-owned car manufacturers in China. It produces both internal combustion engine cars and also electric vehicles. According to this Wiki page, it is the third-largest plug-in electric vehicle (BEV and PHEV) company and the second-largest BEV company in the world, with 10.5% and 13% global market share respectively in 2021.

To wit, as detailed in an earlier article:

F has been very consistent in terms of its CAPEX expenditures. Over the past five years, it has been spending on average 4.7% of its revenues on CAPEX. The expenditure fluctuated only within a very narrow range between 4.5 to 4.9%. In contrast, NIO has been spending a lot more on CAPEX, on average 23.4% since 2019. What is concerning is that its expenditures have fluctuated in a much wider range and is showing a rapidly declining trend as seen. Its CAPEX bottomed to as low as 6.9% in 2021 from over 50% in 2019. And currently, it stands at 11.3% of total revenues.

The picture for XPEV is even more concerning. Its CAPEX expenditures have fluctuated in an even more erratic fashion. It started around 104% in 2019 and declined to the current negligible level of 0.2%.

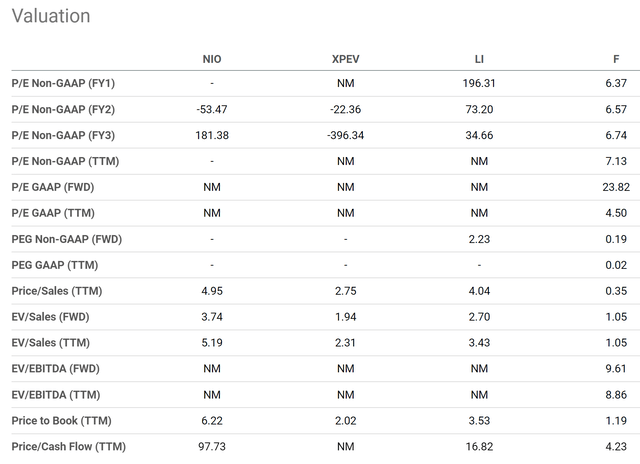

Yet valuation is quite high

Despite all the above issues, both stocks’ valuations are actually quite high. As mentioned above, because of the lack of profit, bottom line-oriented metrics such as P/E and price/cash flow multiples are not meaningful for these stocks. By topline metrics, NIO’s price-to-sales ratio is about 4.95x as of this writing. And compared to about 4.04x for Li Auto, NIO’s sales are valued at a 22% premium. XPEV’s price-to-sales ratio is admittedly lower, only at 2.75x as seen.

However, to put things in a broader perspective, F’s price-to-sales ratio is only about 0.35x, a fraction of both NIO and XPEV. And as aforementioned, Ford has a profitable traditional segment to provide the cash to bridge its transition and expansion into EV, while both NIO and XPEV are showing signs of struggling CAPEX investments. When leverage is considered, the TTM EV to sales is about 5.19x for NIO and 2.31x for XPEV, still quite expensive when compared to F or the general market.

Other risks and final thoughts

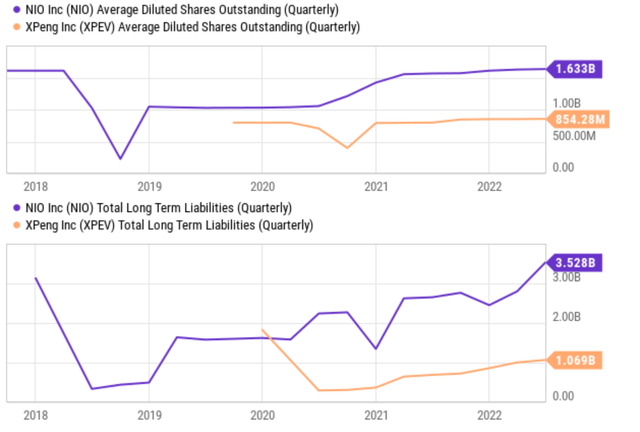

Due to the negative earnings and free cash flow, both NIO and XPEV had been relying on alternative financing avenues in the past. As detailed in my earlier article:

NIO been consistently (and quite aggressively in my view) issuing new equity and debt to finance their operations. As you can see from the top panel of the following chart, NIO’s diluted shares expanded by more than 60% since 2020, from about 1 billion outstanding shares to the current level of more than 1.6 billion shares. NIO’s debt burden was the lightest during 2018 when its total long-term liabilities were only about $400M. And currently, it stands at $3.5 billion.

The picture of XPEV is very similar. XPEV’s diluted shares expanded from 377.1 million in 2020, to 821.5 million in 2021, and currently stand at 850.5 million, more than double in about 2 years. Its total long-term liabilities have swollen substantially too at the same time, as you can see from the bottom panel. XPEV’s debt burden was the lightest during 2020 when its total long-term liabilities were only about $252M. And currently, it stands at $1.07 billion.

On top of the above specific issues, there are also a series of unfolding macroeconomics risks. These risks are best summarized in the following SA report (slightly edited by me):

These risks include the increased worries about Russo-Chinese ties, escalating Taiwan tensions, lingering lockdown effects and concerns over a looming rate hike from the Fed. While lockdown measures in major Chinese cities like Chengdu were recently lifted, the impact of the measures remain a concern for the region’s economic prognosticators. For example, the Asian Development Bank cut its 2022 growth forecast for developing Asia largely in response to the disruptions the pandemic restrictions have wrought on supply chains and consumers across the region.

All told, NIO and XPEV kept bleeding cash, and even more concerningly, at increasing rates in the latest quarter. They seem to be in the dreaded vicious cycle: the more vehicles they sell, the more they lose. The market has been willing to pay a premium for both stocks in the past on the premise of their growth. However, given their chronic lack of profit and consistency in growth CAPEX, the growth premise could be in jeopardy and a dramatic reassessment of their valuations could follow.

Be the first to comment